Abalance – Turning Japanese? We really don’t think so.

VSUN circumvents US duties and will be restricted for sale from 2024 in the USA. Chinese components currently sourced from forced labor trade partners.

viceroyresearch.org/2023/05/16/aba…

Viceroy report now live #abalance $3856 1/

VSUN circumvents US duties and will be restricted for sale from 2024 in the USA. Chinese components currently sourced from forced labor trade partners.

viceroyresearch.org/2023/05/16/aba…

Viceroy report now live #abalance $3856 1/

Abalance is a Japanese corporation which purports to be a solar panel manufacturer. Approximately 90% of the company’s revenues are derived from its Vietnamese subsidiary, Vietnam Sunergy Joint Stock Corporation (VSUN) #abalance $3856 2/

VSUN faces crippling trade restrictions in the USA from next year as a pass-through Chinese supplier. It already circumvents trade duties and operates on slim margins. VSUN employees advertise circumvention of the restrictions #abalance $3856

solarpowerworldonline.com/wp-content/upl…

3/

solarpowerworldonline.com/wp-content/upl…

3/

In an attempt to remedy impending trade restrictions: Abalance claims to be developing a solar cell manufacturing facility in Vietnam. Local filings show no approved construction permits. Forecast capacity would fall far below current output in med-term #abalance $3856 4/

AD/CVD, TRADE RESTRICTIONS & CIRCUMVENTION

Abalance’s golden goose, Vietnam Sunergy Joint Stock Company (VSUN), is a pass-through assembly plant for Chinese products. It serves the sole purpose of avoiding US Anti-Dumping and CounterVailing Duties (AD/CVD) #abalance $3856 5/

Abalance’s golden goose, Vietnam Sunergy Joint Stock Company (VSUN), is a pass-through assembly plant for Chinese products. It serves the sole purpose of avoiding US Anti-Dumping and CounterVailing Duties (AD/CVD) #abalance $3856 5/

VSUN import data shows that it purchases effectively all its components from Chinese suppliers, which it assembles in Vietnam to circumvent Anti-Dumping and Countervailing Duties in the USA: its major market #abalance $3856 6/

Abalance’s solar panels will be subject to crippling restrictions by the USA’s Department of Commerce, set to take effect in Jun 2024, aimed at companies in SE Asia (incl. Vietnam) functioning as pass-throughs for Chinese-made solar panels & components #abalance $3856 7/

VSUN failed to respond to a DoC inquiry into the origin of their products. VSUN has many ties to its former Chinese owners, including shared staff, CE certifications and identical model numbers and catalogues to its still-active Chinese namesake #abalance $3856 8/

In FY 2022 North America accounted for 74% of Abalance’s sales, with solar panels accounting for 88% of revenue for the year. We believe the actions outlined by the DoC will effectively remove this revenue stream #abalance $3856 9/

THE VSUN PHOENIX

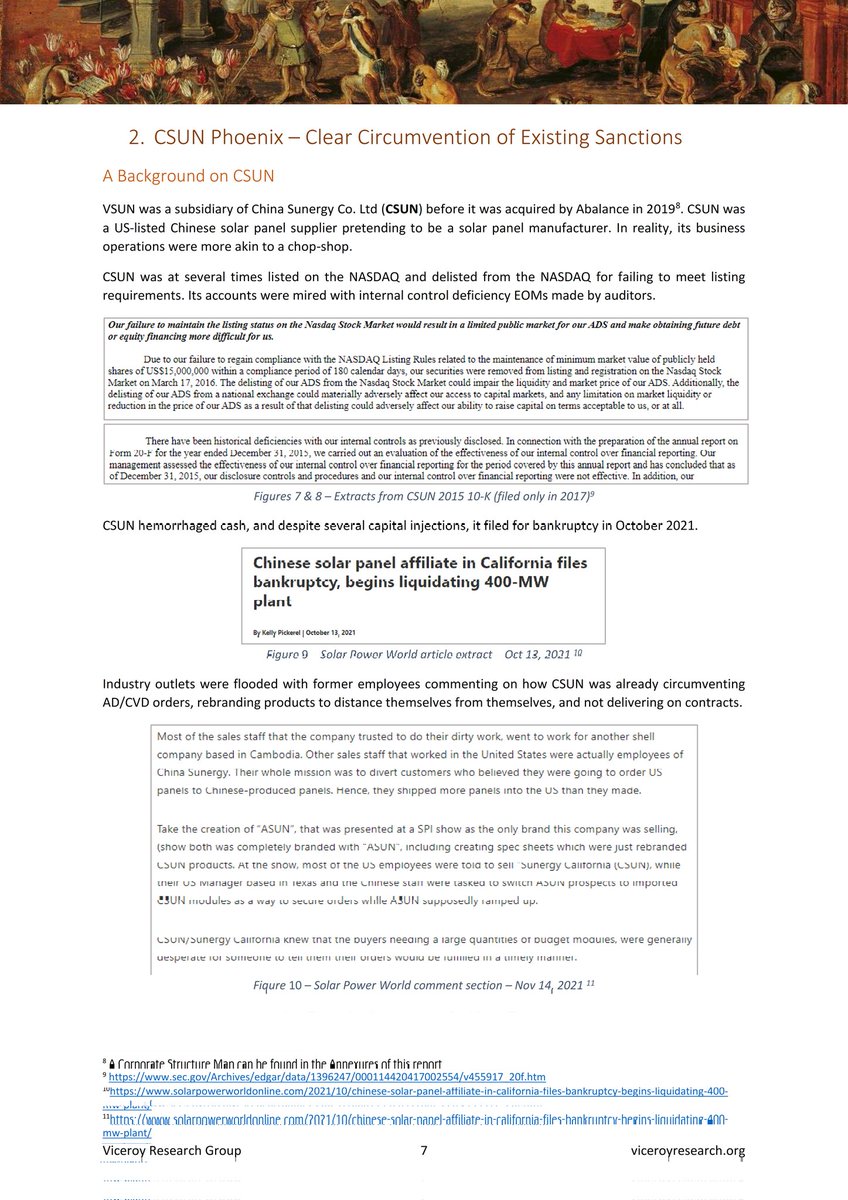

VSUN was acquired by Abalance in 2019. It was previously a subsidiary of the China Sunergy Group (CSUN), a US-listed Chinese solar panel supplier pretending to be a solar panel manufacturer. Its business was more akin to a chop-shop #abalance $3856 10/

VSUN was acquired by Abalance in 2019. It was previously a subsidiary of the China Sunergy Group (CSUN), a US-listed Chinese solar panel supplier pretending to be a solar panel manufacturer. Its business was more akin to a chop-shop #abalance $3856 10/

CSUN was at several times listed and delisted from the NASDAQ for failing to meet listing requirements. Its accounts were mired with internal control deficiencies. It haemorrhaged cash. Despite several capital injections it filed for bankruptcy in Oct 2021 #abalance $3856 11/

China Sunergy has previously been accused of circumventing AD/CVD through companies set up in Vietnam, among other countries #abalance $3856 12/

Despite the top-line bump that Abalance has received from its VSUN investment, it is still cash-flow negative and its margins are falling as its pass-through subsidiary makes up a larger part of its business #abalance $3856 13/

Despite fully consolidating VSUN and stating it owns ~85% of VSUN, Abalance only effectively owns ~43% of the company in a deliberately opaque, complex international corporate structure #abalance $3856 14/

THE WORKAROUND

VSUN is attempting to shore up its Vietnamese solar cell capacity, expecting 3 GW of capacity to enter production in October 2023. Site visits suggest the project will not be completed on schedule #abalance $3856 15/

VSUN is attempting to shore up its Vietnamese solar cell capacity, expecting 3 GW of capacity to enter production in October 2023. Site visits suggest the project will not be completed on schedule #abalance $3856 15/

Checks of Viet registers show that the site has not been green-flagged for construction. No construction certificates displayed at the construction site, as is required by law. Forecast cell capacity will fall far below current panel manufacturing output #abalance $3856 16/

FORCED LABOR CONNECTION

VSUN’s supply chain includes Chinese companies linked to forced labor camps in Xinjiang widely known to use the Uyghur ethnic minority as a forced labor workforce #abalance $3856 17/

VSUN’s supply chain includes Chinese companies linked to forced labor camps in Xinjiang widely known to use the Uyghur ethnic minority as a forced labor workforce #abalance $3856 17/

VSUN’s solar cells are purchased from Chinese suppliers who source materials from forced labor camps in Xinjiang #abalance $3856 18/

Forced labor practices aside, the fact that VSUN imports substantially completed solar components (identified by HSR codes) suggests they are already breaching AD/CVD orders and have been for many years #abalance $3856 19/

AD/CVD orders are aimed at hamstringing uncompetitive advantages afforded by foreign governmentsIn the case of solar cell manufacturing, it is widely known that the among the advantages provided by the CCP are cheap labor tied to forced labor camps in Xinjiang #abalance $3856 20/

KEY TAKEAWAYS

Abalance is complicit in evading US AD/CVD order & will find itself shut out from the US in Jun 2024, if not sooner. The links between VSUN and CSUN are well known. Abalance is extremely dependent on VSUN, making up 88% of sales in FY 2022 #abalance $3856 21/

Abalance is complicit in evading US AD/CVD order & will find itself shut out from the US in Jun 2024, if not sooner. The links between VSUN and CSUN are well known. Abalance is extremely dependent on VSUN, making up 88% of sales in FY 2022 #abalance $3856 21/

Even if VSUN’s cell manufacturing site is developed on-schedule and does not circumvent AD/CVD orders, production capacity will be more than halved for the medium-long term, destroying margins and shareholder value #abalance $3856 22/

In light of these extreme risks, we believe that Abalance is not investible #abalance $3856 23/end

viceroyresearch.org/2023/05/16/aba…

viceroyresearch.org/2023/05/16/aba…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter