At the #BeyondGrowth conference in Brussels, with another 2000 participants, curious to see what's the discourse in the new geopolitics

Last time I was here at a large scale event, in 2018/19, it was for Sustainable Finance, where Europe was organising to discipline carbon capital.

4 years and a US IRA later, that political project is dead.

4 years and a US IRA later, that political project is dead.

first joyful moment, greeting two fierce African feminist/tax justice activists here to challenge Europe's 'derisking Africa'/WallStreetConsensus

the room went quiet, the high priests are entering the church.

Metsola: crisis are existential, cracks in our energy system and security strategies...recent geopolitical events shook us, but showed us power of unprecedented unity (!), EU can enact change rapidly, EU on track to be first climate-neutral continent

Metsola: not throw away the painful lessons - funds are finite, debts must be paid back, we need sustainable growth (room filled w degrowth youth gasping at fiscal austerity stated there)

next, von der Leyen - 'if it werent for you we wouldnt have had a European Green Deal...the most ambitious initiative Europe has ever had to deal with planetary bounds' (Lamberts)

vdL: growth model centred on fossil fuels is obsolete, European Green Deal is our new growth model for prosperous economy, a systematic modernisation of European industry.

..the potential for green hydrogen, electric cars, batteries recycling (all EU green industrial priorities)

..the potential for green hydrogen, electric cars, batteries recycling (all EU green industrial priorities)

social market economy guarantees protection for the big risks in life (here the derisking state comes to the fore)

when Russian tanks rolled into Ukraine...Kremlin waned to blackmail us with energy...there were no blackouts..with solidarity contributions from big energy providers (?)...Europe in 2022 cut emissions by 2.5%

in the world's most improbable follow-up act, @jasonhickel after Mentsola and von der Leyen - getting a lot more applause then the two

Sandrine Dixson-Decleve denounces the obsession with technology to loud applause - yet the European Commission is betting big on Carbon Capture and Storage as a strategic priority of new agenda for green industrial policy

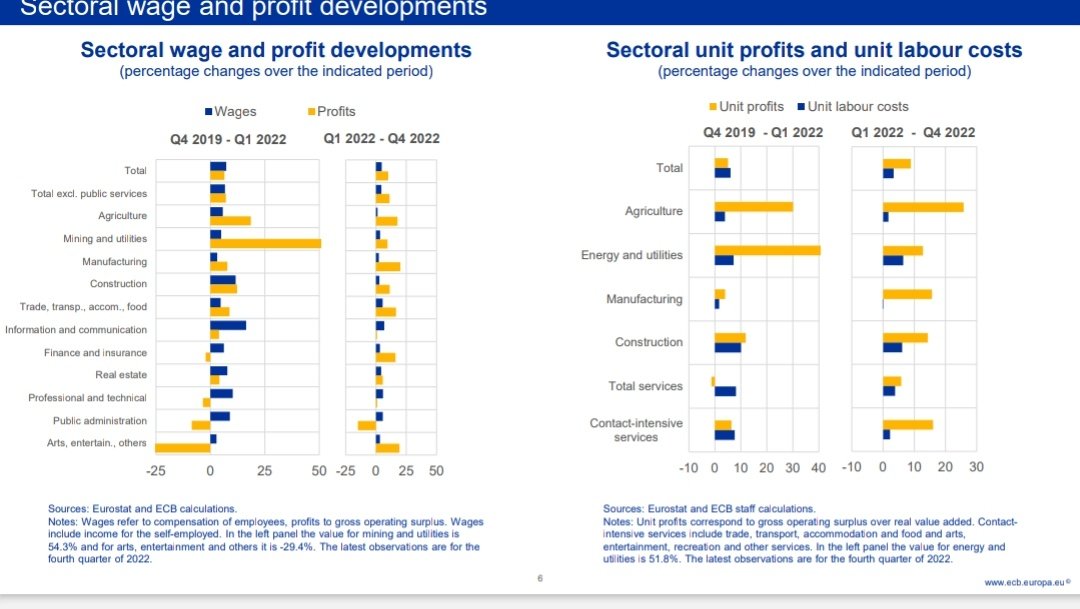

Now @jasonhickel reminding politicians in the room that European production is organised to benefit Capital, with serious social and ecological costs.

Ecological emergency requires scaling down some production (yes, remember Sustainable Finance dirty taxonomy)

Ecological emergency requires scaling down some production (yes, remember Sustainable Finance dirty taxonomy)

This is the terrible paradox of #BeyondGrowth conference - a lot more political momentum behind green capitalism with a lot less political will to discipline capital into a smaller carbon footprint

In many ways, 2019 was a more progressive moment for decarbonisation than 2023.

(Lamberts, the Green MEP behind this conference, is furiously applauding at each 'eat the rich' Hickel jibe, after he's told us he's not running for EP next year)

Lamberts - this Parliament has power, if you want evidence for it look at the relentless lobbying we are facing every day

Listening to Adelaide Charlier, hard to shake the sense that the triumphalist tone is lowering rapidly with age.

Lamberts: let me remind you of opening scene in Terminator, where robots hunt humans on behalf of Capital.

That is a now a distinct possibility.

That is a now a distinct possibility.

Next, Green Industrial Policy panel - where most geopolitical tensions are playing out, and where I bet we'll hear a derisking serenade to green capital

Ninisto, Green MEP - ETS & carbon border adjustment mechanism as price signals for investment.

Financial Sector incentivised to support the green economy via the Sustainable Finance taxonomy

Financial Sector incentivised to support the green economy via the Sustainable Finance taxonomy

'companies now ask us to do more for competitiveness, investors are realising this is a big possibility'

(derisking✓)

(derisking✓)

The Net Zero Industrial Act and the Sovereignty Fund now under discuss - we want to have a European Industry that helps the transition

(derisking ✓✓)

(derisking ✓✓)

Jonathan Barth is bringing sticks to the green industrial policy discussion.

But there are NO STICKS to discipline green capital accumulation in the Commission's proposal

But there are NO STICKS to discipline green capital accumulation in the Commission's proposal

Sitarova, Slovakian metal trade union: NEF research shows only 4 Member States have fiscal space for green investments....US IRA pushes us for finding answers with social conditions.

Now Madsen from Orsted, the Danish renewable energy, and a strong beneficiary of UK's derisking renewables approach

'market fundamentals/regulation have changed so dramatically that it turned out to be profitable in renewables than in fossil fuels'

'market fundamentals/regulation have changed so dramatically that it turned out to be profitable in renewables than in fossil fuels'

'as big buyer of big wind turbines rather than a producer, we can set standards to our suppliers but if we set social/Green demanda to our suppliers we will not be competitive'

Orsted: NZIA - we participate in options, we compete on price (who can accept lower subsidies).

But is that the only parameter we want to compete on in renewable energy options.

But is that the only parameter we want to compete on in renewable energy options.

'if you compete on biodiversity, how do you measure that, our projects will from 2030 have a net positive biodiversity impact' (well well)

This industrial policy is the most 'have our cake and eat it' session at #BeyondGrowth2023

Fascinating that the representative of green capital on the industrial policy panel identified two European sticks for Kapital - the EU taxonomy and ETS.

He also acknowledged that the two are very imperfect.

He also acknowledged that the two are very imperfect.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter