$mmtlp in regards to the settlement talks, liquidity is drying up, unrealized losses will force liquidations

A combined $464,700,000,000+ deposits pulled out from:

JPMorgan, BoA, Wells Fargo I 1 year from April 2022 to April 2023

Read full article:

wallstreetonparade.com/2023/05/deposi…

A combined $464,700,000,000+ deposits pulled out from:

JPMorgan, BoA, Wells Fargo I 1 year from April 2022 to April 2023

Read full article:

wallstreetonparade.com/2023/05/deposi…

$mmtlp "The deposit losses at JPMorgan Chase, Bank of America and Wells Fargo ($464.7 billion) are more than twice of 4,000 small banks lost in total during the same period. Their combined loss in deposits was just $210 billion."

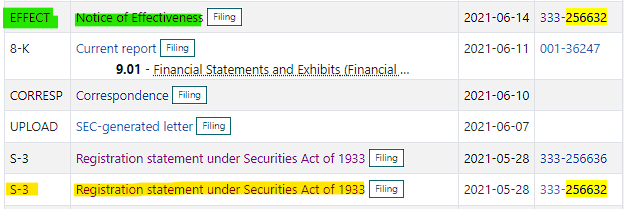

JPM cusip # 9R33424

WF # 591994371

BOA cusip # ??

JPM cusip # 9R33424

WF # 591994371

BOA cusip # ??

$mmtlp My thinking is:

1. I can hold indefinitely (can't speak for others)

2. NBH requested SEC comment (69 workdays ago), or else they will go on with their plan

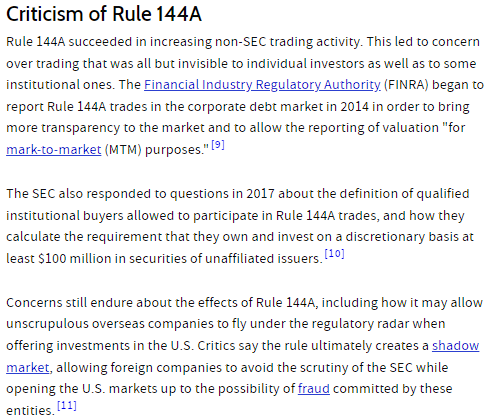

3. SEC knows about the N.shorts; they have Blue data - ALL RADARS WENT OFF

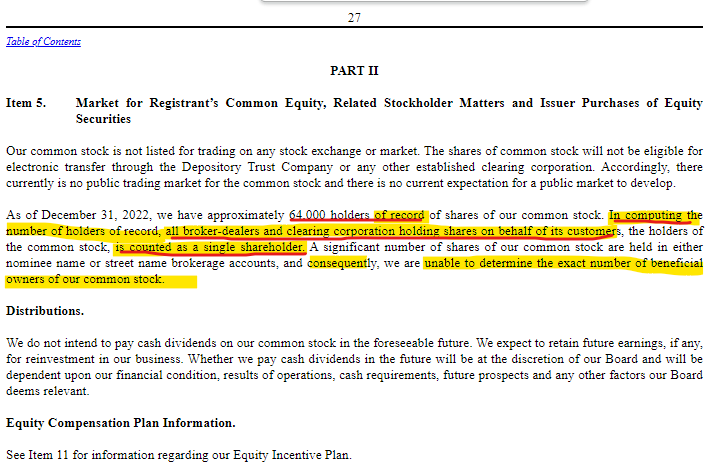

4. # of Beneficial Owners UNKNOWN

1. I can hold indefinitely (can't speak for others)

2. NBH requested SEC comment (69 workdays ago), or else they will go on with their plan

3. SEC knows about the N.shorts; they have Blue data - ALL RADARS WENT OFF

4. # of Beneficial Owners UNKNOWN

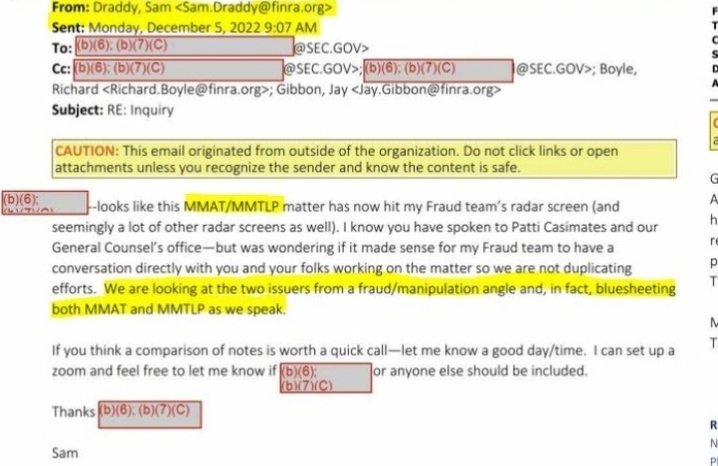

5. Nov 29, 2021 foia email revealed top Fraud dept & 3 SEC officers were looking into $mmtlp 2 months after it began trading contrary to its purpose & plan

6. Dec 2, 2033 FOIA email reveals finra fraud dept & SEC received several tips from someone or perhaps multiple sources.

6. Dec 2, 2033 FOIA email reveals finra fraud dept & SEC received several tips from someone or perhaps multiple sources.

7. Dec 5, 2022 FOIA email reveals $MMTLP hit Fraud teams radar & a lot of OTHER RADAR screens

8. All top Fraud dept guys at SEC & Finra still involved

9. SEC been in touch with Finras General Councels office & Patti

10. Dec 6, 2023 Corp notice issued

11. Dec 8, notice revised

8. All top Fraud dept guys at SEC & Finra still involved

9. SEC been in touch with Finras General Councels office & Patti

10. Dec 6, 2023 Corp notice issued

11. Dec 8, notice revised

Sec officers & the HEADS @ finras fraud dept were looking into $mmtlp since Nov 29, 2021.

Mmtlp hit ALL their fraud radars including "other radars"

I am confident that no one at $trch or $mmat or next bridge committed fraud - mmtlp purpose plan all submitted in sec filings

Mmtlp hit ALL their fraud radars including "other radars"

I am confident that no one at $trch or $mmat or next bridge committed fraud - mmtlp purpose plan all submitted in sec filings

$mmtlp In my opinion:

IF just a few million naked shorts in next bridge existed, why are the top fraud dept guys at finra & SEC getting tipped off, doing zoom calls, speaking to Finra's G.C.O.

SEC wud have issued a comment on the S1, if the problem was easy to resolve

IF just a few million naked shorts in next bridge existed, why are the top fraud dept guys at finra & SEC getting tipped off, doing zoom calls, speaking to Finra's G.C.O.

SEC wud have issued a comment on the S1, if the problem was easy to resolve

$mmtlp in my opinion:

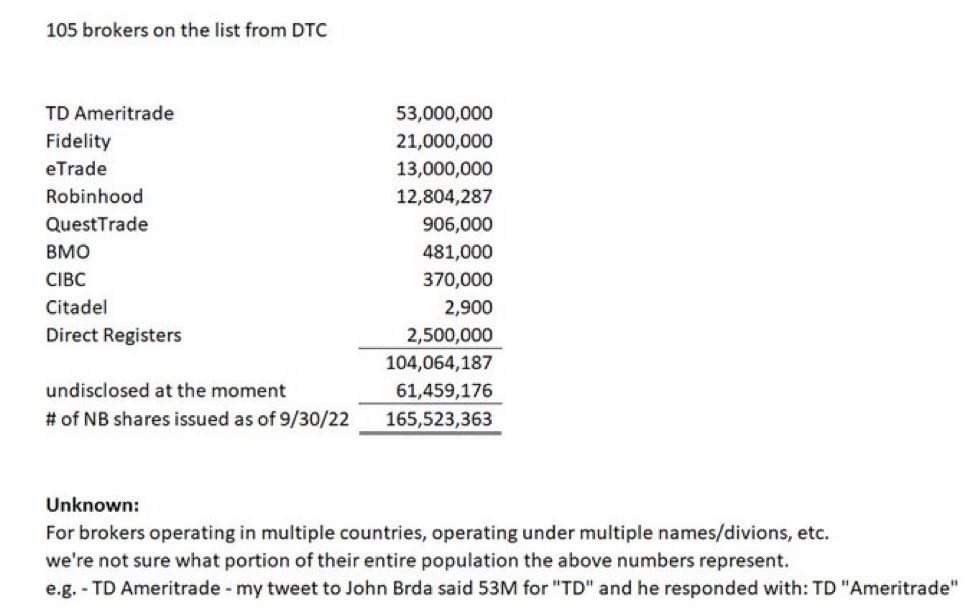

For all the reasons above & more, I believe naked shorts in next bridge are above 500,000,000.

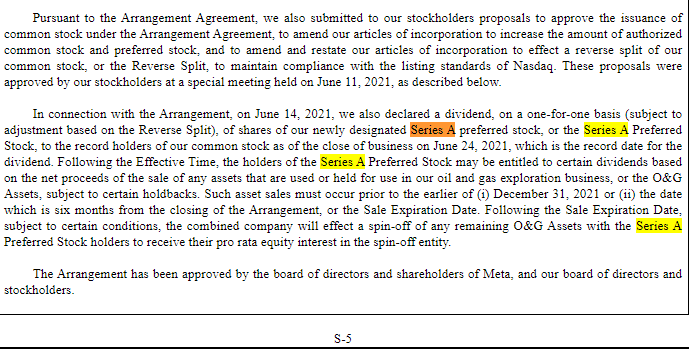

06.24.2021 - Mmtlp issued & mirrored trch naked positions, which increased after it began trading 10.6.2021

12.14, 2023 - mmtlp = NBH

#ReleaseTheBlueSheets

For all the reasons above & more, I believe naked shorts in next bridge are above 500,000,000.

06.24.2021 - Mmtlp issued & mirrored trch naked positions, which increased after it began trading 10.6.2021

12.14, 2023 - mmtlp = NBH

#ReleaseTheBlueSheets

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter