From the introduction to the book ‘King Icahn’ by Mark Stevens,

“Icahn had built a position in a company, then traded over-the-counter, to the point that he owned a substantial block of the outstanding stock.” #BBBY

“Icahn had built a position in a company, then traded over-the-counter, to the point that he owned a substantial block of the outstanding stock.” #BBBY

“Convinced that he had made a forceful case for reconfiguring the business, Icahn paced like an expectant father, waiting for what he hoped would be a favorable response to his plan.”

“Investment banker: ‘You know, Carl, they don't like you at all.’”

“Investment banker: ‘You know, Carl, they don't like you at all.’”

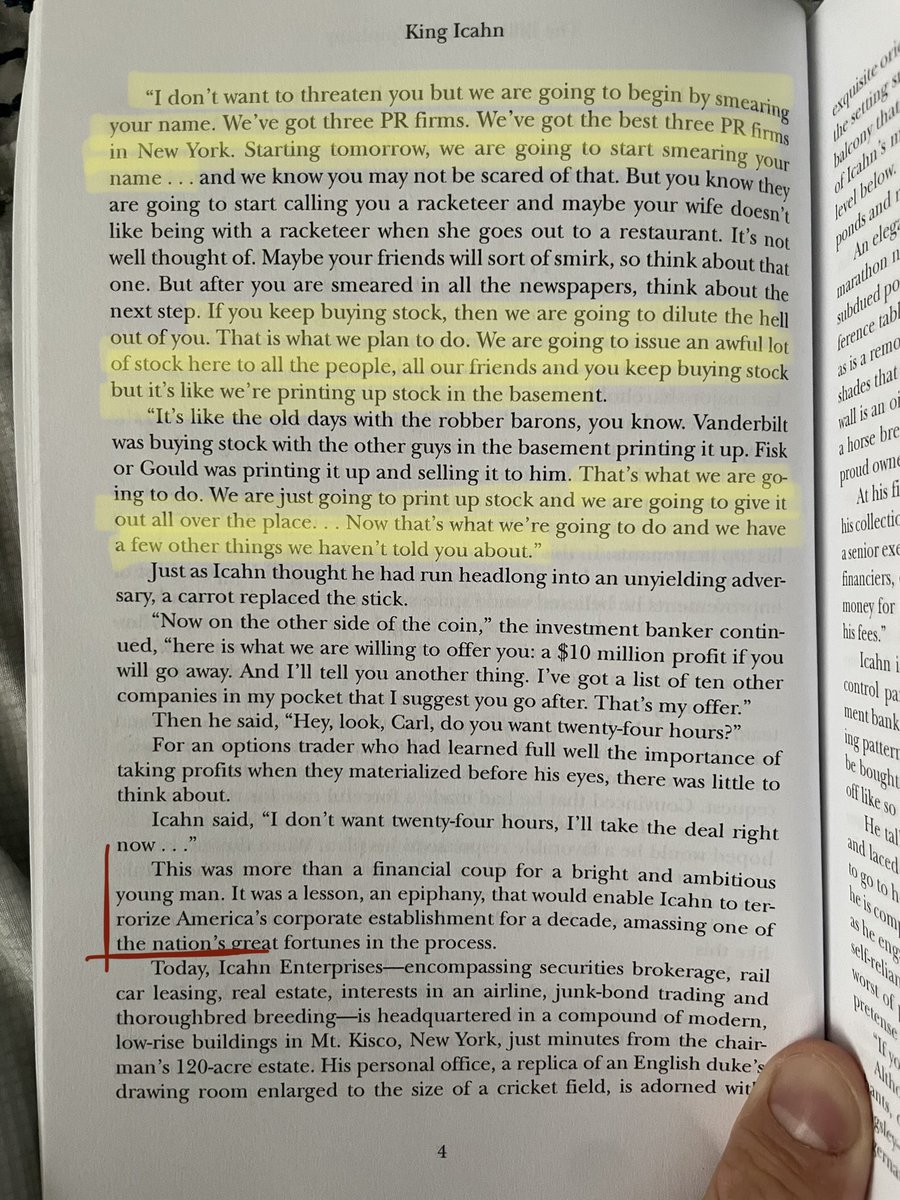

“‘I don't want to threaten you but we are going to begin by smearing your name. We've got three PR firms. We've got the best three PR firms in New York. Starting tomorrow, we are going to start smearing your name...”

“If you keep buying stock, then we are going to dilute the hell out of you. That is what we plan to do. We are going to issue an awful lot of stock here to all the people, all our friends and you keep buying stock but it's like we're printing up stock in the basement.” #JPM

“That's what we are going to do. We are just going to print up stock and we are going to give it out all over the place. .. Now that's what we're going to do and we have a few other things we haven't told you about.’”

This book was published 30 years ago. Icahn has increased his net worth from sub $1b to $17b over those 30 years. @Carl_C_Icahn has made a fortune by fucking these investment bankers.

Good luck to you @HindenburgRes

Good luck to you @HindenburgRes

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter