エーバランスは日本人離れしている?そんなことはないと思います。

VSUNの太陽エネルギー製品は現在、米国の関税を回避しており、米国では2024年から販売が制限される予定です。中国製部品は現在、強制労働の貿易パートナーから調達しています。

viceroyresearch.org/2023/05/16/aba…

#abalance $3856 1/

VSUNの太陽エネルギー製品は現在、米国の関税を回避しており、米国では2024年から販売が制限される予定です。中国製部品は現在、強制労働の貿易パートナーから調達しています。

viceroyresearch.org/2023/05/16/aba…

#abalance $3856 1/

エーバランスは、ソーラーパネルメーカーと称する日本企業です。同社の売上の約90%は、ベトナムの子会社であるVietnam Sunergy Joint Stock Corporation (VSUN)から得られています。#abalance $3856 2/

VSUNは、中国のパススルー・サプライヤーとして、来年から米国での厳しい貿易制限に直面します。すでに貿易関税を回避し、薄利多売で経営している。VSUNの従業員は、制限を回避することを宣伝しています。

solarpowerworldonline.com/wp-content/upl…

#abalance $3856 3/

solarpowerworldonline.com/wp-content/upl…

#abalance $3856 3/

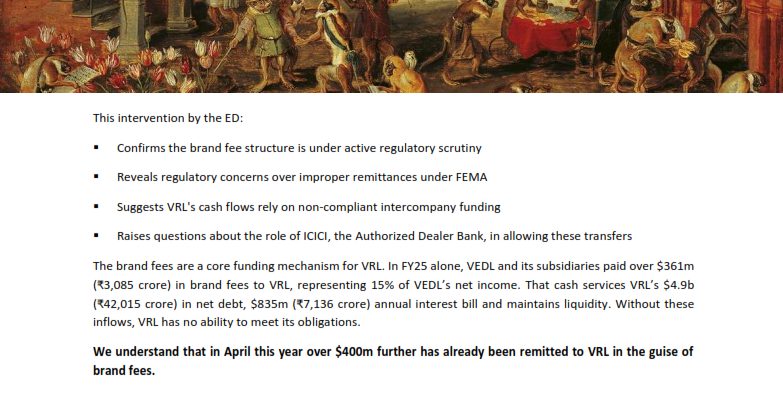

差し迫った貿易制限を是正するため、エーバランスはベトナムに太陽電池製造施設を建設すると主張しています:エーバランスは、ベトナムで太陽電池の製造施設を開発中であると主張しています。しかし、現地での報告書によると、そのような建設許可は下りていません。#abalance $3856 4/

AD/CVD、貿易制限と回避

エーバランスにとって金の卵を産むガチョウであるVietnam Sunergy Joint Stock Company(VSUN)は、中国製品のパススルー組立工場です。米国のアンチダンピング関税とカウンターベイリング関税(AD/CVD)を回避することだけを目的としています。#abalance $3856 5/

エーバランスにとって金の卵を産むガチョウであるVietnam Sunergy Joint Stock Company(VSUN)は、中国製品のパススルー組立工場です。米国のアンチダンピング関税とカウンターベイリング関税(AD/CVD)を回避することだけを目的としています。#abalance $3856 5/

VSUNの輸入データによると、主要市場である米国でのアンチダンピング・相殺関税を回避するために、実質的にすべての部品を中国のサプライヤーから購入し、ベトナムで組み立てていることがわかります。#abalance $3856 6/

エーバランス社のソーラーパネルは、中国製のソーラーパネルや部品のパススルーとして機能しているベトナム、タイ、マレーシア、カンボジアの企業を対象に、2024年6月に施行される米国商務省(DoC)による厳しい規制を受けることになります。#abalance $3856 7/

VSUNは、製品の出所に関するDoCの問い合わせに応じませんでした。VSUNは、かつての中国のオーナーと多くのつながりがあり、その中には、共通の社員、CE認証、現在も活動している中国の社名と同一のモデル番号とカタログがあります。#abalance $3856 8/

2022年度のエーバランスの売上は北米が74%を占め、太陽光パネルが88%を占めました。DoC が示した措置は、この収益源を効果的に消し去ることになると考えています。#abalance $3856 9/

VSUNの不死鳥

VSUNは、'19年にエーバランスの子会社であるFUJI SOLARが買収しました。以前は CSUN の子会社でした。CSUNは米国に上場していた中国のソーラーパネルメーカーを装ったしたサプライヤーでした。実際には、その事業運営はチョップショップ(盗難車の部品を販売する店の意)に近いものでし

VSUNは、'19年にエーバランスの子会社であるFUJI SOLARが買収しました。以前は CSUN の子会社でした。CSUNは米国に上場していた中国のソーラーパネルメーカーを装ったしたサプライヤーでした。実際には、その事業運営はチョップショップ(盗難車の部品を販売する店の意)に近いものでし

CSUNは何度かNASDAQに上場しましたが、上場要件を満たさないという理由で上場廃止になりました。その会計は、監査人による内部統制の不備EOMにまみれていた。資金が流出し、何度か資本注入を行ったものの、2021年10月に自己破産を申請しました。#abalance $3856 11/

China Sunergyは、これまでにもベトナムなどに設立された会社を通じてAD/CVDを回避しているとして訴えられています。#abalance $3856 12/

エーバランスは、VSUNへの出資によりトップラインが拡大したものの、キャッシュフローは依然としてマイナスであり、パススルー子会社の比率が高まるにつれてマージンが低下しています。#abalance $3856 13/

VSUNを完全に統合し、VSUNの85%を所有していると表明しているにもかかわらず、エーバランスは意図的に不透明で複雑な国際的企業構造において、実質的に43%しか所有していないのです。#abalance $3856 14/

打開策

VSUNは、ベトナムの太陽電池生産能力を増強しようとしており、2023年10月に3GWの生産開始を見込んでいます。現地視察によると、このプロジェクトは予定通りには完了しないようです。#abalance $3856 15/

VSUNは、ベトナムの太陽電池生産能力を増強しようとしており、2023年10月に3GWの生産開始を見込んでいます。現地視察によると、このプロジェクトは予定通りには完了しないようです。#abalance $3856 15/

ベトナムの登記簿で初歩的なチェックをしたところ、この現場は建設のためのグリーンフラグが立てられていないことがわかりました。また、Viceroyが現地を訪問したところ、法律で義務付けられている建設証明書が建設現場に掲示されていないことがわかりました。#abalance $3856 16/

強制労働との関係

VSUNのサプライチェーンには、ウイグル族を強制労働力として使用することで広く知られている新疆ウイグル自治区の強制労働収容所と関係のある中国企業も含まれています。#abalance $3856 17/

VSUNのサプライチェーンには、ウイグル族を強制労働力として使用することで広く知られている新疆ウイグル自治区の強制労働収容所と関係のある中国企業も含まれています。#abalance $3856 17/

VSUNの太陽電池は、新疆ウイグル自治区の強制労働収容所から材料を調達している中国のサプライヤーから購入しています。#abalance $3856 18/

強制労働はともかく、VSUN が実質的に完成されたソーラーコンポーネント(HSR コードで識別)を輸入しているという事実は、彼らがすでに AD/CVD 命令に違反しており、長年にわたって違反し続けていることを示唆しています。#abalance $3856 19/

AD/CVD命令は、外国政府が提供する競争力のない優位性を阻害することを目的としている太陽電池製造の場合、中国共産党が提供する優位性の中に、新疆の強制労働収容所と結びついた安価な労働力があることは広く知られています。#abalance $3856 20/

キーポイント

我々は、エーバランスが米国のAD/CVD命令を回避することに加担しており、早ければ2024年6月に米国から締め出されることになると考えています。VSUN と CSUN の関係はよく知られており、DoC はこの件に関して行動を起こすと信じている。#abalance $3856 21/

我々は、エーバランスが米国のAD/CVD命令を回避することに加担しており、早ければ2024年6月に米国から締め出されることになると考えています。VSUN と CSUN の関係はよく知られており、DoC はこの件に関して行動を起こすと信じている。#abalance $3856 21/

仮に、VSUNのセル生産拠点が予定通り開発され、AD/CVD命令を回避しなかったとしても、生産能力は中長期的に半減以上となり、マージンや株主価値を破壊することになります。#abalance $3856 22/

• • •

Missing some Tweet in this thread? You can try to

force a refresh