How to get URL link on X (Twitter) App

1/ Think of Solana Agent Kit (SAK) as the base layer for any agents looking to deploy on Solana and perform Solana actions –– and completely Open-Source.

1/ Think of Solana Agent Kit (SAK) as the base layer for any agents looking to deploy on Solana and perform Solana actions –– and completely Open-Source.

1/ Why even work in crypto?

1/ Why even work in crypto?

1/ Two weeks ago at @_choppingblock, @hosseeb, and @tomhschmidt from @dragonfly_xyz made a bunch of arguments in an Ethereum v. Solana segment.

1/ Two weeks ago at @_choppingblock, @hosseeb, and @tomhschmidt from @dragonfly_xyz made a bunch of arguments in an Ethereum v. Solana segment.

1/ [Chapter 1]: Governance Tokens are Memecoins w/ extra steps.

1/ [Chapter 1]: Governance Tokens are Memecoins w/ extra steps.

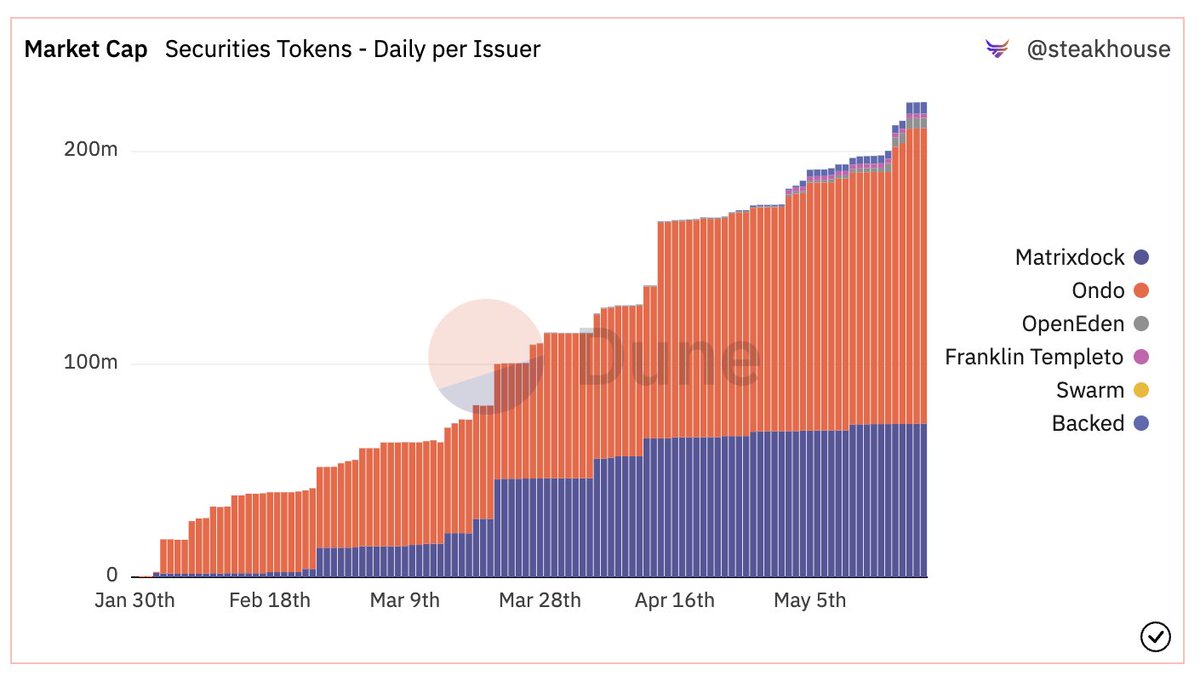

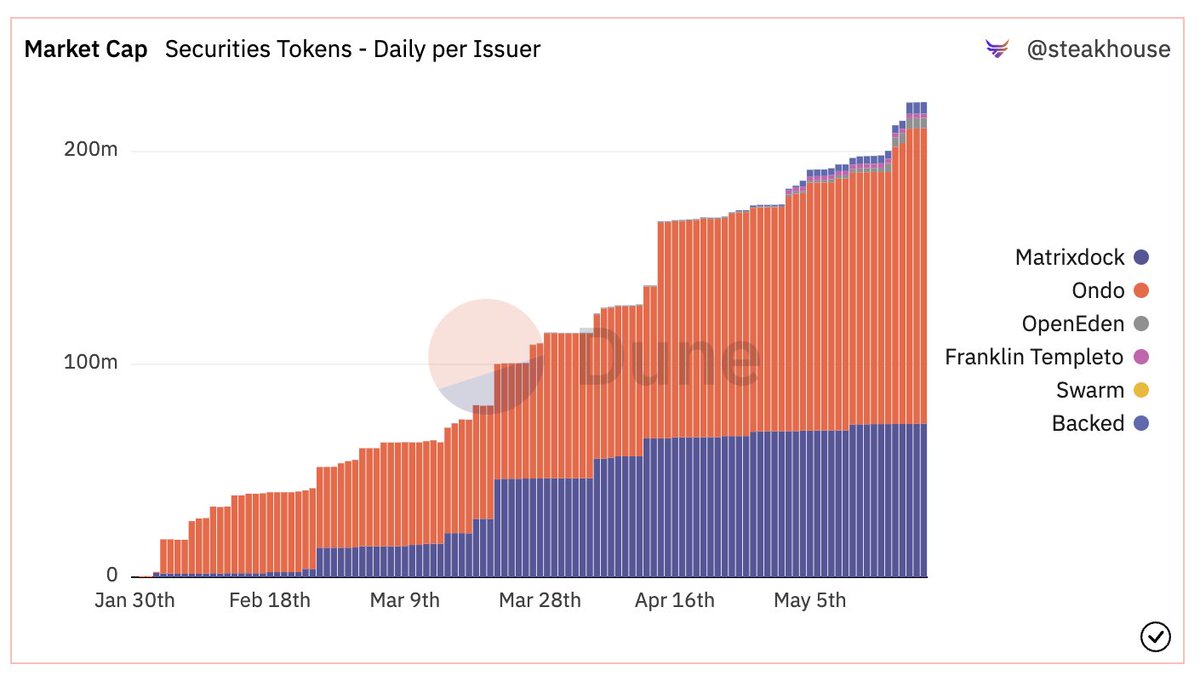

1/ Simply put, Real Word World Assets (RWA) bring any off-chain financial assets on-chain.

1/ Simply put, Real Word World Assets (RWA) bring any off-chain financial assets on-chain.

What are Tokenized Securities?

What are Tokenized Securities?