Senior Fellow @BrookingsInst, previously Chief Economist @IIF and Chief FX Strategist @GoldmanSachs. Opinions are my own. Email: RBrooks@brookings.edu.

21 subscribers

How to get URL link on X (Twitter) App

2. European strategic autonomy: there's a surprising number of folks who - in the event of a Trump win - advocate a European pivot towards China. Seriously? China allied itself firmly with Russia in its invasion of Ukraine. You may not like Trump, but this would be a disaster...

2. European strategic autonomy: there's a surprising number of folks who - in the event of a Trump win - advocate a European pivot towards China. Seriously? China allied itself firmly with Russia in its invasion of Ukraine. You may not like Trump, but this would be a disaster...

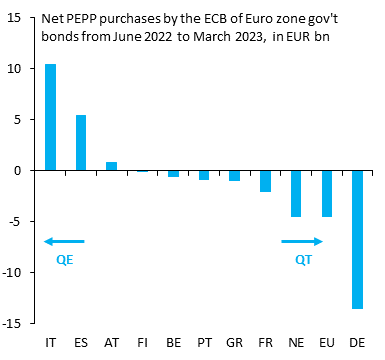

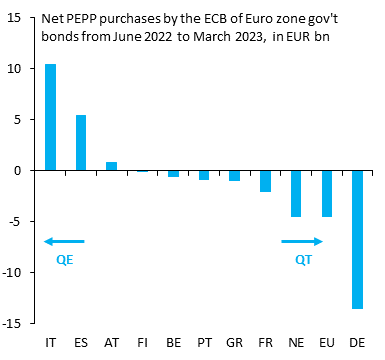

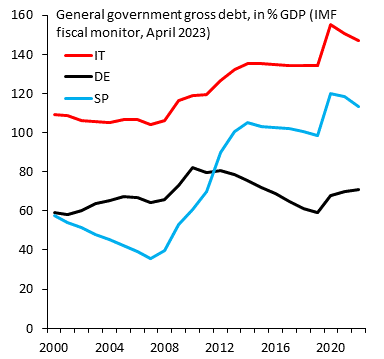

The key balance sheet for this debt shift is the ECB, where a complex jargon exists to hide this debt transfer. For example, high debt means yields periodically spike when there's global shocks. In the ECB vernacular, this gets called "fragmentation" and has to be prevented...

The key balance sheet for this debt shift is the ECB, where a complex jargon exists to hide this debt transfer. For example, high debt means yields periodically spike when there's global shocks. In the ECB vernacular, this gets called "fragmentation" and has to be prevented...

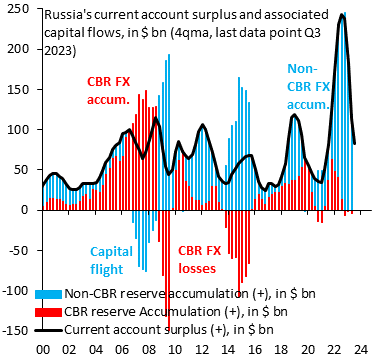

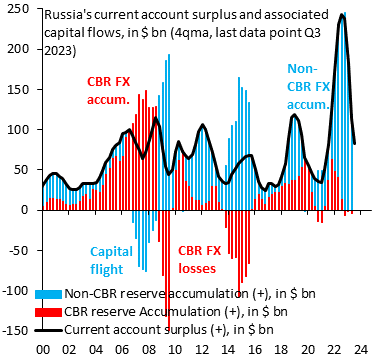

2. It's exactly the other way around. Financial sanctions on Russia can't work, while the G7 cap is the only way to squeeze Putin. We sanctioned some of Russia's banks (red), so money just flows via non-sanctioned banks (blue). Putin still gets ALL the hard currency he wants...

2. It's exactly the other way around. Financial sanctions on Russia can't work, while the G7 cap is the only way to squeeze Putin. We sanctioned some of Russia's banks (red), so money just flows via non-sanctioned banks (blue). Putin still gets ALL the hard currency he wants...

B. Lesson is that you can't hurt a current account surplus country by sanctioning some of its banks. You have to sanction all banks, but that's like a trade embargo, since Putin won't export oil if he can't get paid. The G7 cap recognizes this. It targets the current account...

B. Lesson is that you can't hurt a current account surplus country by sanctioning some of its banks. You have to sanction all banks, but that's like a trade embargo, since Putin won't export oil if he can't get paid. The G7 cap recognizes this. It targets the current account...

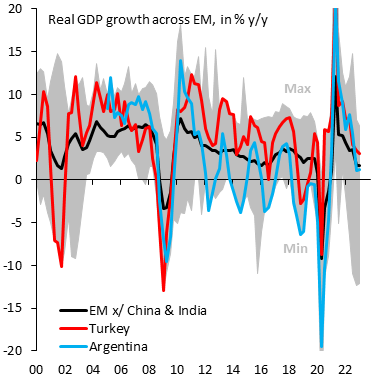

2. This interference in markets is the worst kind of electioneering. This political manipulaton of the economy also shows up in real GDP growth. Similar electoral cycles have given both countries the same boom-bust pattern, even though they're at opposite ends of the planet...

2. This interference in markets is the worst kind of electioneering. This political manipulaton of the economy also shows up in real GDP growth. Similar electoral cycles have given both countries the same boom-bust pattern, even though they're at opposite ends of the planet...

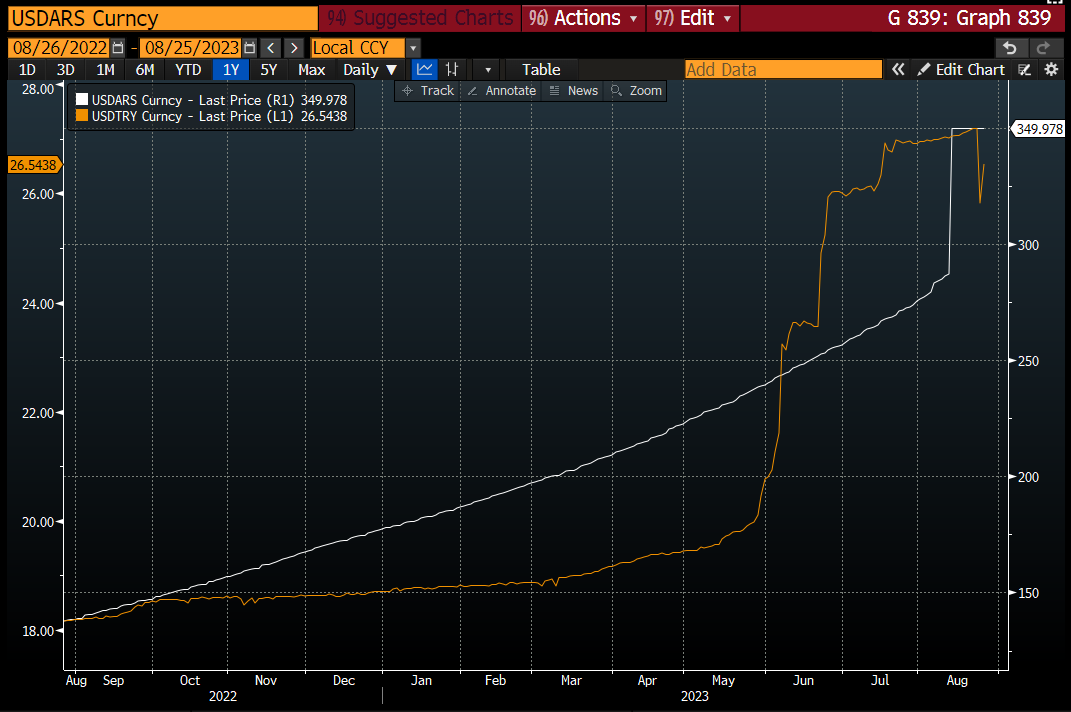

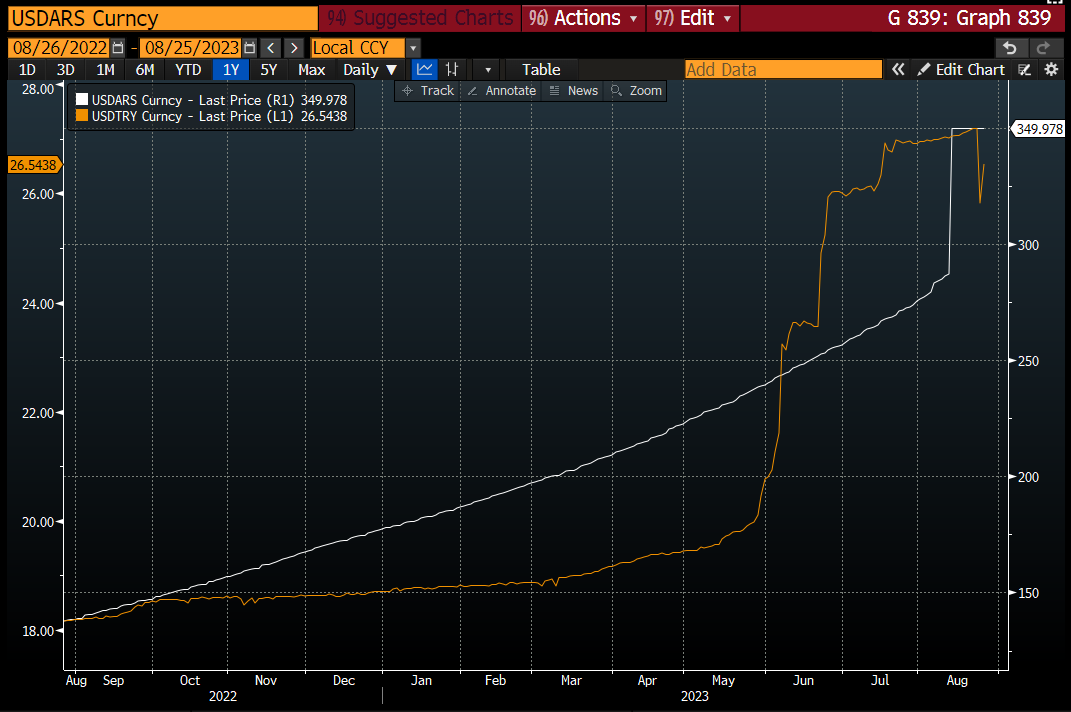

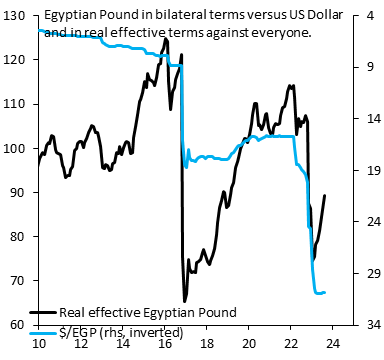

2. What's the problem with EM Dollar pegs (of which Dollarization is just a special case)? EM inflation is above US inflation. If you peg your currency to USD, your real exchange rate inevitably rises & becomes overvalued. That makes explosive devaluation inevitable. See Egypt...

2. What's the problem with EM Dollar pegs (of which Dollarization is just a special case)? EM inflation is above US inflation. If you peg your currency to USD, your real exchange rate inevitably rises & becomes overvalued. That makes explosive devaluation inevitable. See Egypt...

2. Our algorithm looks for unusual trade patterns. It can sometimes pick out false positive. An example: Italy's exports to China spiked early in '23. This was about the end of China's zero-COVID policy and Chinese citizens panic-buying an Italian drug. Not Russia related...

2. Our algorithm looks for unusual trade patterns. It can sometimes pick out false positive. An example: Italy's exports to China spiked early in '23. This was about the end of China's zero-COVID policy and Chinese citizens panic-buying an Italian drug. Not Russia related...

2. These sales of Greek-owned ships to the shadow fleet are likely one reason the share of Greek oil tankers has fallen steadily from its peak in April 2022. There's more money in selling ships to Putin than shipping his oil, especially with all the paperwork around the G7 cap...

2. These sales of Greek-owned ships to the shadow fleet are likely one reason the share of Greek oil tankers has fallen steadily from its peak in April 2022. There's more money in selling ships to Putin than shipping his oil, especially with all the paperwork around the G7 cap...

2. This combination - large current account inflows without private capital flight - means liquidity in Russia has been super abundant since the invasion. The GS financial conditions index is back to where it was before the invasion in Feb. 2022. That's great for Russia's GDP...

2. This combination - large current account inflows without private capital flight - means liquidity in Russia has been super abundant since the invasion. The GS financial conditions index is back to where it was before the invasion in Feb. 2022. That's great for Russia's GDP...

2. Greek shipping oligarchs shifted their tankers to help Russia after the invasion. Greek ships were 33% of total tanker capacity out of Russian ports prior to the invasion. Since then, this number is up to 50%. This means Putin's war machine depends critically on Greek ships...

2. Greek shipping oligarchs shifted their tankers to help Russia after the invasion. Greek ships were 33% of total tanker capacity out of Russian ports prior to the invasion. Since then, this number is up to 50%. This means Putin's war machine depends critically on Greek ships...

2. The country skew in ECB PEPP purchases has gone under the radar, but it shouldn't because it takes ECB bond buying into quasi-fiscal territory. This kind of fiscal skew would have been unthinkable when the ECB was established and is anathema to voters in northern Europe...

2. The country skew in ECB PEPP purchases has gone under the radar, but it shouldn't because it takes ECB bond buying into quasi-fiscal territory. This kind of fiscal skew would have been unthinkable when the ECB was established and is anathema to voters in northern Europe...

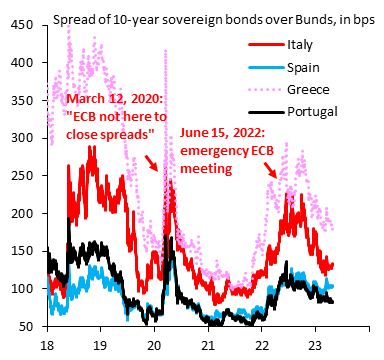

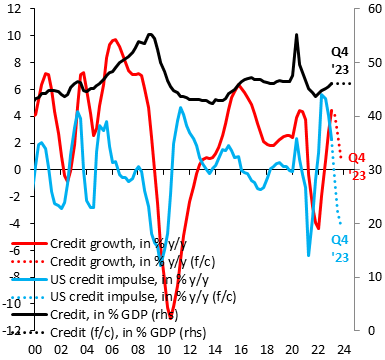

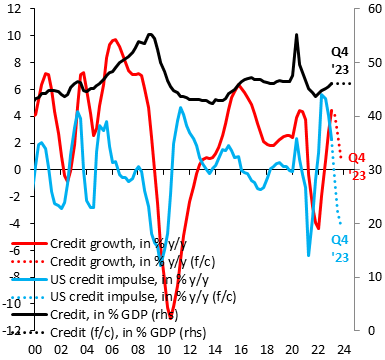

2. The "sudden stop" in loan growth is most pronounced for C&I loans, where cumulative loan growth is 0.3% year-to-date versus 7.8% in 2022 (lhs). That's a HUGE slowdown in lending. Same for consumer loans, where cumulative growth is -0.2% year-to-date versus 4.5% in 2022 (rhs).

2. The "sudden stop" in loan growth is most pronounced for C&I loans, where cumulative loan growth is 0.3% year-to-date versus 7.8% in 2022 (lhs). That's a HUGE slowdown in lending. Same for consumer loans, where cumulative growth is -0.2% year-to-date versus 4.5% in 2022 (rhs).

2. Germany last got first place in 2010 with Lena's mega hit "Satellite," a song we all love. Ever since, it's been the musical wilderness, with last place finishes in 2015, 2016, 2022 & now 2023. Germany got next-to-last place in 2021 and 2019 thanks only to the UK placing last.

2. Germany last got first place in 2010 with Lena's mega hit "Satellite," a song we all love. Ever since, it's been the musical wilderness, with last place finishes in 2015, 2016, 2022 & now 2023. Germany got next-to-last place in 2021 and 2019 thanks only to the UK placing last.

2. There's little doubt that Euro zone slack is greater than the US. Trend growth pre-GFC was on par with the US, only to fall behind in the decade following the 2008 crisis. The Euro zone HAS to have come into COVID and Russia's invasion of Ukraine with more slack than the US...

2. There's little doubt that Euro zone slack is greater than the US. Trend growth pre-GFC was on par with the US, only to fall behind in the decade following the 2008 crisis. The Euro zone HAS to have come into COVID and Russia's invasion of Ukraine with more slack than the US...

2. You can break out Italy's total exports to China into pharmaceuticals (red) and other (blue). The sharp rise in Italy's exports in recent months is entirely accounted for by pharmaceuticals. Other exports to China are actually down a bit. With @econchart and @JonathanPingle

2. You can break out Italy's total exports to China into pharmaceuticals (red) and other (blue). The sharp rise in Italy's exports in recent months is entirely accounted for by pharmaceuticals. Other exports to China are actually down a bit. With @econchart and @JonathanPingle

2. Russia's current account surplus - from energy exports - means it is a net lender to the world, not a borrower. We did sanction some banks, including the central bank (red), but Russia just built up foreign assets via non-sanctioned banks (blue). Putin still got tons of cash.

2. Russia's current account surplus - from energy exports - means it is a net lender to the world, not a borrower. We did sanction some banks, including the central bank (red), but Russia just built up foreign assets via non-sanctioned banks (blue). Putin still got tons of cash.

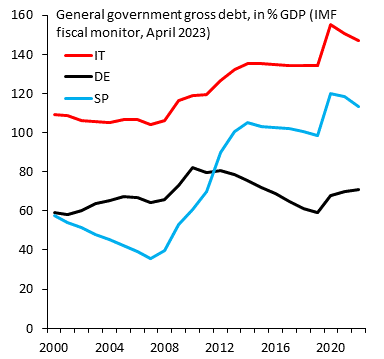

2. Periphery spreads are low. Much of this is due to de facto spread management. We have a natural experiment to show this. In March 2020, President Lagarde said: "ECB isn't here to close spreads." Spreads immediately shot up. There's been de facto spread management ever since.

2. Periphery spreads are low. Much of this is due to de facto spread management. We have a natural experiment to show this. In March 2020, President Lagarde said: "ECB isn't here to close spreads." Spreads immediately shot up. There's been de facto spread management ever since.

2. Root problem is an infatuation with financial sanctions. These can be effective when used on current account deficit countries - Turkey in 2018 is an example - but they don't work on current account surplus countries. This is a key point that cannot be emphasized enough.

2. Root problem is an infatuation with financial sanctions. These can be effective when used on current account deficit countries - Turkey in 2018 is an example - but they don't work on current account surplus countries. This is a key point that cannot be emphasized enough.

2. So there's a kind of collective denial how credit cycles work. Assuming credit in % GDP is stable into end-2023 is arguably an optimistic assumption. Yet even in this positive scenario, the credit impulse almost guarantees a US hard landing. Odds of deep recession have risen.

2. So there's a kind of collective denial how credit cycles work. Assuming credit in % GDP is stable into end-2023 is arguably an optimistic assumption. Yet even in this positive scenario, the credit impulse almost guarantees a US hard landing. Odds of deep recession have risen.