The top 10 facts in the 2023 #IGWT report.

A thread:

1. If the U.S debt ceiling is raised again, it will be the 79th increase since 1960, the 21st since 2000, and the 30th under a Democratic president. Republican Presidents have raised the debt ceiling 49 times.

1/

A thread:

1. If the U.S debt ceiling is raised again, it will be the 79th increase since 1960, the 21st since 2000, and the 30th under a Democratic president. Republican Presidents have raised the debt ceiling 49 times.

1/

2. Gold, you are the apple of my eye… in terms of purchasing power! In 2007, the first iPhone cost $599 or the equivalent of 0.92 ounces of gold. Fifteen years later, only 0.75 ounces of gold are due for the iPhone 14 Pro, which cost $1,499 at its launch in September 2022.

2/

2/

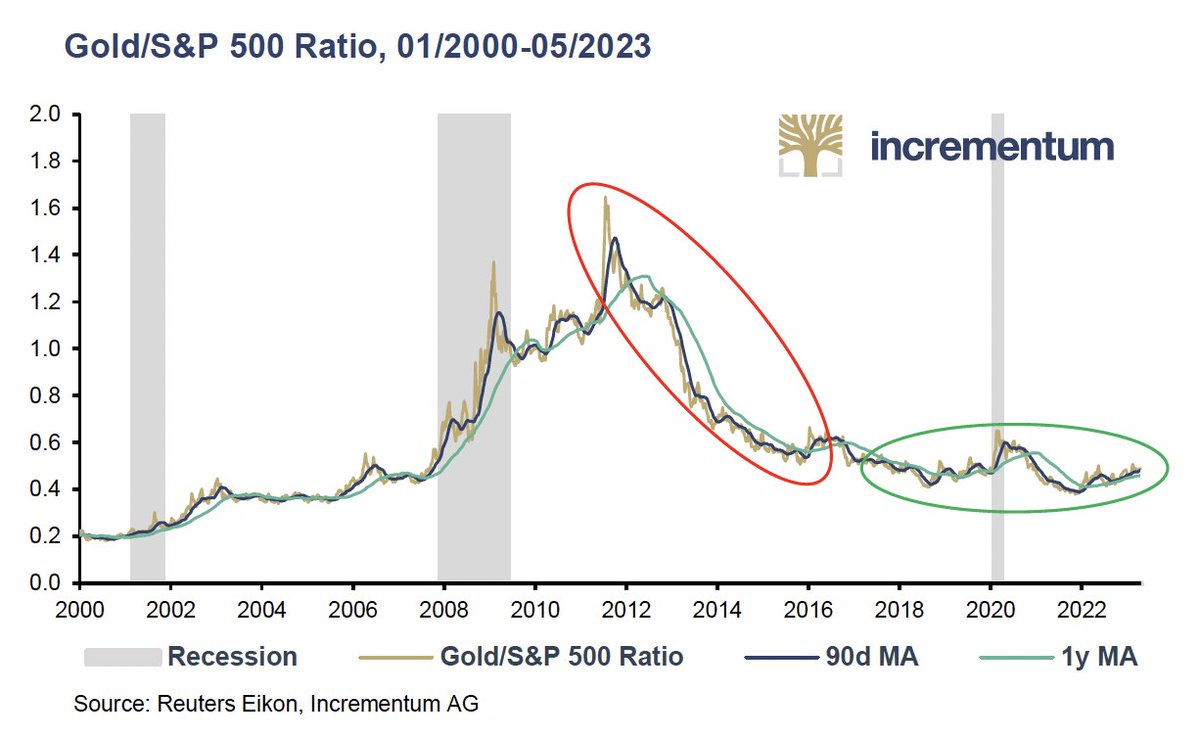

3. Despite US equities becoming more undervalued in the last year (Shiller P/E ratio 38.3 in 2021 vs 2022’s figure of 28.3), gold is still historically undervalued compared to US equities. The Gold/S&P 500 ratio of 0.49 is significantly lower than the long term average of 1.66

3/

3/

4. Miners profit from prioritizing people and planet! A study by the WGC revealed that companies with the highest community scores achieved a total shareholder return of 63%, compared to just 14% for those with the lowest scores. For more, see page 333 of the report.

4/

4/

5. 2022 saw the highest gold buying by central banks on record, i.e., since 1950, when the WGC started its records. Buying reached 1136t, with Türkiye reporting the largest purchases, adding 148t to its reserves.

5/

5/

6. De-dollarization is a reality: Adjusting for FX movements, USD has lost about 11% of its market share since 2016 and 2x that amount since 2008. USD’s share of global currency reserves dropped to only 58% in 2022 from a share of 73% in 2001.

6/

6/

7. After adding 128 tonnes of gold reserves over a six month period between November 2022 and April 2023, the PBoC’s gold reserves now officially stand at 2,076 tonnes. Jan Nieuwenhuijs estimates this amount could be twice as much at 4,400 tonnes of gold.

7/

7/

8. Factoring in gold smuggling of 150–200 tonnes per year for the last 20 years, total gold stock in private hands in India amounts to 31,000–32,000 tonnes - more than the combined gold holdings of the top 27 central bank gold holders in the world!

8/

8/

9. Silver inventories declined in 2022 by 430.9Moz from their end-2020 peak. This is equivalent to more than half of annual mine production, and also more than half of the inventories held in London vaults offering custodian services, as reported by the LBMA.

9/

9/

10. Commodities are historically undervalued: Today the S&P GSCI is below 50, and each time it dropped below this level (1929, the late 1960s, and the late 1990s), a substantial commodities bull market followed.

10/

10/

The 2023 #IGWT report is available, free of charge, on our website, right here:

ingoldwetrust.report/?lang=en

11/11

ingoldwetrust.report/?lang=en

11/11

• • •

Missing some Tweet in this thread? You can try to

force a refresh