Detailed Analysis of RACL Geartech!!

CMP - ₹985

Like a retweet for maximum reach!!

#RACLGeartech #fundamentalanalysis

CMP - ₹985

Like a retweet for maximum reach!!

#RACLGeartech #fundamentalanalysis

1. About company

-RACL Geartech Ltd. manufactures transmission gears & Shafts, sub-assembly, precision machined parts and other components for the high end luxury segment.

-RACL Geartech Ltd. manufactures transmission gears & Shafts, sub-assembly, precision machined parts and other components for the high end luxury segment.

-The company was started as a joint venture between Bharat gears (a Raunaq group enterprise) and PICUP (a U.P Govt. entity) in 1989.

-The company caters mainly to the automotive sector followed by agriculture and industrial sectors.

-The company caters mainly to the automotive sector followed by agriculture and industrial sectors.

-The factories are located in Gajraula which has 4 plants operating right now and accounts for 95% of the revenue and one in Noida. The headquarters are located in New Delhi.

5. Order Process

-The company prioritizes the Process R&D with its clients, which is why it takes 6-9 months to finish the prototyping.

-Company has been fulfilling dynamic demands of its customers and has diversified its product portfolio to nearly 800 products.

-The company prioritizes the Process R&D with its clients, which is why it takes 6-9 months to finish the prototyping.

-Company has been fulfilling dynamic demands of its customers and has diversified its product portfolio to nearly 800 products.

-This makes it difficult for the new player to tap into their market.

-RACL has invested a lot in renewable and energy efficient resource which has managed to significantly reduce their energy and fuel cost

-RACL has invested a lot in renewable and energy efficient resource which has managed to significantly reduce their energy and fuel cost

8. Segment wise clients

-Management has said that no single customer has ever left the company, rather many of them have increased their order value.

-Nearly 50% of their revenue comes from the 2-wheeler segment where these parts are an integral component

-Management has said that no single customer has ever left the company, rather many of them have increased their order value.

-Nearly 50% of their revenue comes from the 2-wheeler segment where these parts are an integral component

of BMW bikes, KTM bikes(KTM 690 & 990 in India), Vespa scooter, etc.

-They were the first Indian company to export components to Kubota Japan.

-They were the first Indian company to export components to Kubota Japan.

10. Product Portfolio

-There are various types of Gear and shaft that the company manufactures which are used in a vehicle.

Chassis components which account for 8% of company’s revenue are used in both ICE and the EV vehicle.

-There are various types of Gear and shaft that the company manufactures which are used in a vehicle.

Chassis components which account for 8% of company’s revenue are used in both ICE and the EV vehicle.

-Company has evolved its manufacturing capabilities for EV transition,as they require High precision and technology with noise reduction

-Their revenue from these EV parts is just 4% in 2022 but is expected to rise as more luxury end vehicles and tractor manufacturers shift to EV

-Their revenue from these EV parts is just 4% in 2022 but is expected to rise as more luxury end vehicles and tractor manufacturers shift to EV

i. Transmission Gears : These gears are used to change the speed or the rotating directions. RACL’s core competencies are manufacturing transmission gears which are used to change gears. But their can be of various types and purpose such as bevel gears, engine gears, etc

ii. EV Components : RACL has also been increasing its technology and revenue share into electric vehicles components. These components require high precision and technology for the noise reduction purpose and hence they have imported

13. Capex

-The company only invests in Capex after receiving the order from the customer.

-In 2021, RACL had planned for a Capex of ₹250 crores by November 2026. ₹50 crores will be invested in each year as they are pipeline orders.

-The company only invests in Capex after receiving the order from the customer.

-In 2021, RACL had planned for a Capex of ₹250 crores by November 2026. ₹50 crores will be invested in each year as they are pipeline orders.

-Out of these, 25% will be used from the reserve fund and 75% will be debt. The company has no plans to issue new equity.

14. Financials

14. Financials

15. Risks

-Oil, Fuel and steel (nickel & chromium) prices has an large impact of company’s operating profit margins

The auto ancillary industry is cyclical and dependent upon the automotive industry.

-Oil, Fuel and steel (nickel & chromium) prices has an large impact of company’s operating profit margins

The auto ancillary industry is cyclical and dependent upon the automotive industry.

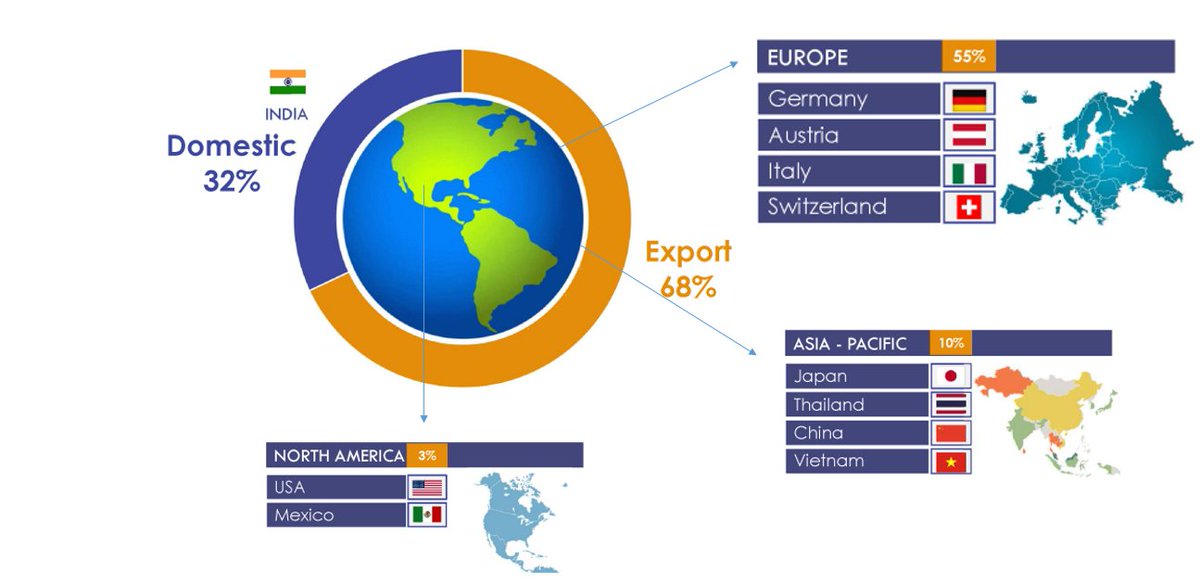

-As the majority of revenue comes from imports, the company has an exposure to Foreign exchange and transportation risks.

-Industry is very competitive and faces competition from China and Taiwan.

-Industry is very competitive and faces competition from China and Taiwan.

16. Future outlook

-Energy and cost inflation crisis in Europe has raised component costs so those OEMs with in-house production are now looking to outsource from Asia.

-Energy and cost inflation crisis in Europe has raised component costs so those OEMs with in-house production are now looking to outsource from Asia.

-China had a competitive cost advantage earlier but due to uncertain government policies and rising labor cost, India is a favorable market with the China plus one policy added.

-RACL is heavily dependant upon Indian automobile industry which is expected to grow at 6.4% CAGR

-RACL is heavily dependant upon Indian automobile industry which is expected to grow at 6.4% CAGR

till 2026

-ZF, one of its key customers, announced a purchase of $300 million auto components this year and $3 billion till 2030.

-ZF, one of its key customers, announced a purchase of $300 million auto components this year and $3 billion till 2030.

Join the Micro Cap Club:

bit.ly/3zYY8OS

bit.ly/3zYY8OS

• • •

Missing some Tweet in this thread? You can try to

force a refresh