The Power of Saving and Investing. A story!

1/6: Meet Jane and Kim, two young professionals who started their careers at the Kienyeji Hotel. Their financial habits led them down different paths during a crisis. #ThePowerOfSavingAndInvesting

1/6: Meet Jane and Kim, two young professionals who started their careers at the Kienyeji Hotel. Their financial habits led them down different paths during a crisis. #ThePowerOfSavingAndInvesting

2/6: Jane was a hard worker who saved 10% of her income, lived modestly, and invested her money wisely. Kim, on the other hand, spent most of his paycheck on "sherehe" and was always in debt. #FinancialHabits

3/6: A few years later, the company went through a major layoff, and both Jane and Kim were let go. Thanks to her savings and investments, Jane was able to weather the crisis, while Kim struggled with no savings and a lot of debt.He had to move back in with his parents (at 35).

4/6: Jane's story is a reminder that financial security is important. By saving and investing, she was able to weather a difficult financial storm. Kim's story is a cautionary tale of what can happen when we don't save and invest. He was left vulnerable. #LearnFromMistakes

5/6: Want to secure your financial future? Start by saving and investing early, spending within your means, paying off debts, and creating a financial plan. #TakeControl

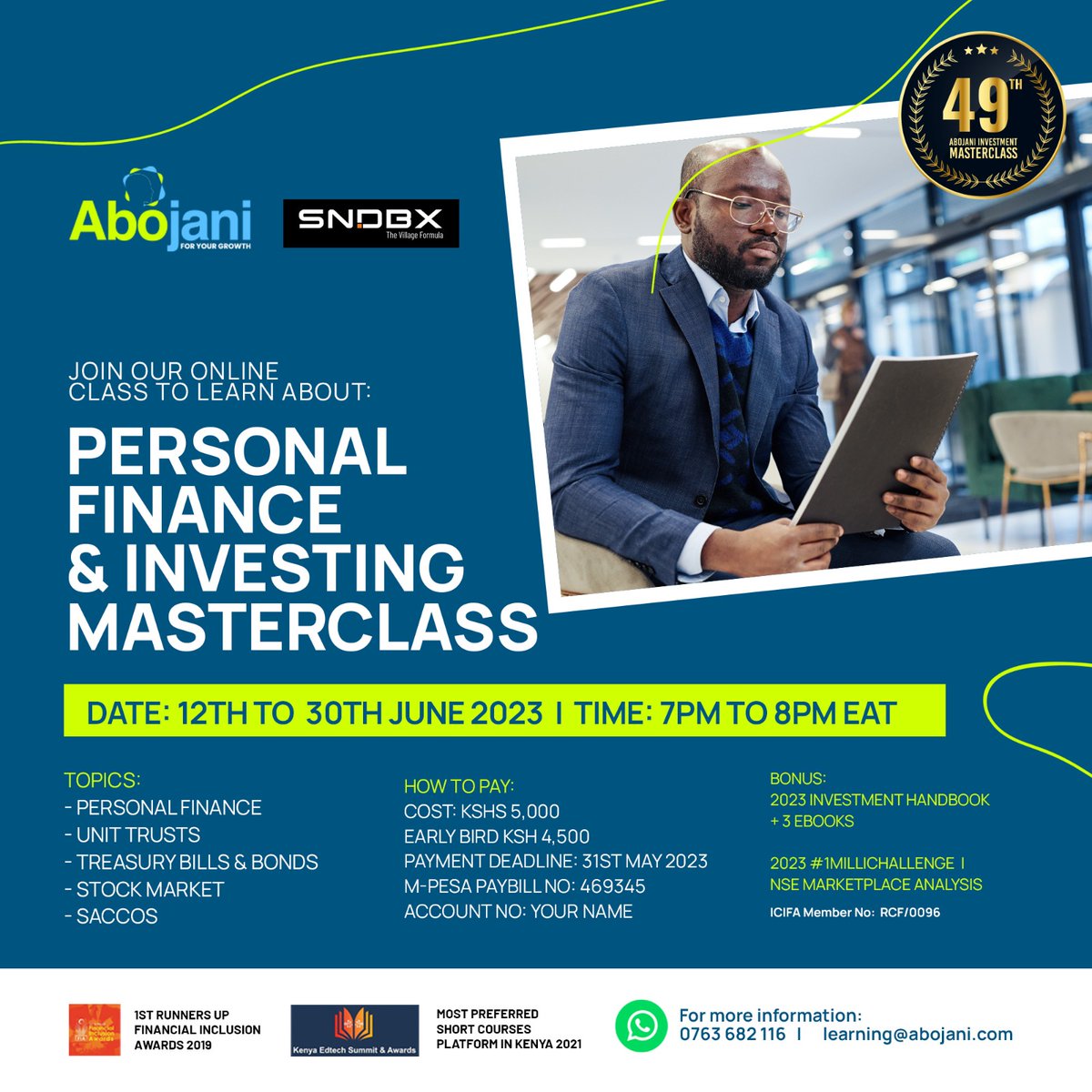

6/6: Join our June Masterclass and learn how to save and invest your money wisely. Take responsibility for your finances and build a secure financial future. #JuneMasterclass #FinancialSecurity #AbojaniInvestment

Abojani Online Masterclass Payment Details

~ Paybill: 469345

~ Account Name: Your Name

~ Early Bird Discount: Ksh 4,500

Regulated by ICIFA

~ Paybill: 469345

~ Account Name: Your Name

~ Early Bird Discount: Ksh 4,500

Regulated by ICIFA

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter