Here at @latticesemi's #analystday2023 at @Nasdaq, a 🧵! Talks from CEO @jranderson, CFO Sherri Luther, and CSO Esam Elashmawi.

Ran into these two goofballs too! @bobodtech @Krewell $lscc

Ran into these two goofballs too! @bobodtech @Krewell $lscc

Over 9000 customers, $180m+ quarterly revenue, 70% GMs. Expanded into mid-range FPGA market with Avant, launched late last year, doubling the addressable market

Here's the video I made for the Lattice Avant launch:

Jim saying $lscc is positioned well with big large addressible markets. New Market leading products, differentiated to comp

Four core strategic markets

- comms

- computing

- industrial

- automotive

90%+ of revenue comes from these four

- comms

- computing

- industrial

- automotive

90%+ of revenue comes from these four

Lattice once told me their attach rate in servers is 0.8 growing to 1.2 and beyond. Kinda insane.

Despite launching Avant mid-range FPGAs, Lattice is still launching new small FPGAs as part of the Nexus platform.

- Nexus CrossLinkU-NX in Q3 2023

- Avant-E in Dec 2022

- Avant-G in 2H 2023

- Avant-X in 2H 2023

- Lattice Drive in Q3 2023

- Nexus CrossLinkU-NX in Q3 2023

- Avant-E in Dec 2022

- Avant-G in 2H 2023

- Avant-X in 2H 2023

- Lattice Drive in Q3 2023

Portfolio of software-specific stacks for customers, now over 50% attach rate (vs ~0 in 2018). Accelerate TTM by 3-6 months. ASPs of design wins with software attach, those ASPs are significantly higher

With 9000 customers, there are lots of customers they can reference. Lattice has doubled its software support structure for customers

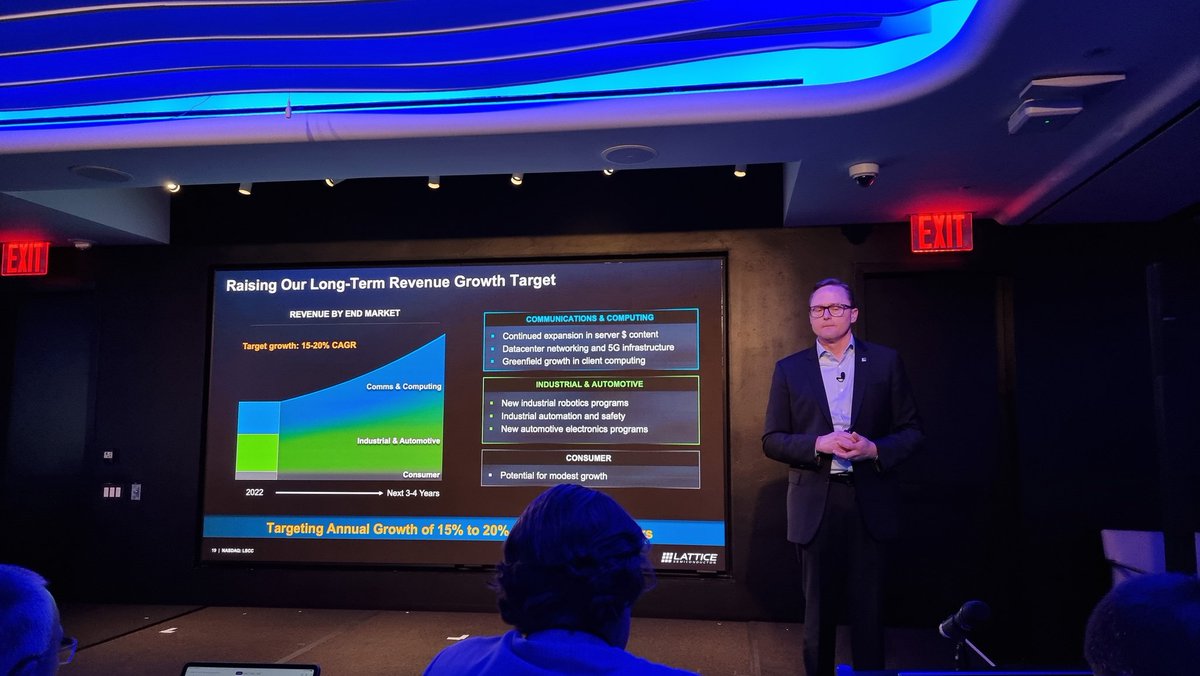

Growing more than 20% cagr expected next 3-4 years. Avant will ramp over years, this is the fpga market

Avant revenue expected to start by end-of-year. Avant ASPs are 10x-20x higher than Nexus. It's all additive

Financial discipline targets. They're already at 70% GM Non-GAAP, the question is what's sustainable

Here's the breakdown for when Lattice talks about FPGA markets. All of Lattice's revenue today, $180m/quarter, it's with those small FPGAs. Any idea how many they sell ?!?

Elam: Lattice's partners are driving new use cases for FPGAs - Avant wouldn't have existed if it wasn't for partners and customers looking at new ways to use Lattice. Helps drive new product revenue cycles too!

Here's the new Nexus for 2023. Customers asking for more IO etc for MachX. CrossLinkU has AI based vision optimizations. More info at launch

G is more for mid-range, and X is the most advanced 'mid-range' FPGA and halo parts for Lattice. More info at Lattice Developer Day later this year.

Now this is going to be big revenue for them: Lattice Drive. ADAS, low power, infotainment. Launching in Q3. More info then.

Left: Lattice offering more ORAN and security and datapath opportunities in comms, it's a long-term growth driver.

Right: DC Networking, Lattice for control security and data security. TOR, routers, aggregation switches.

Right: DC Networking, Lattice for control security and data security. TOR, routers, aggregation switches.

In DC, restraints are power. Need performance but limited power budget, even for control silicon. Lattice is the only vendor providing leading-edge FPGA silicon, and software stacks for it.

Attach rate in servers is now over 1. Servers becoming more modular, more heterogeneous. All need control, security, support.

Better view of this slide. So as we move disaggregated, Lattice sees customers need a unified architecture, CPU agnostic, low power, quick time-to-market. Even 3000W servers need to save a few watts per security device, it all counts with ESG. Also, adaptable security.

Consumer adopting Lattice for new use cases - artificial intelligence. Even a small attach rate in 300m units is significant. OEMs want to improve user experience with AI, need adaptable AI silicon. Wake on approach etc. ASPs per unit low-to-mid single digits.

The wake on approach, or dim on look-away, is a really important use case. It's no joke when this could improve battery life by 1-2hrs. The only downside? Camera has to be always on. Or at least, some form of camera. There has to be a solution here.

Industrial is one of Lattice's biggest revenue segments - multiple FPGAs per system, with a unified software stack at low power with AI inference. Chances to replace several chips with one FPGA.

Automotive - OEMs want to differentiate. Need scalabilty across models, single device solutions that work across all. An ideal FPGA workload. $1 to $100 ASP per FPGA

Sensor aggregation, multi-display connectivity, data processing, adaptable over time and scalable for end vehicle class with a single platform

Elam stated that it's Sherri making sure that everything is measured and accountable for expanding the company. It's fiscal discipline

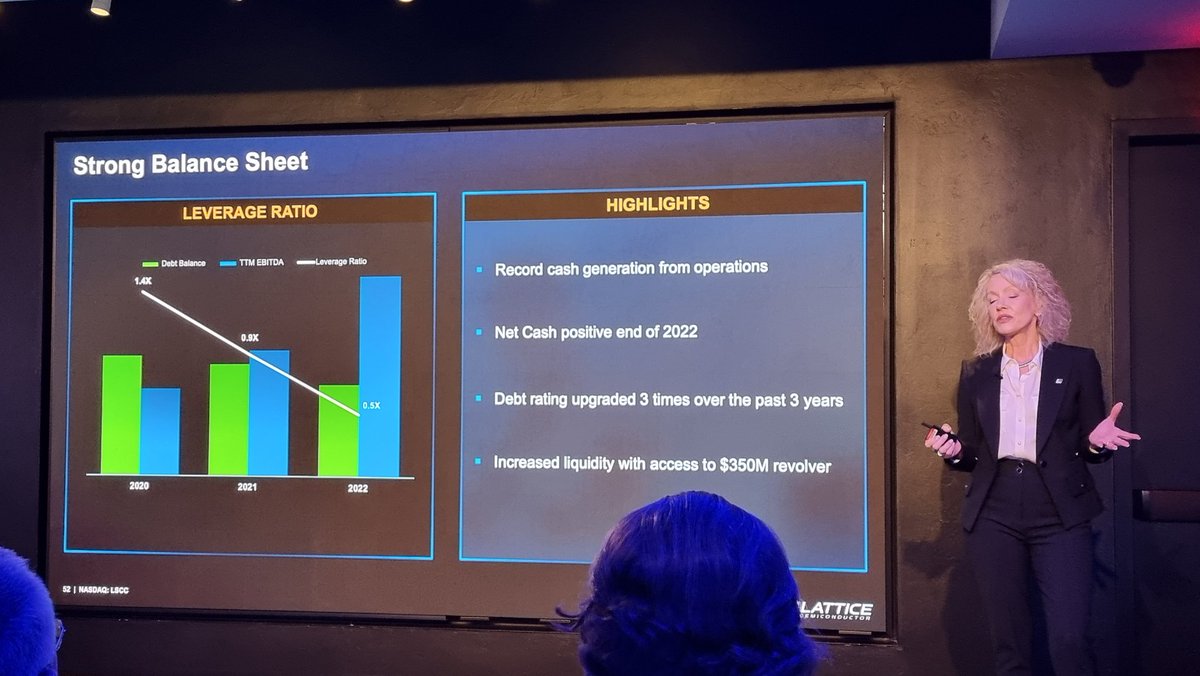

Here's a big set of data showing 3-year metrics. All in the right direction. EPS growing 4x revenue growth.

Lattice is a company that goes after diverse but long product lifecycles with strong products and sustainable revenue streams. This provides high-quality revenue with ever-improving margins.

Strategy:

- Pricing Optimization (Value with functionality)

- Product Mix (Higher capacity)

- Product Cost Reductions (Yield, extended partnerships for supply/demand)

- Pricing Optimization (Value with functionality)

- Product Mix (Higher capacity)

- Product Cost Reductions (Yield, extended partnerships for supply/demand)

OpEx decreasing as % of revenue, but increasing in real terms. SG&A targeting 10-12%. EPS has 2.5x over 2 years.

Increased liquidity, with access to $350m revolver (!)

Focus on organic investment, some inorganic, good debt paydown, and still some share repurchases approved through the year

Q: What's the key highlight to walk away? Guided for 15-20% growth, above the low double digit from 2 years ago. You beat that

A: Product porftolio expansion. The company has never expanded this big, this fast, at the demand of customers. I love products, we're only as good as our products.

A: We're having discussions with big customers, that didn't happen 5 years ago. Multi-generation discussions, multi-gen products, multi-gen trust in Lattice. We're working with customers, meeting their need. Hardware and software.

A: We outperformed our low double-digit CAGR in 2021. The end-market was stronger than what we thought. Semis as a whole. Part of it that. Part of it is Lattice specific too. The rate at which customers switched to us, faster conversion from competitors than anticipated.

A: Industrial and automotive especially. The software solutions drive a lot of that. Makes it easier for customers to switch from customers, or designed us into apps we haven't been used in before.

Q: Time with Avant, Rev in Q4. Talk more about initial revenue markets? Are these new platforms, or existing legacy platforms?

A: Engaged with 100+ customers with Avant definition. First product was Avant-E for edge. So initial revenue is really on Avant-E. But G and X mentioned today also coming. First adoption will be edge though, for industrial and some other segments.

Q: FCF - what's driving that confidence to support long-term FCF. What are the drivers?

A: Best way to drive FCF is record OpIncome. We have discipline in investing. We have focused on cash, working metrics, to drive accountability and results.

A: Best way to drive FCF is record OpIncome. We have discipline in investing. We have focused on cash, working metrics, to drive accountability and results.

A: As we look ahead, our higher revenue targets and OpIncome targets are going to drive that. We'll drive progress.

Q: What's driving the higher ASPs in automotive? Higher prices or software attach, or are they buying higher SKUs due to the software?

A: It's not just automotive. When we measure software attach ASPs, it's significantly higher than non-software attach. It's mostly because of the software attach when we measure like-for-like. We're trying to isolate the purely software benefit.

Q: Early update for Avant - 90% of people already building on Nexus are using software and also using Avant. Is that on track? In long term revenue guidance, what % is Avant?

A: We've been engaging with customers for a while. We look at revenue based on extensive forecasts with customers. We're doing really well with Avant compared to Nexus ramp. Avant is exceeding Nexus metrics at same point.

Q: Target 15-20% growth of 3-4 years. At the end of that, we expect Avant to be 15-20% of the company total revenue.

Sorry that was A

Q: Competition - there are still really only four FPGA companies in the market. As you move into mid-tier, can you give summary of comp landscape? Are competitors reacting?

Q: The other three FPGA companies talking about soft markets in 2H. What's your insights?

1st A: On comp, from day 1 when we joined the company (Jim and Esam), our approach has been to assume robust comp in every segment. We build roadmap based on that. If it occurs, we're ready - if not, upside!

1st A: We also put in sales strategies, marketing strategies, on top of product differentiation. We make sure they're differentiated regardless of comp. But also our software tools, that's a comp advantage for us. Also, customer intimacy. Their roadmaps now aligned with us

2nd A: We don't have specific annual guidance, we guided up QoQ. Over the multi-Q period, as we talked today, we feel good about long-term growth. In channel, one of the things we did well over 12-24 months, we made sure channel and distis didn't get overloaded.

Q: Op/Margins increase a few more %. But FCF target was flat, or outperformed in 2022. Any one time benefits?

A: We're excited about our targets. Record cash gen in 2022. COuld be fluctuations QoQ. Higher Op income, rev growth, enabling strong FCF.

A: We're excited about our targets. Record cash gen in 2022. COuld be fluctuations QoQ. Higher Op income, rev growth, enabling strong FCF.

Q: Why is geo revenue tending away from Asia, now less than 60%?

A: Strength in growth in US and EMEA - but also those numbers are ship-in, so chips shipped there but products sold elsewhere, e.g servers. Also rebuilt sales force in 2019 for USA and EMEA with direct sales

A: Strength in growth in US and EMEA - but also those numbers are ship-in, so chips shipped there but products sold elsewhere, e.g servers. Also rebuilt sales force in 2019 for USA and EMEA with direct sales

Q: Software Attach - design wins have 50% attach rate. Where are you on revenue vs design wins?

A: Design wins over 18 months, we'll see the revenue gain in 12-24 months. Don't have metrics on revenue of software attach, not 50% now, but it's a long-term metrics as they convert

A: Design wins over 18 months, we'll see the revenue gain in 12-24 months. Don't have metrics on revenue of software attach, not 50% now, but it's a long-term metrics as they convert

Q: Margins of software attach - good tailwind? What's the offset on GM given you're already above 70% and trending low 70s.

A: Definitely beneficial to margins. The cogs of the software are effectively zero, so additional ASP with software is pure margin.

A: Definitely beneficial to margins. The cogs of the software are effectively zero, so additional ASP with software is pure margin.

Q: 50% server attach ASPs vs units, tied to new servers or prior?

A: New chips, new modularity, gives us opportunities. The systems are becoming more complex, so driving functionality. Higher $/server over time.

A: New chips, new modularity, gives us opportunities. The systems are becoming more complex, so driving functionality. Higher $/server over time.

...and that's a wrap. Fun times for my first in-person investor analyst day!

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter