Why is it cheaper to add a more expensive #geothermal resource to the grid than add more cheap solar?

My keynote talk at the Dept of @ENERGY Enhanced Geothermal Shot Summit this morning has the answers to this counter-intuitive riddle. Here's my slides: dropbox.com/s/aa6woifltsis…

My keynote talk at the Dept of @ENERGY Enhanced Geothermal Shot Summit this morning has the answers to this counter-intuitive riddle. Here's my slides: dropbox.com/s/aa6woifltsis…

In recent years, wind, solar and battery costs have plummeted, dropping by nearly 90% for solar PV and Lithium-ion battery packs and by more than two-thirds for onshore wind.

In fact, supportive public policy (RD&D & early-market deployment subsidies/mandates) have transformed these once-expensive "alternative energy" sources into THE CHEAPEST source of new electricity we can add to our grids.

Not cheapest CLEAN resources.

The cheapest, period.

Not cheapest CLEAN resources.

The cheapest, period.

So we're done right?

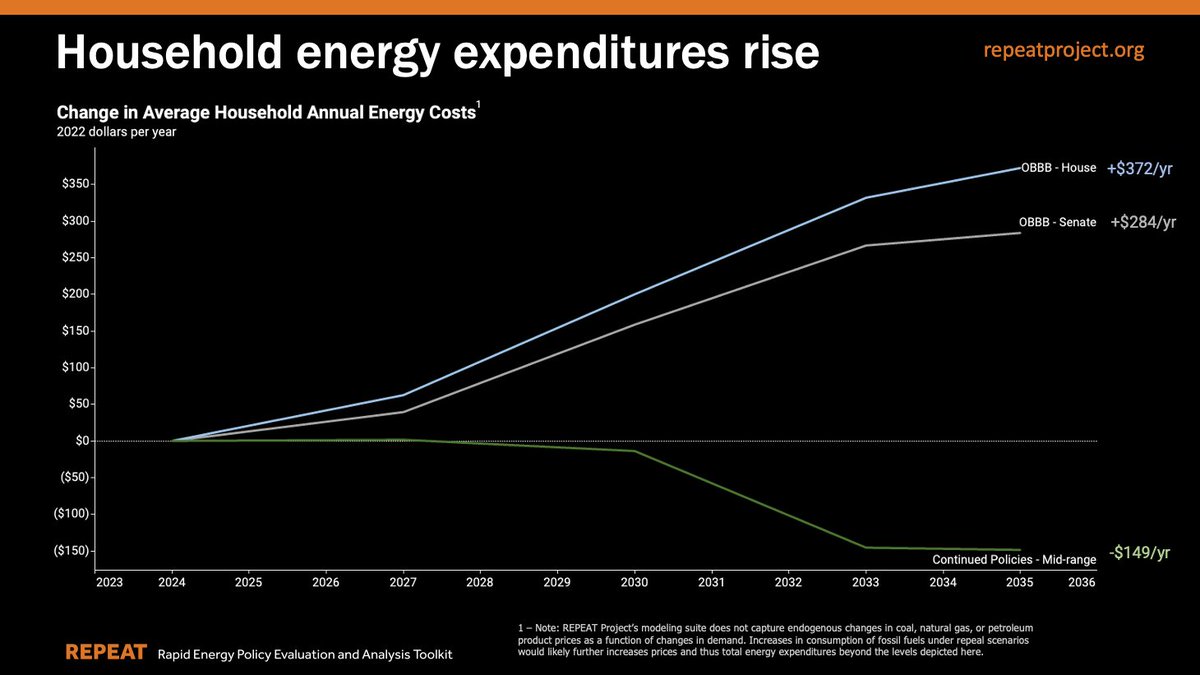

If wind, solar & batteries are so cheap, why do we need innovation to reduce costs of more expensive clean resources like geothermal (focus of today's @ENERGY Summit energy.gov/eere/geotherma…) or waste our time & $ advancing nuclear, fission, or gas w/CCS?

If wind, solar & batteries are so cheap, why do we need innovation to reduce costs of more expensive clean resources like geothermal (focus of today's @ENERGY Summit energy.gov/eere/geotherma…) or waste our time & $ advancing nuclear, fission, or gas w/CCS?

No! We're not done. Why?

Because comparing the cost wind or solar to the cost of geothermal (or nuclear etc) is like comparing the cost of a banana to the cost of a burger when trying to decide what to eat.

Sure it's good to know the banana is cheaper than the burger...

Because comparing the cost wind or solar to the cost of geothermal (or nuclear etc) is like comparing the cost of a banana to the cost of a burger when trying to decide what to eat.

Sure it's good to know the banana is cheaper than the burger...

But you dont want your diet to consist solely of the cheapest calories. Foods, like electricity sources, are imperfect substitutes. They deliver a package of different attributes with different value. And like foods, the more of one type we eat, the less valuable they become.

Why does the value of wind & solar decline as we 'eat' more in our 'electricity diet'? Two key reasons.

First, declining energy substitution value. The more wind/solar we have in any given time, the less valuable all MWh of wind & solar at that time get. These graphics show why.

First, declining energy substitution value. The more wind/solar we have in any given time, the less valuable all MWh of wind & solar at that time get. These graphics show why.

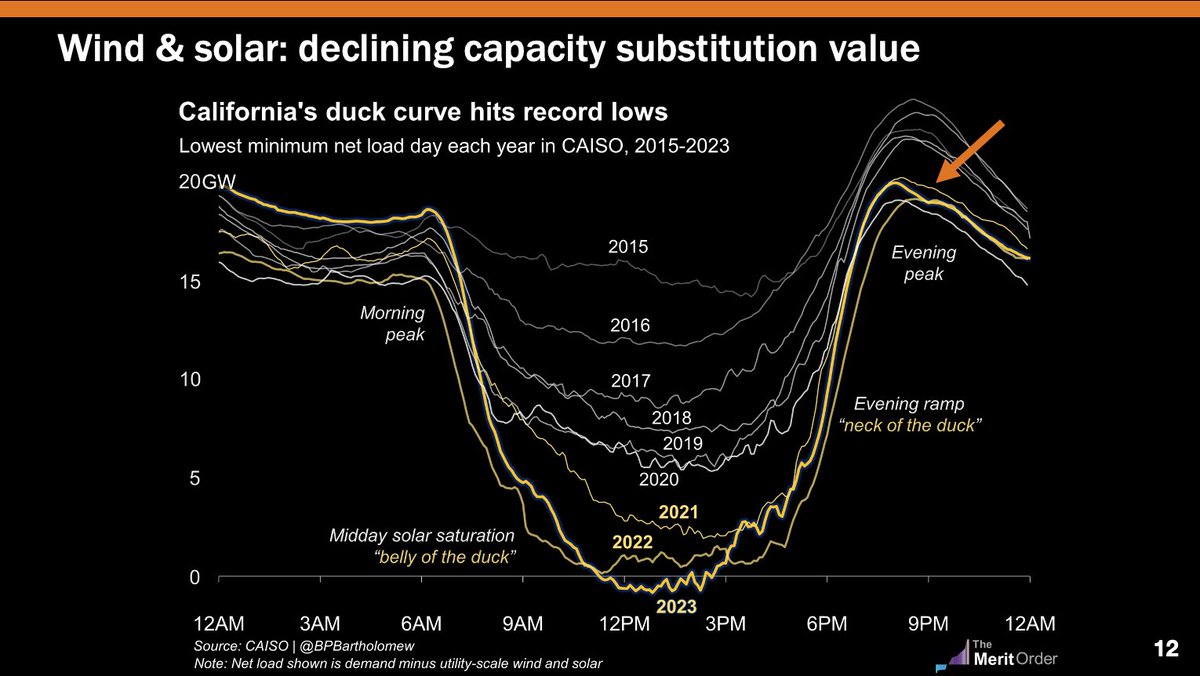

Second, declining capacity substitution value. While wind/solar get most of their value from displacing MWh from higher cost fuel consuming resources (gas, coal), they can also help substitute for some MW of capacity. Unfortunately, this value declines fast.

The famous Duck Curve illustrates why (h/t @BPBartholomew). Solar & wind now provide enough energy to take Cali. net load to 0 at times & supply big share of annual MWh. But peak evening peak has barely fallen. It takes a lot of MWs of wind/solar to displace a MW of firm capacity

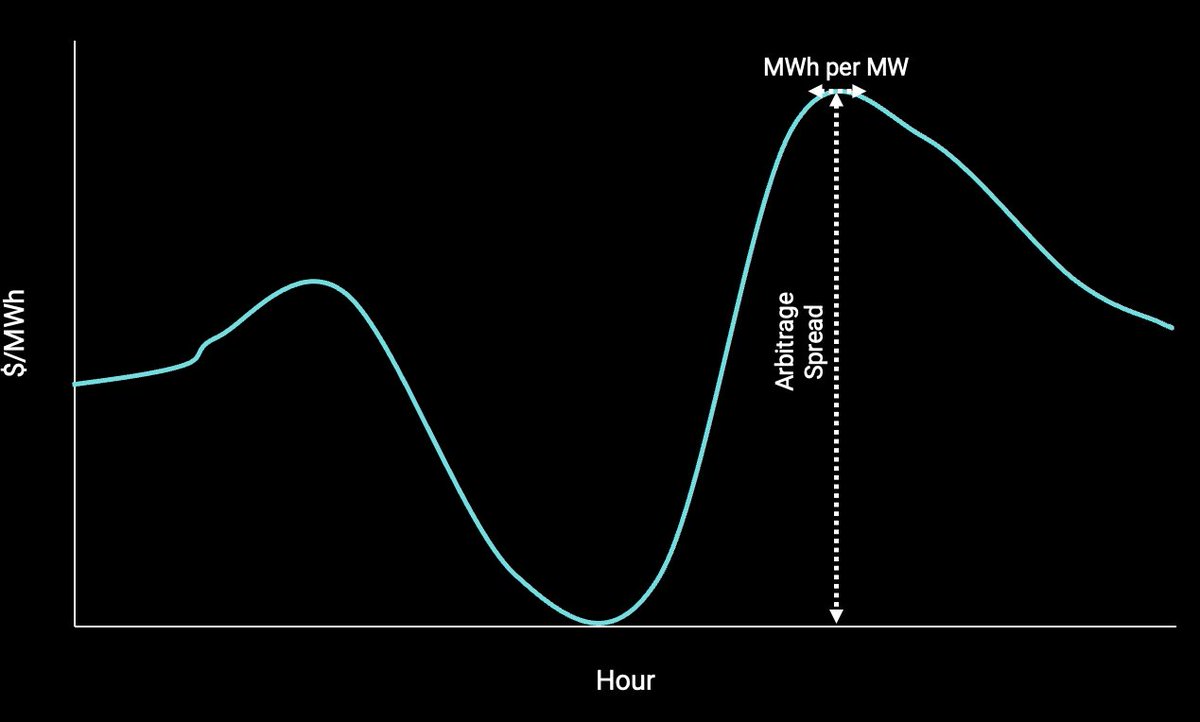

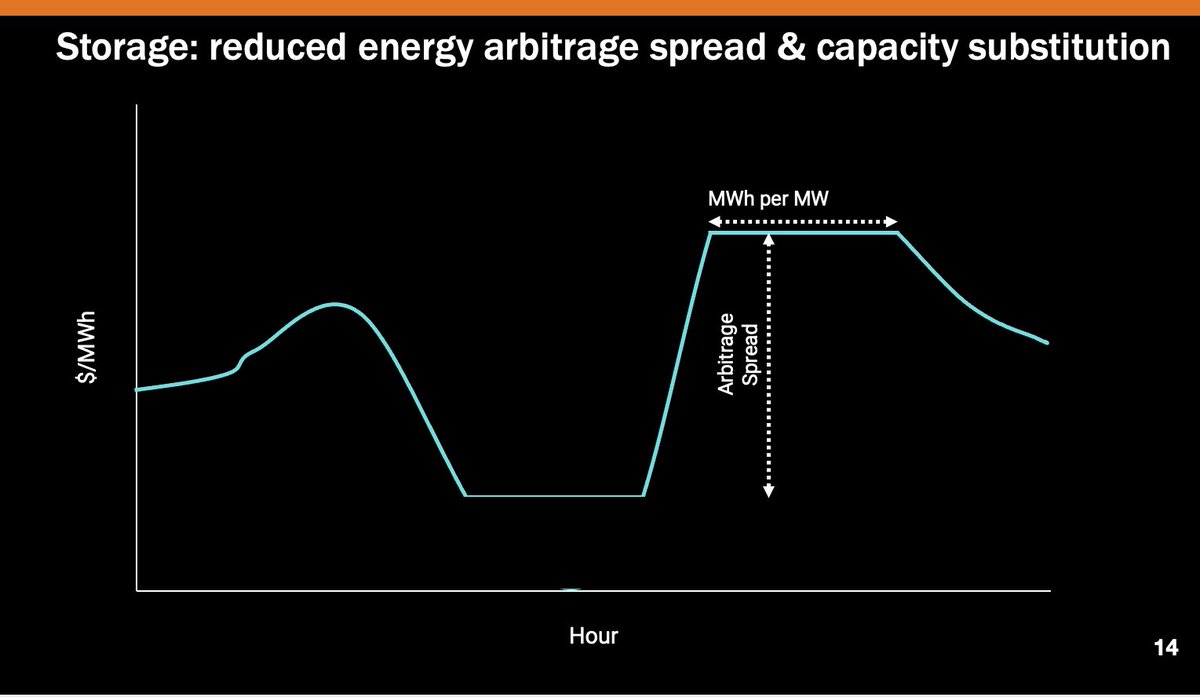

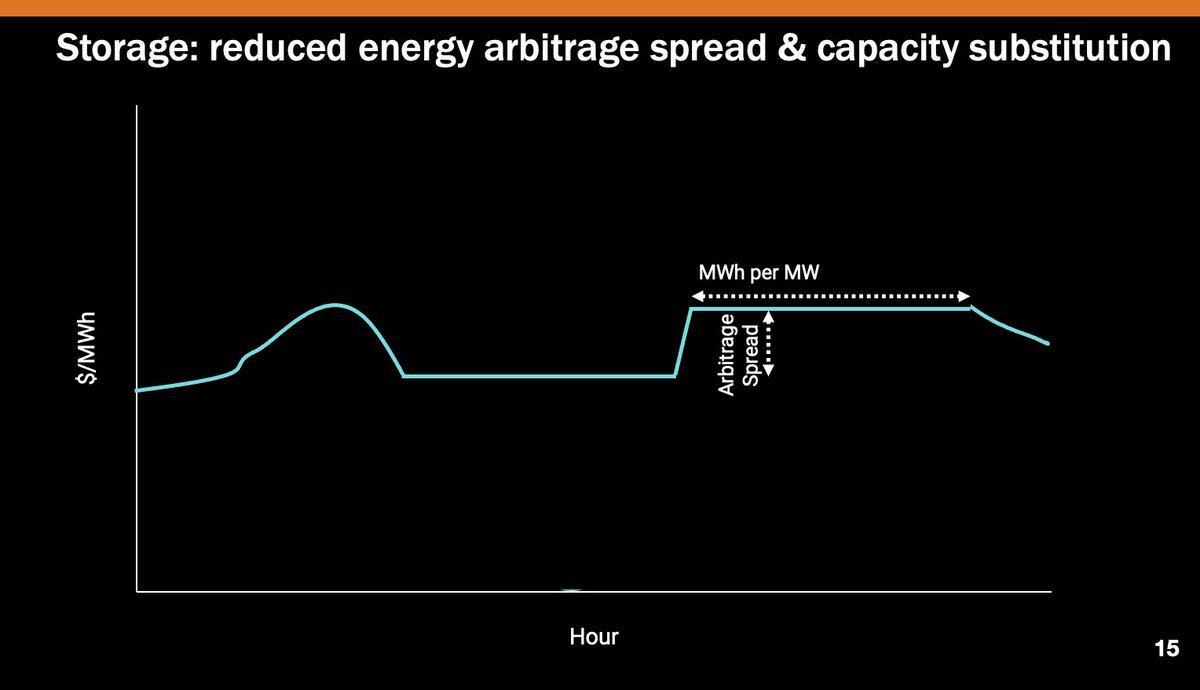

Ok, but batteries are the answer right? Move energy from when it's cheap and abundant to when it's expensive and needed. Yes that helps a lot! But like solar/wind, storage exhibits pretty rapid value decline too. Again, there's two key reasons...

First, the more that buy low, the higher the low price gets, and the more that sell high, the lower the high price gets, compressing the arbitrage spread that pays storage's bills.

Second, you need more & more MWh of battery capacity to displace each MW of additional capacity.

Second, you need more & more MWh of battery capacity to displace each MW of additional capacity.

So solar, wind & batteries are gonna be huge. They're the staples of our low-carb(on) energy diet! But just like in nutrition, a balanced energy diet is the key. And for that, we're missing some key ingredients...

In particular, we need FIRM LOW-CARBON RESOURCES, resources that are available whenever we need them, for as long as we need them.

That makes firm low-carbon resources the key complement to weather-dependent renewables & time-limited batteries or demand flexibility.

That makes firm low-carbon resources the key complement to weather-dependent renewables & time-limited batteries or demand flexibility.

Of course, this is where enhanced geothermal energy systems fits in.

For background on what enhanced geothermal is, here's an explainer from DOE energy.gov/eere/geotherma… and great podcast intro from @drvolts & ZERO Lab's @wilson_ricks here volts.wtf/p/the-extraord…

For background on what enhanced geothermal is, here's an explainer from DOE energy.gov/eere/geotherma… and great podcast intro from @drvolts & ZERO Lab's @wilson_ricks here volts.wtf/p/the-extraord…

In a study (doi.org/10.5281/zenodo…) on the long-term potential and impact of enhanced geothermal led by @wilson_ricks & with enhanced geo. developer @fervoenergy, we found that there are actually TWO key routes to substantial impact & market share for enhanced geothermal...

If we just assume the basics of enhanced geothermal are proven to work -- succesful reservoir stimulation, flow rates, thermal stability -- and assume today's basic drilling costs and basic operations, we see EGS get a foothold, at ~15 GW and 7% of Western Interconnection grid.

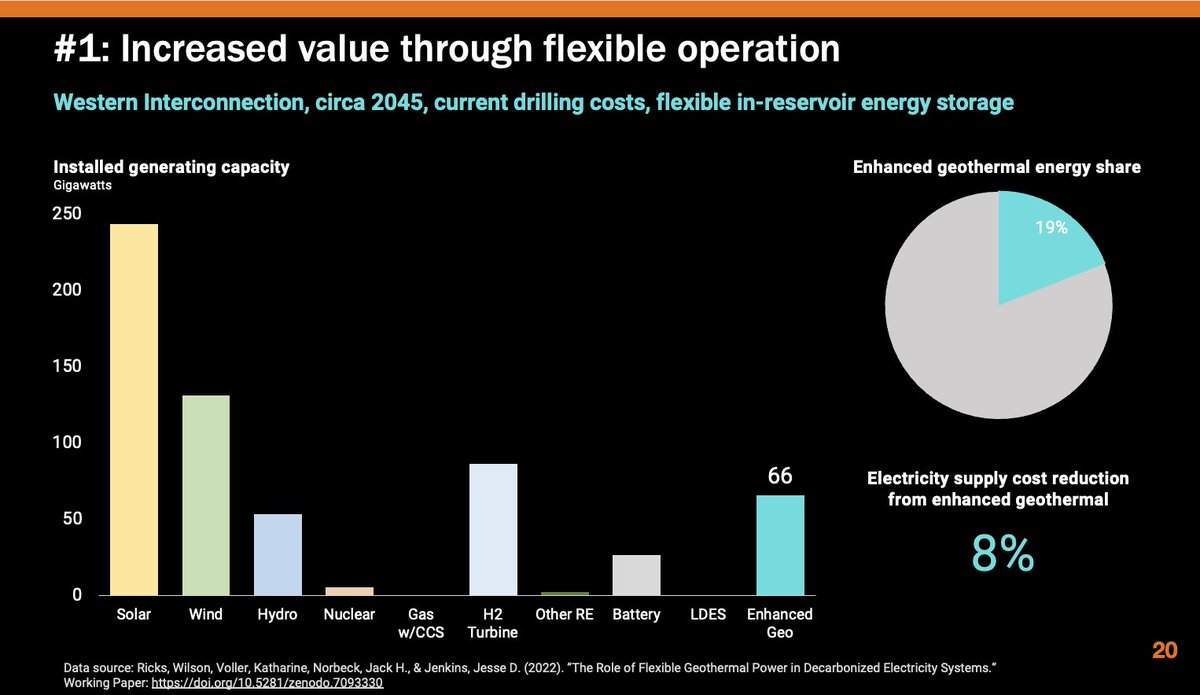

That's nice, but not huge. Hence @ENERGY's Earthshot focus on innovations to drop the cost of enhanced geothermal. I'll get to that, but first, there's ANOTHER way for enhanced geothermal to make it big: increase the VALUE through flexible operation (see dropbox.com/s/1j78gwvihhn6…)

Since EGS l is creating artificial reservoirs in confined rock, it can also act as a giant, free, long-duration battery (again, here's @wilson_ricks volts.wtf/p/the-extraord…). That means enhanced geo. can shift ALL of its energy to highest value periods, earning a lot more value.

We find that even without ANY further improvements in drilling technology, this added value from flexibility alone means enhanced geothermal is ready for prime time, reaching about 66 GW in the West and supplying ~1/5th of electricity while lowering electricity supply costs 8%!

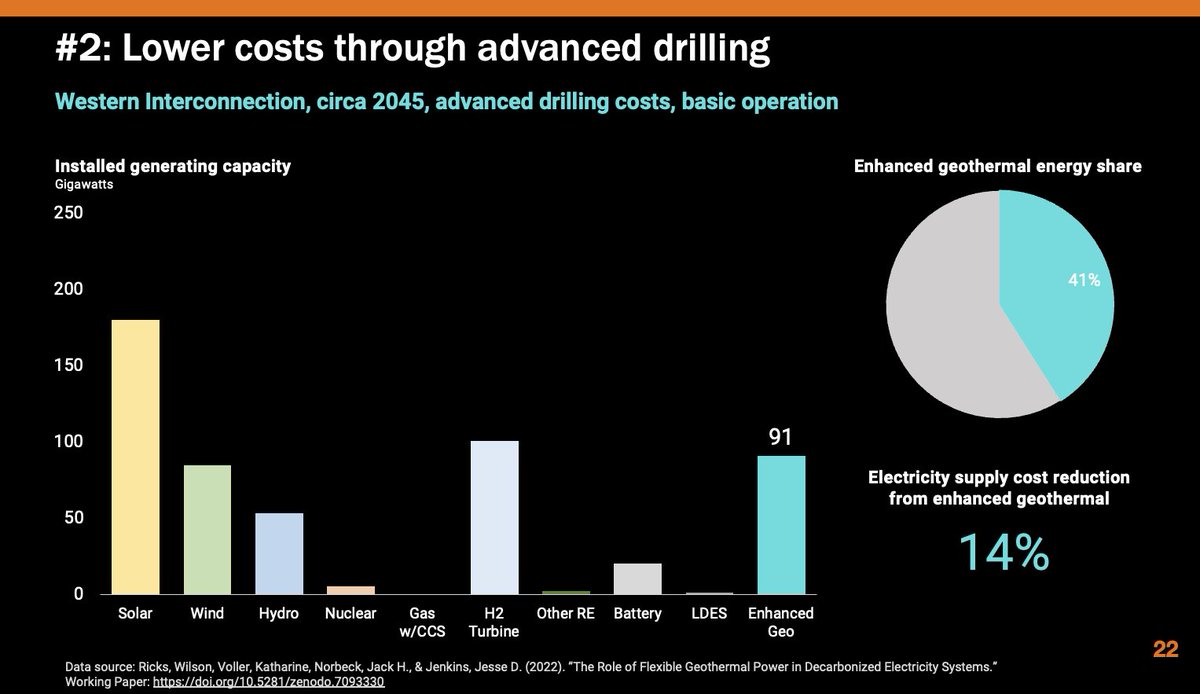

Of course, there's huge potential to lower the costs of EGS too. That's focus of @ENERGY's Enhanced Geothermal Shot (energy.gov/eere/geotherma…). We modeled a similar advanced drilling, basic operations scenario and found ~90 GW, ~40% of Western supply & 14% lower electricity costs.

Why not both? (*insert frequently used GIF*)

Indeed! If enhanced geothermal realizes BOTH advanced drilling AND flexible operation, then it is economic to deploy more capacity in the West by 2045 than all nuclear plants in US today & dropping electricity costs >20%. 💪🌋⚡️🔌

Indeed! If enhanced geothermal realizes BOTH advanced drilling AND flexible operation, then it is economic to deploy more capacity in the West by 2045 than all nuclear plants in US today & dropping electricity costs >20%. 💪🌋⚡️🔌

That's it. That's the talk. Cheers!

Full slides again here: dropbox.com/s/aa6woifltsis…

@wilson_ricks papers on flexible in-reservoir energy storage in enhanced geothermal systems here:

dropbox.com/s/1j78gwvihhn6…

And here: doi.org/10.5281/zenodo…

Podcast here: volts.wtf/p/the-extraord…

Full slides again here: dropbox.com/s/aa6woifltsis…

@wilson_ricks papers on flexible in-reservoir energy storage in enhanced geothermal systems here:

dropbox.com/s/1j78gwvihhn6…

And here: doi.org/10.5281/zenodo…

Podcast here: volts.wtf/p/the-extraord…

@threadreaderapp unroll please.

• • •

Missing some Tweet in this thread? You can try to

force a refresh