1/10 I just realized that the US Gov has to PAY to prop-up the USD in the CURRENT BUDGET through Quasi Fiscal Deficit.

Let's explain the Druck USD short. 🧵

Because QFD is your chickens coming to roost right there.

Let's explain the Druck USD short. 🧵

Because QFD is your chickens coming to roost right there.

2/10 There WERE two timelines. The thing you pay now, the thing you owe in the future. Petrodollars and expansion of #TSY in foreign central banks.

3/10 In 2000 the monetary base is small, the US gov debt is a lot more reasonable. The currency is propped up by petrodollar. Any means of circulation acquires its value in use and non redeemable gov currency the most.

4/10 In 2000 what US "pays now" is supported by a much strong currency vs THINGS. Check the course of PMs or $Oil, althrough PMs wer probably 50% undervalued.

And the demand for what you owe keeps increasing (it's a strong paper, why would any non G-7 balk at the acquisition?)

And the demand for what you owe keeps increasing (it's a strong paper, why would any non G-7 balk at the acquisition?)

5/10 However today the cost of supporting the USD has to be paid in the current budget by the US gov, not backloaded by increases in #TSY holding or increase in Petrodollar, the opposite!

6/10 How so?

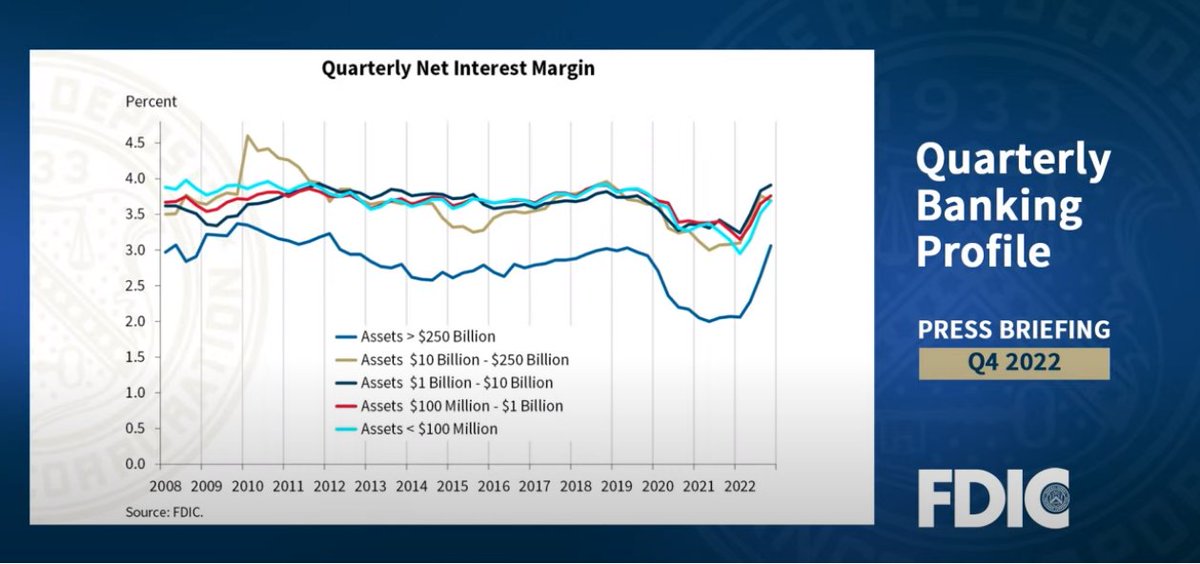

Demand for USD is propped by interest payments on Reserves. The #Fed has a cost of sterilization of M0, that leads to a budget shortfall. If you stop the stimuli to promote demand on USD, the USD falls, that's patently obvious & alluded to by Mr. Druckenmiller.

Demand for USD is propped by interest payments on Reserves. The #Fed has a cost of sterilization of M0, that leads to a budget shortfall. If you stop the stimuli to promote demand on USD, the USD falls, that's patently obvious & alluded to by Mr. Druckenmiller.

7/10 Now some people belive there is a USD squeeze. NO. The US gov PAYS in the budget to prop up the USD.

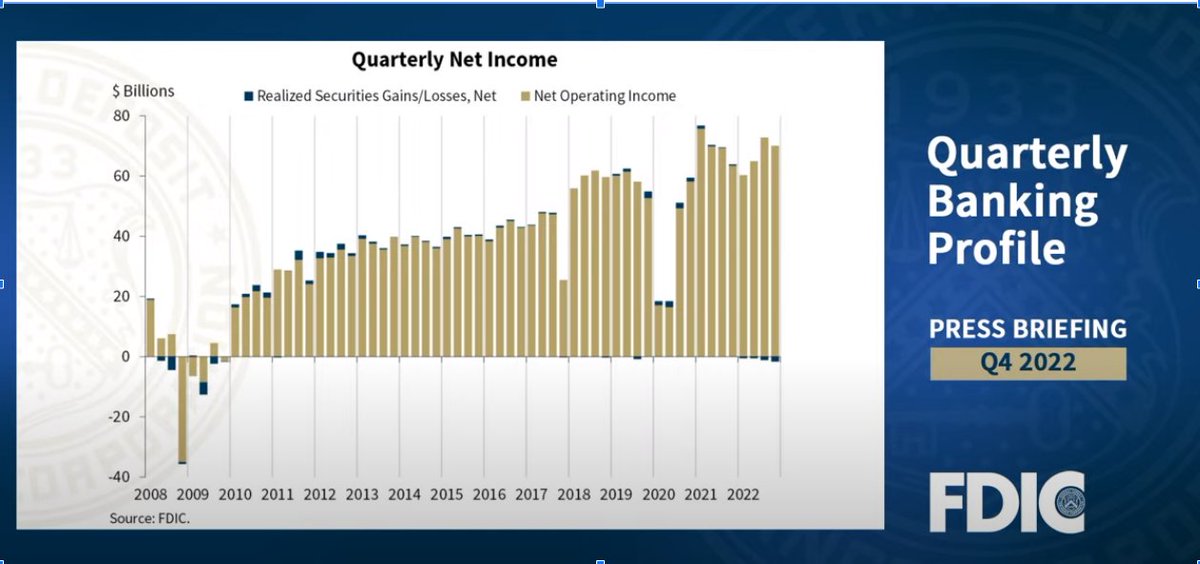

In a squeeze, not only you don't need to pay interest on M0. There is huge excess of private credit vs a tiny M0 base (2008). Massive M0 demand, you even need to print.

In a squeeze, not only you don't need to pay interest on M0. There is huge excess of private credit vs a tiny M0 base (2008). Massive M0 demand, you even need to print.

8/10 The keyword is PRIVATE CREDIT. GOV CREDIT IS NOT DEBT, IT'NOT REPAID, CONSTANTLY EXPANDED, it's money.

Unless US Gov cuts Gov spending you have constant excess of M0. Debt now compounded by the DIRECT COST OF PROPPING UP THE USD by paying interest on M0 to create demand.

Unless US Gov cuts Gov spending you have constant excess of M0. Debt now compounded by the DIRECT COST OF PROPPING UP THE USD by paying interest on M0 to create demand.

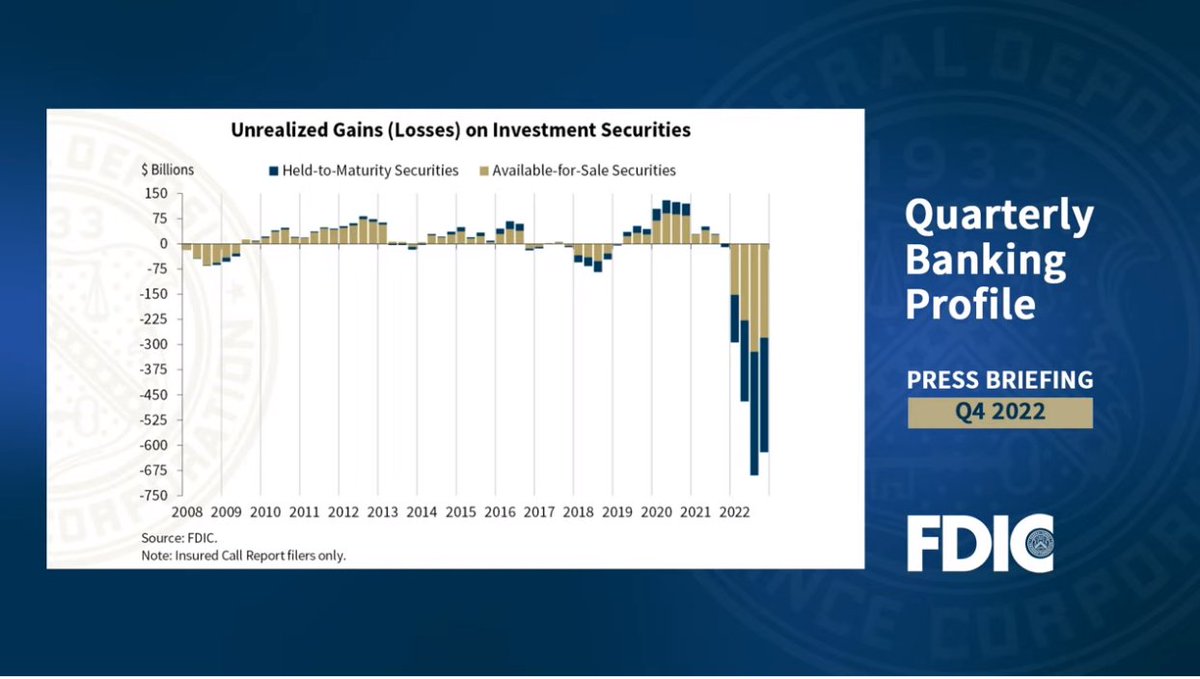

9/10 And on the backend of the funding (long term #TSY), the foreign central banks KNOW you have a quasi fiscal deficit.

Hence Singapore just boosting its Gold reserve by 49% since end of 2022

Hence Singapore just boosting its Gold reserve by 49% since end of 2022

10/10 The cost of propping up the USD, instead of being born by the Petrollar and backloaded by the expansion of #TSY holding by foreign central banks is NOW DIRECTLY FRONT-LOADED by Quasi Fiscal Deficit as a cost in US Budget.

@SamanthaLaDuc

@SamanthaLaDuc

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter