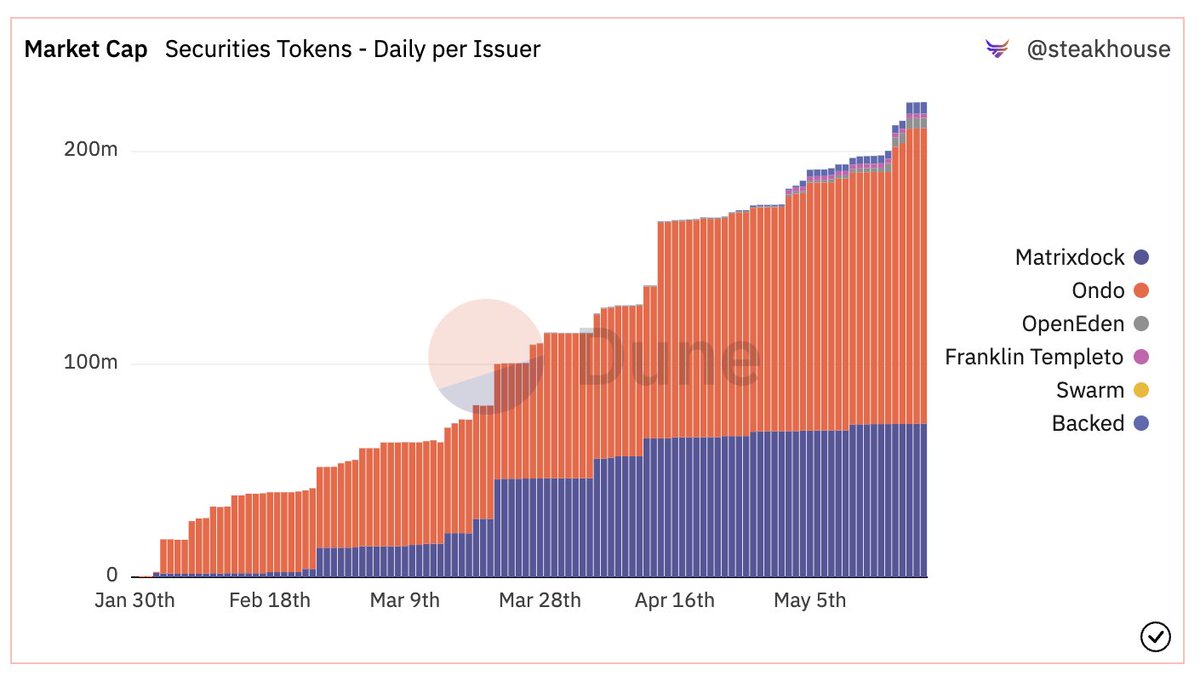

Tokenized Securities [On-chain T-bills/ETFs] are going strong with over $220 Million Market Cap - almost all in the last 4-5 months!🔥

What's going on in the space - why it's booming, how it works, and what's ahead? 🧵⇩

What's going on in the space - why it's booming, how it works, and what's ahead? 🧵⇩

What are Tokenized Securities?

Think of them as USDC but for publicly traded instruments or 'Real World Assets' like T-Bills, ETFs, or Stocks instead of US Dollars as the underlying asset.

On-chain 'representation' and 'ownership' of Off-chain securities!

Think of them as USDC but for publicly traded instruments or 'Real World Assets' like T-Bills, ETFs, or Stocks instead of US Dollars as the underlying asset.

On-chain 'representation' and 'ownership' of Off-chain securities!

Why it's booming?

- DeFi yields are pretty low in a bear market

- Huge on-chain treasury capital needs yield (Directly investing in TradFi is tedious)

- Tokenized T-bills offer investing via USDC into low-risk assets (more efficient funds flow for on-chain treasuries).

- DeFi yields are pretty low in a bear market

- Huge on-chain treasury capital needs yield (Directly investing in TradFi is tedious)

- Tokenized T-bills offer investing via USDC into low-risk assets (more efficient funds flow for on-chain treasuries).

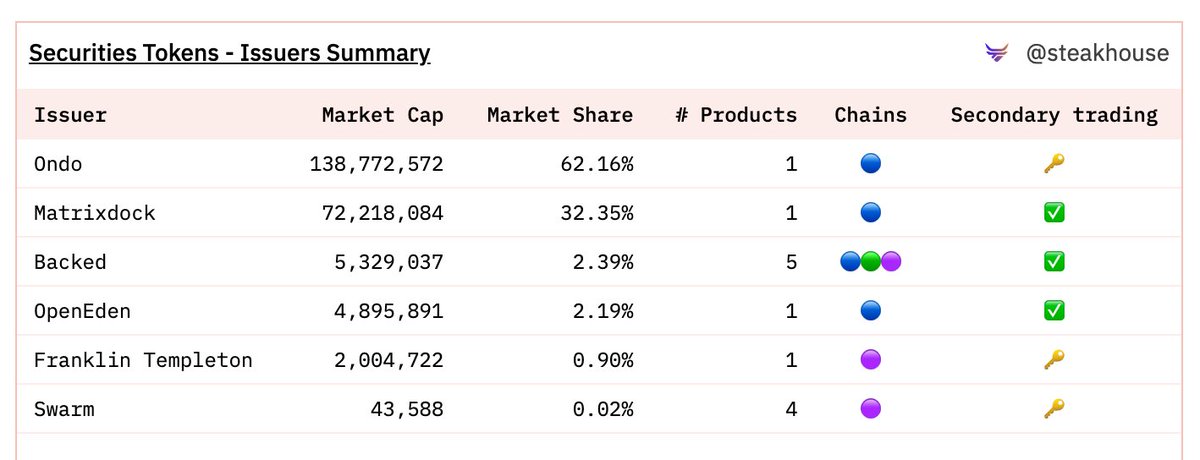

Major players and their Marketcap:

- Ondo [$138.7 Million]

- Matrixdock [$72.2 Million]

- Backed [$5.3 Million]

- OpenEden [$4.9 Million]

- Franklin Templeton [$2 Million]

With many more launching soon!

- Ondo [$138.7 Million]

- Matrixdock [$72.2 Million]

- Backed [$5.3 Million]

- OpenEden [$4.9 Million]

- Franklin Templeton [$2 Million]

With many more launching soon!

On which chains are these tokenized assets issued?

A whopping [> 96%] on Ethereum, why?

- Highest capital Ecosystem by huge margins

- Low-frequency transactions make it economically feasible despite high gas fees & poor UX.

Polygon & Gnosis chain comes next, but still very low.

A whopping [> 96%] on Ethereum, why?

- Highest capital Ecosystem by huge margins

- Low-frequency transactions make it economically feasible despite high gas fees & poor UX.

Polygon & Gnosis chain comes next, but still very low.

How does it work?

KYC’d Investors → Invest USDC → sent to Coinbase (Off-ramp'd) → to USD → Wire'd to → Clear Street (Custodian & prime brokerage) → Investment Manager purchases/sales NASDAQ listed BlackRock iShares ETFs -> Token sent to KYC'd address

[Ondo's fund flow]⬆️

KYC’d Investors → Invest USDC → sent to Coinbase (Off-ramp'd) → to USD → Wire'd to → Clear Street (Custodian & prime brokerage) → Investment Manager purchases/sales NASDAQ listed BlackRock iShares ETFs -> Token sent to KYC'd address

[Ondo's fund flow]⬆️

What's ahead?

While it's still less efficient than TradFi counterparts and it's just serving as a gateway for on-chain capital and crypto-native investors (not solving much of problems)

It still has a high potential to disrupt a Trillion dollar market.

While it's still less efficient than TradFi counterparts and it's just serving as a gateway for on-chain capital and crypto-native investors (not solving much of problems)

It still has a high potential to disrupt a Trillion dollar market.

It's essential to attract non-crypto users via:

- More instruments requiring high frequency in L2s like Arbitrum or L1s like Solana

- Leveraging programmability & 24/7 infrastructure to issue these real-world securities natively (Vision: On-chain NASDAQ)

Your Views?🤔

- More instruments requiring high frequency in L2s like Arbitrum or L1s like Solana

- Leveraging programmability & 24/7 infrastructure to issue these real-world securities natively (Vision: On-chain NASDAQ)

Your Views?🤔

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter