Do you ever wonder why some PD arrays get ignored, and your stop gets run? Here is exactly how to identify when that is likely to happen!

#ICT #Thread 🧵

#ICT #Thread 🧵

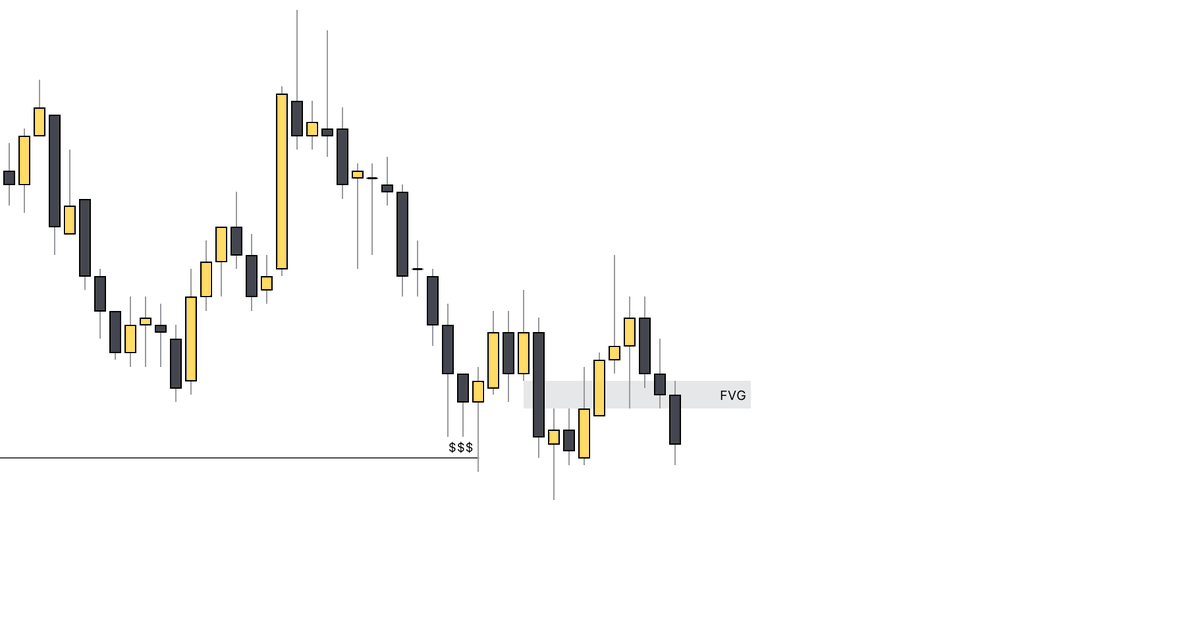

Example #1

This FVG is obviously ignored.

No Market Structure Shift.

So why was this ignored?

(Answer below 👇)

This FVG is obviously ignored.

No Market Structure Shift.

So why was this ignored?

(Answer below 👇)

Answer #1

The reason is, sell side liquidity was swept.

After sell side liquidity has been swept, any bearish PD arrays can be ignored because won't reject price anymore.

The reason is, sell side liquidity was swept.

After sell side liquidity has been swept, any bearish PD arrays can be ignored because won't reject price anymore.

Yet again.

Sell side liquidity was swept.

After sell side is swept, any bearish PD arrays will likely fail.

Sell side liquidity was swept.

After sell side is swept, any bearish PD arrays will likely fail.

Answer #3

This Order Block is ignored.

Buy side liquidity was swept.

When this happens, it is called a Breaker Block.

As you can see, the price later retraces back into the area and uses the Breaker Block as resistance.

This Order Block is ignored.

Buy side liquidity was swept.

When this happens, it is called a Breaker Block.

As you can see, the price later retraces back into the area and uses the Breaker Block as resistance.

Answer #4

If you said no, you'd be correct.

Sell side liquidity was swept.

In this case, the old FVG was used as an Inversion.

An Inversion is just like a Breaker Block. It is later used as support if is not respected the first time.

If you said no, you'd be correct.

Sell side liquidity was swept.

In this case, the old FVG was used as an Inversion.

An Inversion is just like a Breaker Block. It is later used as support if is not respected the first time.

I hope you have learned a lot from this. I try my best to keep everything simple for everyone to understand.

If you like this content and would like to support me, you can like, retweet, comment, and even share!

If you'd like to see more content like this, hit that follow! ❤️

If you like this content and would like to support me, you can like, retweet, comment, and even share!

If you'd like to see more content like this, hit that follow! ❤️

• • •

Missing some Tweet in this thread? You can try to

force a refresh