🧵1/Ω

$COIN Q1 unaudited earnings takeaways:

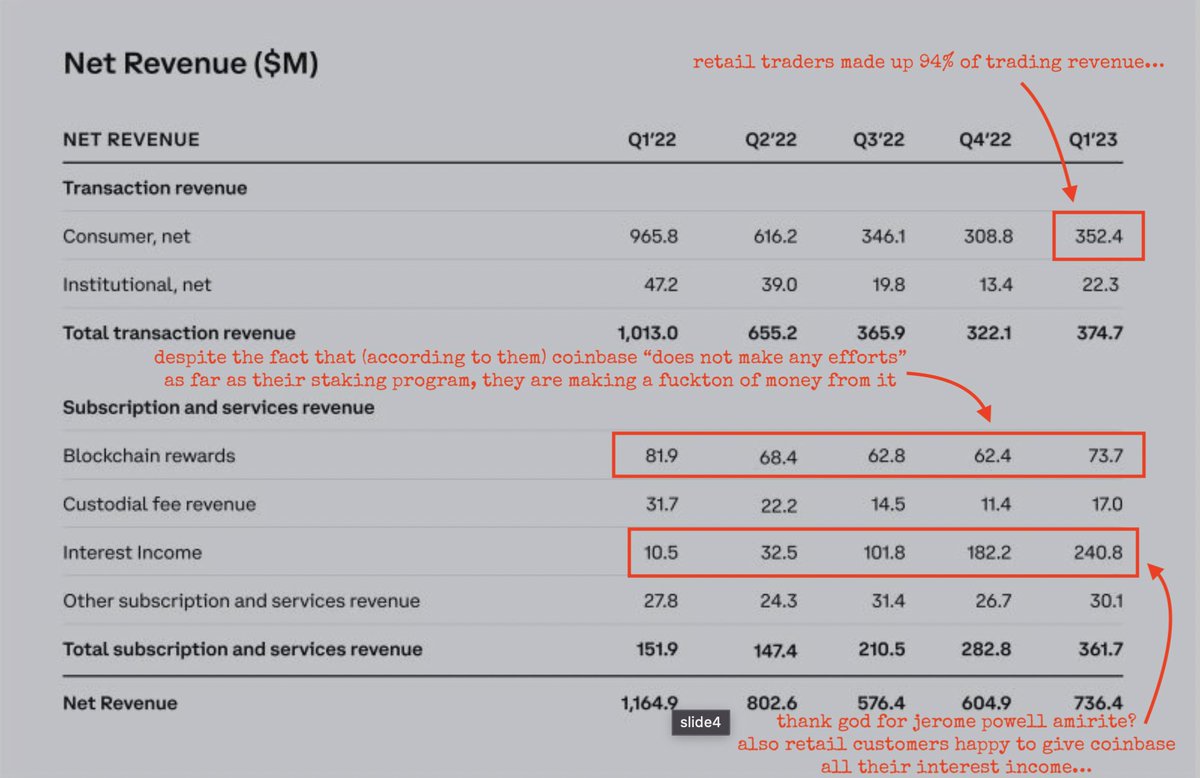

➤ thank god for jerome powell

➤ retail customers getting fleeced

➤ shitcoins are king

$COIN Q1 unaudited earnings takeaways:

➤ thank god for jerome powell

➤ retail customers getting fleeced

➤ shitcoins are king

🧵3/Ω

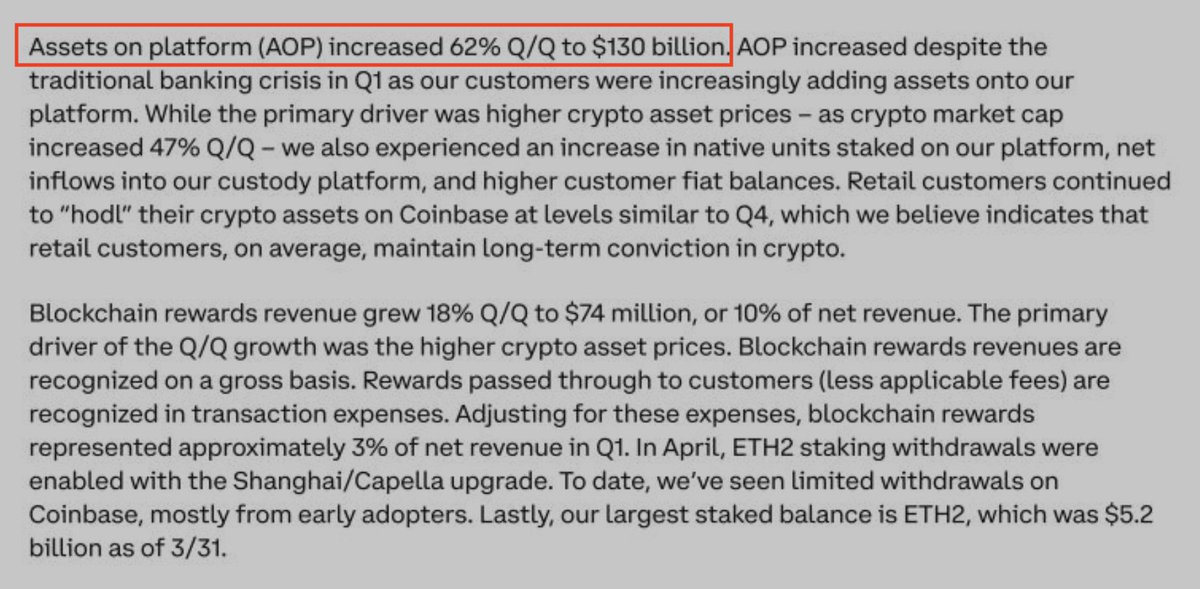

$COIN is saying assets on platform are up 62% because more people moved their crypto onto Coinbase but... isn't the price of BTC and ETH also up like 70%?

$COIN is saying assets on platform are up 62% because more people moved their crypto onto Coinbase but... isn't the price of BTC and ETH also up like 70%?

🧵4/Ω

On the expense side $COIN's big layoffs in early January 2023 definitely showing up in the numbers bigtime.

On the expense side $COIN's big layoffs in early January 2023 definitely showing up in the numbers bigtime.

🧵5/Ω

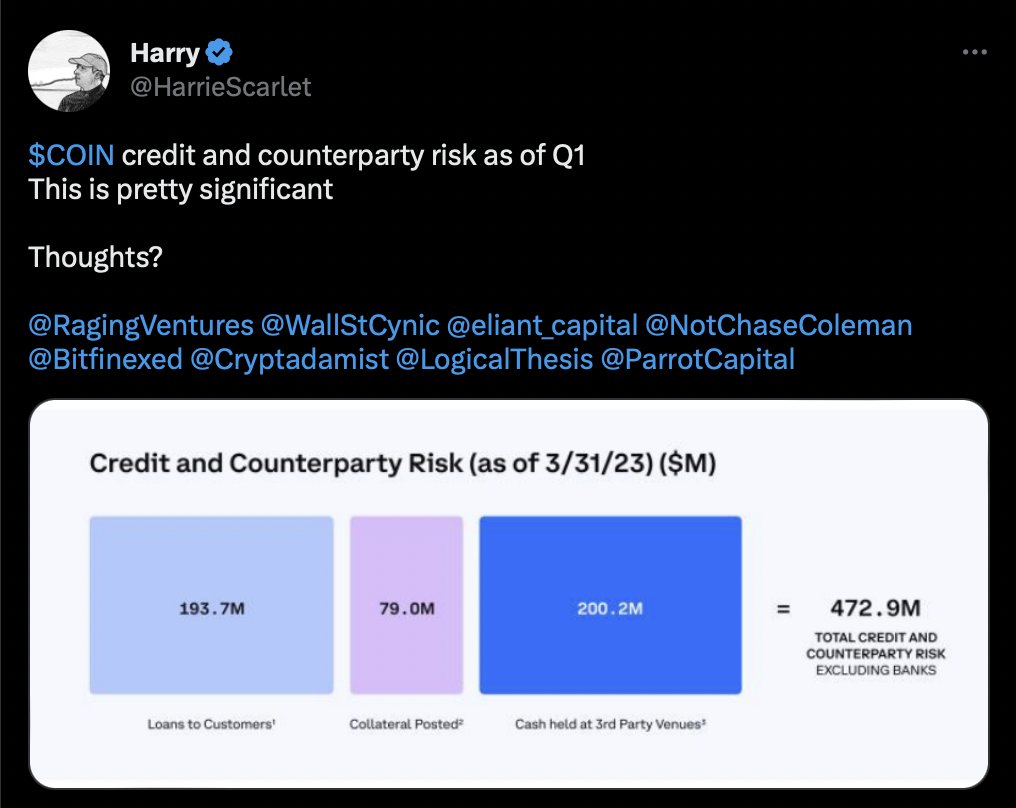

This program "Coinbase Borrow" is unsecured loans against crypto collateral (sort of) and will be discontinued as of May 10th (announcement was yesterday).

@HarrieScarlet pointed out most people thought this was a small # but $400 million in exposure is not small.

This program "Coinbase Borrow" is unsecured loans against crypto collateral (sort of) and will be discontinued as of May 10th (announcement was yesterday).

@HarrieScarlet pointed out most people thought this was a small # but $400 million in exposure is not small.

🧵6/Ω

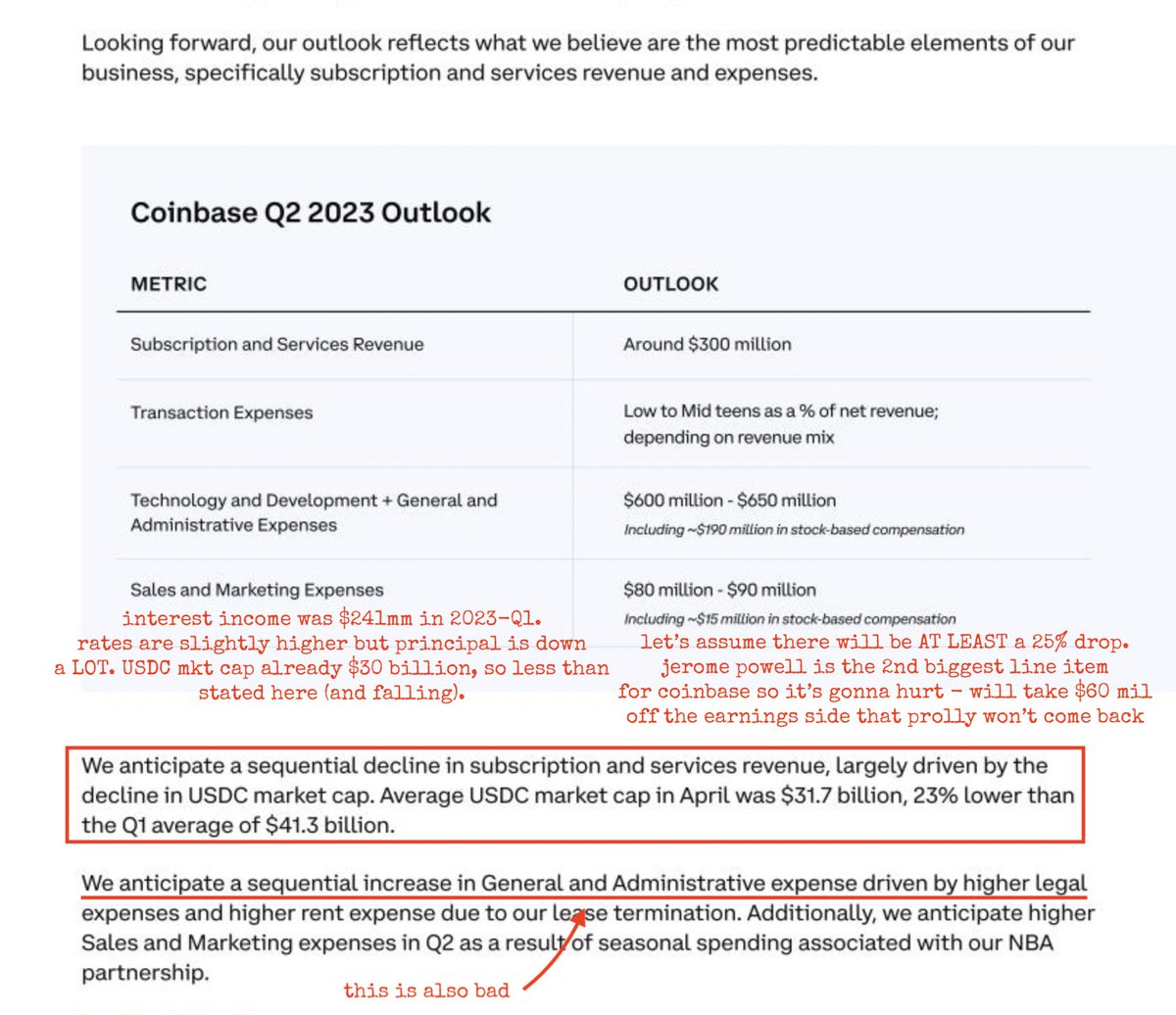

$COIN provided vague "outlook". Remember this is an preliminary announcement and not an SEC filing so they can say kinda whatever they want, within reason.

tl;dr they are predicting big drop in revenue and higher costs.

god help them if the price of crypto falls again

$COIN provided vague "outlook". Remember this is an preliminary announcement and not an SEC filing so they can say kinda whatever they want, within reason.

tl;dr they are predicting big drop in revenue and higher costs.

god help them if the price of crypto falls again

🧵7/Ω

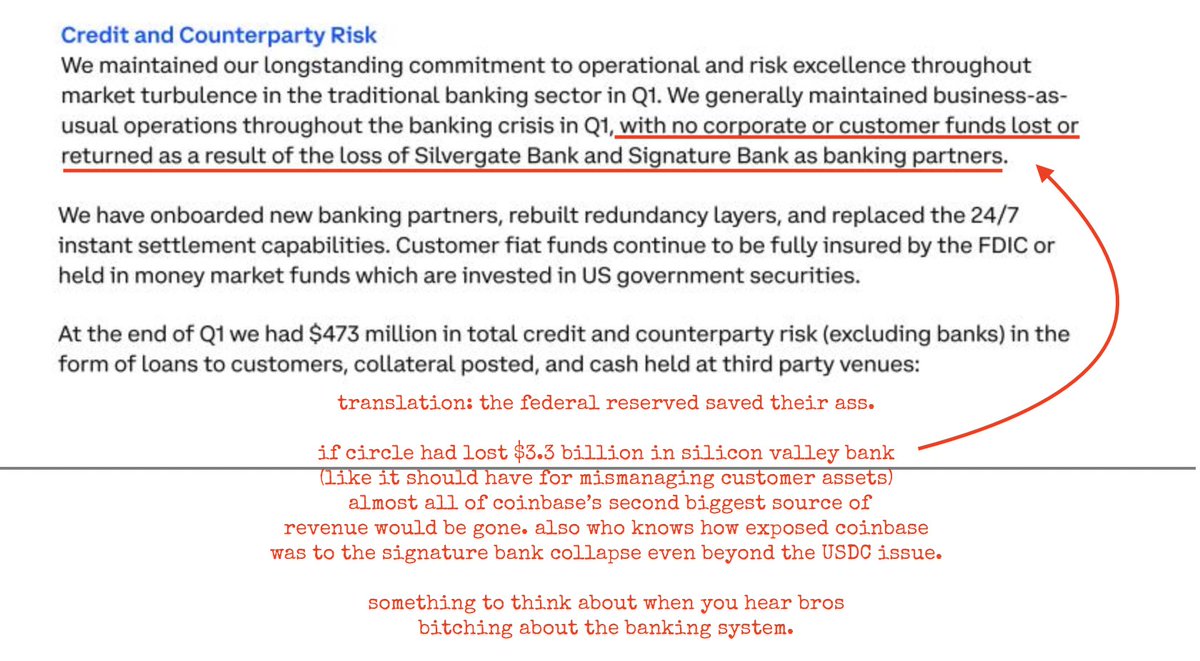

Also I couldn't help but be troubled by the fact that the federal reserve and the taxpayer bailed out such a piece of shit company, bc if Circle had lost $3.3bn in #SVB's collapse like it should have, $COIN would be totally rekt.

Also I couldn't help but be troubled by the fact that the federal reserve and the taxpayer bailed out such a piece of shit company, bc if Circle had lost $3.3bn in #SVB's collapse like it should have, $COIN would be totally rekt.

🧵8/Ω

Think about that anon the next time some crypto bro is trying to tell you about "operation chokepoint".

I leave you with this:

Think about that anon the next time some crypto bro is trying to tell you about "operation chokepoint".

I leave you with this:

https://twitter.com/Cryptadamist/status/1654012871909470208

🧵9/Ω

This is an important point. $COIN total trading volume was completely flat and yet they are making 15% more in fees.

That $50 million in new revenue came from the higher take rate Coinbase has on shitcoins, either bc more degneracy or higher fees.

This is an important point. $COIN total trading volume was completely flat and yet they are making 15% more in fees.

That $50 million in new revenue came from the higher take rate Coinbase has on shitcoins, either bc more degneracy or higher fees.

https://twitter.com/walamaking/status/1654238447773839361

• • •

Missing some Tweet in this thread? You can try to

force a refresh