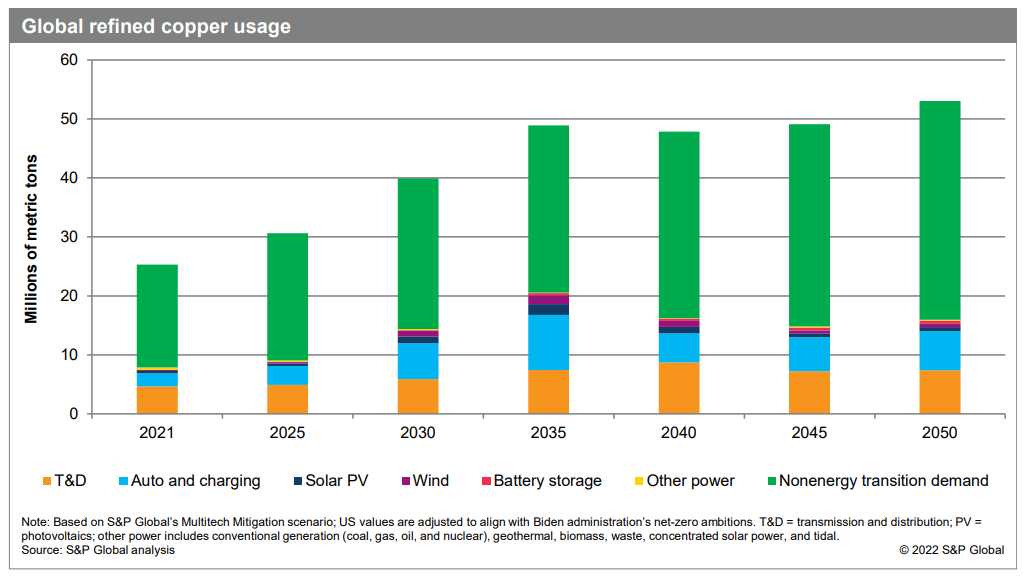

With the increased M&A activity in the #copper sector, I think it’s a good time to share how I think majors want to spend capital going forward and how this relates to copper juniors hoping to get bought out during the cycle.

$ASCU.TO $ATX.V $ALDE.V $ADZN.V $DNT.TO $FIL.TO

1/n

$ASCU.TO $ATX.V $ALDE.V $ADZN.V $DNT.TO $FIL.TO

1/n

$FDY.TO $HCH.V $LA.V $LBC.V $MARI.TO

$MUX $NGEX.V $OCO.V $QCCU.V $SURG.V $REG.V $SLS.TO $SOLG.TO $WRN.TO

Clearly, 1st priority is to buy existing production as we've seen with $BHP / $OZL, $RIO / Turquoise Hill and now $GLEN trying to buy $TECK. Buying producing assets

2/n

$MUX $NGEX.V $OCO.V $QCCU.V $SURG.V $REG.V $SLS.TO $SOLG.TO $WRN.TO

Clearly, 1st priority is to buy existing production as we've seen with $BHP / $OZL, $RIO / Turquoise Hill and now $GLEN trying to buy $TECK. Buying producing assets

2/n

provide buyers with instant cash flow. Building mines have probably never been harder and more expensive, hence it makes sense to buy/merge with other companies. However, there is a limited number of companies available to buy and buying existing production doesn't solve the

3/n

3/n

worlds increasing need for #copper. I believe the 2nd priority for capital allocation are brownfield extensions and exploiting potential synergies with neighboring mines. For instance, $GLEN is advocating for potential synergies between Collahuasai and $TECK's QB mine.

4/n

4/n

Another example could be $LUN.TO buying Caserones. I believe juniors having good projects close to existing mines / in brownfield locations will be in a sweet spot within the next 12-18 months. Ideally the deposits/ geology is similar

5/n

5/n

and mined material can be treated using existing facilities. This obviously lowers cost and majors will naturally be more comfortable buying a project having relevant experience. However, already having paid infrastructure, local support etc. makes brownfield very attractive.

6/n

6/n

One thing that most likely will become a kick in the teeth to smaller and marginal projects is the clear improvement in leaching technologies over the last few years. All the big miners are investing heavily in this and Nuton, Jetti, $FCX and others seem to have working

7/n

7/n

solutions ready in the coming years. This potentially make tired existing mines, with large stockpiles and lower grade material, much more valuable going forward. Morenci and other $FCX operations in the US are good examples. In addition, sulphide leaching is definitely a

8/n

8/n

focus and may “unlock” great deposits that wasn’t viable in the past. A good example to watch is the giant La Granja project in northern #Peru that has been in the news recently. If the Nuton technology can help lower costs and deal with the arsenic in an economically way

9/n

9/n

there, I think several large projects will become much more attractive. Again, this may also make the typical smaller and marginal projects held by juniors less attractive to the majors. However, majors consolidating and getting larger may give room to smaller producers

10/n

10/n

to become larger and interested in these projects, I guess. Since this thread is about my thoughts on major mining companies’ behavior, I’ll focus on them though. So, I have established that I think majors will be looking to firstly increase production by buying existing

11/n

11/n

production, secondly looking at brownfield extensions and exploiting potential synergies with mines close by and thirdly investing heavily in the leaching technologies converting current waste to mineable ore and thereby prolonging current operations and opening up new ones.

12/n

12/n

Does this mean that I don’t think majors will want to buy greenfield projects at some point in this cycle? Of course, I do, but I think they will be “pickier” than most expect since building mines in today’s world is super hard. I also believe we'll see majors teaming up/

13/n

13/n

doing JV’s to share the costs and the risks associated with building new mines (what $RIO and $FM.TO are trying to do with La Granja is a good example of this)

So, what are they looking for? I think projects need of one of the following characteristics

14/n

So, what are they looking for? I think projects need of one of the following characteristics

14/n

1) looking good in a DCF model and being able to produce +100kt of #copper per annum for 30 years or 2) being “too big to ignore”. With that I mean projects that may not be looking extremely attractive in a DCF model but have the potential to produce +200kt of #copper

15/n

15/n

annually for +50 years, hence being very strategic and worth the effort and risk.

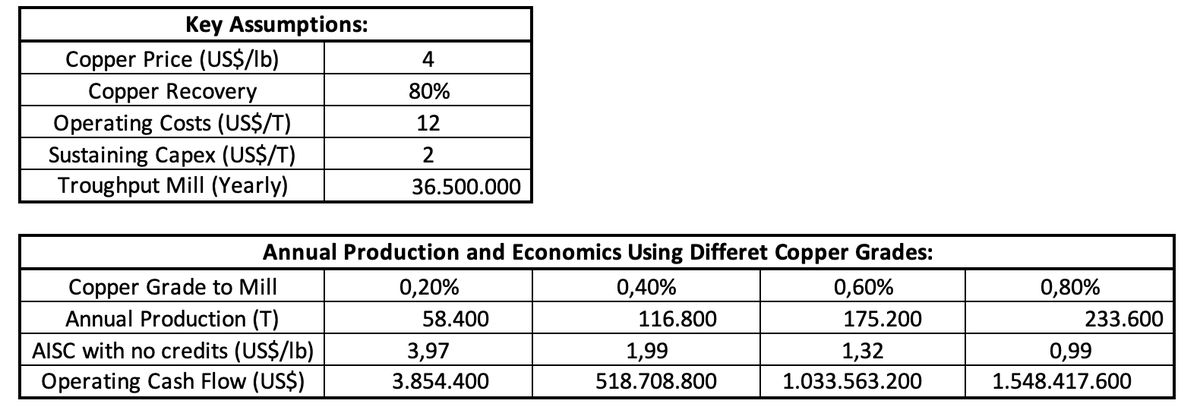

What makes a project look good in a DCF model? a low to moderate CAPEX is crucial and that is affected by location, infrastructure, complexity and size of operation, prestripping (if open pit)

16/n

What makes a project look good in a DCF model? a low to moderate CAPEX is crucial and that is affected by location, infrastructure, complexity and size of operation, prestripping (if open pit)

16/n

for example. Once a mine is built, grade, strip ratio, recoveries and throughput are key factors assuming operating costs are in line with peers. To show how important grade can be I’ve created a theoretical example using simple and constant assumptions.

17/n

17/n

One thing a lot of people seem to understate is the importance of when you receive good cash flows. For instance, a lot of open pit deposits have high strip ratios and lower grade material close to surface. The timing of when you mine higher grade material can have a

18/n

18/n

very large impact on the NPV. For instance, in the image I show what the present value of a billion dollars is depending on when you expect to generate the cash flow. As it appears, generating large cash flows / mining higher grade material in the beginning of the mine

19/n

19/n

life can really improve the NPV of a project. In block cave mining, mine planners can sometimes cherry pick where they want to start mining a deposit, hence controlling the cash flows better. However, there are also disadvantages to this type of mining. For instance,

20/n

20/n

the construction period is often longer, and the CAPEX is usually higher. These are factors that have negative impacts on the NPV and IRR of a project. In addition, only a few groups have the necessary knowledge/ experience to build these projects, so the potential

21/n

21/n

buyers of block cave projects are very limited. This mean I only expect the best and highest-grade block cave projects to be bought out and I think some people will be disappointed.

The “too big to ignore” group of projects are very limited and therefore can be worth a lot

22/n

The “too big to ignore” group of projects are very limited and therefore can be worth a lot

22/n

of money as major miners and countries try to secure future #copper supply. As @robert_ivanhoe say, it doesn’t make sense to evaluate extremely large projects using a DCF model. As I’ve said, I think we will see major miners "team up" (potentially partnering with countries

23/n

23/n

or large companies to secure #copper supply for the decades to come). I think what we have seen in #Argentina with Stellantis taking a strategic stake is just the start and that country actually have at least a couple of “too big to ignore” projects.

24/n

24/n

To sum up:

I think there will an enormous rush for the best #copper projects once majors have optimized current operations and “unlocked the easy value”.

I emphasize, only the best projects in terms of standard DCF modelling and the best in size/strategic value.

25/END

I think there will an enormous rush for the best #copper projects once majors have optimized current operations and “unlocked the easy value”.

I emphasize, only the best projects in terms of standard DCF modelling and the best in size/strategic value.

25/END

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter