#BRICS trading group is gaining steam while US Dollar is losing steam. As of 2021 18.5% of all trades were settled in Yuan, by 2022 it jumped to 26.6%.

Iran is trading in Yuan

Iraq is trading in Yuan

India is trading in Yuan

Brazil is trading in Yuan

France is trading in Yuan

Russia is trading in Yuan

Sri Lanka is trading in Yuan

Argentina is trading in Yuan

Saudi Arabia is trading in Yuan

It’s only a matter of time for Yuan to takeover the US Dollar as the world reserve currency unless something drastically changes.

A thread 🧵 for your awareness👇

Iran is trading in Yuan

Iraq is trading in Yuan

India is trading in Yuan

Brazil is trading in Yuan

France is trading in Yuan

Russia is trading in Yuan

Sri Lanka is trading in Yuan

Argentina is trading in Yuan

Saudi Arabia is trading in Yuan

It’s only a matter of time for Yuan to takeover the US Dollar as the world reserve currency unless something drastically changes.

A thread 🧵 for your awareness👇

A prev thread 🧵 on the rise of BRICS

https://twitter.com/DeepBlueCrypto/status/1642929307755462661

IF YOU WEAPONIZE YOUR CURRENCY (USD) ENOUGH TIMES, OTHER COUNTRIES WILL STOP USING IT

They’re talking about sanctions on other countries to trade internationally

They’re talking about sanctions on other countries to trade internationally

BRICS member states account for over 40 percent of the global population and around a quarter of the global GDP.

The greenback has become more unreliable for dollarized economies due to rising interest rates regulated by the FED and the weaponization of the dollar by sanctions.

The greenback has become more unreliable for dollarized economies due to rising interest rates regulated by the FED and the weaponization of the dollar by sanctions.

Former Morgan Stanley analyst Steven Jen warns the dollar is falling off a cliff. #Dedollarization is happening at record speeds from USD share of 73% in 2001 to 55% in 2020. Then it fell off a cliff losing 8% in a year to 47% in 2022 due to sanctions.

Gotta agree with @balajis

We have a multipolar world and the US is coming to terms with it…

Their days of CIA misinformation, mainstream media misinformation, declare regime changes and military bases everywhere are dwindling fast.

We have a multipolar world and the US is coming to terms with it…

Their days of CIA misinformation, mainstream media misinformation, declare regime changes and military bases everywhere are dwindling fast.

A 13 year old girl asked Warren Buffett about the U.S dollar losing its reserve currency status with the debt hitting $31 trillion a 125% of GDP and countries fleeing from the dollar.

She’s asking a better question than 99% of journalists.

She’s asking a better question than 99% of journalists.

BRICS+ includes Brazil, Russia, India, China, South Africa and soon Indonesia, Saudi Arabia and 13 other applicants. This multipolar alliance is bigger than the G7. It will end US hegemony and the US dollar as a reserve currency. The expiry date of US empire is set.

"We absolutely cannot protect the economy if the US defaults on its debt," said the Fed's Neel Kashkari.

US Dollar being a world reserve currency is a confidence game. Debt defaults and these standoffs don’t instill confidence.

US Dollar being a world reserve currency is a confidence game. Debt defaults and these standoffs don’t instill confidence.

Look at the countries primary trading partners shift every 30 years (3 decades) from USA (1960) to Germany (1990) to China (2020)

China is the world’s largest manufacturing hub and the worlds largest trading partner for most countries now.

From negotiations perspective, USA isn’t in a position of strength, China is.

From an economic perspective, USA no longer holds the bargaining chip, China does.

From a diplomatic perspective, USA lost its credibility through lies, wars and sanctions. China has an upper hand from this regard as well.

From a capital investment perspective I’d rather invest in China and India rather than US & Europe.

China is the world’s largest manufacturing hub and the worlds largest trading partner for most countries now.

From negotiations perspective, USA isn’t in a position of strength, China is.

From an economic perspective, USA no longer holds the bargaining chip, China does.

From a diplomatic perspective, USA lost its credibility through lies, wars and sanctions. China has an upper hand from this regard as well.

From a capital investment perspective I’d rather invest in China and India rather than US & Europe.

Egypt 🇪🇬 to settle trades with BRICS nations in their local currencies from India, China and Russia 👍

“Why do we need to trade goods & services between Kenya & Djibouti in US Dollars?”

People are realizing the benefits of frictionless trade between countries in their local currencies

US Dollar dominance declines slowly then suddenly

People are realizing the benefits of frictionless trade between countries in their local currencies

US Dollar dominance declines slowly then suddenly

China welcomes Palestinian President Mahmoud Abbas to announce a strategic partnership. Xi Jinping wants to repair the damage that the US and Israel have done.

China is bringing peace to the Middle East which was destroyed by the USA 🇺🇸 and Israel 🇮🇱

China is bringing peace to the Middle East which was destroyed by the USA 🇺🇸 and Israel 🇮🇱

Damn… #BRICS is getting more and more popular…

US Dollar is losing steam

Chinese Yuan gaining traction

US Dollar is losing steam

Chinese Yuan gaining traction

Putin Is Right Again About The New Multipolar World Getting Stronger

Putin at St. Petersburg Economic Forum: "The neocolonial international system has ceased to exist, while the multipolar order is getting ever stronger. This process is inevitable."

Putin at St. Petersburg Economic Forum: "The neocolonial international system has ceased to exist, while the multipolar order is getting ever stronger. This process is inevitable."

Almost 20 countries have applied to join BRICS as per Russia’s🇷🇺 Deputy Foreign Minister

The list of applicants include:

Saudi Arabia🇸🇦

UAE🇦🇪

Egypt🇪🇬

Algeria🇩🇿

Bahrain🇧🇭

Indonesia🇮🇩

Argentina🇦🇷

Mexico🇲🇽

Nigeria🇳🇬

Bangladesh🇧🇩

Venezuela🇻🇪

Iran🇮🇷

Kazakhstan🇰🇿

Turkey🇹🇷

Syria🇸🇾

Nicaragua🇳🇮

The new BRICS currency being discussed will reportedly be backed by gold, rare earth metals and the other natural resources of the BRICS members, with expansion bringing in the vast natural resource wealth of new members.

While the US dollar is backed arguably by nothing other than the US’ military dominance and declining hegemonic bullying, will the arrival of the BRICS currency deal a quick and fatal blow to the position of the dollar as the world’s most dominant currency 🤷♂️

The list of applicants include:

Saudi Arabia🇸🇦

UAE🇦🇪

Egypt🇪🇬

Algeria🇩🇿

Bahrain🇧🇭

Indonesia🇮🇩

Argentina🇦🇷

Mexico🇲🇽

Nigeria🇳🇬

Bangladesh🇧🇩

Venezuela🇻🇪

Iran🇮🇷

Kazakhstan🇰🇿

Turkey🇹🇷

Syria🇸🇾

Nicaragua🇳🇮

The new BRICS currency being discussed will reportedly be backed by gold, rare earth metals and the other natural resources of the BRICS members, with expansion bringing in the vast natural resource wealth of new members.

While the US dollar is backed arguably by nothing other than the US’ military dominance and declining hegemonic bullying, will the arrival of the BRICS currency deal a quick and fatal blow to the position of the dollar as the world’s most dominant currency 🤷♂️

East is dominating the west in the future

BRICS will dominate G7 going forward

BRICS will dominate G7 going forward

https://twitter.com/DeepBlueCrypto/status/1669905571791659015

BRICS membership (GDP):

🇧🇷 Brazil: $2.08 trillion

🇷🇺 Russia: $2.06 trillion

🇮🇳 India: $3.74 trillion

🇨🇳 China: $19.37 trillion

🇿🇦 South Africa: $399 billion

Applied for membership:

🇩🇿 Algeria: $206 billion

🇦🇷 Argentina: $641 billion

🇧🇭 Bahrain: $44 billion

🇪🇬 Egypt: $387 billion

🇮🇩 Indonesia: $1.39 trillion

🇮🇷 Iran: $367 billion

🇸🇦 Saudi Arabia: $1.06 trillion

🇦🇪 UAE: $499 billion

…

…

That’s well over $33 trillion

🇧🇷 Brazil: $2.08 trillion

🇷🇺 Russia: $2.06 trillion

🇮🇳 India: $3.74 trillion

🇨🇳 China: $19.37 trillion

🇿🇦 South Africa: $399 billion

Applied for membership:

🇩🇿 Algeria: $206 billion

🇦🇷 Argentina: $641 billion

🇧🇭 Bahrain: $44 billion

🇪🇬 Egypt: $387 billion

🇮🇩 Indonesia: $1.39 trillion

🇮🇷 Iran: $367 billion

🇸🇦 Saudi Arabia: $1.06 trillion

🇦🇪 UAE: $499 billion

…

…

That’s well over $33 trillion

BRICS to launch new currency backed by gold at August 2023 summit

‘Gold standard will be a great benefit to strengthening new single currency’

‘41 countries have applied for BRICS-membership’

#BRICS >> G7 and USD de-dollarization continues

‘Gold standard will be a great benefit to strengthening new single currency’

‘41 countries have applied for BRICS-membership’

#BRICS >> G7 and USD de-dollarization continues

Russia confirms that BRICS countries are launching a BRICS currency backed by #gold.

It’s on the agenda for BRICS South Africa meeting in August. 41 other countries have applied to join BRICS.

De-dollarization is happening fast.

It’s on the agenda for BRICS South Africa meeting in August. 41 other countries have applied to join BRICS.

De-dollarization is happening fast.

The Chinese yuan will never replace the US Dollars as the world reserve currency… because the Chinese government doesn’t want the filthy rich to exit the country

Brazil president calls for an end to US dollar trade dominance and the weaponization of the dollar with sanctions on the poor countries

The resentment towards United States and the western NATO forces around the world is exploited by the BRICS nations including Russia and China to their advantage by pulling those nations with friendly gestures instead of western sanctions

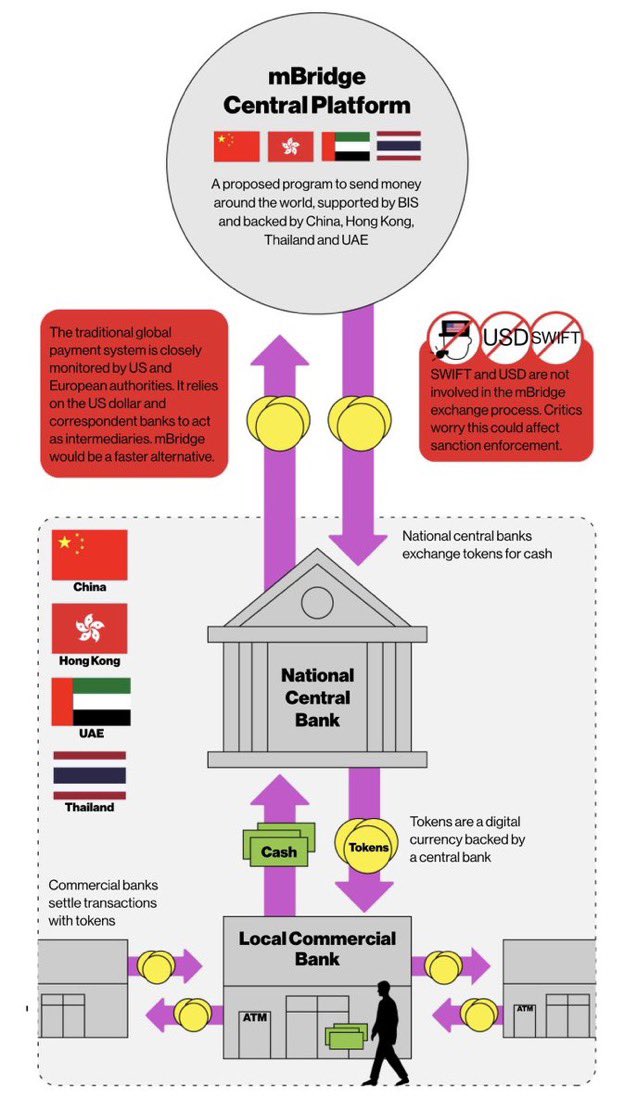

China has partnered with the Bank of International Settlements to create mBridge, a digital payment system that completely bypasses SWIFT and 🇺🇸 US banks

America and the west is scared of what China is doing in Africa. They’re beating the west in their own game financially but with much better success since they’re not colonizing Africa like the west.

Donald Trump — The US Dollar is losing its position as a dominant world reserve currency. This is a bigger loss than any war. If this continues the economy will be in shambles.

XI JINPING addresses South Africa media before the BRICS summit 👍

"We should fear no hegemony, and work with each other as real partners to push forward our relations amid the changing international landscape."

"What the world needs today is peace, not conflict; what the world wants is coordination, not confrontation. China and South Africa, as natural members of the Global South, should work together to appeal for greater voice and influence of developing countries in international affairs, promote accelerated reform of international financial institutions, and oppose unilateral sanctions and the “small yard, high fence” approach. We should jointly safeguard our common interests."

"We should fear no hegemony, and work with each other as real partners to push forward our relations amid the changing international landscape."

"What the world needs today is peace, not conflict; what the world wants is coordination, not confrontation. China and South Africa, as natural members of the Global South, should work together to appeal for greater voice and influence of developing countries in international affairs, promote accelerated reform of international financial institutions, and oppose unilateral sanctions and the “small yard, high fence” approach. We should jointly safeguard our common interests."

The BRICS bank vs. The World Bank

The BRICS Bank is preparing to lend in South African and Brazilian currencies to reduce reliance on the US Dollar.

The World Banks purpose is to destroy small countries that are in trouble by lending at huge costs and demanding much more than interests.

Dedollarization continues to undermine the dollar at the worlds stage and the more countries trade in their own currencies, the weaker the dollar gets.

The BRICS Bank is preparing to lend in South African and Brazilian currencies to reduce reliance on the US Dollar.

The World Banks purpose is to destroy small countries that are in trouble by lending at huge costs and demanding much more than interests.

Dedollarization continues to undermine the dollar at the worlds stage and the more countries trade in their own currencies, the weaker the dollar gets.

The biggest lesson United States can learn from this is… going forward in a multipolar world, sanctions don’t work

Eastern economies will grow much faster than the western economies. The era of financial slavery and colonialism in Africa will come to an end. No more stealing.

Eastern economies will grow much faster than the western economies. The era of financial slavery and colonialism in Africa will come to an end. No more stealing.

Goldman Sachs says the BRICS will dominate the world economy by 2050 yet the western media is completely silent on what’s happening.

The western hegemony is over and the east will rise going forward.

The western hegemony is over and the east will rise going forward.

BRICS “New Development Bank” Chief Dilma Rousseff says the BRICS Bank will accept 4-5 new members, with oil superpower Saudi Arabia seeking to join earlier this year.

BRICS New Development Bank Membership:

Brazil🇧🇷

Russia🇷🇺

India🇮🇳

China🇨🇳

South Africa🇿🇦

Bangladesh🇧🇩

UAE🇦🇪

Egypt🇪🇬

Uruguay🇺🇾 (officially in the process of joining)

As of May 2023, the BRICS Bank has lent $33 billion to 96 infrastructure projects. They will be lending much more in the next couple of years. You will see the NDB taking a larger role in nation building than the IMF & World Banks.

BRICS New Development Bank Membership:

Brazil🇧🇷

Russia🇷🇺

India🇮🇳

China🇨🇳

South Africa🇿🇦

Bangladesh🇧🇩

UAE🇦🇪

Egypt🇪🇬

Uruguay🇺🇾 (officially in the process of joining)

As of May 2023, the BRICS Bank has lent $33 billion to 96 infrastructure projects. They will be lending much more in the next couple of years. You will see the NDB taking a larger role in nation building than the IMF & World Banks.

Chinese President XI Jinping’s statements:

- BRICS countries should oppose economic coercion and focus on business cooperation.

- BRICS countries should expand political and security cooperation, maintain peace and tranquility.

- Cold War mentality persists today, geopolitical situation grim.

- China is ready to cooperate with all parties to establish a mechanism for sustainable industrial exchange and cooperation in the BRICS countries.

- BRICS countries should oppose economic coercion and focus on business cooperation.

- BRICS countries should expand political and security cooperation, maintain peace and tranquility.

- Cold War mentality persists today, geopolitical situation grim.

- China is ready to cooperate with all parties to establish a mechanism for sustainable industrial exchange and cooperation in the BRICS countries.

BRICS just announced that Argentina, Iran, Saudi Arabia, Egypt and UAE are members. Dedollarization continues and the petrodollars are dead.

6 new countries are joining BRICS by January 1st 2024. They can all start trading goods and services in their local currencies.

BRICS countries now control 80% of the world's oil reserves and more than 35% of global GDP. The #PetroDollar is toast and US hegemony is at stake.

They are developing a single currency for international trade.

They are developing a single currency for international trade.

‘We already live in a post-American and a post-Western world. We’re in a world where the BRICS countries are larger than the G7 countries…the US is a quarter of a century out of date’

-Jeffrey Sachs

-Jeffrey Sachs

Why Ethiopia? What’s the significance of joining Ethiopia into BRICS and also establishing the headquarters there?

Because it is a direct appeal to the rest of Africa. Moreover, the appeal is at the level of historical feeling. Ethiopia is the only country on the African continent that has never been a European colony. There simply could not be a louder signal for the entire Black Continent than the admission of Ethiopia to the BRICS.

Because it is a direct appeal to the rest of Africa. Moreover, the appeal is at the level of historical feeling. Ethiopia is the only country on the African continent that has never been a European colony. There simply could not be a louder signal for the entire Black Continent than the admission of Ethiopia to the BRICS.

🇮🇳 India GDP per capita 2000: $442

🇮🇳 India GDP per capita 2023: $2,601

GDP grew 6x in 23 years… amazing

🇮🇳 India GDP per capita 2023: $2,601

GDP grew 6x in 23 years… amazing

In the first five months of this year, the Iranian government added more than 4.1 tons of standard gold bars to its treasury.

Gold >>> US Dollars >>> Iranian Rial

Gold >>> US Dollars >>> Iranian Rial

BRICS+

🇧🇷🇷🇺🇮🇳🇨🇳🇿🇦🇸🇦🇦🇪🇮🇷🇪🇬🇦🇷🇪🇹

45% of the world's oil production🛢️

37% of global GDP @ PPP💰

25% of global merchandise trade

45% of global forex reserves💱

47% of global population🌍

44% of global oil reserves🛢️

25% of global exports🚢

38.3% of global industrial output🏭

🇧🇷🇷🇺🇮🇳🇨🇳🇿🇦🇸🇦🇦🇪🇮🇷🇪🇬🇦🇷🇪🇹

45% of the world's oil production🛢️

37% of global GDP @ PPP💰

25% of global merchandise trade

45% of global forex reserves💱

47% of global population🌍

44% of global oil reserves🛢️

25% of global exports🚢

38.3% of global industrial output🏭

• • •

Missing some Tweet in this thread? You can try to

force a refresh