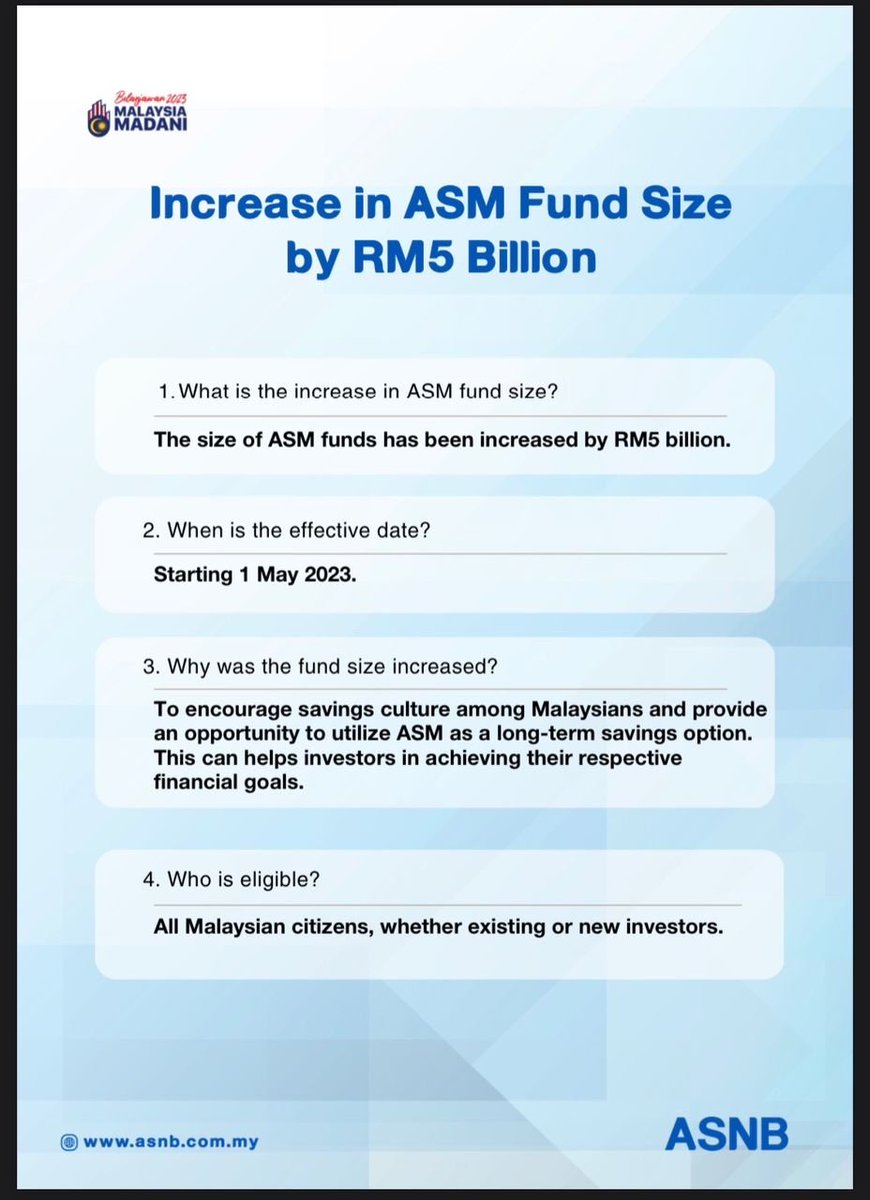

Amanah Saham Malaysia (ASM) has recently increased its fund size by RM5 billion.

The investment is open to ALL investors on a first come first serve basis.

Here’s a breakdown of everything you need to know about ASNB. 🧵

The investment is open to ALL investors on a first come first serve basis.

Here’s a breakdown of everything you need to know about ASNB. 🧵

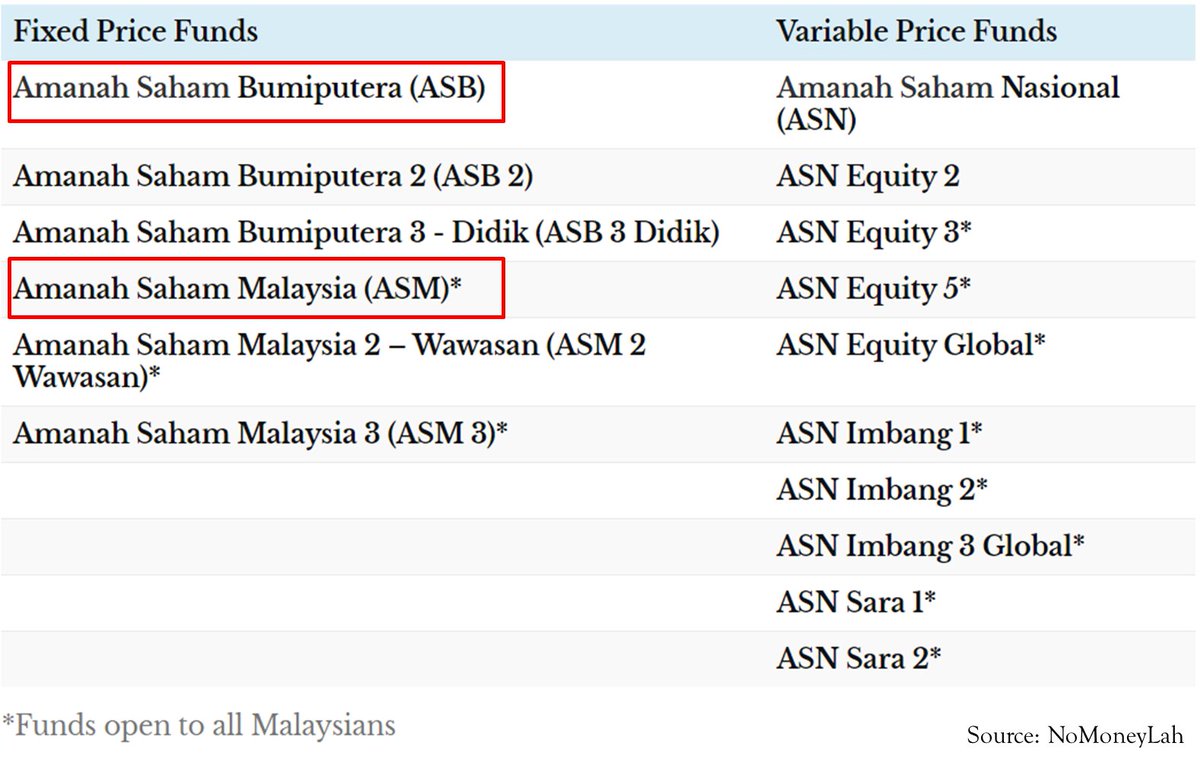

1. Amanah Saham Nasional Berhad (ASNB) is a unit trust company established in 1979.

There are currently 16 types of funds offered, each with a varying degree of risk.

For today’s purposes, we’ll focus on the ones with the lowest risk - ASB and ASM.

There are currently 16 types of funds offered, each with a varying degree of risk.

For today’s purposes, we’ll focus on the ones with the lowest risk - ASB and ASM.

2. ASB and ASM are fixed-price funds that are always sold at RM1 per unit.

This means that you can plan your investments without worrying about market volatility or price swings.

This means that you can plan your investments without worrying about market volatility or price swings.

3. ASB and ASM both pay decent dividends.

The payout averaged 6.92% and 5.68% in the past 11 years for ASB and ASM, respectively.

During the height of the pandemic in 2020, both funds managed to deliver dividends above 4%.

The payout averaged 6.92% and 5.68% in the past 11 years for ASB and ASM, respectively.

During the height of the pandemic in 2020, both funds managed to deliver dividends above 4%.

4. ASB and ASM dividends are not taxable!

There are also no sales charge or upfront costs when you start investing, unlike other ASNB funds, which charge up to 5%.

There are also no sales charge or upfront costs when you start investing, unlike other ASNB funds, which charge up to 5%.

5. Redeem anytime, instantly.

You can withdraw up to 2,000 units (or RM2,000) from ASB or ASM every month through the myASNB app online.

For bigger amounts, you can do so at an ASNB branch.

You can withdraw up to 2,000 units (or RM2,000) from ASB or ASM every month through the myASNB app online.

For bigger amounts, you can do so at an ASNB branch.

6. What are the risks?

• Returns are not guaranteed. ASB and ASM dividends fluctuate based on market conditions and interest rates.

• All funds by ASNB are not insured by PIDM.

• Returns are not guaranteed. ASB and ASM dividends fluctuate based on market conditions and interest rates.

• All funds by ASNB are not insured by PIDM.

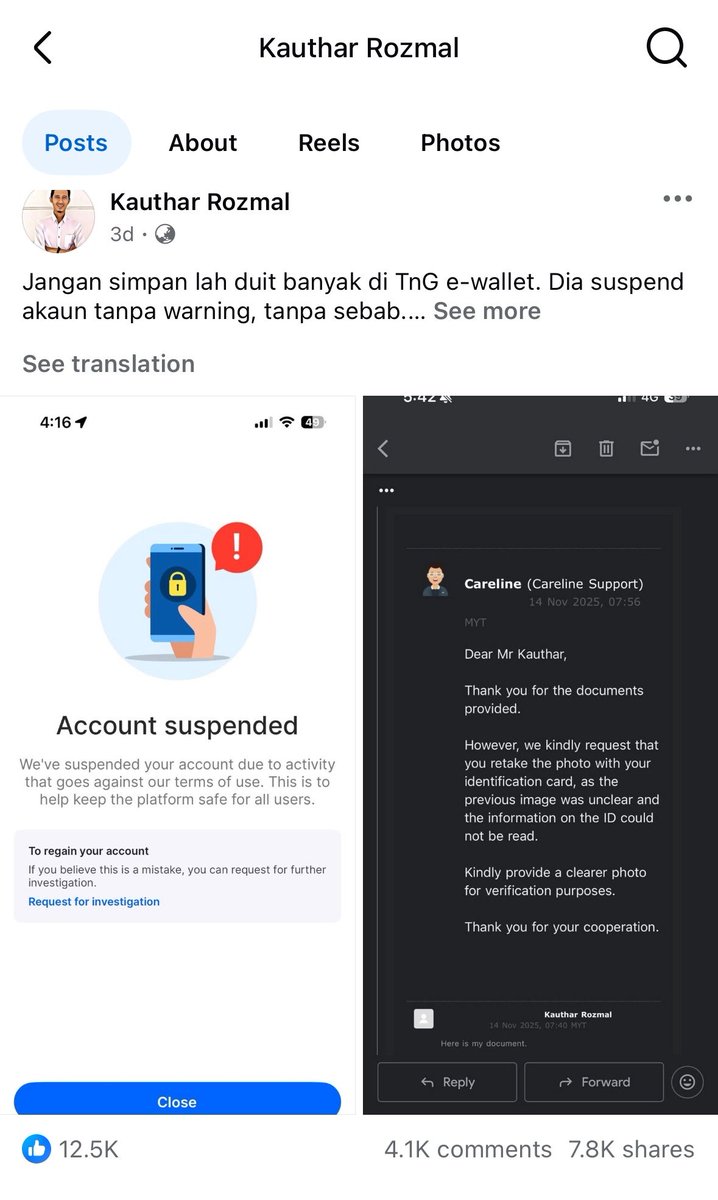

7. How do I register?

i. Download the myASNB app and enter your personal details.

ii. Take a photo of your IC and be ready to take videos/selfies for verification.

iii. Setup your username and password.

*It took us only 10 minutes to register and get approved.

i. Download the myASNB app and enter your personal details.

ii. Take a photo of your IC and be ready to take videos/selfies for verification.

iii. Setup your username and password.

*It took us only 10 minutes to register and get approved.

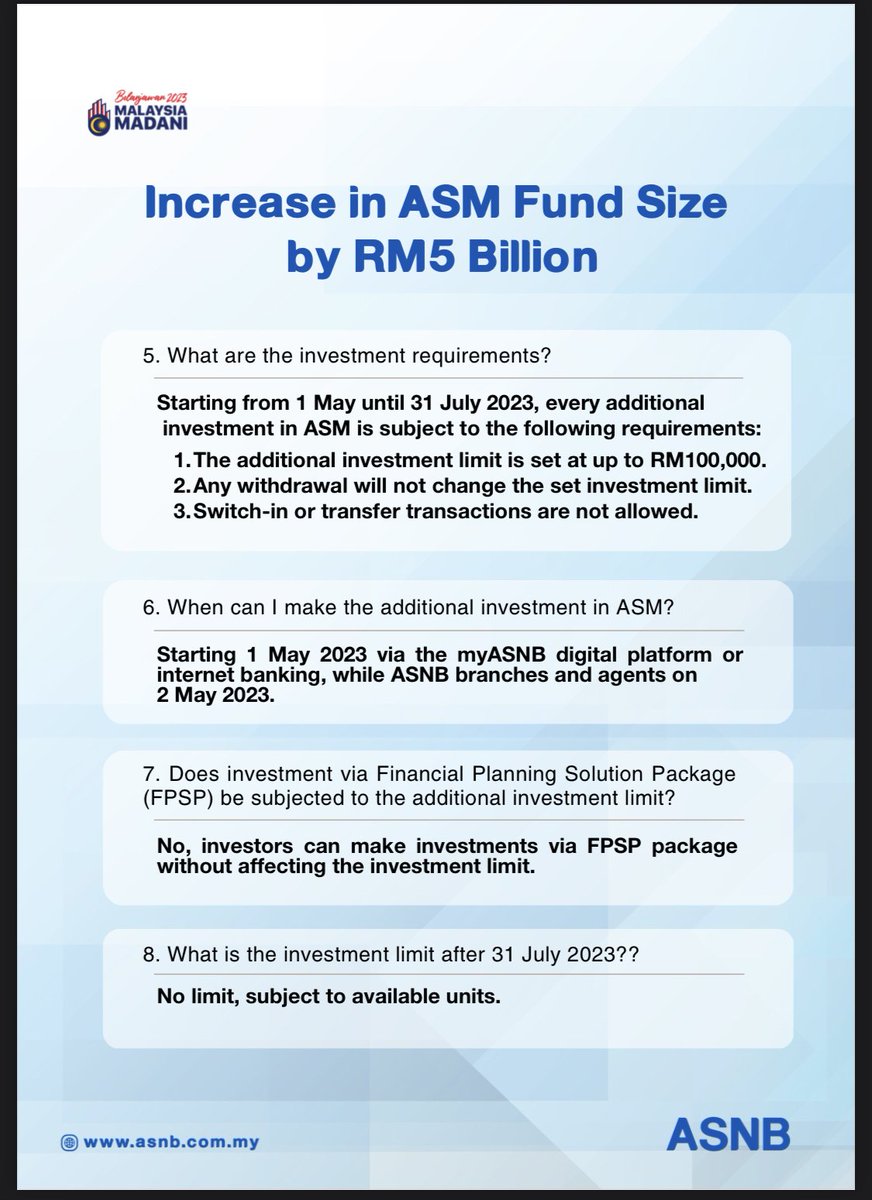

8. Additional things to note:

When you login for the first time, ASNB will request you to complete a one-time risk assessment.

After that, you’ll be prompted to make an initial investment of RM10 via FPX.

When you login for the first time, ASNB will request you to complete a one-time risk assessment.

After that, you’ll be prompted to make an initial investment of RM10 via FPX.

Thanks for reading till the end!

We hope this thread was helpful to you.

Follow us @TheFuturizts to stay updated on the latest market movers and financial matters.

Subscribe to our weekly newsletter for free:

thefuturizts.beehiiv.com

We hope this thread was helpful to you.

Follow us @TheFuturizts to stay updated on the latest market movers and financial matters.

Subscribe to our weekly newsletter for free:

thefuturizts.beehiiv.com

Further readings and sources:

i. ASNB:

asnb.com.my/onlineredempti….

ii. MisterLeaf:

misterleaf.com/11708/amanah-s…

iii. NoMoneyLah:

nomoneylah.com/2022/01/23/int…

i. ASNB:

asnb.com.my/onlineredempti….

ii. MisterLeaf:

misterleaf.com/11708/amanah-s…

iii. NoMoneyLah:

nomoneylah.com/2022/01/23/int…

You may also be interested in:

https://twitter.com/TheFuturizts/status/1611238380528099330?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh