Backtesting Onchain Metrics in 5 Minutes? Absolutely.

See How @glassnode and GPT-4 Can Help You Achieve It in 5 Steps.

👇 #btc #eth #onchain #chatgpt

See How @glassnode and GPT-4 Can Help You Achieve It in 5 Steps.

👇 #btc #eth #onchain #chatgpt

Here is the chat gpt 4 prompt I used:

"I want you to be a data analyst and create a sma backtesting strategy and calculate the Sharpe ratio of BTC. BTC = m1, and each formula needs to follow the following format: f1,f2,f3... Here is the glassnode syntax:"

"I want you to be a data analyst and create a sma backtesting strategy and calculate the Sharpe ratio of BTC. BTC = m1, and each formula needs to follow the following format: f1,f2,f3... Here is the glassnode syntax:"

Since #chatgpt 4 isn't familiar with the newest glassnode syntax, you will need to copy and paste it from this google sheets file:

@glassnode Workbench Syntax

docs.google.com/spreadsheets/d…

@glassnode Workbench Syntax

docs.google.com/spreadsheets/d…

I wasn't that happy with the initial request, so I asked chat gpt to output a crossover strategy with two simple moving averages.

Prompt: "Can you do the same but make the strategy with two sma."

Prompt: "Can you do the same but make the strategy with two sma."

Chat Gpt 4 output:

We can create a backtesting strategy using two SMAs, often called a Moving Average Crossover strategy. In this example, we will use a short-term (20-day) and a long-term (50-day) SMA.

We can create a backtesting strategy using two SMAs, often called a Moving Average Crossover strategy. In this example, we will use a short-term (20-day) and a long-term (50-day) SMA.

Great!

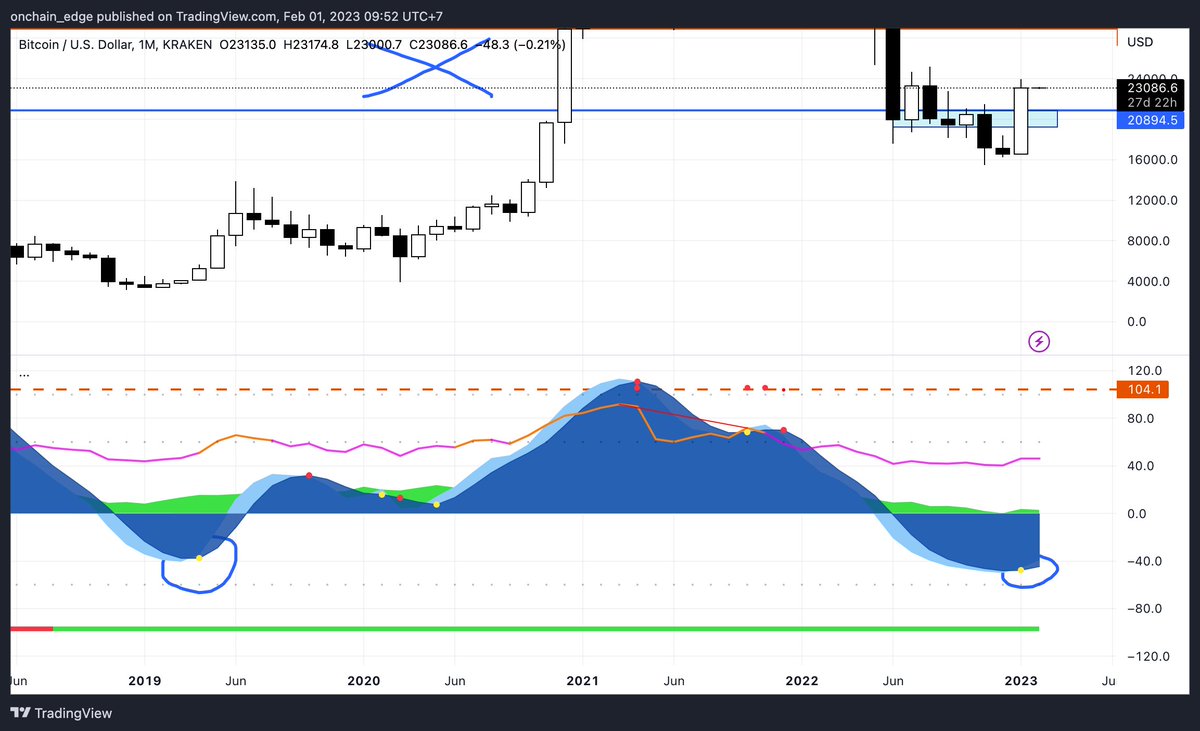

Now let's add the formulas to @glassnode

f1 = sma(m1, 20)

f2 = sma(m1, 50)

f3 = if(f1, ">", f2, 1, -1)

f4 = backtest(m1, f3, "2020-01-01", 10000, 0.001)

f5 = sharpe_ratio(f4, 50)

Now let's add the formulas to @glassnode

f1 = sma(m1, 20)

f2 = sma(m1, 50)

f3 = if(f1, ">", f2, 1, -1)

f4 = backtest(m1, f3, "2020-01-01", 10000, 0.001)

f5 = sharpe_ratio(f4, 50)

Go to @glassnode workbench and click on + Add to add a formula.

If you don't have a glassnode account, you can support me by using my link:

studio.glassnode.com/partner/oe

If you don't have a glassnode account, you can support me by using my link:

studio.glassnode.com/partner/oe

Copy and paste the formula into the input field, then click "Evaluate and draw".

Do that with the remaining formulas.

Do that with the remaining formulas.

I also recommend asking chat gpt 4 questions on the different formulas. That will improve your comprehension.

Let's say I want to understand what:

f3 = if(f1, ">", f2, 1, -1)

does

Let's say I want to understand what:

f3 = if(f1, ">", f2, 1, -1)

does

So I ask: "What does formula f3 do"

I get this answer:

`f3` generates a trading signal for the moving average crossover strategy by comparing the 20-day and 50-day SMAs.

I get this answer:

`f3` generates a trading signal for the moving average crossover strategy by comparing the 20-day and 50-day SMAs.

But is this backtesting strategy actually any good?

A trading strategy is useless if you don't know it's better than a simple "buy-and-hold" strategy.

A trading strategy is useless if you don't know it's better than a simple "buy-and-hold" strategy.

The first chat gpt 4 output wasn't that great so I need to regenerate a few times.

I had to do a bit of troubleshooting.

The syntax that chat gpt 4 spits out isn't always correct.

I had to do a bit of troubleshooting.

The syntax that chat gpt 4 spits out isn't always correct.

Here are the formulas you need to add:

f6 = value_at(m1, "2020-01-01")

f7 = m1-1

f8 = (f7 / f6) * 10000

f9 = f4-1 - f8

f6 = value_at(m1, "2020-01-01")

f7 = m1-1

f8 = (f7 / f6) * 10000

f9 = f4-1 - f8

Results:

The backtested strategy value: $15'642 💀

Buy-and-hold strategy value: $40'288 🔥

Profitability (f9): -24k

Conclusion: The strategy was not more profitable than a simple "buy-and-hold" strategy.

The backtested strategy value: $15'642 💀

Buy-and-hold strategy value: $40'288 🔥

Profitability (f9): -24k

Conclusion: The strategy was not more profitable than a simple "buy-and-hold" strategy.

This shows us how important it is to backtest strategies to know if they're profitable.

I will backtest many onchain strategies in the next few weeks and share the profitability scores.

Let's find the most profitable and successful backtesting strategy.

Caveat: There is a risk of overfitting the strategy to the past data. I need to keep that in mind.

Let's find the most profitable and successful backtesting strategy.

Caveat: There is a risk of overfitting the strategy to the past data. I need to keep that in mind.

I hope you've found this thread helpful.

Follow me @onchain_edge for more.

Like/Retweet the first tweet below if you can:

Follow me @onchain_edge for more.

Like/Retweet the first tweet below if you can:

https://twitter.com/onchain_edge/status/1654038045052768257

I appreciate the support! ❤️

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter