Bribe thread? Bribe thread.

Starting with newcomer @MammothFi with a $1000 bribe to the $MMTH / $BTC.b pairing!

(🧵1/5)

Starting with newcomer @MammothFi with a $1000 bribe to the $MMTH / $BTC.b pairing!

(🧵1/5)

@MammothFi @GMDprotocol (🧵3/5)

We also have a $720 bribe on the $BTC.b / $WAVAX pool👀

Come get some bribes #AVAX BTC.b chads

We also have a $720 bribe on the $BTC.b / $WAVAX pool👀

Come get some bribes #AVAX BTC.b chads

@MammothFi @GMDprotocol (🧵4/5)

Consistent bribers @YieldfarmingI continue their trend with a $1200 bribe to the $gmdUSDC / $YFX pairing

Consistent bribers @YieldfarmingI continue their trend with a $1200 bribe to the $gmdUSDC / $YFX pairing

@MammothFi @GMDprotocol @YieldfarmingI (🧵5/5)

And last but certainly not least, @fBombOpera has a little over $1000 on the $xSHRAP / $WETH.e pool!

And last but certainly not least, @fBombOpera has a little over $1000 on the $xSHRAP / $WETH.e pool!

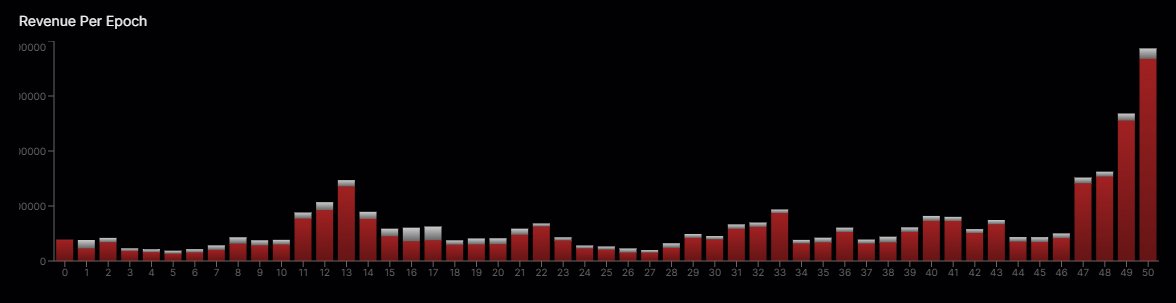

@MammothFi @GMDprotocol @YieldfarmingI @fBombOpera Current vote APR is over 200% AGAIN, which means locking your $GLCR for veGLCR is extremely lucrative currently with our bribe ecosystem.

With concentrated liquidity from @CryptoAlgebra and @GammaStrategies coming very soon, those Vote APRs should be even higher!

Get some… twitter.com/i/web/status/1…

With concentrated liquidity from @CryptoAlgebra and @GammaStrategies coming very soon, those Vote APRs should be even higher!

Get some… twitter.com/i/web/status/1…

• • •

Missing some Tweet in this thread? You can try to

force a refresh