Bangladesh once beat India to become the fastest growing economies in the world!

Now it's on the brink of joining Sri Lanka & Pakistan in an ECONOMIC CRISIS

The crazy part? IMF has given them the last warning

THREAD: fall of the Bangladesh economy and the reasons behind it:

Now it's on the brink of joining Sri Lanka & Pakistan in an ECONOMIC CRISIS

The crazy part? IMF has given them the last warning

THREAD: fall of the Bangladesh economy and the reasons behind it:

In January this year, the IMF agreed to a $4.7 Bn support loan package for Bangladesh to help it cope with soaring energy and food costs that have sparked huge protests.

We've broken the entire situation of this 'Land of Rivers' in a very easy-to-understand way for you.

We've broken the entire situation of this 'Land of Rivers' in a very easy-to-understand way for you.

The main problem that Bangladesh is facing is the problem of

— DEBT & DEFICIT.

You see, the Bangladeshi economy is dependent on garment manufacturing up to a great extent.

Production of garments is 1/3rd of their total industrial production.

— DEBT & DEFICIT.

You see, the Bangladeshi economy is dependent on garment manufacturing up to a great extent.

Production of garments is 1/3rd of their total industrial production.

But with the outbreak of the COVID-19, the production and distribution system of this nation fell apart.

On top of that, the Russia-Ukraine war made things worse.

Let's see how:

On top of that, the Russia-Ukraine war made things worse.

Let's see how:

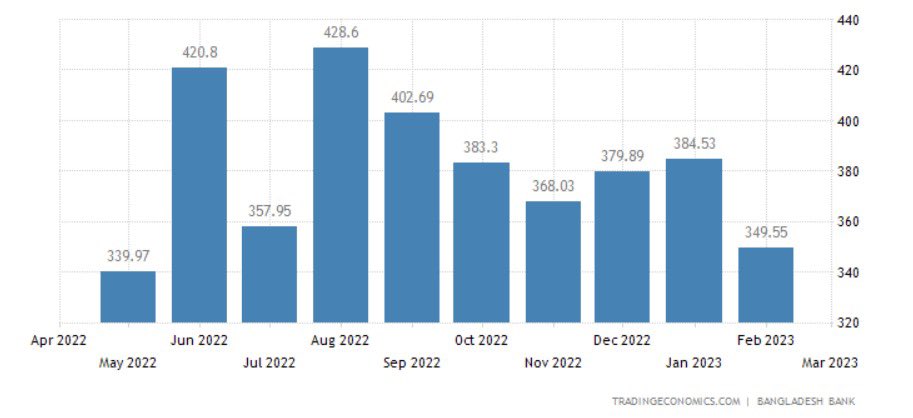

1️⃣ INCREASING IMPORTS

Bangladesh has always been an import-dependent country.

It imports raw materials (textiles) for garment production, petroleum & oil, iron & steel, chemicals, wheat, etc.

But these imports became more expensive with the outbreak of the COVID-19.

Bangladesh has always been an import-dependent country.

It imports raw materials (textiles) for garment production, petroleum & oil, iron & steel, chemicals, wheat, etc.

But these imports became more expensive with the outbreak of the COVID-19.

Even though Bangladesh's economic recovery was commendable, their import costs increased by 29% between 2021 and 2022, reaching an all-time-high of $6.61 Bn in June 2022.

OUTCOME?

Their imports were rising at a faster pace than their exports.

OUTCOME?

Their imports were rising at a faster pace than their exports.

So, to save dollars, the central bank imposed 100% cash margin on all kinds of imports except the government's.

2️⃣ REDUCED PACE OF EXPORTS

Bangladesh's exports are rising, but NOT at an increasing rate. They majorly export fully-manufactured garments to all the major countries.

2️⃣ REDUCED PACE OF EXPORTS

Bangladesh's exports are rising, but NOT at an increasing rate. They majorly export fully-manufactured garments to all the major countries.

But now, with the rising cost of raw material, the cost of stitched garments is also INCREASING.

This is lowering the demand for garments in the international markets.

OUTCOME? The slower pace of increase in exports.

This is lowering the demand for garments in the international markets.

OUTCOME? The slower pace of increase in exports.

3️⃣ WIDENED TRADE DEFICIT

Trade Deficit is the amount by which the country's imports exceed its exports.

IMPORTS - EXPORTS = TRADE DEFECIT

Bangladesh’s trade deficit was over $30 Bn in FY22 compared to $15.51 Bn in FY21!!!

Trade Deficit is the amount by which the country's imports exceed its exports.

IMPORTS - EXPORTS = TRADE DEFECIT

Bangladesh’s trade deficit was over $30 Bn in FY22 compared to $15.51 Bn in FY21!!!

Now, why are we discussing the trade deficit?

A trade deficit reduces the income for domestic workers and national savings because the major portion of the national income gets spent on import payments.

This hampers the wealth creation process of a country.

A trade deficit reduces the income for domestic workers and national savings because the major portion of the national income gets spent on import payments.

This hampers the wealth creation process of a country.

So to reduce the deficit, they need to increase their exports and remittances.

And the imports of unnecessary and luxury items need to be reduced.

And the imports of unnecessary and luxury items need to be reduced.

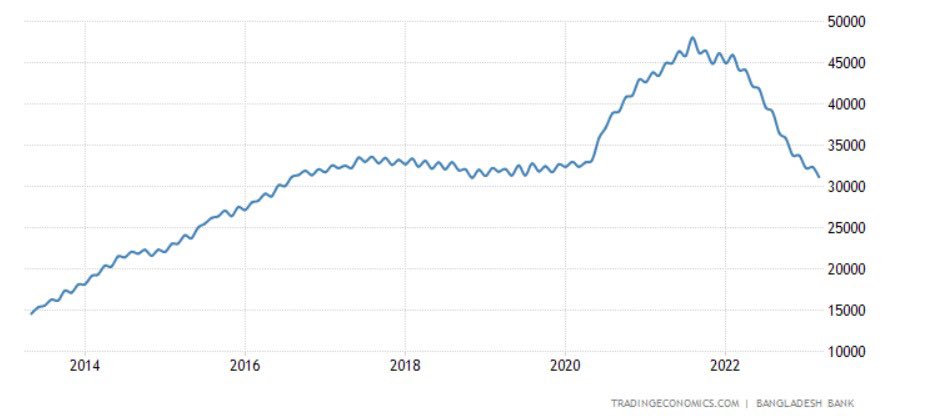

4️⃣ FALLING FORIEGN EXCHANGE RESERVES

Bangladesh remains one of the fastest growing economies in the Asia-Pacific region.

However, despite the narrowing trade deficit in recent months, Bangladesh’s forex reserves have hit a 6-year low recently.

Bangladesh remains one of the fastest growing economies in the Asia-Pacific region.

However, despite the narrowing trade deficit in recent months, Bangladesh’s forex reserves have hit a 6-year low recently.

Maintaining a healthy forex reserve is very important because it stabilizes the exchange rate and financial markets of a country.

These reserves are assets for central banks, and depleting assets is always bad news.

Why? Because this causes devaluation of the national currency.

These reserves are assets for central banks, and depleting assets is always bad news.

Why? Because this causes devaluation of the national currency.

5️⃣ DEVALUATION OF CURRENCY

The decline in the inflow of remittances by Bangladeshi workers and a rise in import payments is depreciating the country's currency — TAKA.

Moreover, their central bank is using its forex reserve to stabilize the value of TAKA against the dollar.

The decline in the inflow of remittances by Bangladeshi workers and a rise in import payments is depreciating the country's currency — TAKA.

Moreover, their central bank is using its forex reserve to stabilize the value of TAKA against the dollar.

And a weak domestic currency makes:

a) imports EXPENSIVE, and

b) exports CHEAPER in the global market.

Consequently, this tends to improve the trade deficit of a country.

a) imports EXPENSIVE, and

b) exports CHEAPER in the global market.

Consequently, this tends to improve the trade deficit of a country.

On one hand, devaluation encourages foreign investors to invest their money in a country.

But on the other hand, it increases inflation and reduces the purchasing power of the country's residents.

But on the other hand, it increases inflation and reduces the purchasing power of the country's residents.

6️⃣ BAD INVESTMENT DECISIONS

Bangladesh has taken some foreign loans in recent years to develop some expensive but unprofitable mega projects, like nuclear power plants and bridges.

The country needs to pay $4 B per year instalments to repay these loans.

Bangladesh has taken some foreign loans in recent years to develop some expensive but unprofitable mega projects, like nuclear power plants and bridges.

The country needs to pay $4 B per year instalments to repay these loans.

But they might not be able to repay these loans on time due to a shortage of income from these mega projects.

So, they don't have any room for negligence, corruption, and delay in these projects because that will further increase the cost of these projects.

So, they don't have any room for negligence, corruption, and delay in these projects because that will further increase the cost of these projects.

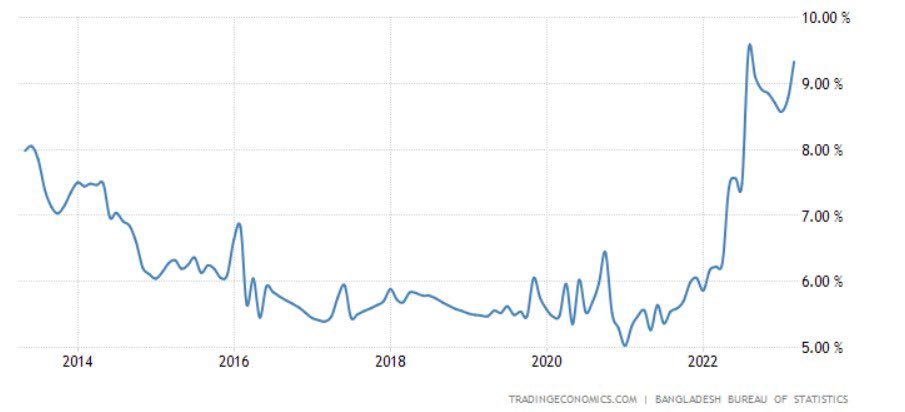

7️⃣ INCREASING INFLATION

Last but not the least, increasing inflation always is the core factor of every economic crisis.

General price level increased due to the rise in the price of crude oil, which increased after the commencement of the war between Russia and Ukraine.

Last but not the least, increasing inflation always is the core factor of every economic crisis.

General price level increased due to the rise in the price of crude oil, which increased after the commencement of the war between Russia and Ukraine.

Bangladesh Government announced price hike of fuel by 51.7%, which will turn increased the price of every single commodity of their economy.

This will further reduce the household savings and investments in Bangladesh.

This will further reduce the household savings and investments in Bangladesh.

We factor in a lot of economic variables while taking decisions for a country, but only the poor people suffer its consequences.

And this is why anti-government protests broke out in Bangladesh in December 2022.

And this is why anti-government protests broke out in Bangladesh in December 2022.

The virtue of every country and its citizens lies in the hands of its government and their management.

GOOD GOVERNANCE IS THE NEED OF THE HOUR FOR BANGLADESH.

GOOD GOVERNANCE IS THE NEED OF THE HOUR FOR BANGLADESH.

If you liked this read do ReTweet🔄 the 1st tweet

and follow us @FinFloww for such threads every Monday, Wednesday and Friday!

and follow us @FinFloww for such threads every Monday, Wednesday and Friday!

Join 14079 people who receive such stories daily on their WhatsApp:

chat.whatsapp.com/HaD02akgLtv3WS…

chat.whatsapp.com/HaD02akgLtv3WS…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter