Instead of relying on "ALPHA callers"...

You can discover the next $PEPE, by following the smart money yourself🧠.

In this thread 🧵, I'll teach you how to track smart money using only Free tools like @DuneAnalytics and @DeBankDeF in 4 simple steps.

You can discover the next $PEPE, by following the smart money yourself🧠.

In this thread 🧵, I'll teach you how to track smart money using only Free tools like @DuneAnalytics and @DeBankDeF in 4 simple steps.

1/

Step 1: Find the whale

- Choose the token you wish to investigate.

- Enter the chain and token address into this dune dashboard created by @defi_mochi, click "Apply all parameters," and let the dashboard run.

In this case, I use $BOB as an example:

dune.com/defimochi/toke…

Step 1: Find the whale

- Choose the token you wish to investigate.

- Enter the chain and token address into this dune dashboard created by @defi_mochi, click "Apply all parameters," and let the dashboard run.

In this case, I use $BOB as an example:

dune.com/defimochi/toke…

2/

Step 2: Detect the whale

Now, we need to search for smart money.

Scroll down to the bottom and locate the table titled "Top 100 Trades by Estimated Profit."

In this list, most of the wallets are MEV bots, and I have to manually filter the "TRUE" smart addresses.

Step 2: Detect the whale

Now, we need to search for smart money.

Scroll down to the bottom and locate the table titled "Top 100 Trades by Estimated Profit."

In this list, most of the wallets are MEV bots, and I have to manually filter the "TRUE" smart addresses.

3/

To filter out the smart addresses, let's get rid of the MEV bot addresses.

How to know if an address is an MEV bot?

Click on the address, and see if it has the tag #MEV.

Meanwhile, I found an address that made $1.4M from $BOB 👇

0x72b586B651A82fD6C9b34aa7BaEeC7a20a9B4B1e.

To filter out the smart addresses, let's get rid of the MEV bot addresses.

How to know if an address is an MEV bot?

Click on the address, and see if it has the tag #MEV.

Meanwhile, I found an address that made $1.4M from $BOB 👇

0x72b586B651A82fD6C9b34aa7BaEeC7a20a9B4B1e.

4/

Step 3: Know the whale

Interested in this whale's $BOB trading history?

You can input the token and wallet address into this dashboard.

From what I have observed, this whale has been selling off $BOB since the day of his first buy.

Portal:

dune.com/cgq0123/wallet…

Step 3: Know the whale

Interested in this whale's $BOB trading history?

You can input the token and wallet address into this dashboard.

From what I have observed, this whale has been selling off $BOB since the day of his first buy.

Portal:

dune.com/cgq0123/wallet…

5/

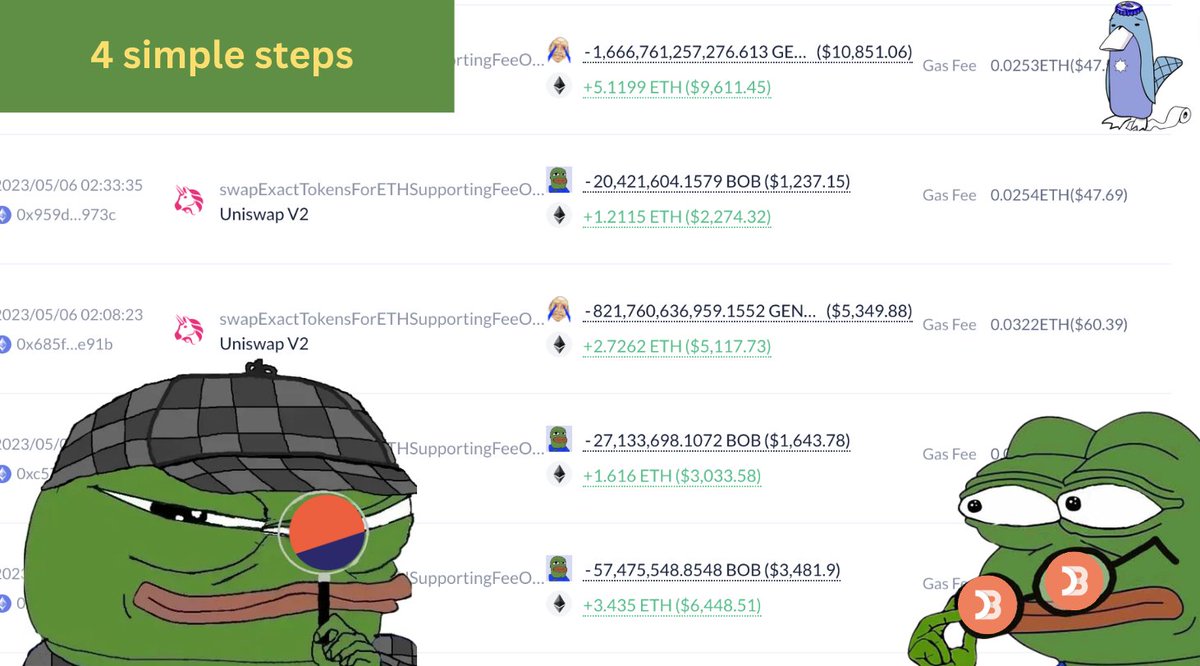

Step 4: Catch the whale

To find out what else this whale has bought, simply copy and paste his address into @DeBankDeFi .

As we can see in the image, he has been selling a lot of $GENSLR and $BOB in the past 7 days.

0x72b586b651a82fd6c9b34aa7baeec7a20a9b4b1e

Step 4: Catch the whale

To find out what else this whale has bought, simply copy and paste his address into @DeBankDeFi .

As we can see in the image, he has been selling a lot of $GENSLR and $BOB in the past 7 days.

0x72b586b651a82fd6c9b34aa7baeec7a20a9b4b1e

6/

And that's it! I hope you found this thread useful.

⚠️ Disclaimer ⚠️*

However, it is important to remember that solely following smart money is not the only criterion for evaluating an investment.

Always manage your risk and conduct your own research (DYOR).

And that's it! I hope you found this thread useful.

⚠️ Disclaimer ⚠️*

However, it is important to remember that solely following smart money is not the only criterion for evaluating an investment.

Always manage your risk and conduct your own research (DYOR).

7/

Tagging PEPE & BOB lover to catch whales tgt :

@ardizor @wacy_time1 @themafiaboss420 @DimitriDotEth @CryptoShiro_ @BobAmorMusic @Deebs_DeFi

@davincithreads @mrpunkdoteth @CryptoNikyous

@ExplainThisBob @ChadCaff @DextMoon @Crypto_Aeon7 @fonkydonk

@KoolKongNFT @0xDamien

Tagging PEPE & BOB lover to catch whales tgt :

@ardizor @wacy_time1 @themafiaboss420 @DimitriDotEth @CryptoShiro_ @BobAmorMusic @Deebs_DeFi

@davincithreads @mrpunkdoteth @CryptoNikyous

@ExplainThisBob @ChadCaff @DextMoon @Crypto_Aeon7 @fonkydonk

@KoolKongNFT @0xDamien

8/

Tagging Big brains to chat about memecoin :

@arndxt_xo @100y_eth @CryptoKoryo @0xTindorr

@Only1temmy @psychguy_eth @0xBobdbldr @0xkhan_

@defi9er @Hercules_Defi @ArsalanSartaj @2lambro

@crypticdegen22 @OvrCldJonny @tomwanhh

@Hercules_Defi @ArbiAlpha @Alvin0617 @hmalviya9

Tagging Big brains to chat about memecoin :

@arndxt_xo @100y_eth @CryptoKoryo @0xTindorr

@Only1temmy @psychguy_eth @0xBobdbldr @0xkhan_

@defi9er @Hercules_Defi @ArsalanSartaj @2lambro

@crypticdegen22 @OvrCldJonny @tomwanhh

@Hercules_Defi @ArbiAlpha @Alvin0617 @hmalviya9

• • •

Missing some Tweet in this thread? You can try to

force a refresh