Breaking: a new @Greenpeace report just exposed the insurance companies underwriting the massive expansion of oil and gas extraction in Norway’s North Sea. Also today, >500 British students informed fossil fuel insurers they won’t work for climate wreckers. Read on! 🧵

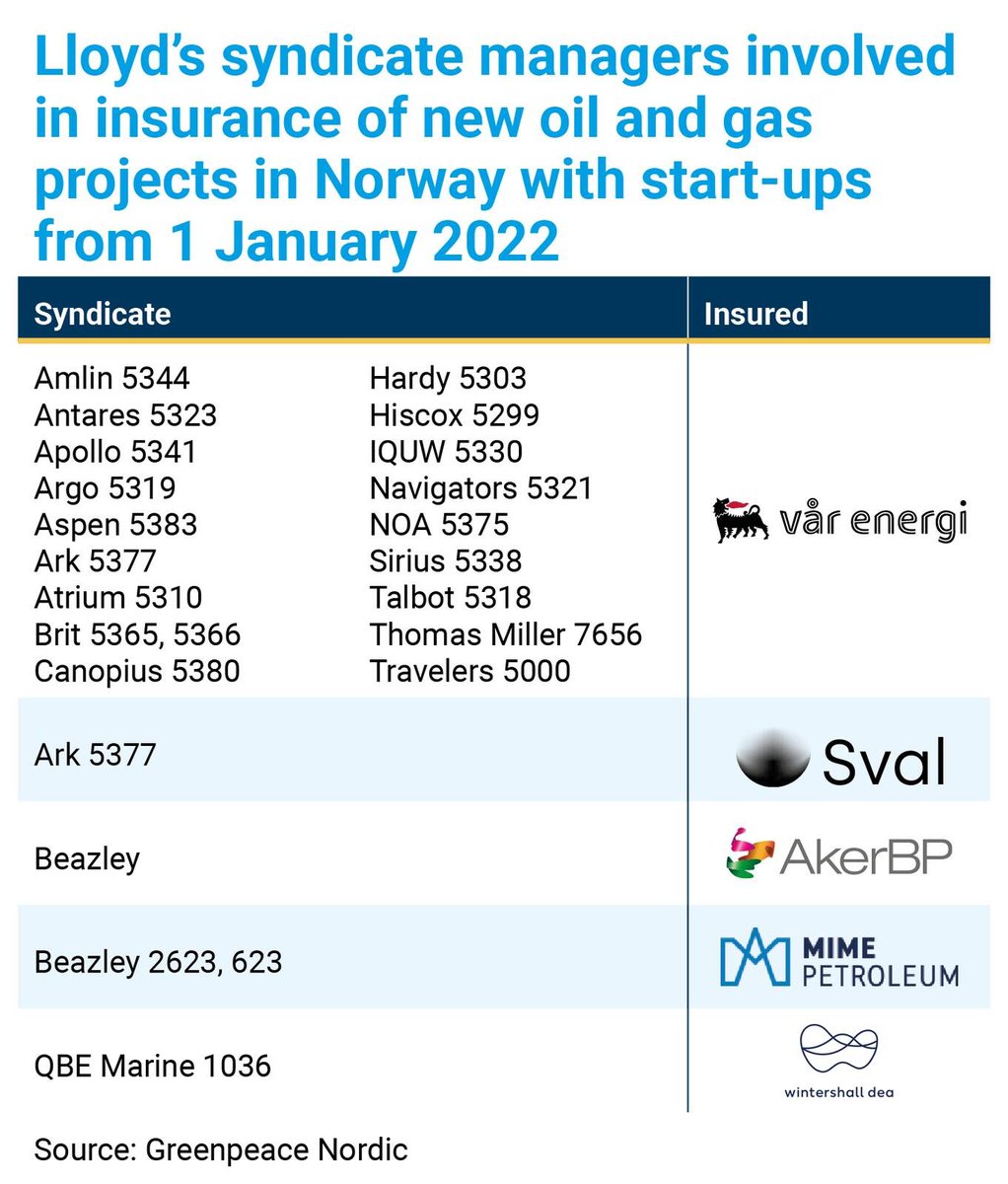

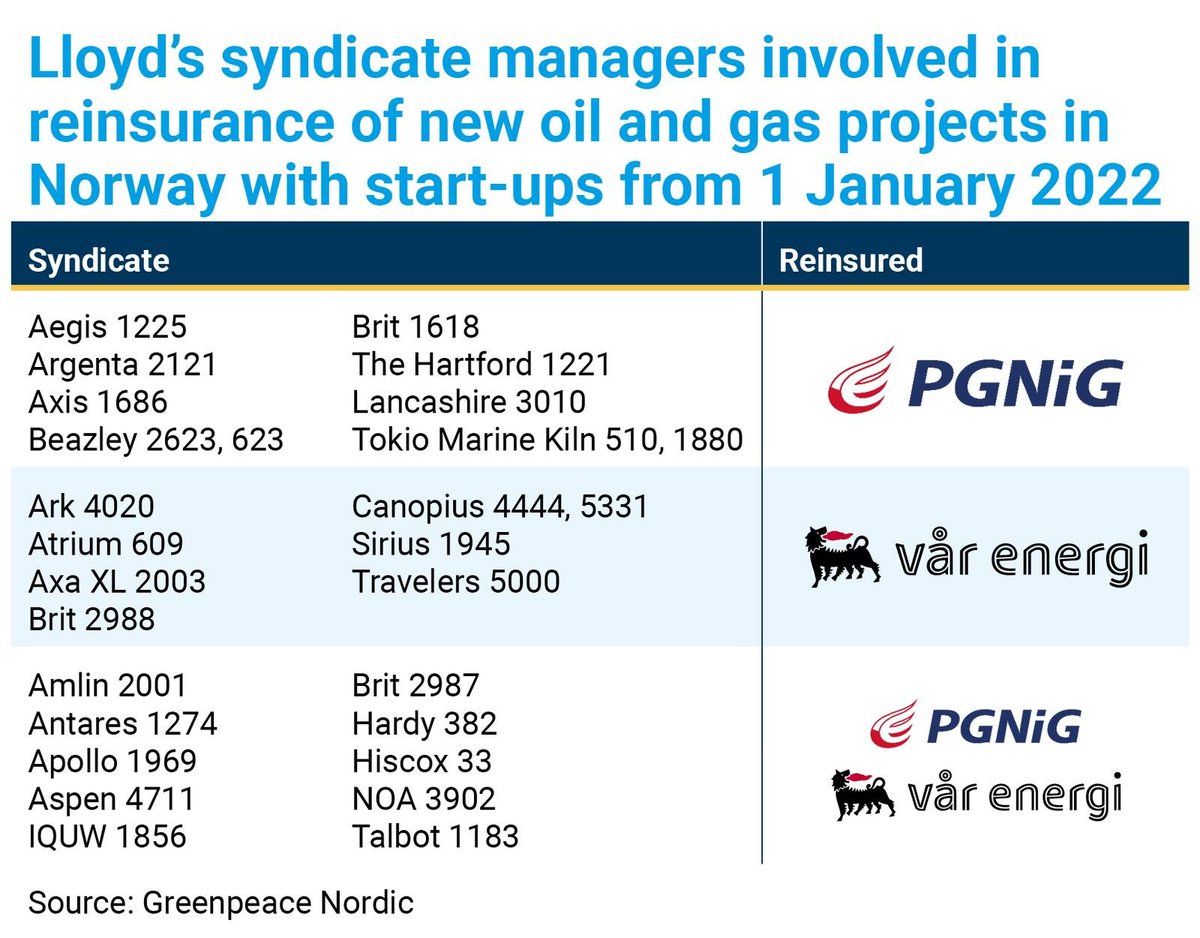

The Greenpeace report identified 69 insurers offering cover for the 21 oil and gas companies with massive expansion plans in the North Sea. Most of them are syndicates of @LloydsofLondon such as @BeazleyGroup, @britinsurance and @HiscoxComms.

The 21 companies are planning to develop new oil and gas fields holding about 3 bn barrels of oil equivalent, which will produce some 1.3 bn tons of CO2 when burnt. Climate scientists tell us that none of these projects can go forward within 1.5C of global warming.

The list of insurers also includes prominent public brands such as @AIGinsurance, @Allianz, @AXA, @LibertyMutual, @QBE, @SCOR_SE, @tokiomarine and @Zurich. “These insurers are accomplices in climate crimes”, warns Greenpeace’s @andreasrandoy.

“Don’t work for climate wreckers”, @antonioguterres told graduating students last year. Today, >500 UK students followed suit. “We won’t work for you if you insure new fossil fuel projects such as #EACOP and the Rosebank oil field”, they told @LloydsofLondon and other insurers.

According to a new Deloitte report, more than 40% of Gen Z and Millennials have changed jobs or sectors due to climate concerns, or plan to do so in the future. Fossil fuel insurers have an aging problem and will struggle to attract new talent.

Lloyd’s, the world’s biggest energy insurer, will hold their annual general meeting tomorrow. Will they finally announce restrictions on their oil and gas insurance? Stay tuned! #InsureOurFuture

You will find the new Greenpeace Nordic report at greenpeace.org/sweden/pressme… and a Guardian story on the students’ letter at theguardian.com/business/2023/…. Students can still sign the pledge at actionnetwork.org/forms/student-….

Here is the full list of insurers and reinsurers of oil and gas companies in the Norwegian North Sea. (Lloyd's insurers will be listed separately.)

And here is the full list of @LloydsofLondon insurers and reinsurers. Beware of the climate wreckers! (Source for all lists: Greenpeace Nordic)

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter