Educational Content for Malaysians to Achieve Financial Literacy.

Join our paid WhatsApp group to stay informed: https://t.co/Kk2ANoM2pc

How to get URL link on X (Twitter) App

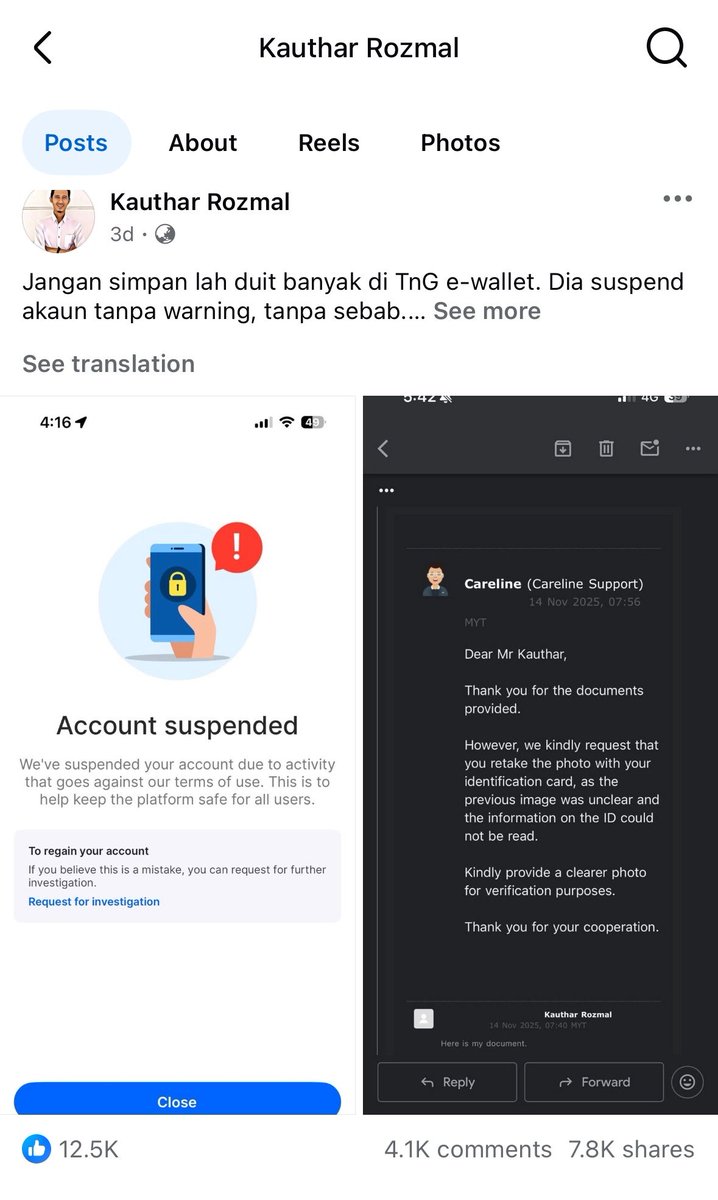

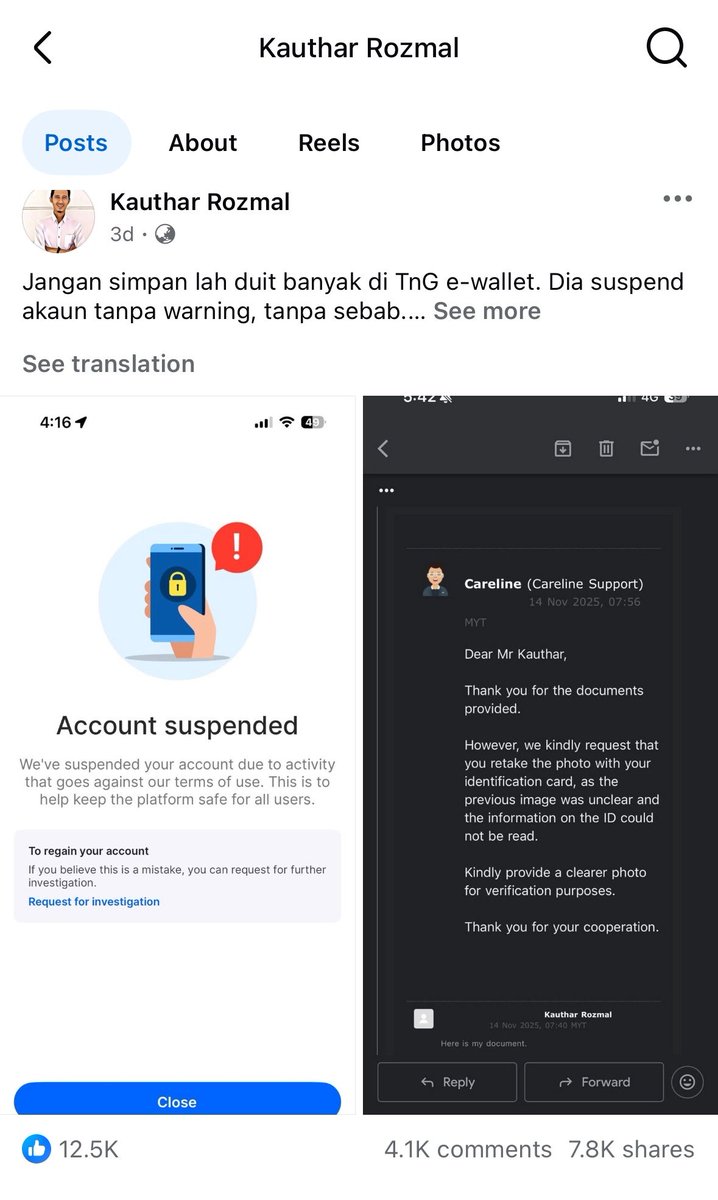

1. The trouble began on 11 November when the user’s account got suspended for no reason.

1. The trouble began on 11 November when the user’s account got suspended for no reason.

1. Currencies fluctuate due to supply and demand.

1. Currencies fluctuate due to supply and demand.

1. Almost every reply revolved around the power of Education.

1. Almost every reply revolved around the power of Education.

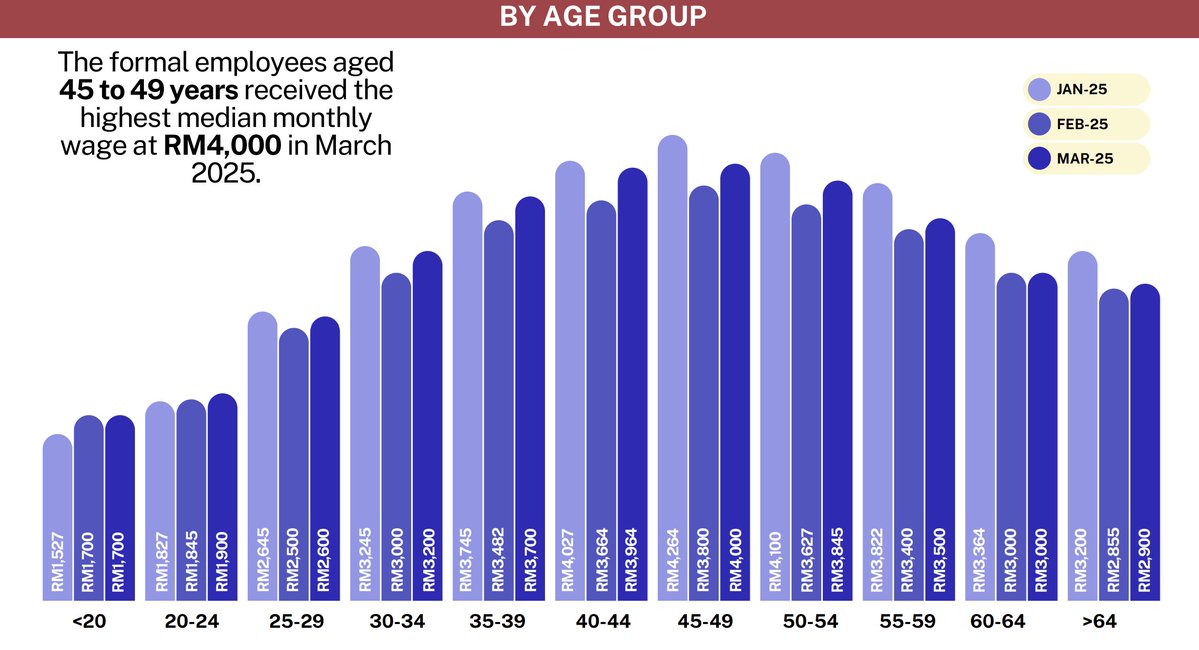

1. Looking across age groups,

1. Looking across age groups,

1. Assuming your investments generate ~5% per year, it will take about 14.4 years for your current funds to double.

1. Assuming your investments generate ~5% per year, it will take about 14.4 years for your current funds to double.

1. ASM, ASM2, and ASM3 are unit trust funds that offer stable returns with low risk.

1. ASM, ASM2, and ASM3 are unit trust funds that offer stable returns with low risk.

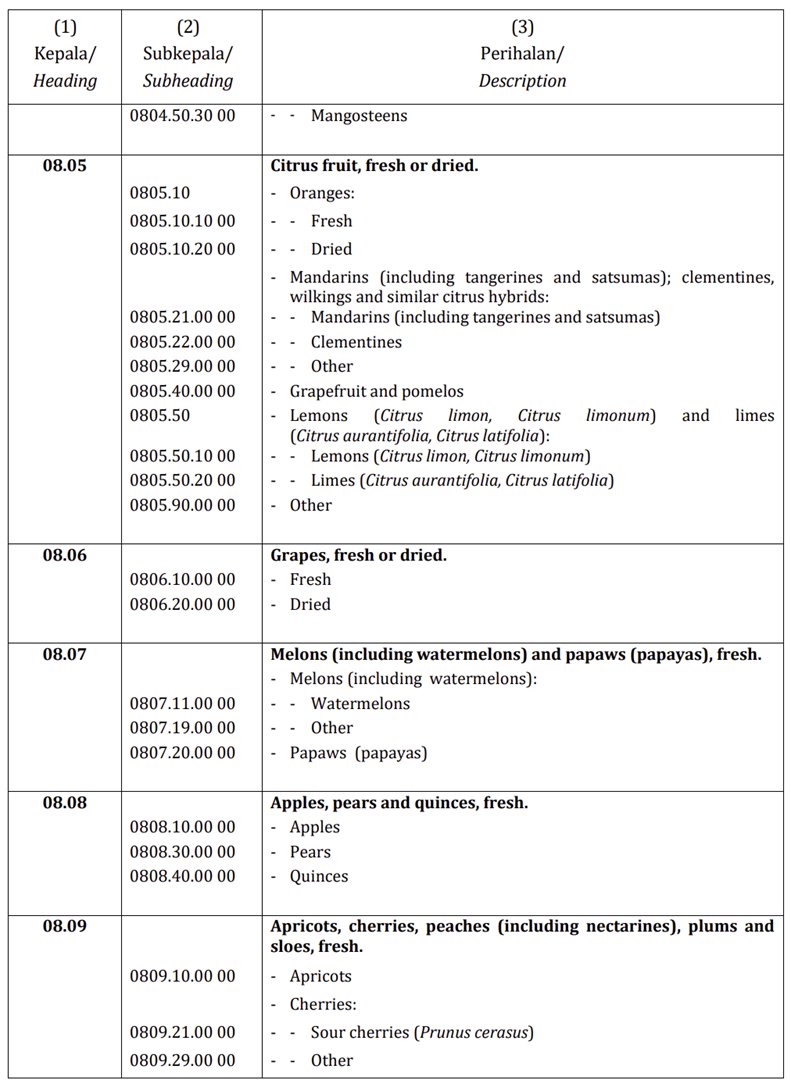

1. IMPORTED FRUITS

1. IMPORTED FRUITS

https://twitter.com/ByJasonNg/status/1917144400326697312

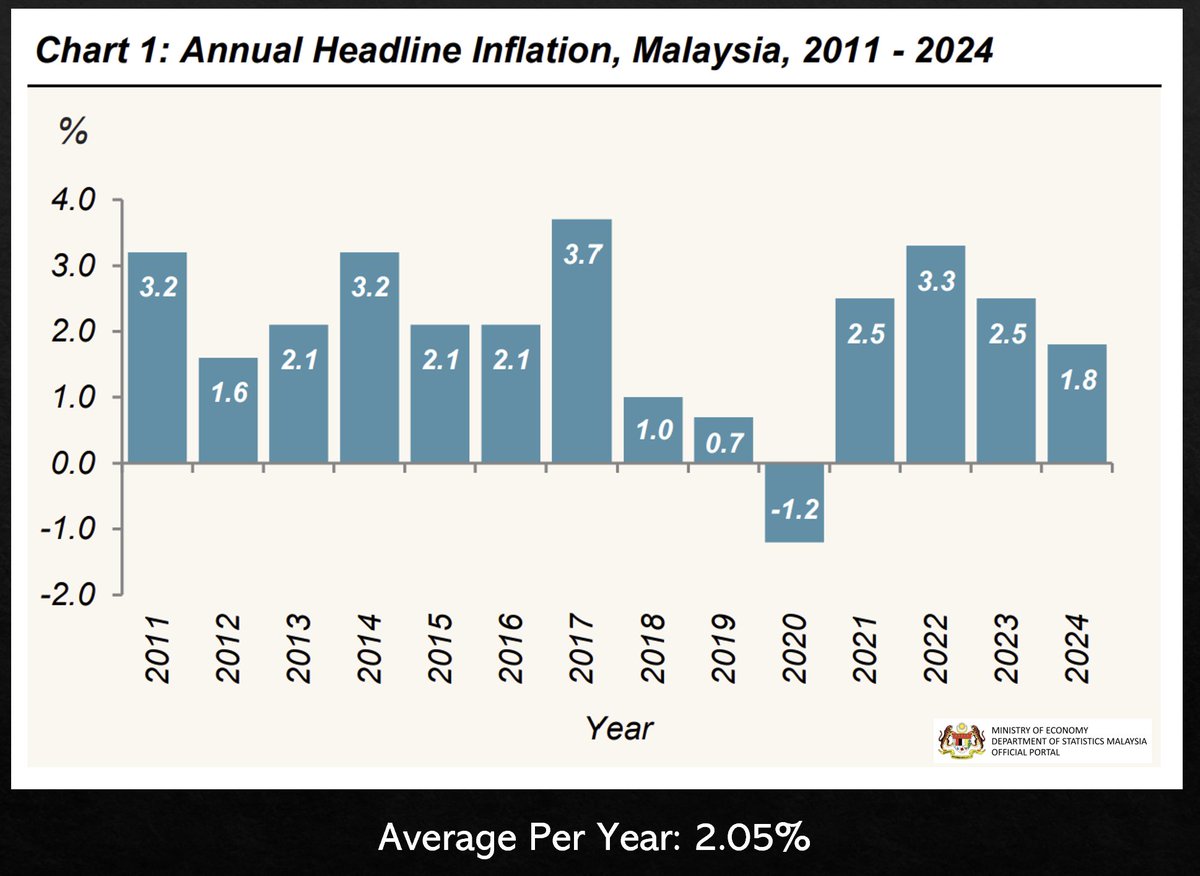

1. Meanwhile, the reported national inflation rate during this period (2011-2024) was 28.7%.

1. Meanwhile, the reported national inflation rate during this period (2011-2024) was 28.7%.

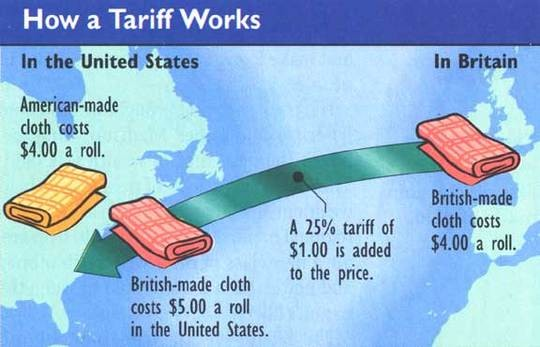

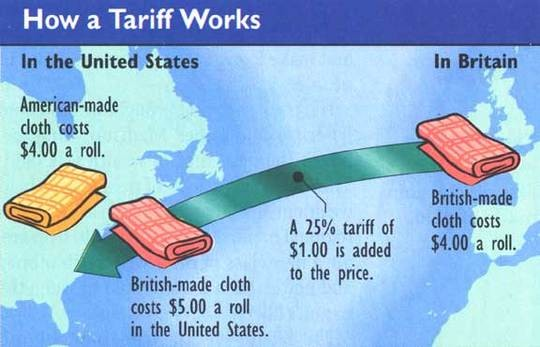

https://twitter.com/NewsBFM/status/19075989847909089741. Tariffs are a tax placed on foreign goods entering the country.

https://twitter.com/NewsBFM/status/1903990152663609709The answer: All FOUR of them.

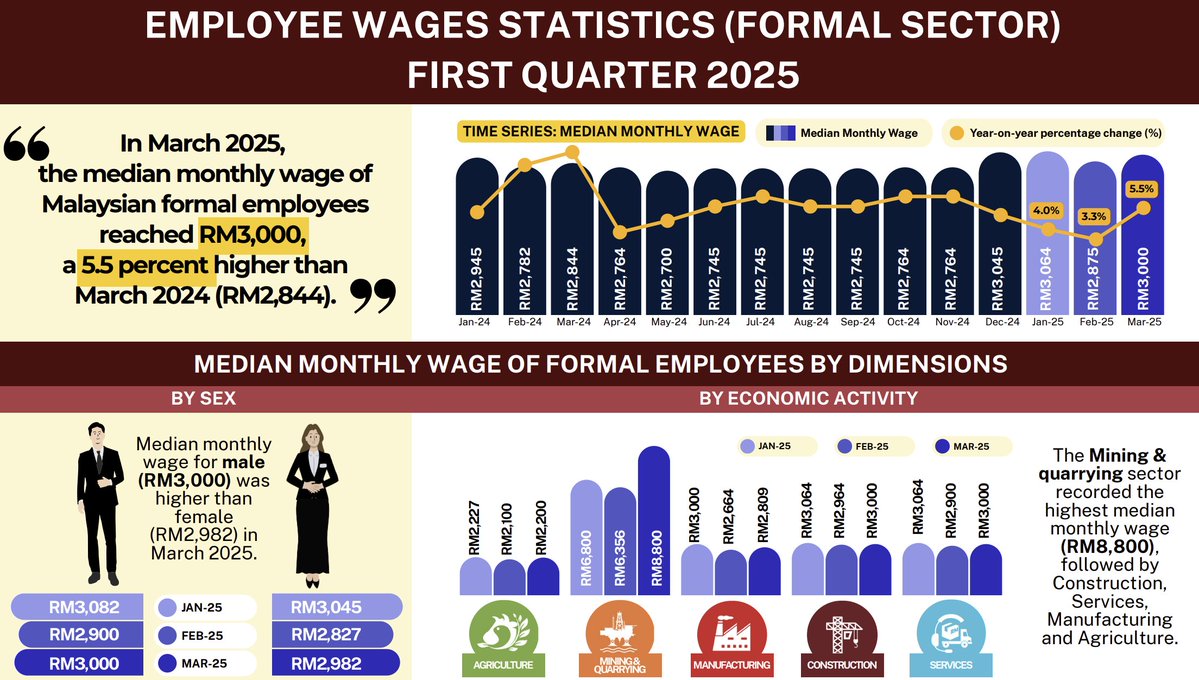

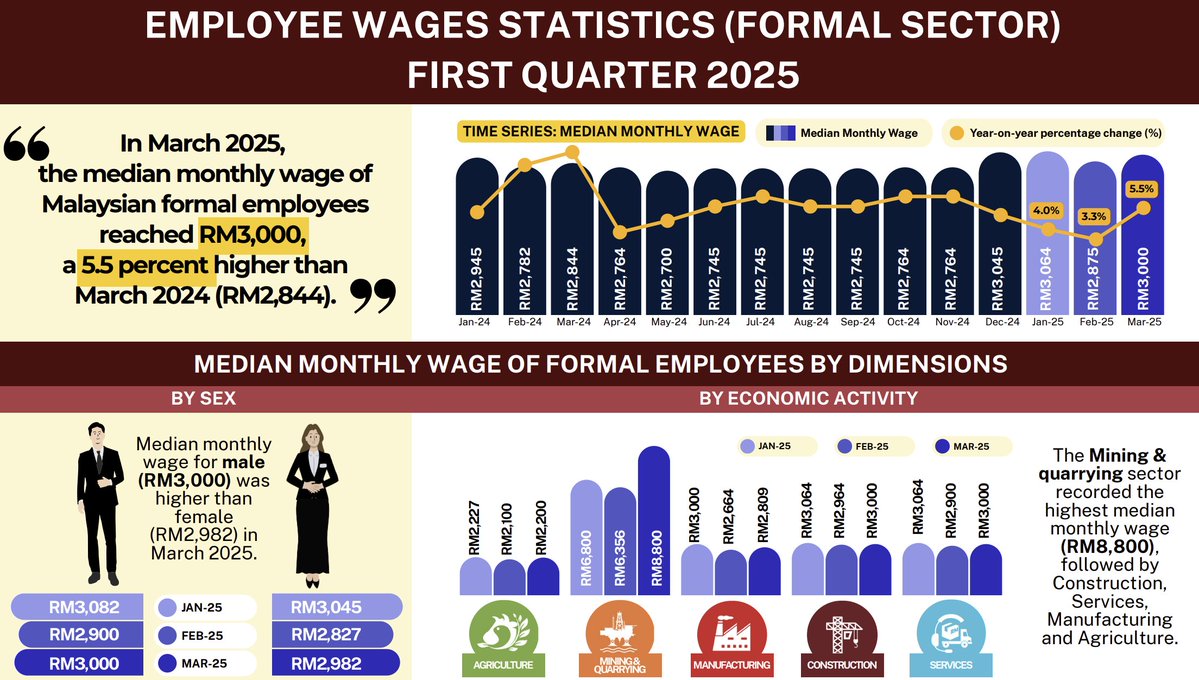

1. Why these figures?

1. Why these figures?

1. GXBank is still the best travel card, for now.

1. GXBank is still the best travel card, for now.

1. If your salary is RM5,000 and below:

1. If your salary is RM5,000 and below:

1. In the post, she mentioned that she is a full-time housewife, her husband is the sole breadwinner, and they have three children.

1. In the post, she mentioned that she is a full-time housewife, her husband is the sole breadwinner, and they have three children.

1. Back in May, Sarawak signed a deal with Petronas to take over all of the gas distribution in the state.

1. Back in May, Sarawak signed a deal with Petronas to take over all of the gas distribution in the state.

1. Budgeting: 50/30/20.

1. Budgeting: 50/30/20.

1. Under EPF’s i-Saraan initiative, members are eligible to receive 20% bonus for voluntary contributions if they are:

1. Under EPF’s i-Saraan initiative, members are eligible to receive 20% bonus for voluntary contributions if they are:

1. RISK.

1. RISK.