HOW TO LIVE OFF DIVIDENDS:

The Truthful Math Behind the Ultimate Form of Financial Freedom:

(And why many will never achieve it)

A Step by Step Guide (Thread) 👇

The Truthful Math Behind the Ultimate Form of Financial Freedom:

(And why many will never achieve it)

A Step by Step Guide (Thread) 👇

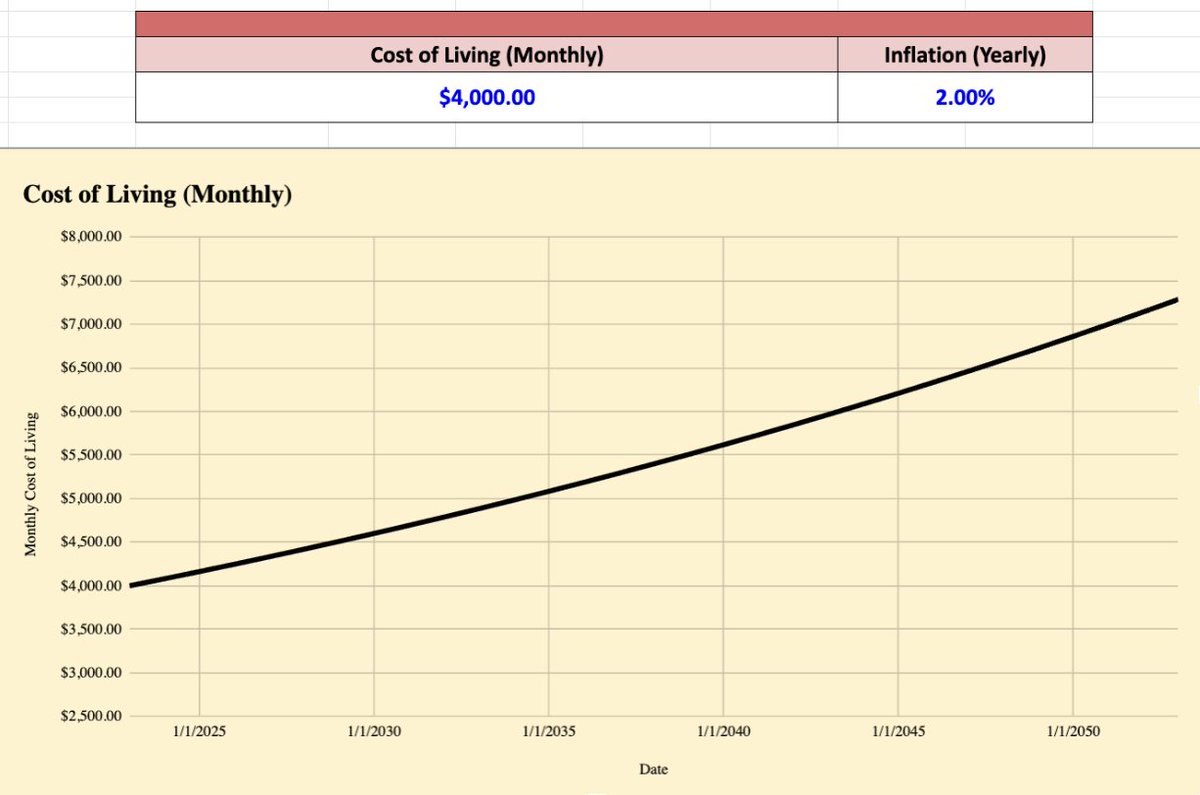

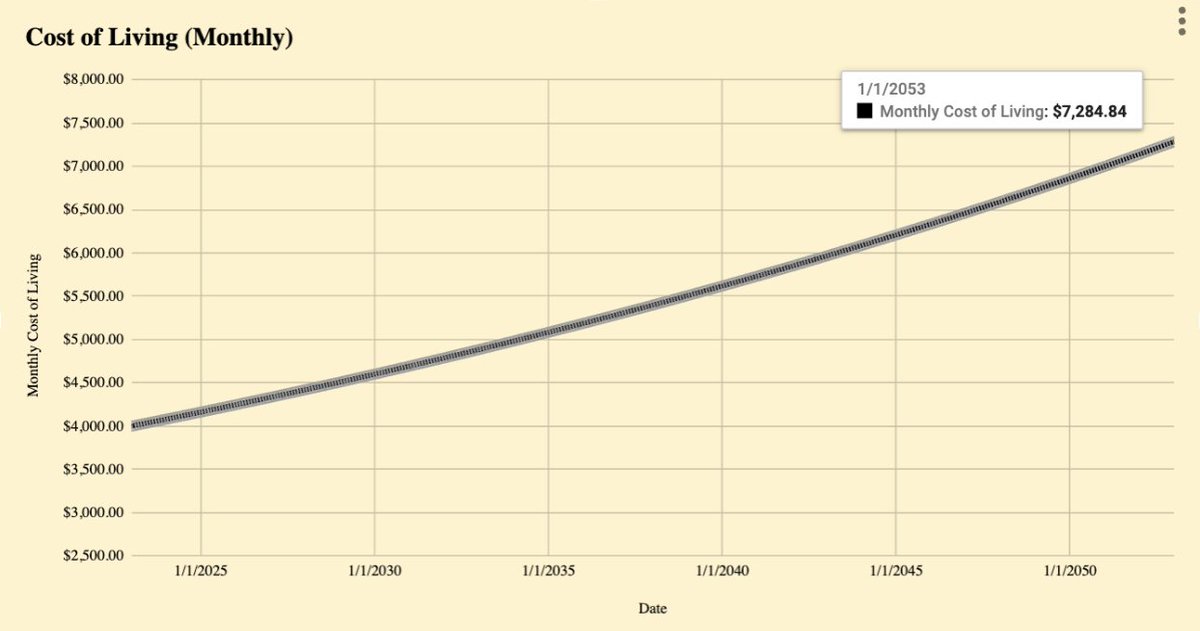

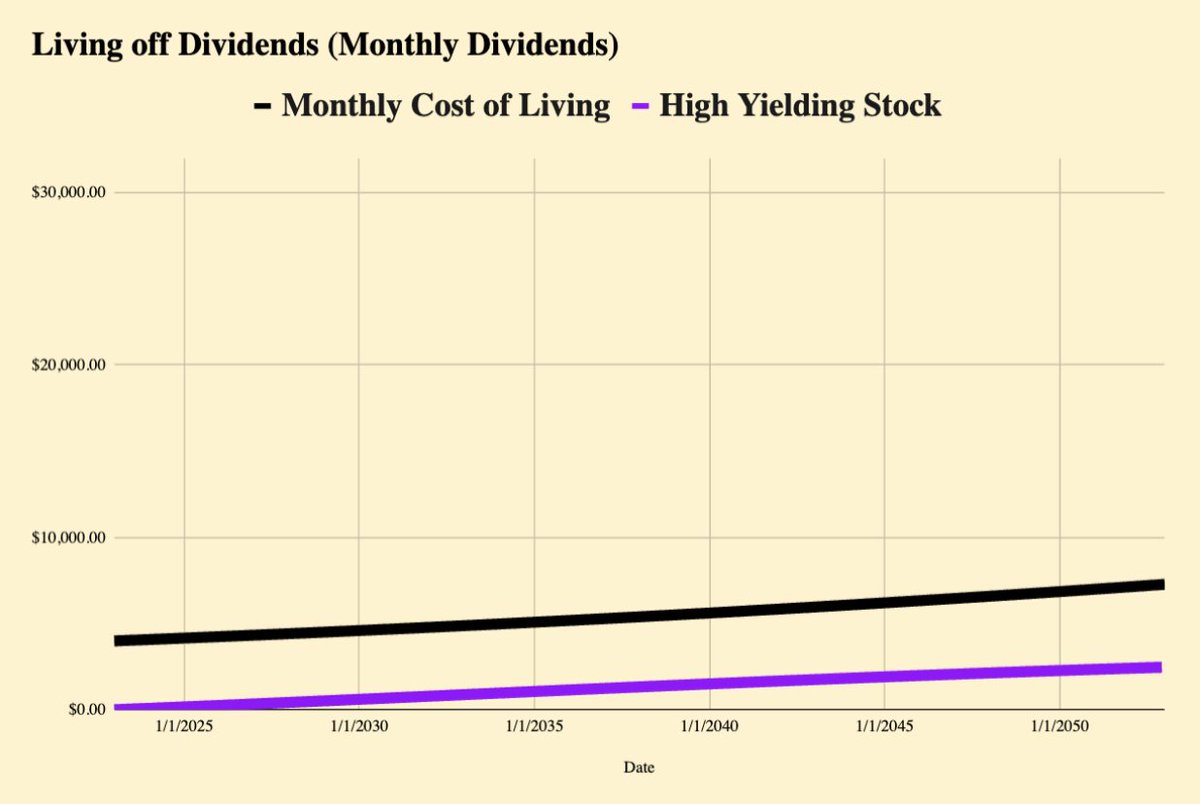

This line is our cost of living.

It’s the amount of money we have to make every month to pay our living expenses.

In this scenario, let's assume a low monthly cost of living of $4,000 a month, with a 2% yearly inflation rate. (This is close to the historical average).

It’s the amount of money we have to make every month to pay our living expenses.

In this scenario, let's assume a low monthly cost of living of $4,000 a month, with a 2% yearly inflation rate. (This is close to the historical average).

At the end of a 30 year period, our monthly COL would be $7,284.

So our goal is to find a way to get our monthly dividend payments above that line, and keep it there.

And ideally, I’d love to make that happen as fast as possible.

So our goal is to find a way to get our monthly dividend payments above that line, and keep it there.

And ideally, I’d love to make that happen as fast as possible.

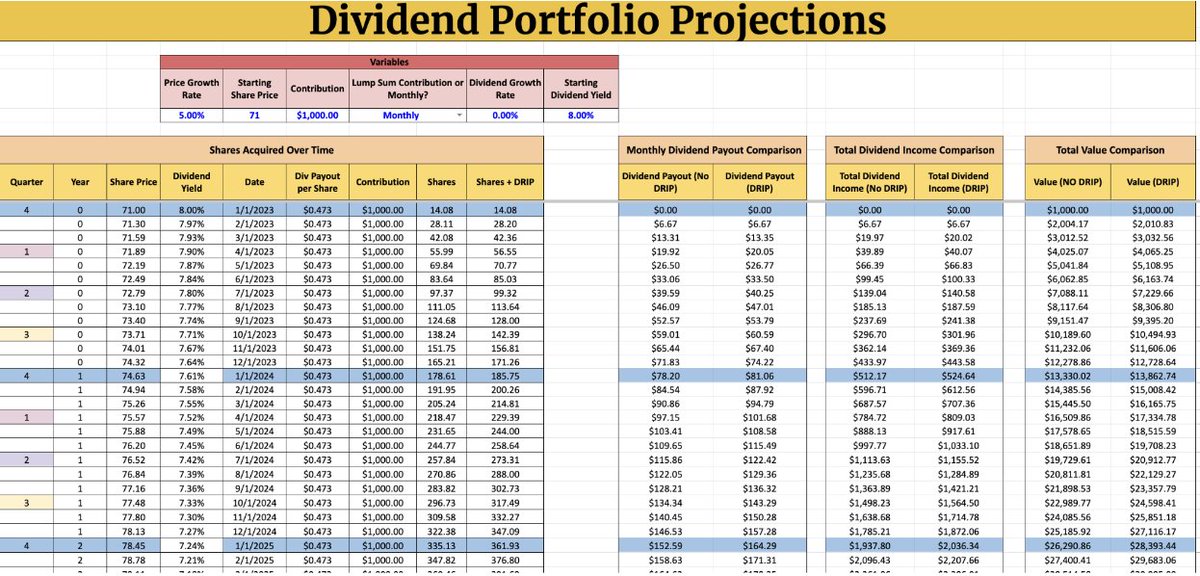

So naturally, most people’s first inclination is to utilize high yielding stocks.

Surely that's the fastest way, right?

Let’s look at a model I've built to test this out.

Surely that's the fastest way, right?

Let’s look at a model I've built to test this out.

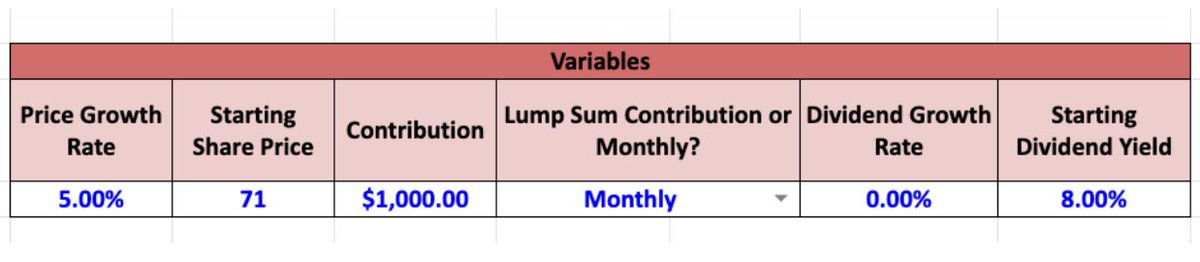

Assuming we invest into a stock that has a starting dividend yield of 8%, price growth of 5%, and a dividend growth rate of 0%.

We’re also assuming we make monthly contributions of $1,000 and reinvesting dividends.

So what would be the results of this high yield strategy?

We’re also assuming we make monthly contributions of $1,000 and reinvesting dividends.

So what would be the results of this high yield strategy?

At no point did this investment strategy give us the ability to live off dividends.

At the end of our 30 year period, we would be bringing in $2,471 a month in dividend income, with a monthly COL of $7,282. (Yikes!)

At the end of our 30 year period, we would be bringing in $2,471 a month in dividend income, with a monthly COL of $7,282. (Yikes!)

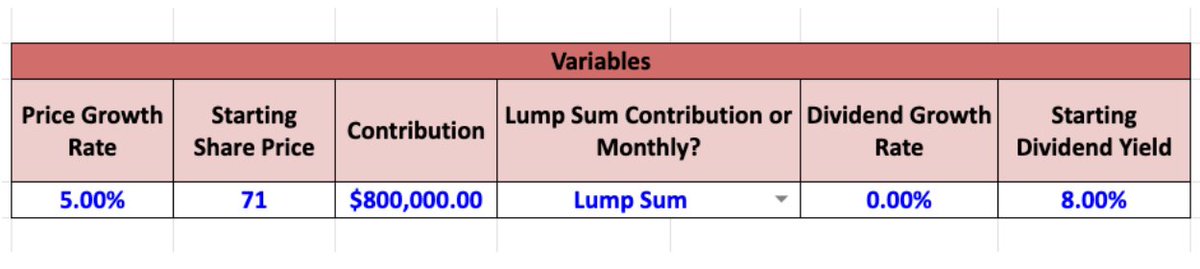

But what if we had a lump sum amount to invest?

Let’s say we invested $800,000 all at once (It’s nice to dream, right?), and also kept the same assumptions.

This time we won’t be reinvesting dividends, since we’re hoping to live off of them.

Let’s say we invested $800,000 all at once (It’s nice to dream, right?), and also kept the same assumptions.

This time we won’t be reinvesting dividends, since we’re hoping to live off of them.

The results look promising- at first.

For the first 14 years, we could live off dividends!

But due to the fact inflation continues to grow at a faster rate than our dividends, our monthly COL eventually passes the amount we would be receiving in monthly dividend income.

For the first 14 years, we could live off dividends!

But due to the fact inflation continues to grow at a faster rate than our dividends, our monthly COL eventually passes the amount we would be receiving in monthly dividend income.

So it doesn’t appear high yielding investments is the best way to achieve financial freedom through dividend investing.

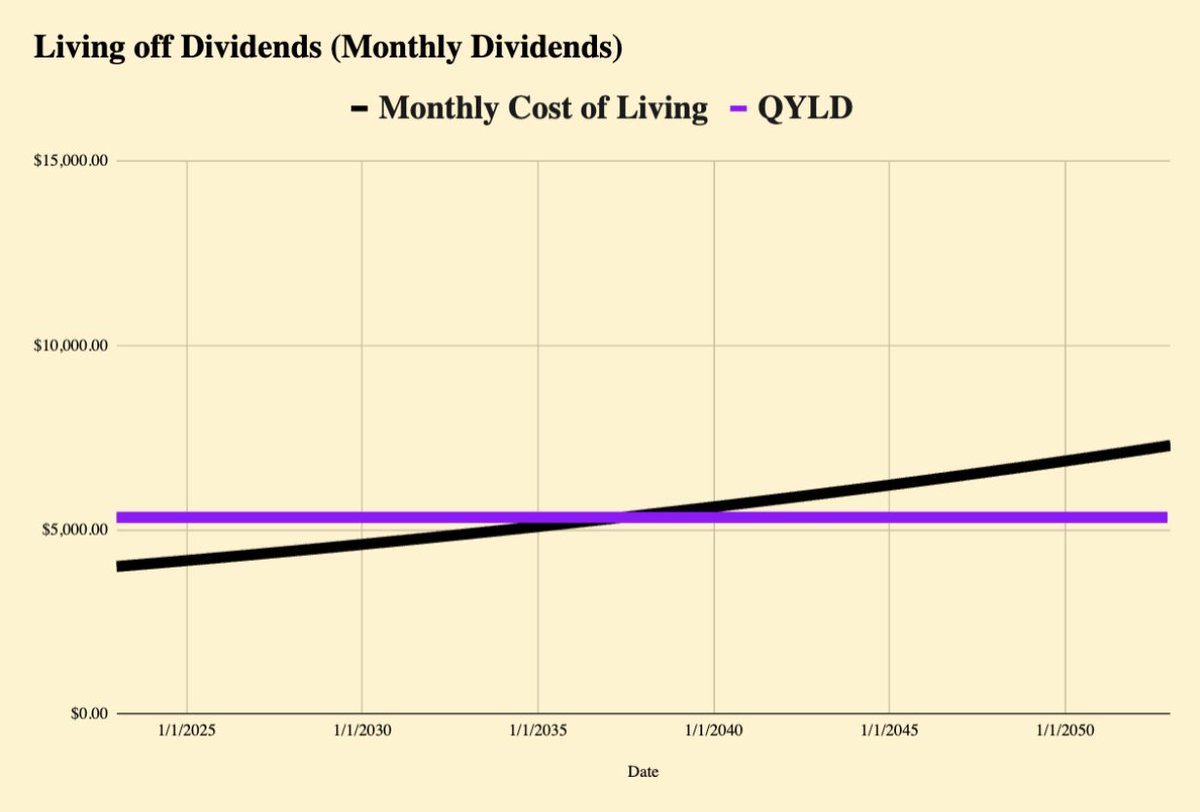

But what about dividend growth investing?

This is the same method investors like Warren Buffett utilize.

Let’s put this method to the test as well.

But what about dividend growth investing?

This is the same method investors like Warren Buffett utilize.

Let’s put this method to the test as well.

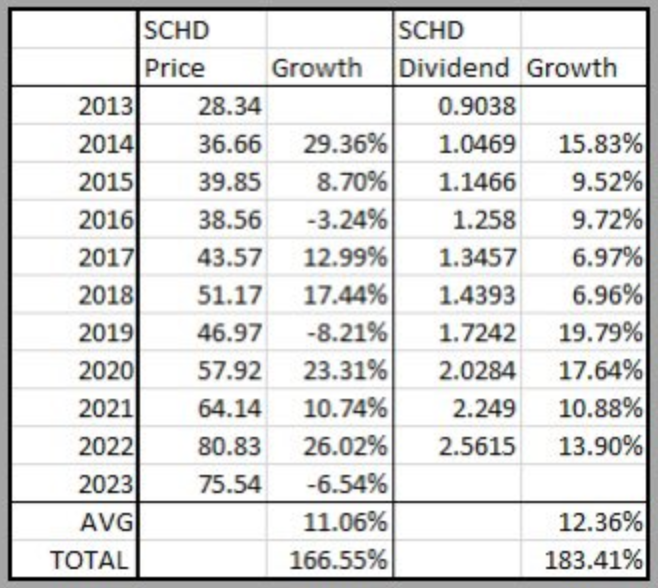

Let’s use the dividend ETF $SCHD as an example.

Over the past decade, this fund has seen share price growth of around 11% and dividend growth of around 12% annually.

Let’s use that data to build our next model.

Over the past decade, this fund has seen share price growth of around 11% and dividend growth of around 12% annually.

Let’s use that data to build our next model.

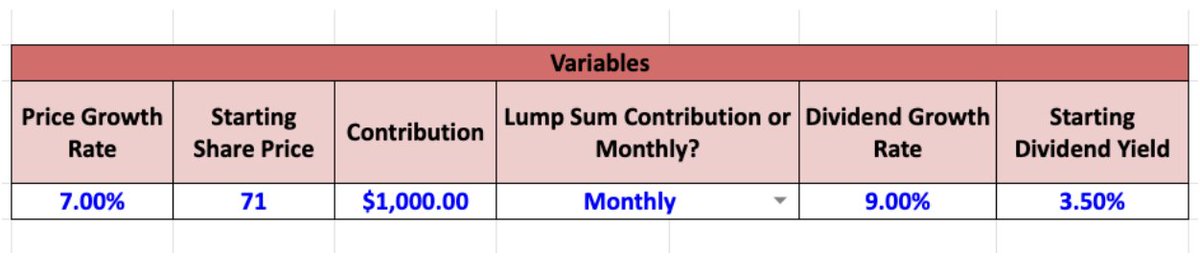

Let’s be conservative, and assume $SCHD doesn’t perform as well as it has over the past decade.

We’ll assume 7% share price growth, with 9% dividend growth.

Let’s keep our monthly contributions the same at $1,000 and reinvest dividends.

We’ll assume 7% share price growth, with 9% dividend growth.

Let’s keep our monthly contributions the same at $1,000 and reinvest dividends.

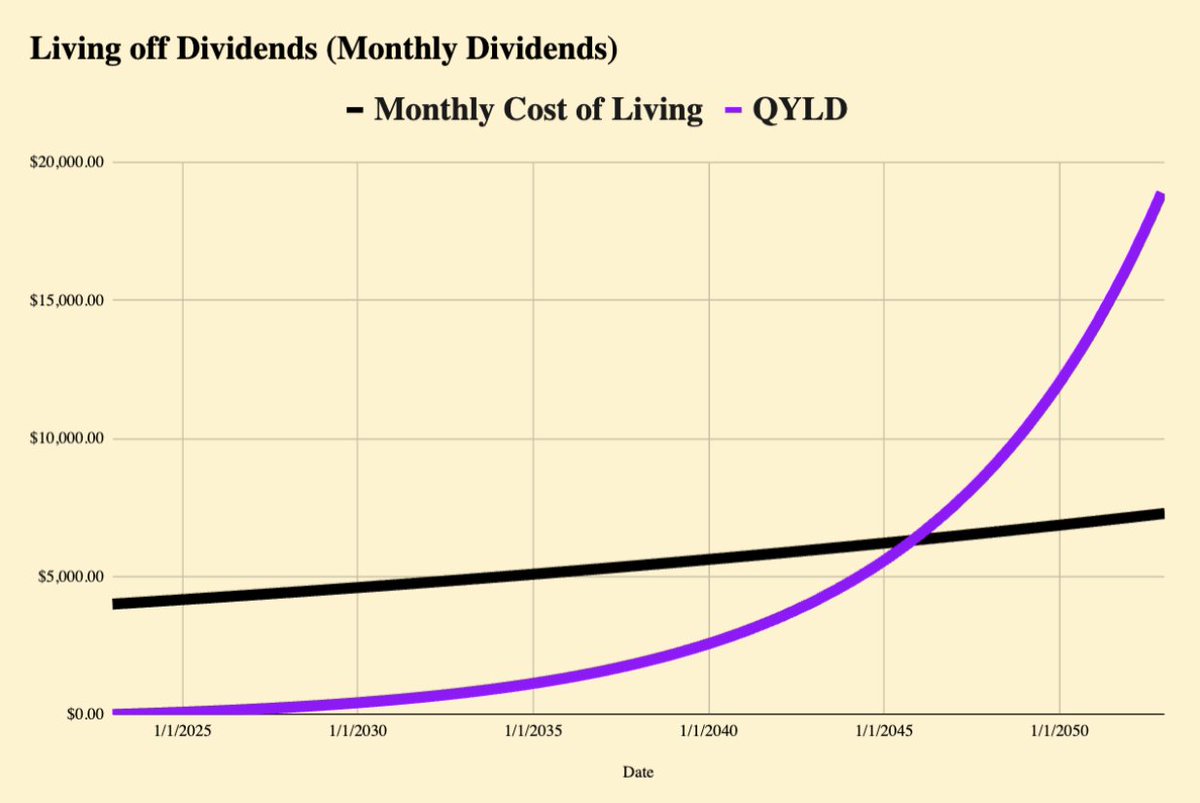

The results we get are completely different from the results from our high yielding investments.

Starting out, the dividends coming in are slow.

But after just 22 years, our monthly dividend payments pass our monthly COL.

Starting out, the dividends coming in are slow.

But after just 22 years, our monthly dividend payments pass our monthly COL.

After 30 years, our monthly dividend payments would be $18,904! (WOW!)

And our portfolio value would be 3.6M!

And here’s the real kicker-

This all comes from total contributions of $361,000.

And our portfolio value would be 3.6M!

And here’s the real kicker-

This all comes from total contributions of $361,000.

That's the power of dividend growth investing!

When you invest into stocks that increase their dividend payments over time and reinvest dividends, the compounding effect takes off at a rapid rate.

This is the same strategy that I use for my personal dividend portfolio.

When you invest into stocks that increase their dividend payments over time and reinvest dividends, the compounding effect takes off at a rapid rate.

This is the same strategy that I use for my personal dividend portfolio.

If you’d like to join me on my journey of achieving financial freedom by utilizing dividend stocks, be sure to follow me here @dividendology

You can also click the link in my bio to subscribe to my YouTube (over 50K subscribers!) or join my monthly newsletter!

You can also click the link in my bio to subscribe to my YouTube (over 50K subscribers!) or join my monthly newsletter!

You can also download the spreadsheet I used in this thread to see if you are on track to live off dividends.

Link in bio!

Enjoy and happy dividend investing!

Link in bio!

Enjoy and happy dividend investing!

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter