#BARCLAYS #ARGENTINA 🇦🇷

Barclays on Argentina 🧐

The economic and financial crisisis deepening in Argentina, in line with our baseline scenario (Argentina Quarterly: Drought fuels the fire). The exchange rate gap has widened to 110%, from 85% in February. (sigue)

Barclays on Argentina 🧐

The economic and financial crisisis deepening in Argentina, in line with our baseline scenario (Argentina Quarterly: Drought fuels the fire). The exchange rate gap has widened to 110%, from 85% in February. (sigue)

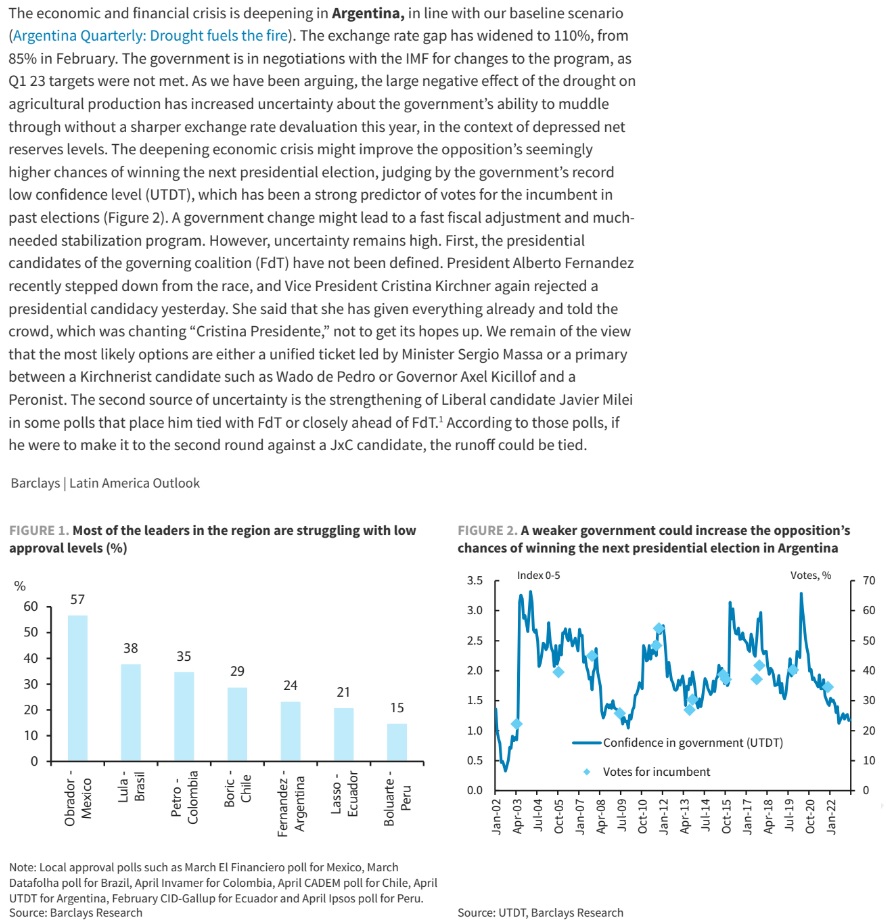

The government is in negotiations with the IMF for changes to the program, as Q1 23 targets were not met. As we have been arguing, the large negative effect of the drought on agricultural production has increased uncertainty about the government’s ability to muddle through

without as harper exchange rate devaluation this year, in the context of depressed net reserves levels. The deepening economic crisis might improve the opposition’s seemingly higher chances of winning the next presidential election, judging by the government’s record (sigue)

low confidence level (UTDT), which has been a strong predictor of votes for the incumbent in past elections (Figure2). A government change might lead to a fast fiscal adjustment and much-needed stabilization program. However, uncertainty remains high. (sigue)

First, the presidential candidates of the governing coalition (FdT) have not been defined. President Alberto Fernandez recently stepped down from the race, and Vice President Cristina Kirchner again rejected a presidential candidacy yesterday. (sigue)

She said that she has given everything already and told the crowd, which was chanting“ Cristina Presidente,” not to get its hopes up. Were main of the view that the most likely options are either a unified ticket led by Minister Sergio Massa or a primary between (sigue)

a Kirchnerist candidate such as Wado de Pedro or Governor Axel Kicillof and a Peronist. The second source of uncertainty is the strengthening of Liberal candidate Javier Milei in some polls that place him tied with FdT or closely ahead of FdT.1 (sigue)

According to those polls, if he were to make it to the second round against a JxC candidate, the runoff could be tied.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter