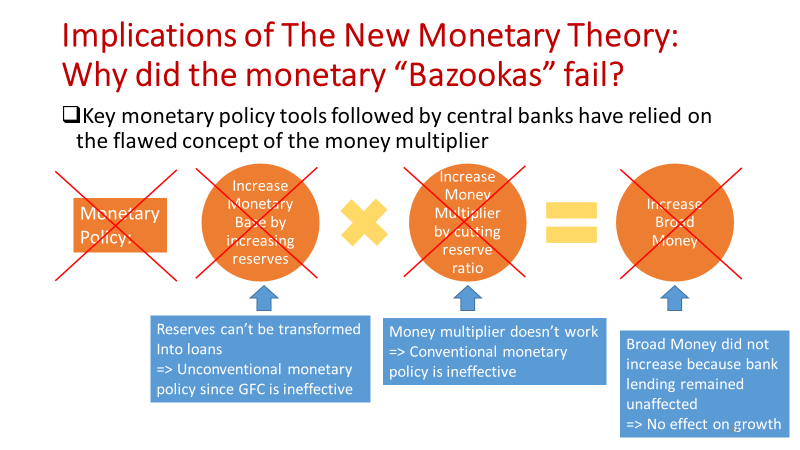

Presenting a Synopsis of our book #MoneyAZeroSumGame thru this presentation. Thread🧵where each tweet contains the image of a slide. Thread #2

• • •

Missing some Tweet in this thread? You can try to

force a refresh