Join me on my journey as I find ways to achieve financial freedom by living off of dividend income! 200k subs on YouTube and growing!

2 subscribers

How to get URL link on X (Twitter) App

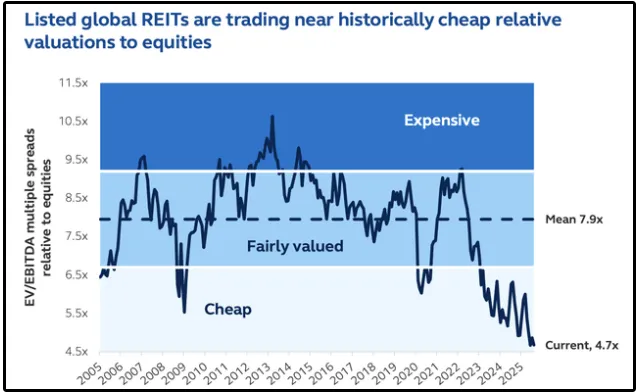

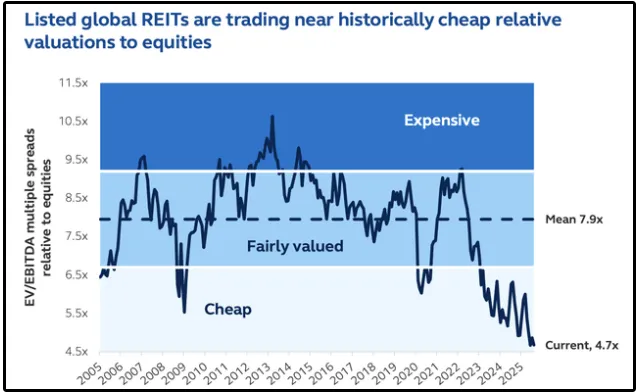

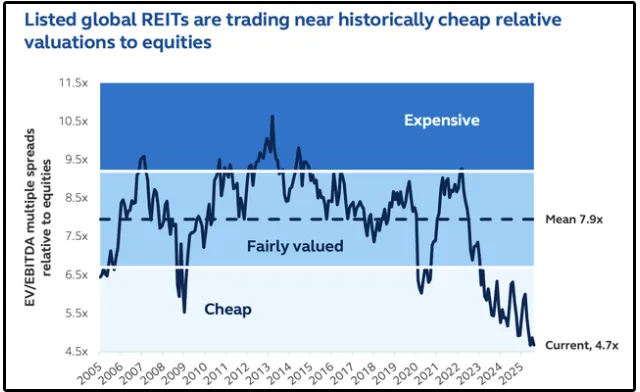

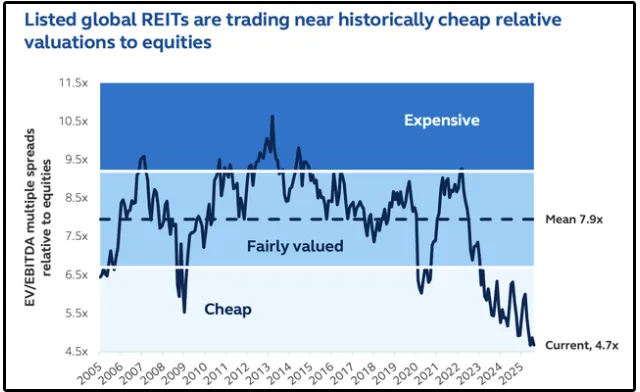

Sentiment surrounding REITs right now is incredibly low.

Sentiment surrounding REITs right now is incredibly low.

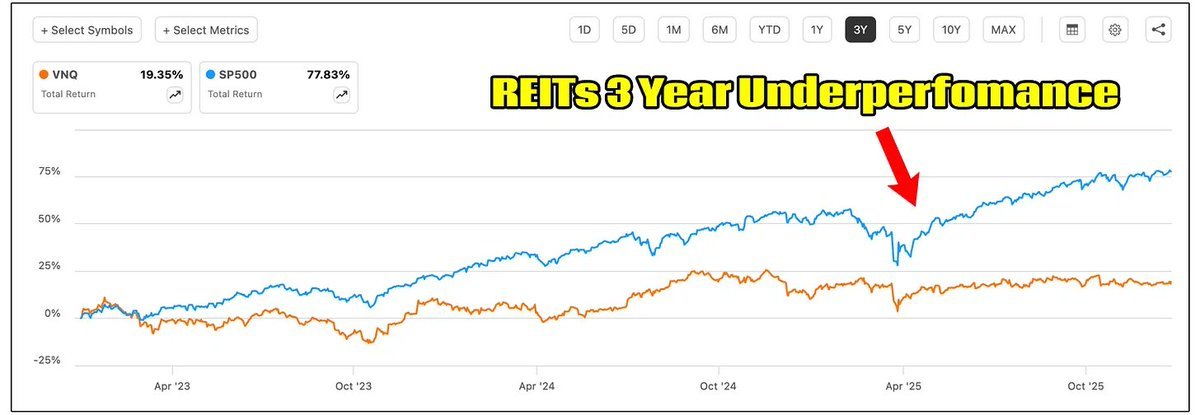

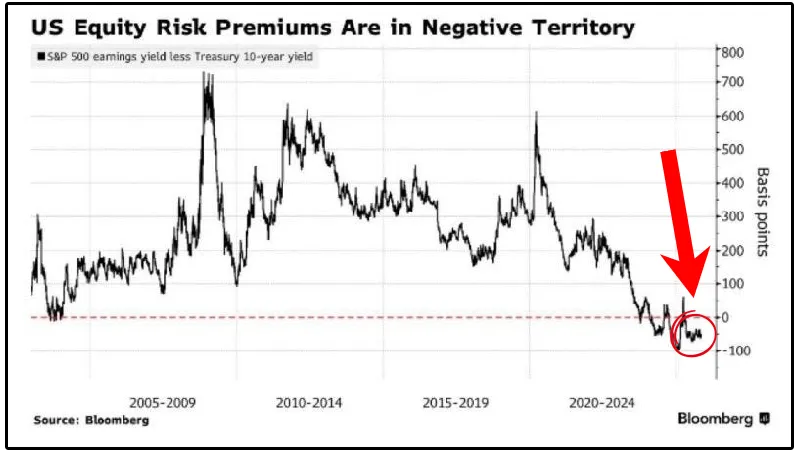

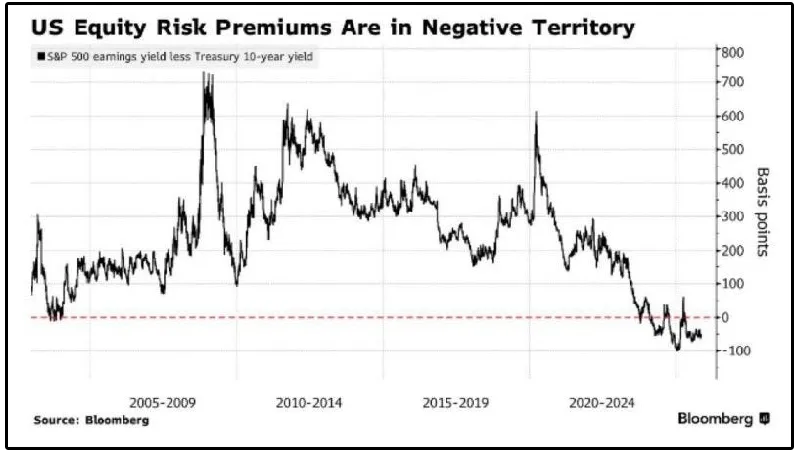

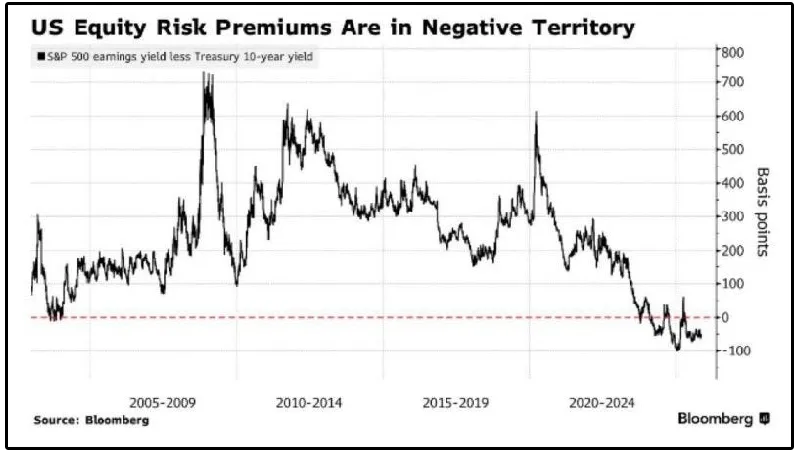

How much extra return are investors being paid to own stocks instead of “risk-free” government bonds?

How much extra return are investors being paid to own stocks instead of “risk-free” government bonds?

Sentiment surrounding REITs right now is incredibly low.

Sentiment surrounding REITs right now is incredibly low.

How much extra return are investors being paid to own stocks instead of “risk-free” government bonds?

How much extra return are investors being paid to own stocks instead of “risk-free” government bonds?

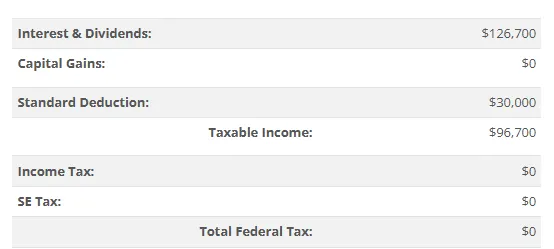

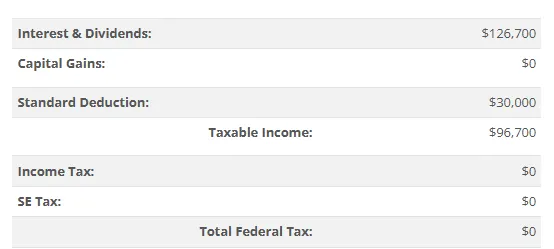

Generating $126,700 of federal tax-free money is almost equivalent to generating a before-tax salary of $165,000 (since you would pay approximately 25% in federal taxes)!

Generating $126,700 of federal tax-free money is almost equivalent to generating a before-tax salary of $165,000 (since you would pay approximately 25% in federal taxes)!

Generating $126,700 of federal tax-free money is almost equivalent to generating a before-tax salary of $165,000 (since you would pay approximately 25% in federal taxes)!

Generating $126,700 of federal tax-free money is almost equivalent to generating a before-tax salary of $165,000 (since you would pay approximately 25% in federal taxes)!

1. High Monthly Income, with Stability

1. High Monthly Income, with Stability

1) Ackman sees Hertz as two businesses in one:

1) Ackman sees Hertz as two businesses in one: