@GSMA has published its annual State of the Industry Report on Mobile Money 2023, which provides insights into the global mobile money landscape.

Here are some key takeaways from the report.

A thread:

#MobileMoney #DFS #FinancialInclusion #DigitalPayments

Here are some key takeaways from the report.

A thread:

#MobileMoney #DFS #FinancialInclusion #DigitalPayments

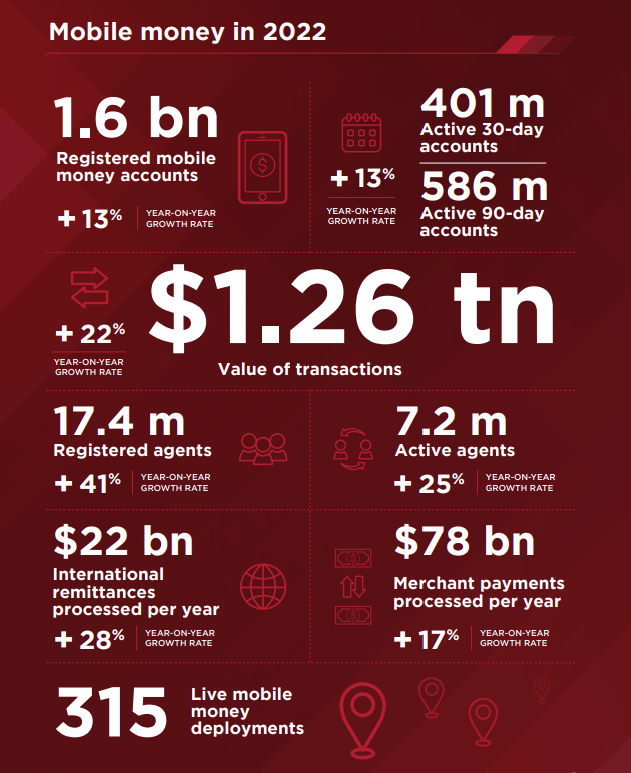

↗️Adoption and active usage continue to rise, with registered accounts growing by 13% YoY, from 1.4 billion in 2021 to 1.6 billion in 2022.

Accounts active on a 30-day basis also grew at the same rate.

Africa continues to show growth and particularly Ethiopia 🇪🇹 and Nigeria 🇳🇬.

Accounts active on a 30-day basis also grew at the same rate.

Africa continues to show growth and particularly Ethiopia 🇪🇹 and Nigeria 🇳🇬.

📱Mobile money has become a mainstream financial service in many countries enabling millions of people in low and middle-income countries to access digital financial services for their daily needs.

📈As the impact of the pandemic eased, mobile money services grew faster in 2022 than during pre-COVID times. The habit of using digital payments, enforced by the pandemic, has stuck for many.

💸In many countries, growth in mobile money activity is now outpacing new registrations - a sign that the industry is maturing beyond a handful of markets.

🌍The pandemic led to a significant global expansion of mobile money services and accounts, with registered accounts and 30-day active accounts growing faster than forecast in 2019.

#MobileMoney #DFS #FinancialInclusion #DigitalPayments

#MobileMoney #DFS #FinancialInclusion #DigitalPayments

💳Transaction values grew by 22% between 2021 and 2022, from $1 trillion to around $1.26 trillion. However, the share of cash-based transactions in the overall transaction mix declined, with cash-in and cash-out transactions dropping nearly two percentage points.

💴Global daily transaction values exceeded predictions, with $3.45 billion transacted daily via mobile money in 2022. Agent networks continue to drive industry expansion, with the no of MM agents growing from 12 million in 2021 to around 17 million in 2022 - a 41% YoY increase.

👩💼💸 Women in low- and middle-income countries are 28% less likely than men to own a mobile money account. Although more women than ever before have a mobile money account, there is still a gender gap in ownership that has recently widened in some countries.

📈🔌 Bill payments grew by 36% YoY in 2022 and became the third most common transaction after person-to-person (P2P) transfers and combined cash-in/cash-out (CICO) transactions. Around 97% of MMPs surveyed in 2022 offer bill payments.

🌎💸 Mobile money-enabled international remittances grew by 28% YoY in 2022. During the pandemic, many diasporas sent more funds via mobile money to friends and family than ever before, leading to significant growth in international remittances.

🔁 Interoperable transactions between mobile money providers and local banks are driving the industry, with bank-to-mobile interoperable transactions growing by 36% YoY and mobile-to-bank transactions rising by 47%.

💰 Mobile money remains a key savings channel, with around 60% of MMPs offering users a savings account in 2022. The World Bank Global Findex 2021 found that 15% of adults in Sub-Saharan Africa saved using a mobile money account.

🚀 While the mobile money industry remains reliant on customer fees, there is room for revenue growth from business and government fees. However, challenges such as taxation and fraud are affecting regulation in the industry.

📈Mobile money is changing the financial landscape in Low and middle-income countries, enabling greater financial inclusion and access to digital financial services. #MobileMoney #FinancialInclusion #DigitalPayments

📱💰 Mobile money has come a long way in the past few years, but there's still a lot of room for growth and innovation. With increasing mobile phone penetration and improvements in digital literacy, we can expect even further growth in the years to come.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter