Evaluation of our sanctions policy

1. Only 2 questions matter. First, have our sanctions meaningfully curtailed Russia's ability to wage war? Second, are our sanctions a deterrent to countries that may wage war in the future? Unfortunately, the answer to both questions is: "No!"

1. Only 2 questions matter. First, have our sanctions meaningfully curtailed Russia's ability to wage war? Second, are our sanctions a deterrent to countries that may wage war in the future? Unfortunately, the answer to both questions is: "No!"

2. Root problem is an infatuation with financial sanctions. These can be effective when used on current account deficit countries - Turkey in 2018 is an example - but they don't work on current account surplus countries. This is a key point that cannot be emphasized enough.

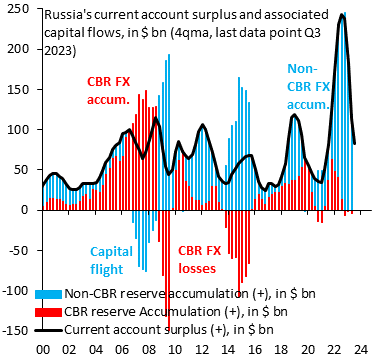

3. Russia shows how our financial sanctions failed. We sanctioned some banks, including the central bank (red), but not all. This meant that all the cash from Russia's current account surplus got routed through non-sanctioned Russian banks (blue). Putin still got all his cash...

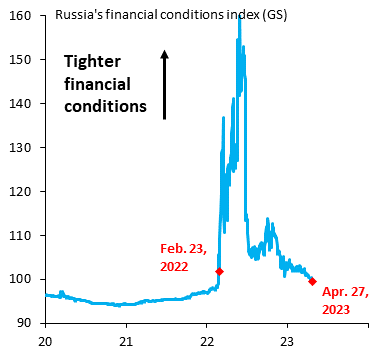

4. So our financial sanctions did not prevent Putin getting all his cash in return for energy exports. All this cash just got routed through different banks than before. As a result, financial conditions in Russia eased back to pre-war levels, a big plus for Russia's war economy.

5. We could have avoided this, but it would have required sanctioning ALL Russian banks. That's the same as a trade embargo, since Putin no longer gets paid and stops exporting. This shows what's needed to hurt c/a surplus countries: a trade embargo! Not financial sanctions...

6. Number one lesson from Russia is that our infatuation with financial sanctions must end. They don't work on c/a surplus countries, unless we sanction all banks, in which case we're just doing a trade embargo. We need to be doing trade embargos instead of financial sanctions...

7. Had we done a hard energy embargo on Russia, this would have come at a cost to the West, but Russia would have gone into financial crisis, making the war harder for Putin to fight. An embargo would have also scared other potentially hostile current account surplus countries.

8. It's not too late. First, the West needs to end its focus on financial sanctions. Second, we need to start talking about hard trade-offs that are needed to confront c/a surplus countries. We need to stop giving them cash, which means we need to stop buying their stuff...

9. A footnote on the G7 oil price cap. The cap is recognition of the fact that Russia's current account surplus needs to be cut. But - thanks to Greek shipping oligarchs - the cap was set at $60 and wasn't binding. A mistake that can be fixed now by lowering the cap...

• • •

Missing some Tweet in this thread? You can try to

force a refresh