The #BankingCrisis is severe and it’s all caused by the #FederalReserve and the worlds central banks.

The central banks printed about $10-$12 trillion since the pandemic hit to cover for the lost productivity as economies were shutdown. FED did not fix all the problems since 2007 crisis, instead it had sold worthless treasury bonds to most banks while interest rates were dirt cheap. Now that FED increased interest rates so high so fast to fight inflation, these bonds lost tremendous value and the fractional reserve banks were completely out of liquidity as soon as <10% of clients started withdrawing holdings from their accounts.

The #GreatFinancialCollapse during 2007-2008 saw 200+ banks collapse to about $510 billion. Compared to that we just have 3-5 banks fail with much higher valuations. #BankingCrisis is just the beginning. Next comes the credit crunch, the commercial real estate bubble collapse and as the recession worsens people lose jobs and the real estate bubble might collapse.

A thread 🧵 for your awareness👇

The central banks printed about $10-$12 trillion since the pandemic hit to cover for the lost productivity as economies were shutdown. FED did not fix all the problems since 2007 crisis, instead it had sold worthless treasury bonds to most banks while interest rates were dirt cheap. Now that FED increased interest rates so high so fast to fight inflation, these bonds lost tremendous value and the fractional reserve banks were completely out of liquidity as soon as <10% of clients started withdrawing holdings from their accounts.

The #GreatFinancialCollapse during 2007-2008 saw 200+ banks collapse to about $510 billion. Compared to that we just have 3-5 banks fail with much higher valuations. #BankingCrisis is just the beginning. Next comes the credit crunch, the commercial real estate bubble collapse and as the recession worsens people lose jobs and the real estate bubble might collapse.

A thread 🧵 for your awareness👇

Here’s a prev thread 🧵 on the FED

https://twitter.com/DeepBlueCrypto/status/1643761040738377728

At the beginning of 2023 US banks had assets just 10% over liabilities. With the interest rates being so high, with the credit crunch, with dwindling banks liquidity, with bonds getting worthless by the day… it’s not hard to imagine these banks collapsing under mounting debt pressures.

Consolidation is the name of the game as these small banks collapse. They’re all being merged into the top 4 - JPMorgan Chase, Bank of America, CitiBank and Wells Fargo.

Consolidation is the name of the game as these small banks collapse. They’re all being merged into the top 4 - JPMorgan Chase, Bank of America, CitiBank and Wells Fargo.

We are on the verge of commercial real estate collapse. Ever since COVID pandemic hit, economies were shutdown, remote work picked up and lots of commercial real estate and office space went vacant.

Looking at the US regional banks exposure to commercial real estate loans… I’d expect these banks to fail from top down in that order of exposure to commercial real estate.

- Bank Ozk

- Glacier Bancorp Inc

- Valley National Bancorp

…

Looking at the US regional banks exposure to commercial real estate loans… I’d expect these banks to fail from top down in that order of exposure to commercial real estate.

- Bank Ozk

- Glacier Bancorp Inc

- Valley National Bancorp

…

FED has pumped trillions into the economy since 2001.

- Bank bailouts

- Auto/Airline bailouts

- Cash for clunkers

- Big Pharma contracts

FED is still pumping money bailing out failing banks even today. Will it have enough to sustain a bad recession?

- Bank bailouts

- Auto/Airline bailouts

- Cash for clunkers

- Big Pharma contracts

FED is still pumping money bailing out failing banks even today. Will it have enough to sustain a bad recession?

FED CAN PRINT MONEY AT WILL, BUT YOU ALL NEED TO WORK AND PAY TAXES FOR THE SAME MONEY

Remember this from Alan Greenspan:

“The US can always pay any debt it has because we can always print more money.”

Remember this from Alan Greenspan:

“The US can always pay any debt it has because we can always print more money.”

If you think the #BankingCrisis is over, fasten your seatbelts. All this for just a few failed banks, wait until most of those 722 banks fail… an Armageddon

https://twitter.com/balajis/status/1654531148289302528

A 13 year old girl asked Warren Buffett about the U.S dollar losing its reserve currency status.

She’s asking a better question than 99% of journalists.

She’s asking a better question than 99% of journalists.

Why are clients moving funds away from banks in the billions. They’re moving funds away from savings to money market, CDs and bonds 👇

Plague doctors and modern economists have a lot in common. #FederalReserve economists seem to act like they understand the implications of their actions on interest rates and money printing.

#PlagueDoctors were like our economists

#PlagueDoctors were like our economists

Jamie Dimon

- Talks trash about #Bitcoin and it fell 20-30% after that, later JPMorgan offices in Europe trades the same.

- Trades derivatives on precious metals gold, silver and copper suppressing its price for years. Pays millions in fines.

- Supports Jeffrey Epstein and his clients through his banking transactions. Has senior JPMorgan executives meeting Epstein even after he was caught trafficking children, no issues keeps doing the same.

- A ship got caught with cocaine owned by JPMorgan and got hushed up, nothing business as normal.

When the JPMorgan stock goes up, he’s is great mood, top of the world. When the stock tanks, go after the short sellers and their tweets.

- Talks trash about #Bitcoin and it fell 20-30% after that, later JPMorgan offices in Europe trades the same.

- Trades derivatives on precious metals gold, silver and copper suppressing its price for years. Pays millions in fines.

- Supports Jeffrey Epstein and his clients through his banking transactions. Has senior JPMorgan executives meeting Epstein even after he was caught trafficking children, no issues keeps doing the same.

- A ship got caught with cocaine owned by JPMorgan and got hushed up, nothing business as normal.

When the JPMorgan stock goes up, he’s is great mood, top of the world. When the stock tanks, go after the short sellers and their tweets.

https://twitter.com/GRDecter/status/1656645767484915713/video/1

The Federal Reserve has been gaslighting Americans for the last 2 years on inflation. The latest manufacturing index from Empire State was expected at -5, it came out to -31. Worst reading since the month of COVID. We are in a deep recession.

The former execs of failed banks Silicon Valley Bank and First Republic refused to commit to giving up their compensation when questioned about it. They made millions as the banks collapsed, per Bloomberg.

RISK IS ALL YOURS, WE COLLECT BONUSES

RISK IS ALL YOURS, WE COLLECT BONUSES

"We absolutely cannot protect the economy if the US defaults on its debt," said the Fed's Neel Kashkari.

US Dollar being a world reserve currency is a confidence game. Debt defaults and these standoffs don’t instill confidence.

US Dollar being a world reserve currency is a confidence game. Debt defaults and these standoffs don’t instill confidence.

The FEDs preferred inflation metric the PCE is rising again for the first time since 2022… higher rates soon 🤷♂️

The #FederalReserve fixing all your monetary issues

75% of your wealth is tied up in real estate

Real estate is dependent on FED interest rates and the dollar index

FED mismanages the dollar both ways and it’s policy is dependent on politicians and #DeepState

Your politicians & #DeepState are warmongers and corrupt to the core

YUP… YOU ALL ARE FED SLAVES

Real estate is dependent on FED interest rates and the dollar index

FED mismanages the dollar both ways and it’s policy is dependent on politicians and #DeepState

Your politicians & #DeepState are warmongers and corrupt to the core

YUP… YOU ALL ARE FED SLAVES

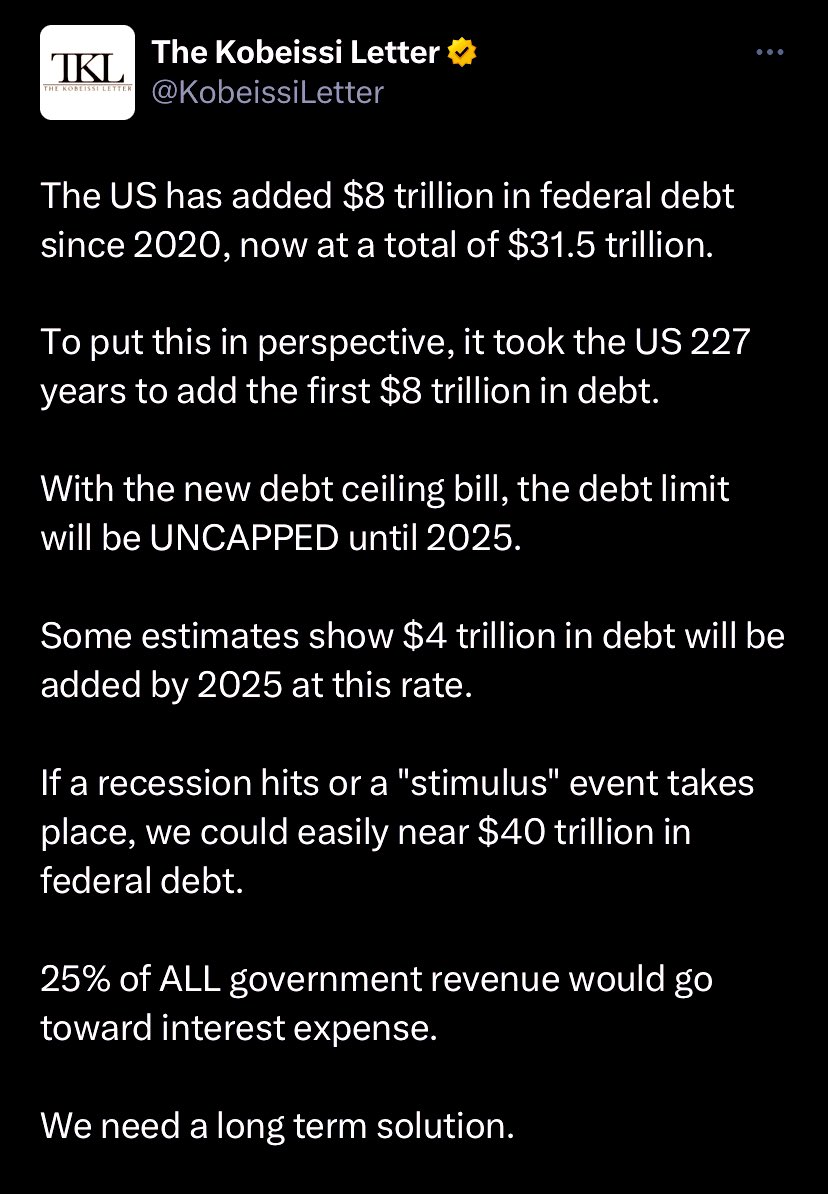

It took America 277 years to add $8 trillion in Federal debt.

America added $8 trillion in federal debt since 2020 in 3 years. The debt is growing exponentially.

America doesn’t have an income problem. They have a spending problem.

America added $8 trillion in federal debt since 2020 in 3 years. The debt is growing exponentially.

America doesn’t have an income problem. They have a spending problem.

The sheer size difference between a million, a billion and a trillion. Now imagine how much is $32 trillion US debt.

US Dollar was backed by Gold before 1971

US Dollar is backed by nothing but faith in US economy after 1972

US Dollar is backed by nothing but faith in US economy after 1972

“House Minority Leader Hakeem Jeffries says he supports the negotiated debt ceiling deal.”

In other words

- printing unlimited money is great

- $35 trillion in debt is great

- spending money on wars we didn’t start & things we don’t need is great

In other words

- printing unlimited money is great

- $35 trillion in debt is great

- spending money on wars we didn’t start & things we don’t need is great

Debt ceiling is a joke

Politicians are a joke

Kevin McCarthy just crippled the US debt ceiling until 2026 when it will be $36 trillion - $36,000,000,000,000+

Both democrats & republicans want to spend your money for bad policies

Politicians are a joke

Kevin McCarthy just crippled the US debt ceiling until 2026 when it will be $36 trillion - $36,000,000,000,000+

Both democrats & republicans want to spend your money for bad policies

Fiat debt ceiling always crumbles

This is just one currency - Cuba 🇨🇺

This is just one currency - Cuba 🇨🇺

#BrettonWoods system was proposed in 1944, took effect in 1958. It just took 13 years until 1972 to fail fast.

Lebanon 🇱🇧 currency losing over 90% of its value against the US dollars in 3 years

“Why do we need to trade goods & services between Kenya & Djibouti in US Dollars?”

People are realizing the benefits of frictionless trade between countries in their local currencies

US Dollar dominance declines slowly then suddenly

People are realizing the benefits of frictionless trade between countries in their local currencies

US Dollar dominance declines slowly then suddenly

Our #FederalReserve making hard decisions each and everyday… especially on the FOMC meetings

The entire world economy relies of the #FederalReserve

The US #FederalReserve economy relies on the consumer spending

You don’t spend, economy collapses

The US #FederalReserve economy relies on the consumer spending

You don’t spend, economy collapses

If you think the inflation is bad now, wait until this hits mainstream and UBI prints like this are more common

Fiats will die faster than your dreams. UBI rewards laziness and punishes builders and creators. The society will soon be doomed with Universal Basic Income.

Fiats will die faster than your dreams. UBI rewards laziness and punishes builders and creators. The society will soon be doomed with Universal Basic Income.

Jerome Powell:

A recession “is not the most likely case,” though it is possible, Fed Chair Powell said at the ECB Forum.

Translation: Recession is confirmed.

A recession “is not the most likely case,” though it is possible, Fed Chair Powell said at the ECB Forum.

Translation: Recession is confirmed.

ECB PRESIDENT LAGARDE says "Inflation is proving to be persistent."

2021: We will not respond to inflation blips

2022: Inflation came from nowhere

2022: Inflation will be temporary

2023: Inflation still way too high

Gotta love these economic experts.

2021: We will not respond to inflation blips

2022: Inflation came from nowhere

2022: Inflation will be temporary

2023: Inflation still way too high

Gotta love these economic experts.

#FederalReserve fixing the economy

#FederalReserve printing money happened and it’s been happening since 1971, you’re just feeling the pain now since a lot more printing happened the last 3 years

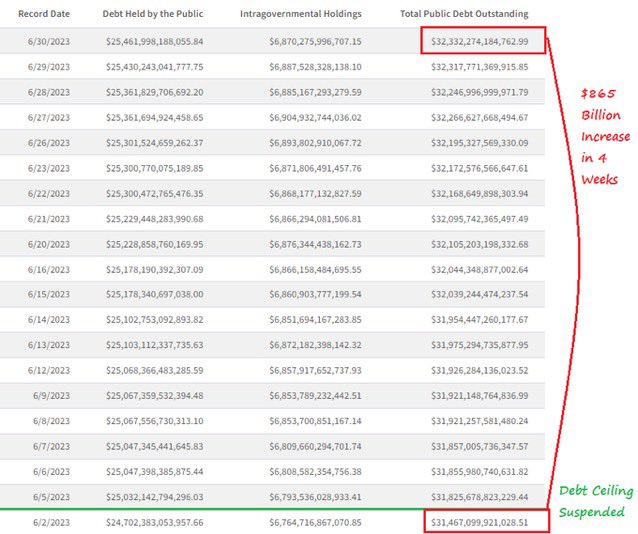

$865 billion increase in US National Debt since the debt ceiling was suspended 4 weeks ago.

It was the plan all along, there was never a plan to pay off debt. Run up the debt, destroy middle class, enrich the top 1% and install #NewWorldOrder

It was the plan all along, there was never a plan to pay off debt. Run up the debt, destroy middle class, enrich the top 1% and install #NewWorldOrder

Argentina currency is worthless again and they’re letting people open bank accounts with US Dollars and Chinese Yuan

The #FederalReserve is a criminal organization that shouldn’t even exist

Until 1913 US government had to raise money by selling bonds to people to go to war or spend on anything

After 1913 the #FederalReserve it has a free license to print money at will

After 1913 the #FederalReserve it has a free license to print money at will

We need to be extra cautious when they say everything is under control

#FederalReserve

#EverythingIsUnderControl

#FederalReserve

#EverythingIsUnderControl

Argentina inflation is so bad… Germans are buying products in ARGENTINE PESOS in online stores and the Argentine Central Bank automatically returns 40% due to the special regime for foreign cards with the MEP rate.

There are many German tutorials on Youtube explaining how to do it.

There are many German tutorials on Youtube explaining how to do it.

When you print money out of thin air

When you buy everything on debt

When you sell people dreams instead of anything substantial, you get the American economy

When you buy everything on debt

When you sell people dreams instead of anything substantial, you get the American economy

• • •

Missing some Tweet in this thread? You can try to

force a refresh