A group of individuals that see the world differently. Read our disclaimer on each report.

2 subscribers

How to get URL link on X (Twitter) App

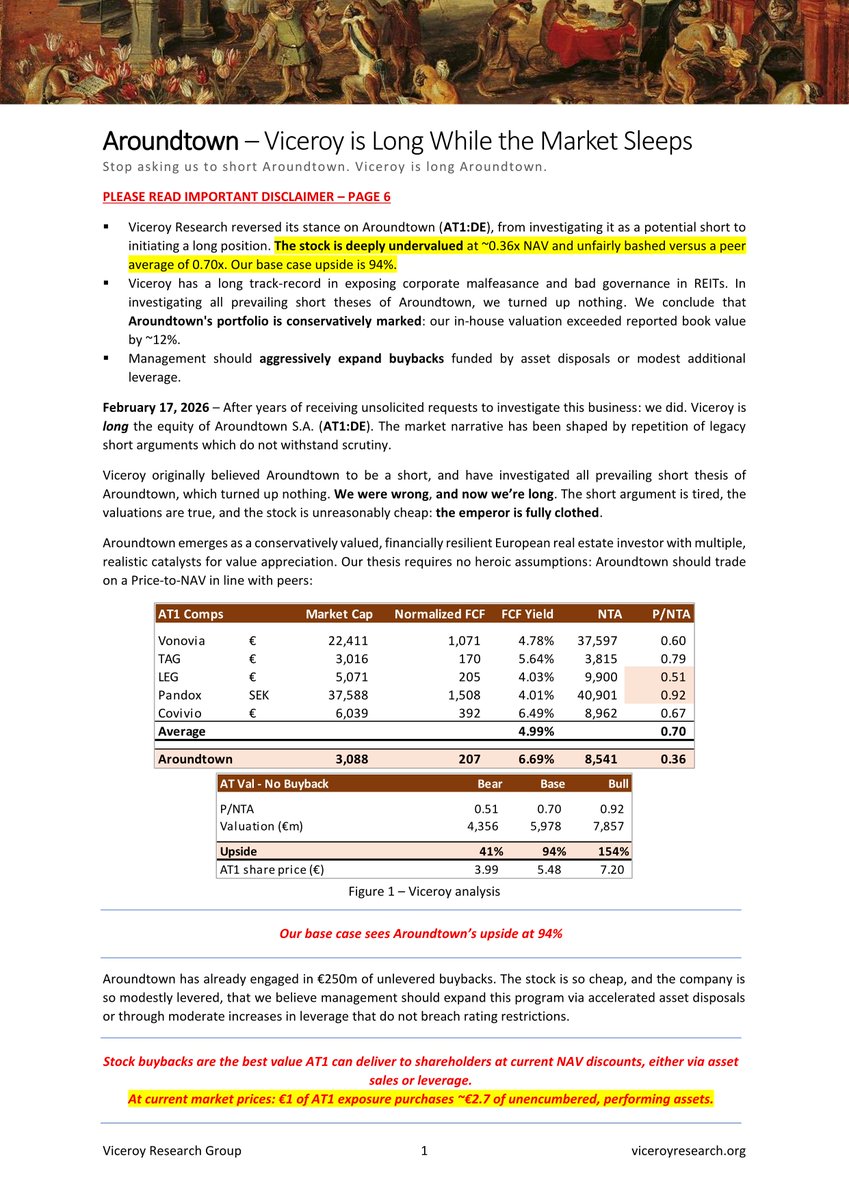

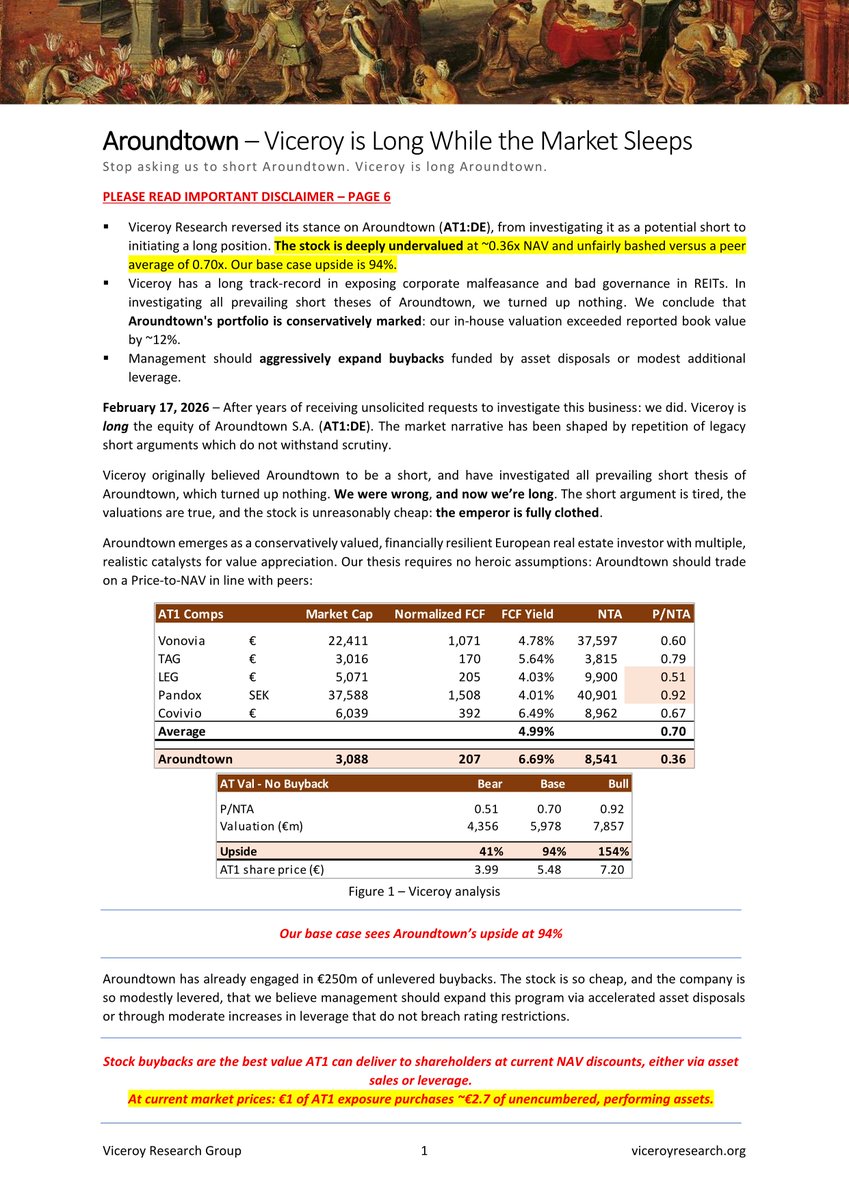

For years we've received unsolicited requests to short $AT1. We originally believed it was a short.

For years we've received unsolicited requests to short $AT1. We originally believed it was a short.

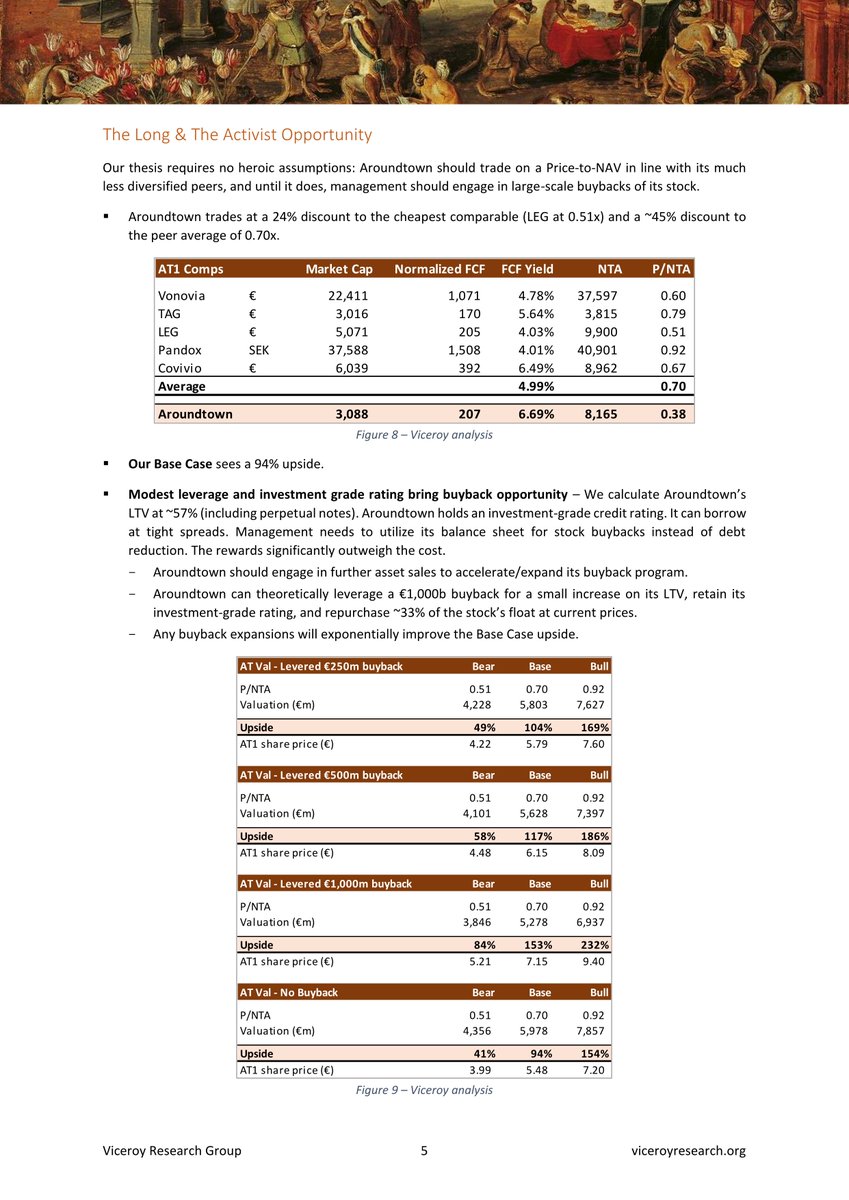

Report now live $HZL $VEDL 2/

Report now live $HZL $VEDL 2/

Our report on Vedanta Resources & its subsidiaries is now available on our website. $VEDL 2/

Our report on Vedanta Resources & its subsidiaries is now available on our website. $VEDL 2/

Report now live on our website $ABR 2/

Report now live on our website $ABR 2/

Report now live on our website. $ABR 2/

Report now live on our website. $ABR 2/

https://twitter.com/viceroyresearch/status/1851982744881865080

$ABR PIK appears to have grown about $83m this quarter alone, comprising 29% of its interest income and almost 150% of net income. Given Arbor's collateral assets are almost exclusively loss-making (DSCR < 0.5x), these amounts are non-recoverable.

$ABR PIK appears to have grown about $83m this quarter alone, comprising 29% of its interest income and almost 150% of net income. Given Arbor's collateral assets are almost exclusively loss-making (DSCR < 0.5x), these amounts are non-recoverable.

https://twitter.com/viceroyresearch/status/1773335110068170954The straw that broke the camel's back is a letter from the SEC demanding Steward financials.

SCA’s Forest Surveys: Beating Expectations

SCA’s Forest Surveys: Beating Expectations

Structured business loans are down ~90% yoy. Dividends consist of principal, not profits. Where will growth come from? 2/ $ABR

Structured business loans are down ~90% yoy. Dividends consist of principal, not profits. Where will growth come from? 2/ $ABR

Hexagon is a corporate dictatorship run by majority owner and controlling voter: Melker Schorling. Hexagon’s top-brass (Schorling, Chairman, C-Level executives) front-run Hexagon investments through an investment Viceroy believes management has committed fraud. $HEXAB 2/

Hexagon is a corporate dictatorship run by majority owner and controlling voter: Melker Schorling. Hexagon’s top-brass (Schorling, Chairman, C-Level executives) front-run Hexagon investments through an investment Viceroy believes management has committed fraud. $HEXAB 2/

エーバランスは、ソーラーパネルメーカーと称する日本企業です。同社の売上の約90%は、ベトナムの子会社であるVietnam Sunergy Joint Stock Corporation (VSUN)から得られています。#abalance $3856 2/

エーバランスは、ソーラーパネルメーカーと称する日本企業です。同社の売上の約90%は、ベトナムの子会社であるVietnam Sunergy Joint Stock Corporation (VSUN)から得られています。#abalance $3856 2/

Abalance is a Japanese corporation which purports to be a solar panel manufacturer. Approximately 90% of the company’s revenues are derived from its Vietnamese subsidiary, Vietnam Sunergy Joint Stock Corporation (VSUN) #abalance $3856 2/

Abalance is a Japanese corporation which purports to be a solar panel manufacturer. Approximately 90% of the company’s revenues are derived from its Vietnamese subsidiary, Vietnam Sunergy Joint Stock Corporation (VSUN) #abalance $3856 2/

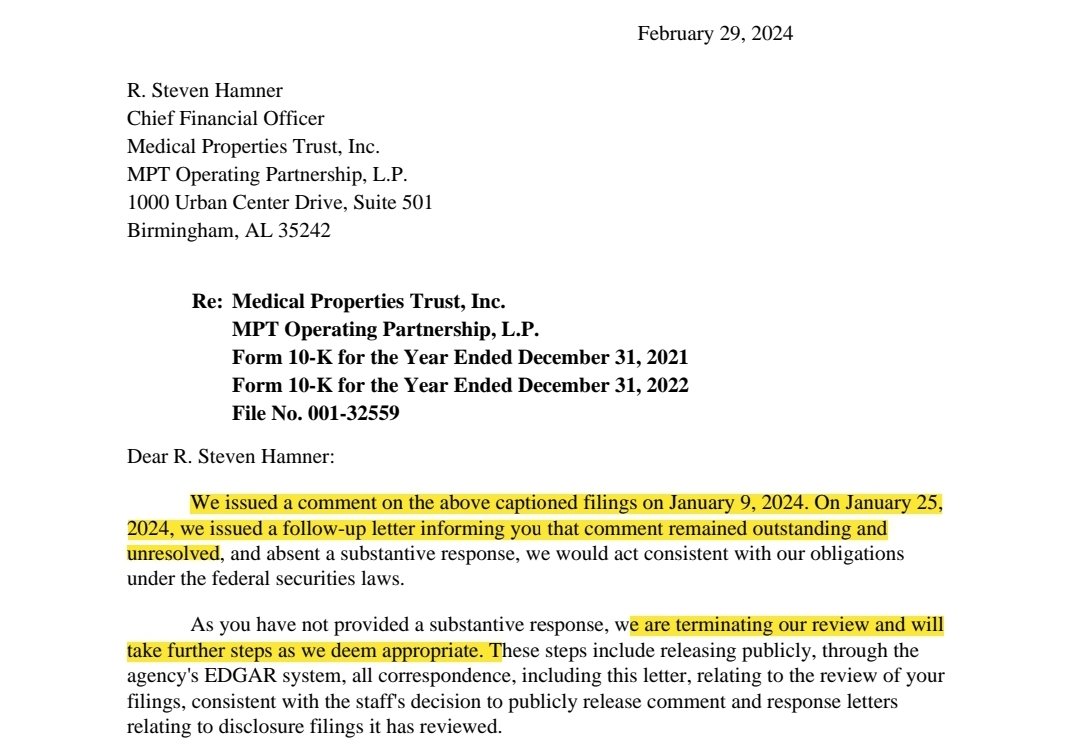

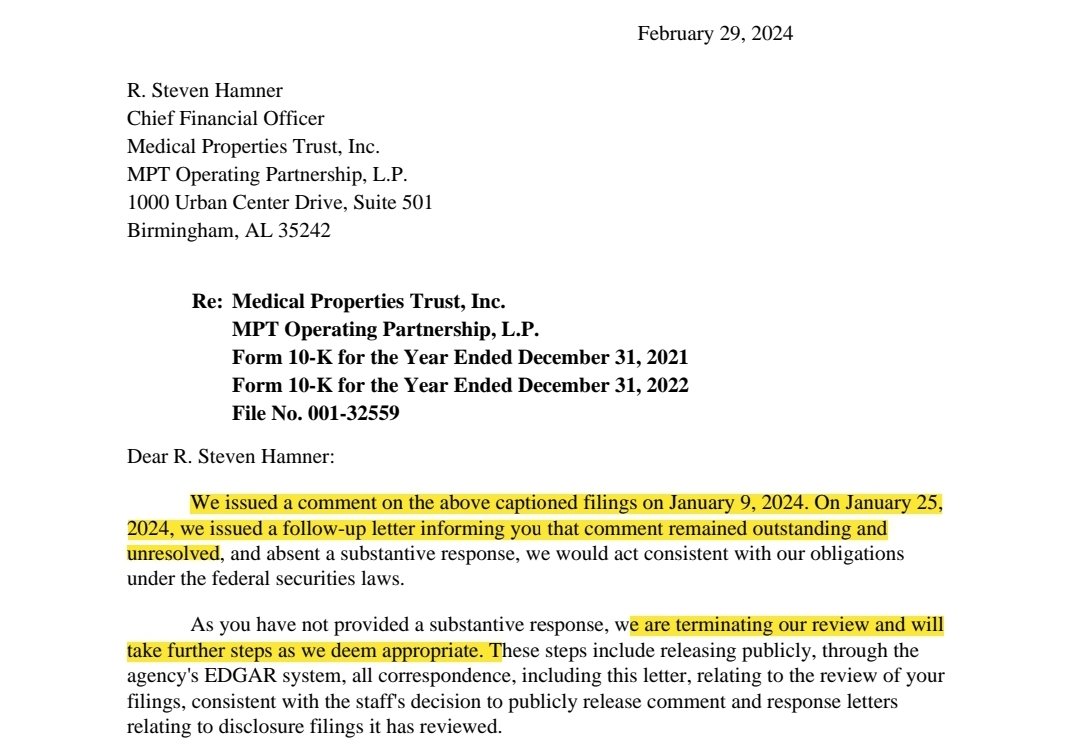

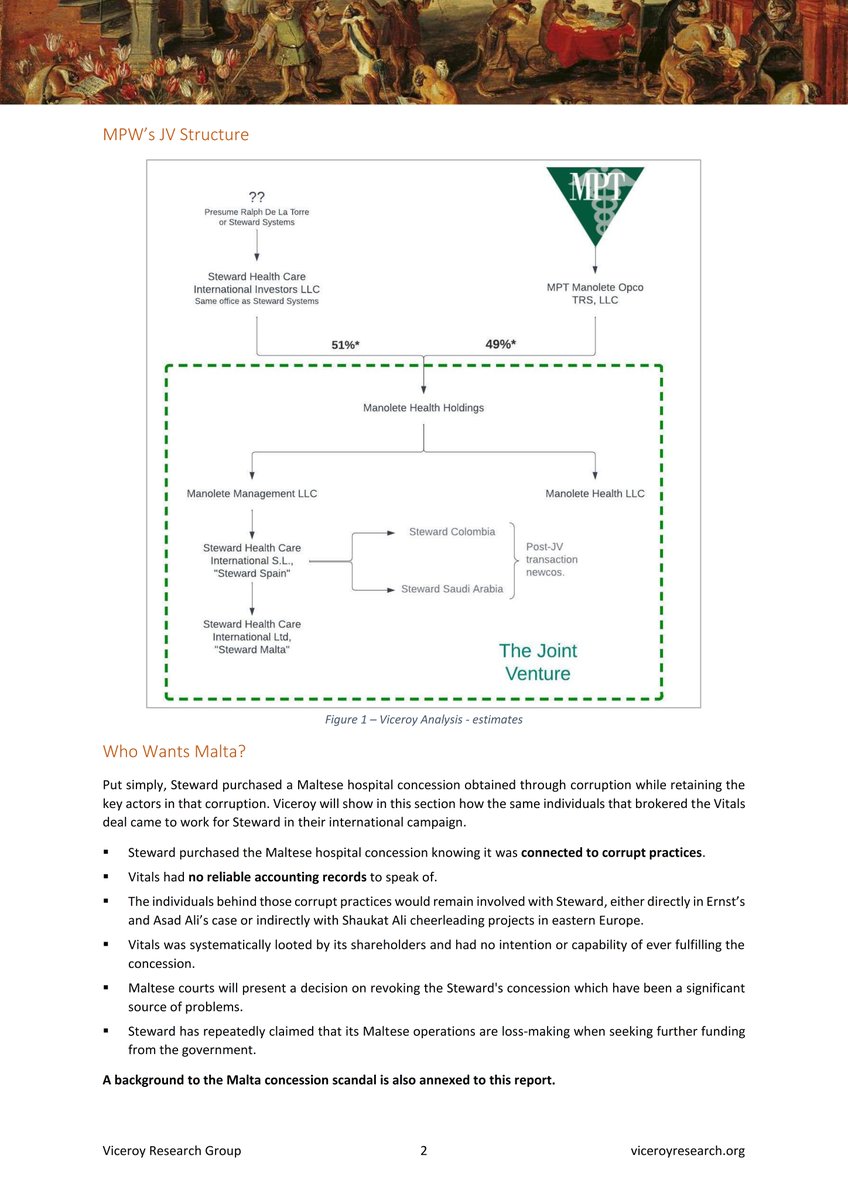

MPW’s joint venture with Steward CEO, Ralph De La Torre, has been the subject of intense curiosity by MPW bulls and bears alike. Today, Viceroy Research will detail the JV’s structure, the ownership of Steward Malta, and egregious, and likely criminal, payments. $MPW 2/

MPW’s joint venture with Steward CEO, Ralph De La Torre, has been the subject of intense curiosity by MPW bulls and bears alike. Today, Viceroy Research will detail the JV’s structure, the ownership of Steward Malta, and egregious, and likely criminal, payments. $MPW 2/

Viceroy’s investigations show that combined costs of the Neuropsychiatric Hospital development and appraised value of land was ~$9.1m at the date of $MPW's acquisition. MPW claim to have outlaid over $28m on the project, which has been capitalized. 2/

Viceroy’s investigations show that combined costs of the Neuropsychiatric Hospital development and appraised value of land was ~$9.1m at the date of $MPW's acquisition. MPW claim to have outlaid over $28m on the project, which has been capitalized. 2/