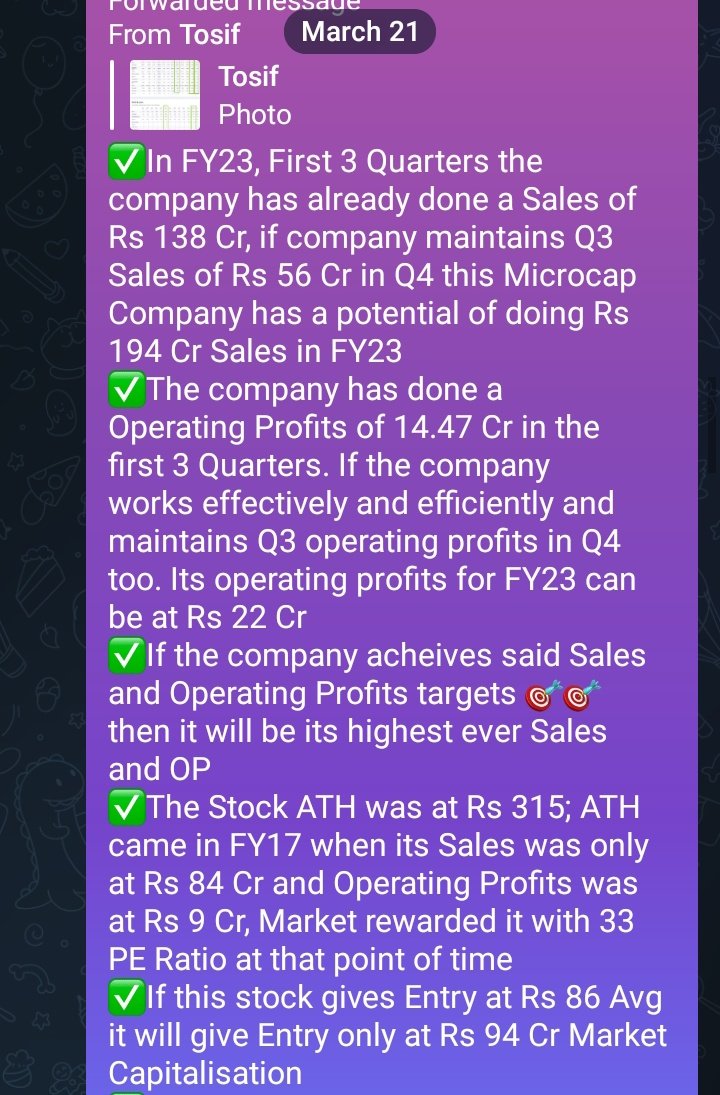

✅Prima Plastics was a 21st March set-up from the Microcap Space🧢🌌

✅Explained the Valuation Gap in Details(Read Below Thesis)

✅Told that Prima Plastics can do its Highest ever Sales and Operating Profits in the present FY23

✅After explaining fundamental analysis told that if

✅Explained the Valuation Gap in Details(Read Below Thesis)

✅Told that Prima Plastics can do its Highest ever Sales and Operating Profits in the present FY23

✅After explaining fundamental analysis told that if

Market rewards prima Plastics with 12 PE Ratio its share price will reach at Rs 160+

✅Prima Plastics was a Microcap 🧢 company and its all products were available in Amazon it was a big trigger point for it

✅Prima Plastics was a Microcap 🧢 company and its all products were available in Amazon it was a big trigger point for it

☑️Treasurian 💎💎✨ Community Rs 43,500 Member PL in Prima Plastics

☑️Fortune 🔮 can be made even in a Mircocap if one is able to Buy at correct valuation and price💯💯

☑️Microcaps are Risky but risk is involved in all caps in stock market

☑️Fortune 🔮 can be made even in a Mircocap if one is able to Buy at correct valuation and price💯💯

☑️Microcaps are Risky but risk is involved in all caps in stock market

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter