Okay, some activity on my ...

... eheh: 'my'

... FIN boards on @TeamKujira.

But before we dive into arb'n away to my heart's content, let's take a mo' to catalogue my @TeamKujira portfolio positions.

This, we call my daily report. 😎

... eheh: 'my'

... FIN boards on @TeamKujira.

But before we dive into arb'n away to my heart's content, let's take a mo' to catalogue my @TeamKujira portfolio positions.

This, we call my daily report. 😎

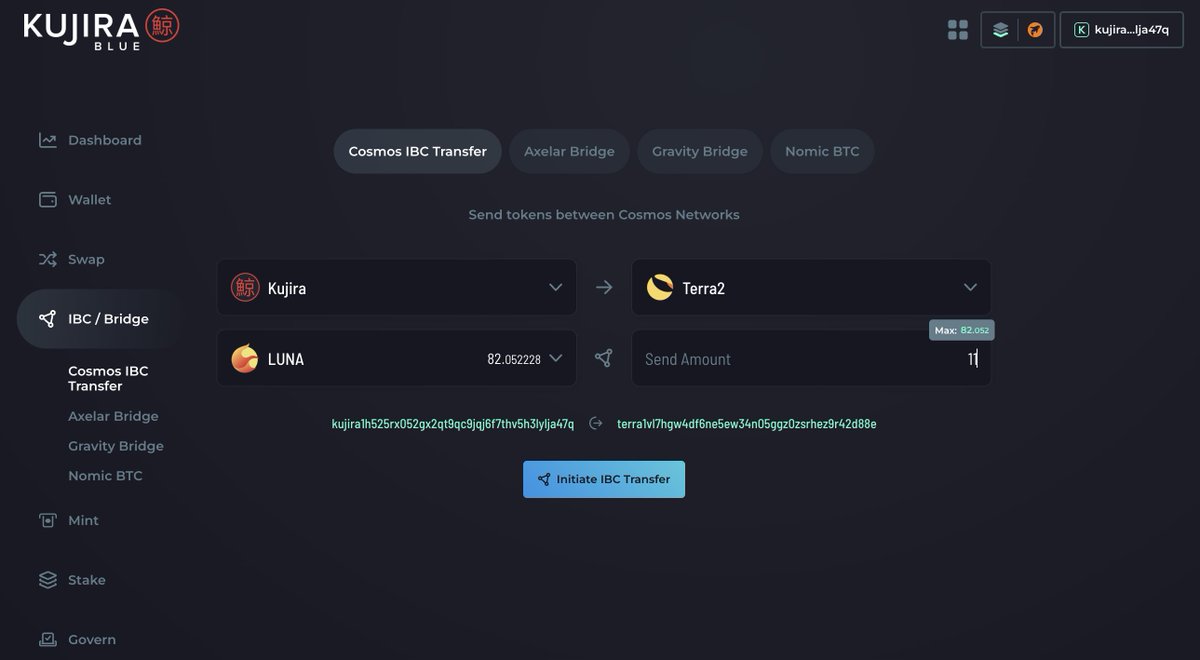

The first thing I encounter when I take stock is that @TeamKujira dev team has changed the wallet data-layout on BLUE, causing my ./wallet-parser to puke, ...

./wallet: github.com/logicalgraphs/…

So, time to roll up my sleeves and to modify some code.

#ProgrammersWorkIsNeverDone

./wallet: github.com/logicalgraphs/…

So, time to roll up my sleeves and to modify some code.

#ProgrammersWorkIsNeverDone

Okay. That's sorted. git repository updated.

Wallet balances on 2023-05-21

./wallet (github.com/logicalgraphs/…) computes and sorts balances from a scrap of Kujira BLUE wallet (blue.kujira.app/wallet)

Wallet balances on 2023-05-21

./wallet (github.com/logicalgraphs/…) computes and sorts balances from a scrap of Kujira BLUE wallet (blue.kujira.app/wallet)

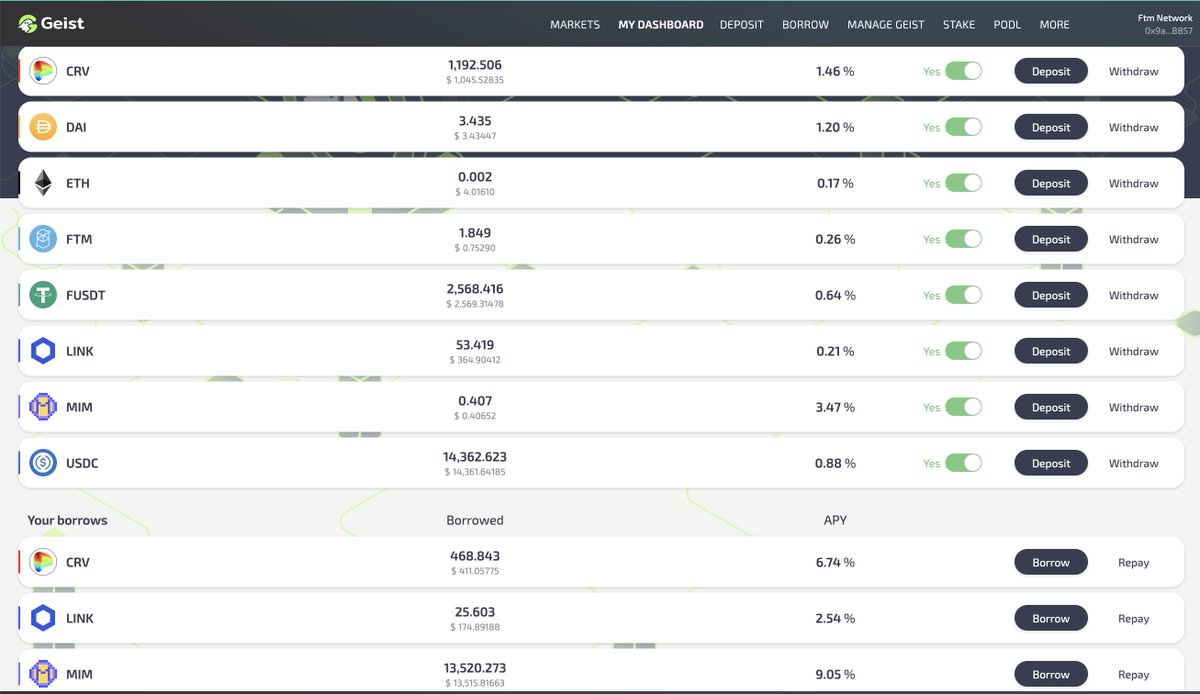

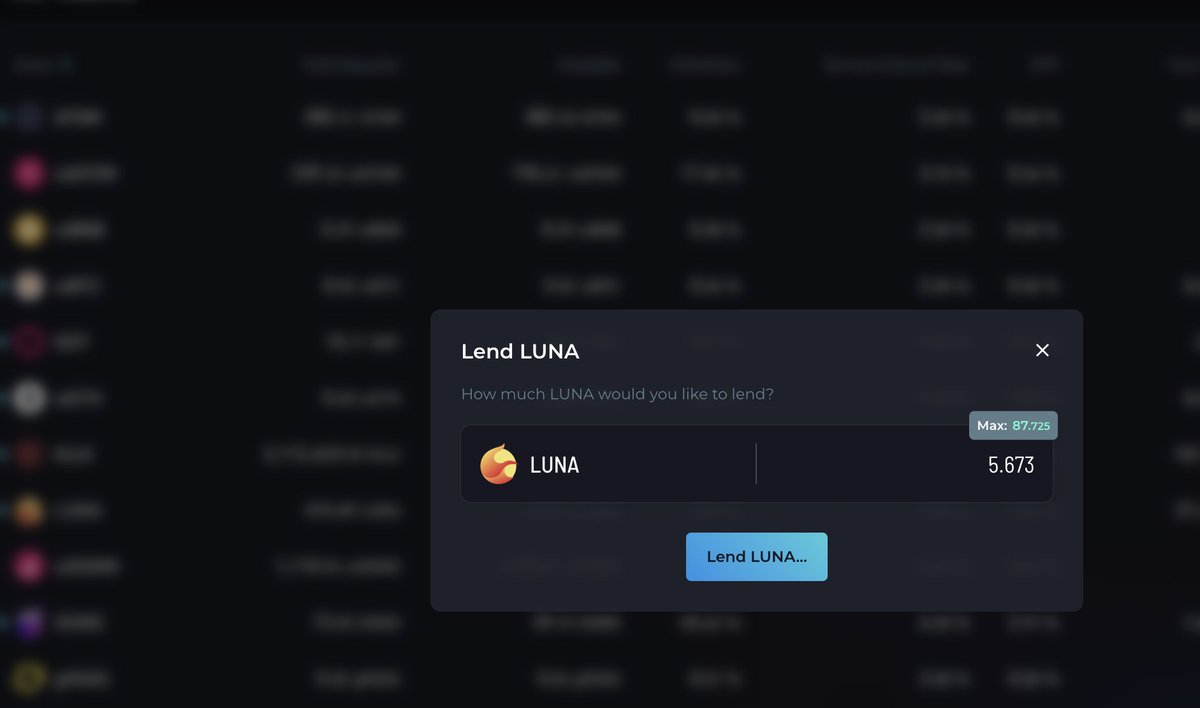

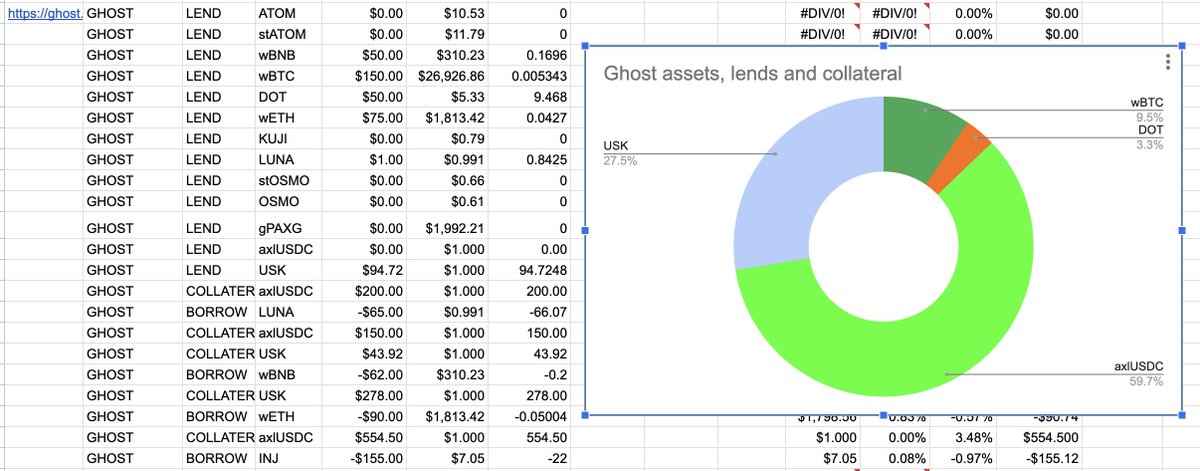

Ghost, 2023-05-21

Ghost has a very different face today. As opposed to lending my assets, I've activated most of my assets as borrows that I'm now arb'n on FIN.

Ghost has a very different face today. As opposed to lending my assets, I've activated most of my assets as borrows that I'm now arb'n on FIN.

Next,

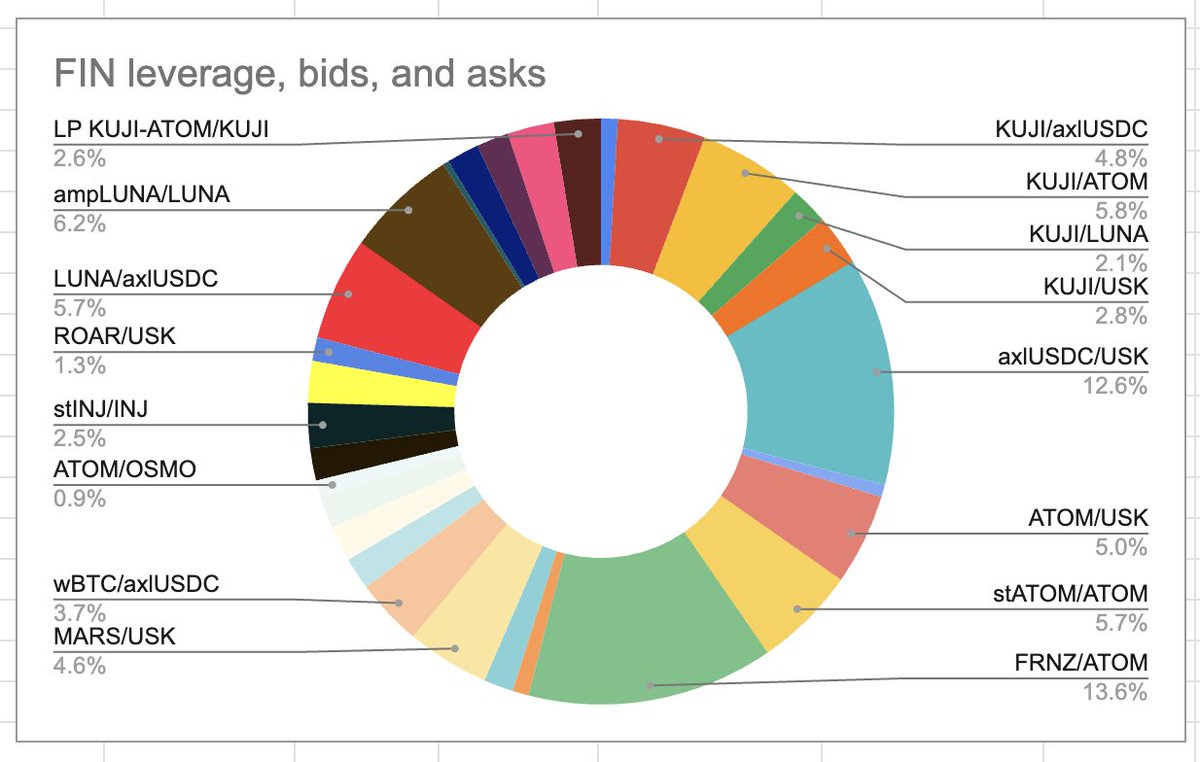

FIN, 2023-05-21.

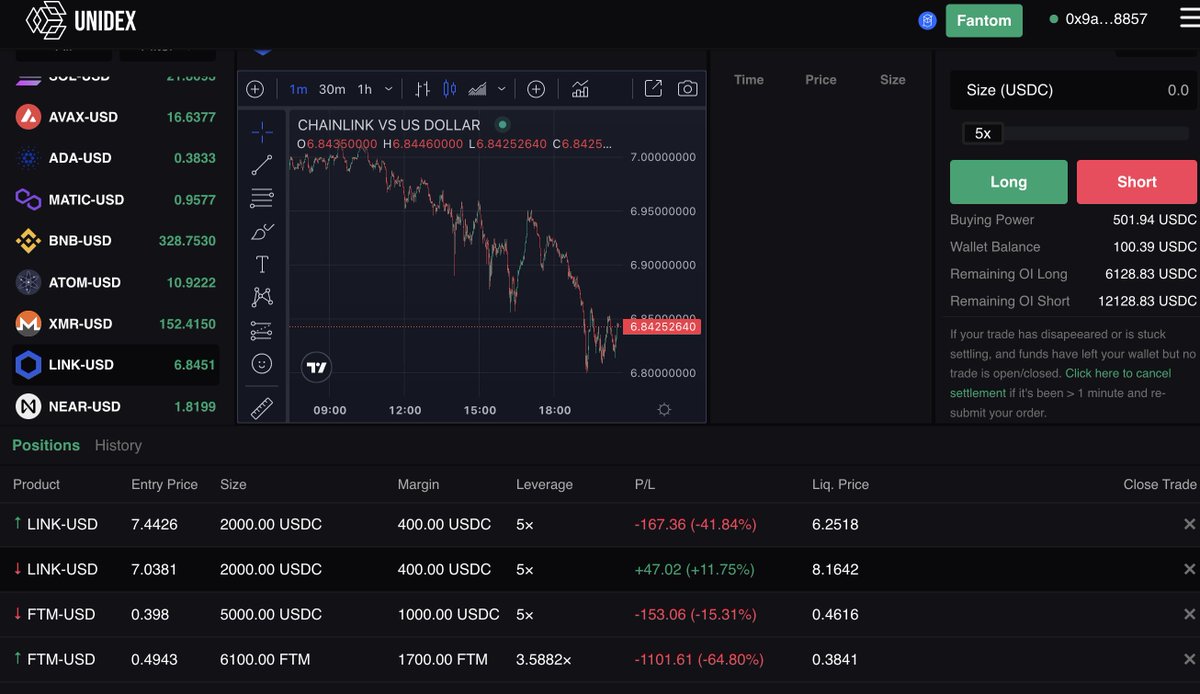

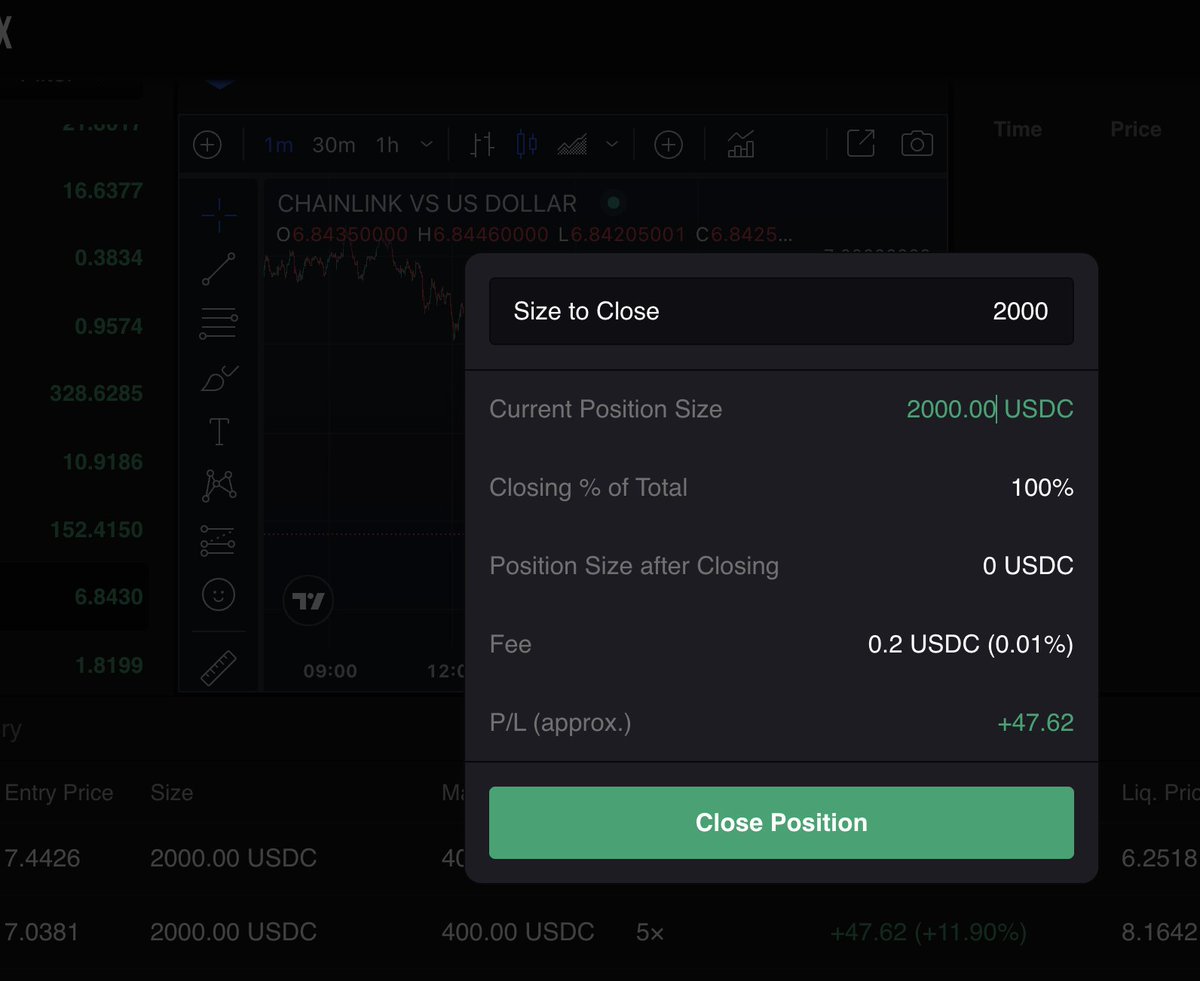

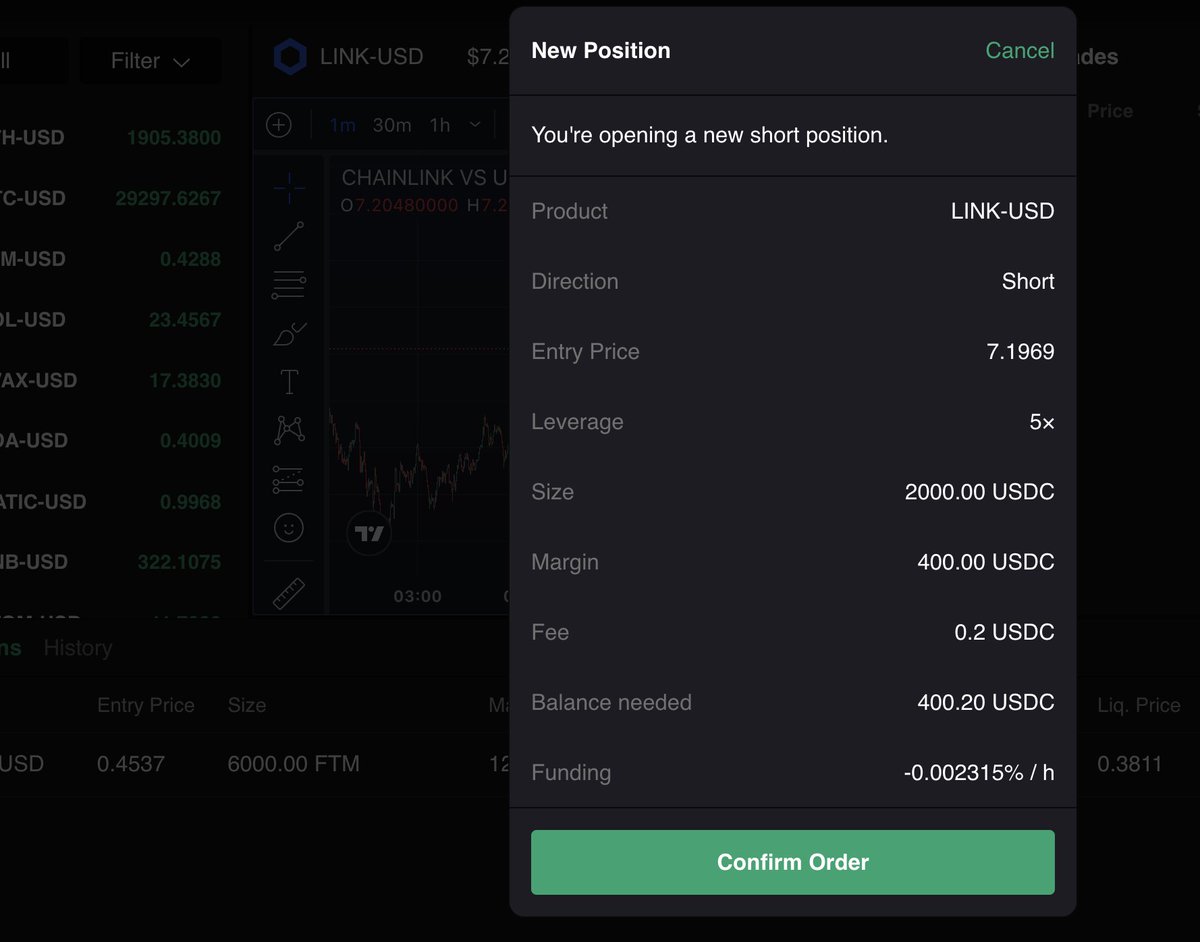

First and foremost, I check my leveraged long and leveraged short positions on FIN:

$LUNA

$wBNB and

$wETH

HOWTO leverage long: logicalgraphs.blogspot.com/2023/05/howto-…

HOWTO leverage short on @TeamKujira FIN: logicalgraphs.blogspot.com/2023/05/howto-… (yes, you read that correctly)

FIN, 2023-05-21.

First and foremost, I check my leveraged long and leveraged short positions on FIN:

$LUNA

$wBNB and

$wETH

HOWTO leverage long: logicalgraphs.blogspot.com/2023/05/howto-…

HOWTO leverage short on @TeamKujira FIN: logicalgraphs.blogspot.com/2023/05/howto-… (yes, you read that correctly)

None of the leveraged positions on FIN require action at this time.

... bummer. 🙁

... bummer. 🙁

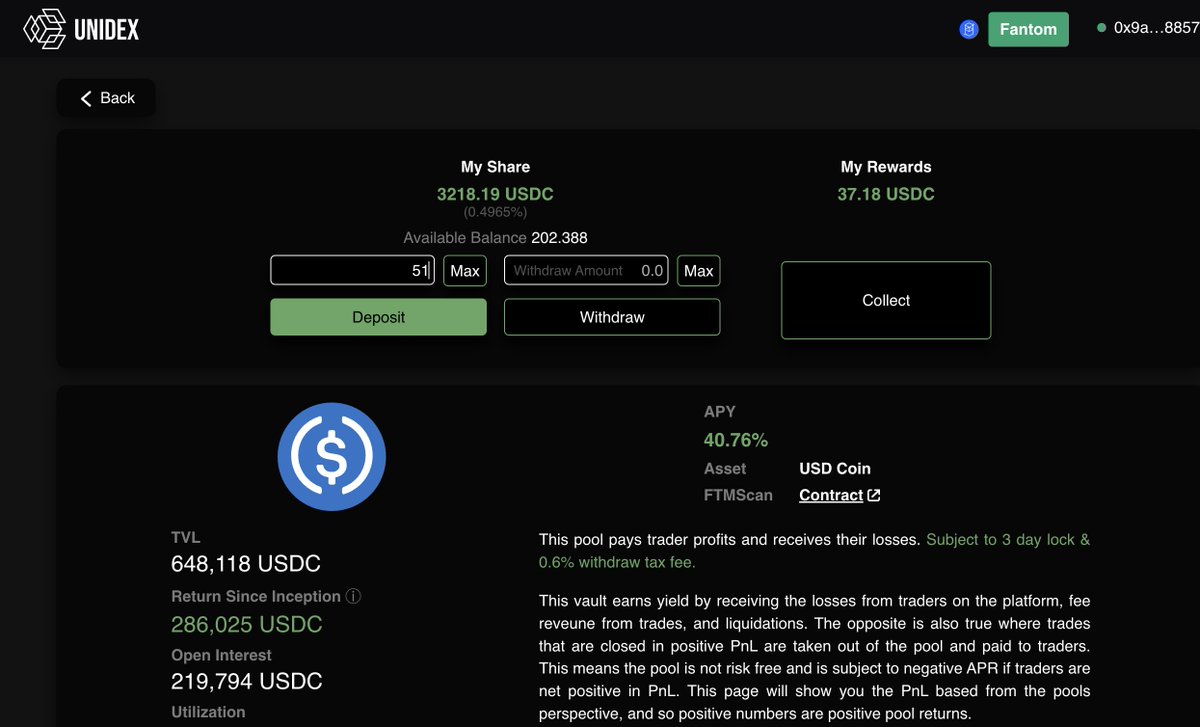

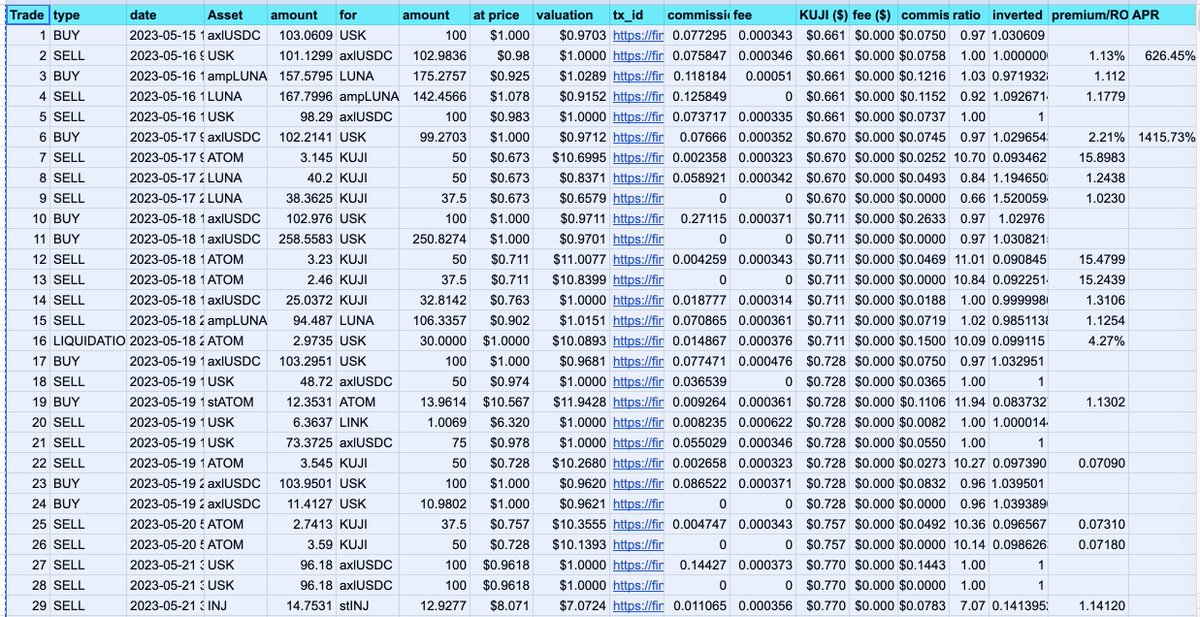

Now for the (non-leveraged) FIN order books.

How I'm going to do this is go through each order book I have orders on, and the ones that are fulfilled, I'm going to manage, because, usually that means I'm in the midst of an arb, or am closing an arb out.

Let's see.

How I'm going to do this is go through each order book I have orders on, and the ones that are fulfilled, I'm going to manage, because, usually that means I'm in the midst of an arb, or am closing an arb out.

Let's see.

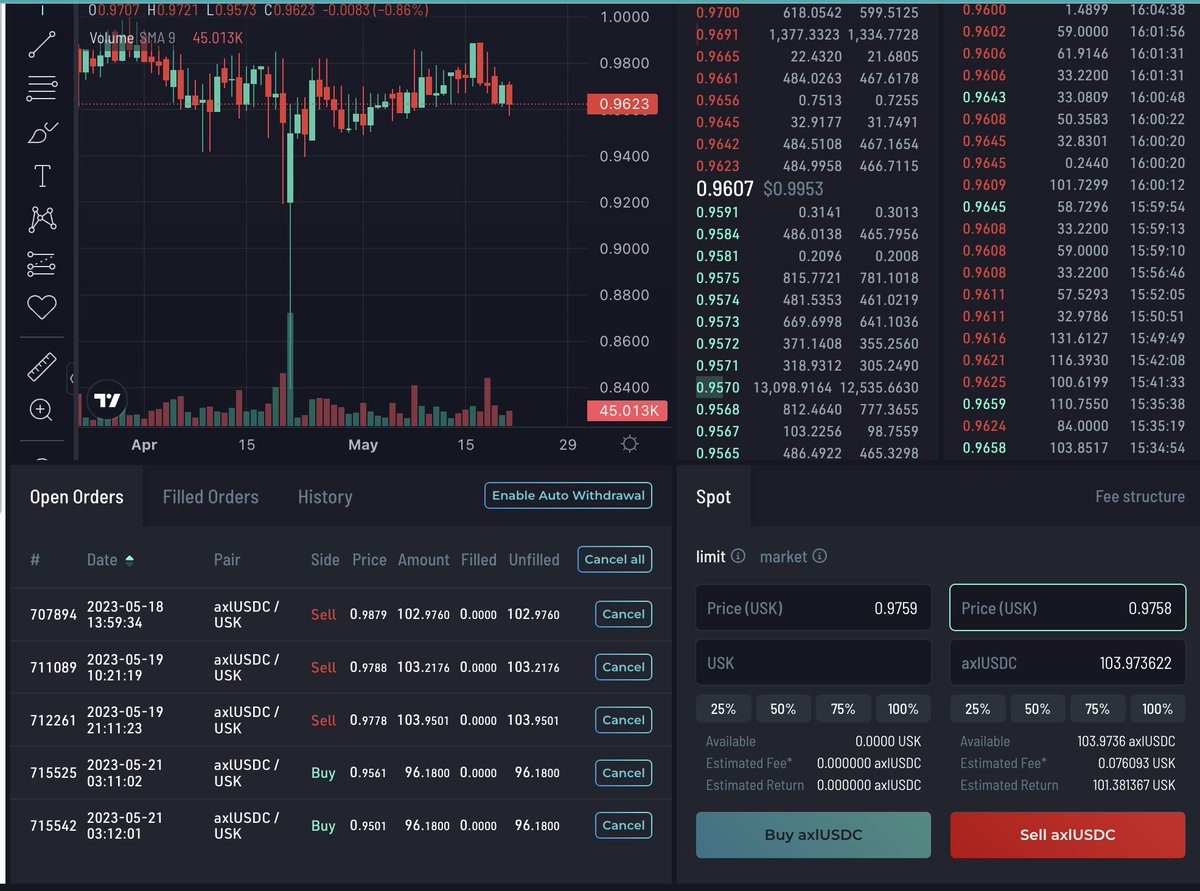

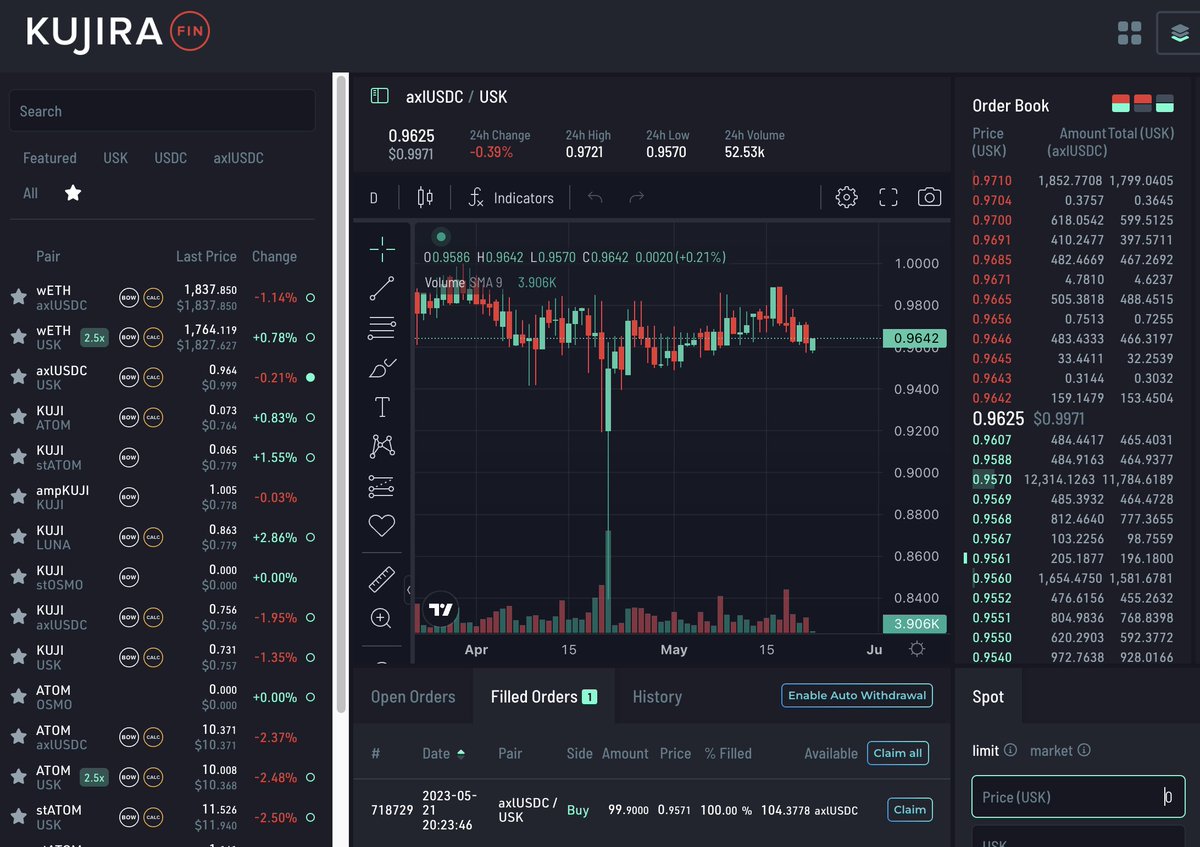

First up is the axlUSDC/USK order book, or, as I call it, the 🪄💸🖨️.

And, just as fate would have it, there's an $USK-arb-in-progress-order-fulfilled (dites ce phrase-ça, cinq fois rapidement!), so I claim the buy-order and place the corresponding sell-order, eyeing arb closure

And, just as fate would have it, there's an $USK-arb-in-progress-order-fulfilled (dites ce phrase-ça, cinq fois rapidement!), so I claim the buy-order and place the corresponding sell-order, eyeing arb closure

I keep a record of my arbs-in-progress and archive completed arbs on the Trades-page of my blog at logicalgraphs.blogspot.com/p/trades.html

Those who wish to see each trade executed for each one of my arbs and become an arbiteur, just like moiself (that is French) (no, it's not), there you go!

Those who wish to see each trade executed for each one of my arbs and become an arbiteur, just like moiself (that is French) (no, it's not), there you go!

The whole point of that evolution was to ensure the orders placed on axlUSDC/USK FIN match what I have on my #SPREADSHEETSZORXEN!

And now, they do match.

Let's continue, shall we?

And now, they do match.

Let's continue, shall we?

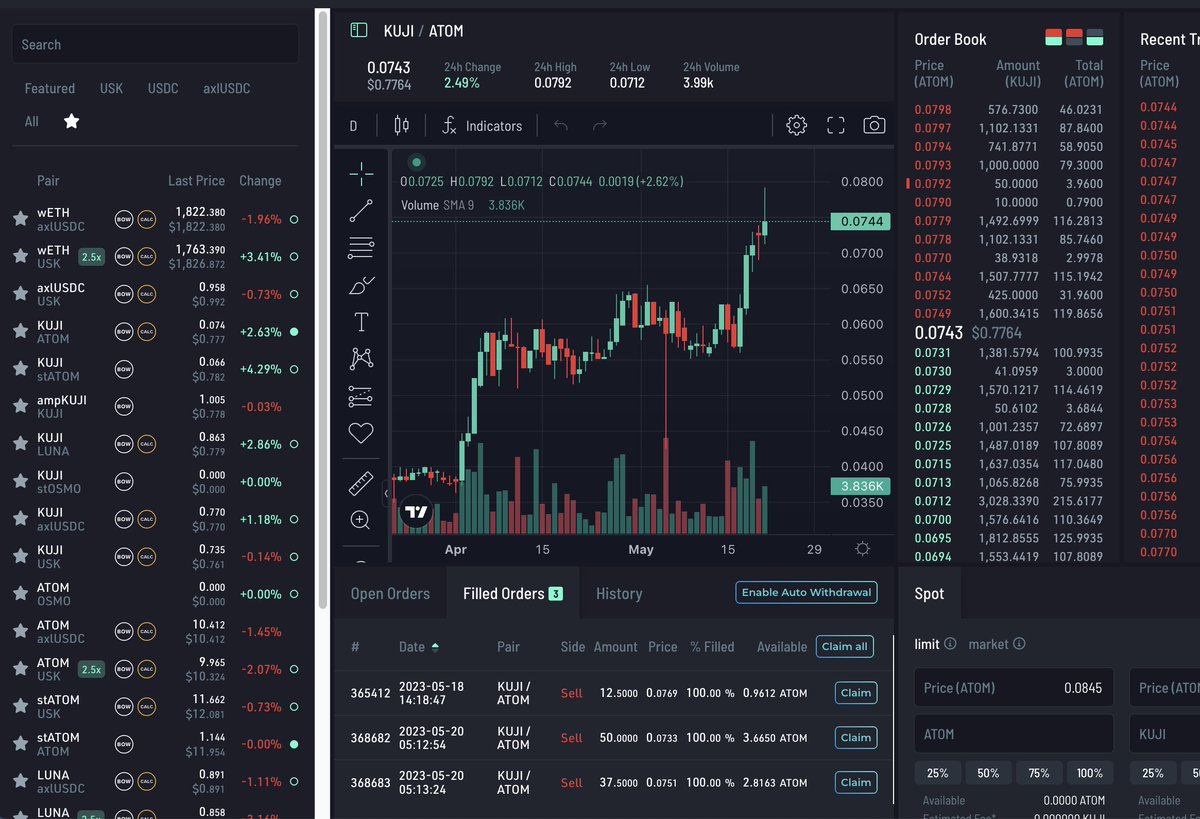

Next, the KUJI/ATOM order book.

Three more sell-orders hit, and, as you can see, I have a ton of buy-orders placed.

Does this annoy me?

... a little.

But I look at it this way: when they hit, I'll have a ton of $KUJI. If they don't hit? I cancel them to get a ton of $ATOM. 😎

Three more sell-orders hit, and, as you can see, I have a ton of buy-orders placed.

Does this annoy me?

... a little.

But I look at it this way: when they hit, I'll have a ton of $KUJI. If they don't hit? I cancel them to get a ton of $ATOM. 😎

After all the analyses of the FIN order books, my positions have the following layout.

FIN, 2023-05-21

FIN, 2023-05-21

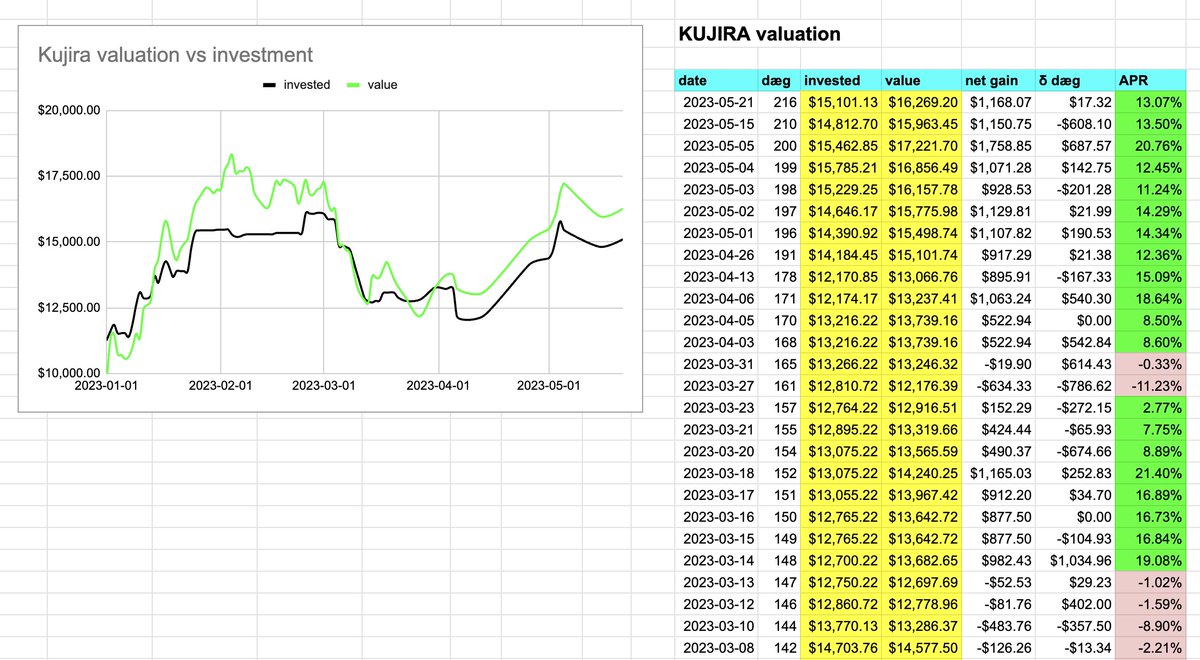

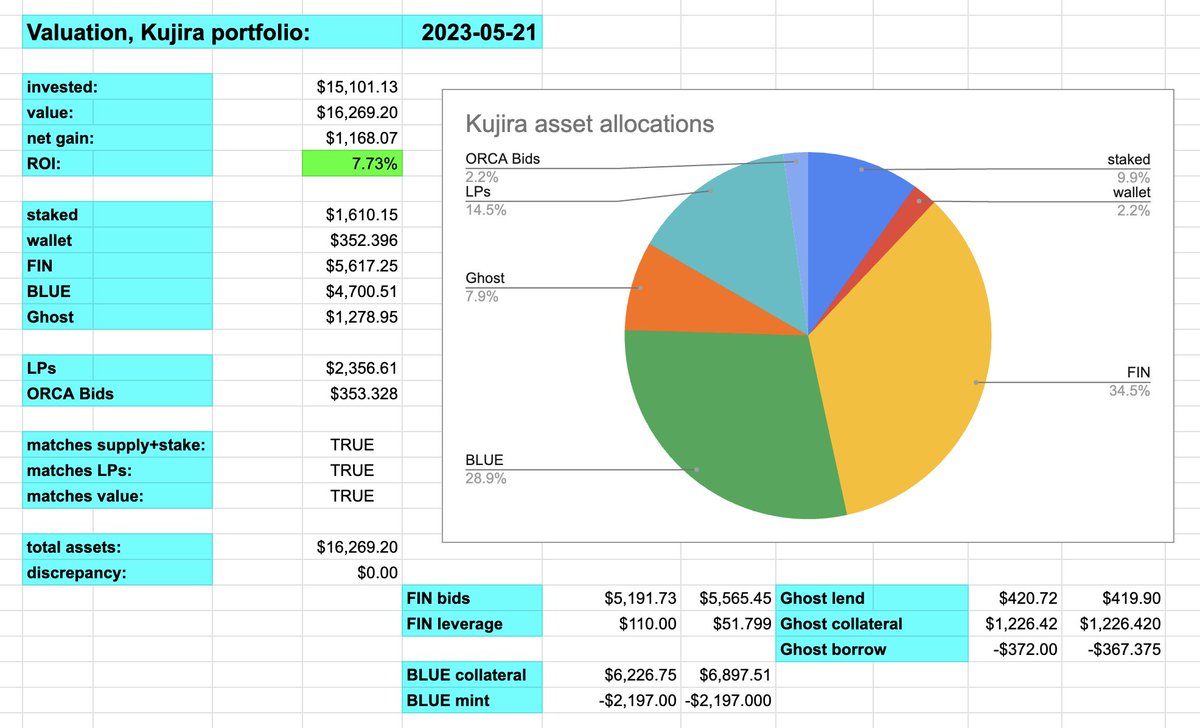

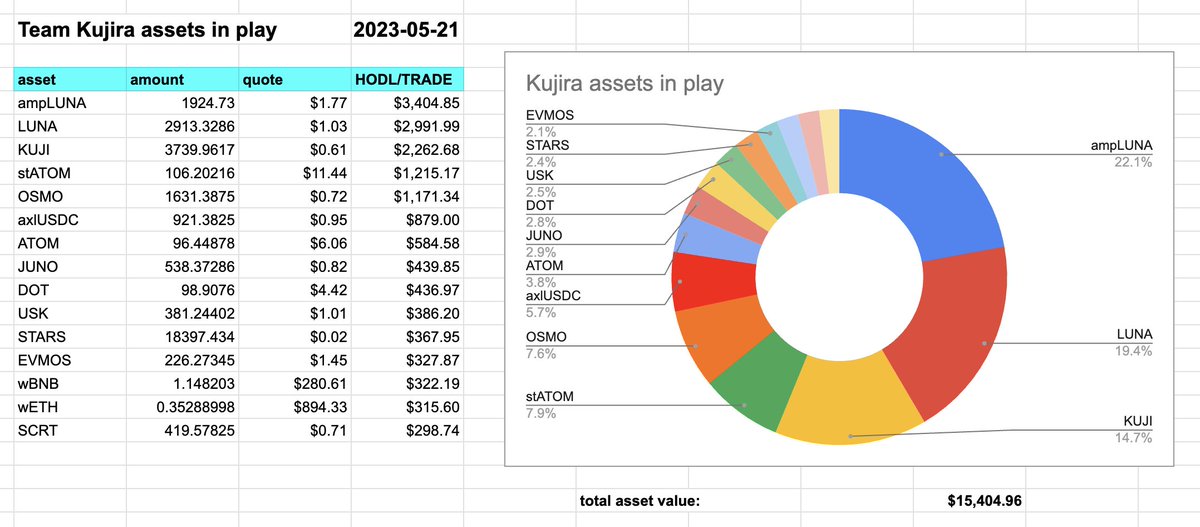

We can now analyze my entire @TeamKujira portfolio.

Valuation, Kujira portfolio: 2023-05-21

invested: $15,101.13

value: $16,269.20

net gain: $1,168.07

ROI: 7.73%

staked $1,610.15

wallet $352.40

FIN $5,617.25

BLUE $4,700.51

Ghost $1,278.95

LPs $2,356.61

ORCA Bids $353.33

total assets: $16,269.20

discrepancy: $0.00

invested: $15,101.13

value: $16,269.20

net gain: $1,168.07

ROI: 7.73%

staked $1,610.15

wallet $352.40

FIN $5,617.25

BLUE $4,700.51

Ghost $1,278.95

LPs $2,356.61

ORCA Bids $353.33

total assets: $16,269.20

discrepancy: $0.00

Whilst doing this valuation, the buy-order hit on my $USK-arb, so I claim that and place the sell-order, eyeing the closing of this arb against the 513 $LUNA collateral.

PnL

@TeamKujira FIN order books: 2023-05-21

Profit: $130.34

Loss: $135.58

subtotal: -$5.24

fees: $0.01

commission: $2.04

total costs: $2.04

Total profit (or loss): -$7.28 on 34 trades

average: -$0.21 per trade

1 liquidation at a 4.27% premium (avg)

Assets in play

@TeamKujira FIN order books: 2023-05-21

Profit: $130.34

Loss: $135.58

subtotal: -$5.24

fees: $0.01

commission: $2.04

total costs: $2.04

Total profit (or loss): -$7.28 on 34 trades

average: -$0.21 per trade

1 liquidation at a 4.27% premium (avg)

Assets in play

With this report finished, we can review income for 'today,' too.

This report is archived on my blog at logicalgraphs.blogspot.com/2023/05/valuat…

In fact, my blog has a report-bias, ICYMI: logicalgraphs.blogspot.com

Do you like this report? RT the OT --v and share the ♥️

This report is archived on my blog at logicalgraphs.blogspot.com/2023/05/valuat…

In fact, my blog has a report-bias, ICYMI: logicalgraphs.blogspot.com

Do you like this report? RT the OT --v and share the ♥️

https://twitter.com/logicalgraphs/status/1660333929126043648

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter