NEW: The giant #USS pension plan has surged further into the black, reporting a £7.6bn surplus at the end of March.

In 2020, the scheme reported a £14bn deficit.

In 2020, the scheme reported a £14bn deficit.

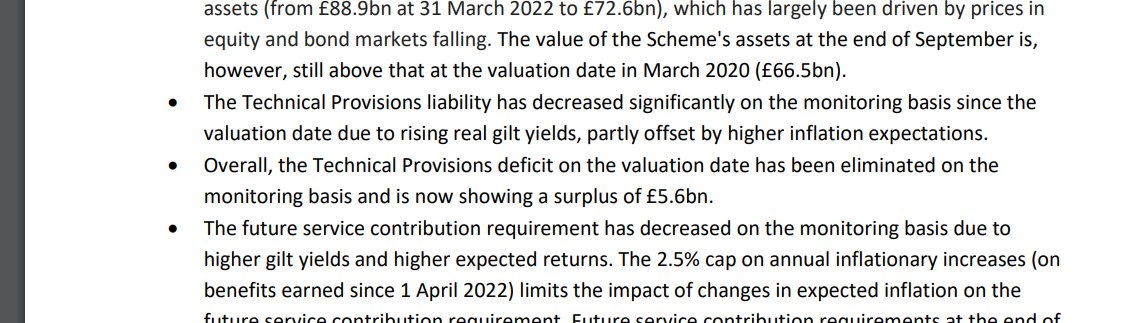

The £7.6bn suprlus for the #USS pension plan, with more than 400,000 members, was identified thru

routine monitoring at March end.

The #USS is currently undertaking a full valuation of assets and liabilities. The valuation date is March 31, the same as the monitoring report.

routine monitoring at March end.

The #USS is currently undertaking a full valuation of assets and liabilities. The valuation date is March 31, the same as the monitoring report.

On the swing to a £7.5bn surplus from a £14bn deficit three years ago, Bill Galvin #USS chief said the signs were "very encouraging" for the current valuation.

In 2021, the #USS defended its decision to undertake the 2020 valuation during a pandemic-driven market crash.

The 2020 valuation identified a £14bn funding hole, with this deficit precipitatiing retirement benefit cuts for tens of thousands of active savers.

The 2020 valuation identified a £14bn funding hole, with this deficit precipitatiing retirement benefit cuts for tens of thousands of active savers.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter