In-depth analysis and insights on gold, silver, commodities, inflation, macro economics, Austrian Economics, Bitcoin and mining. Charts and long-form threads.

7 subscribers

How to get URL link on X (Twitter) App

2. The document tasks the Finance Ministers and Central Bank Governors of the BRICS countries to continue considering local currencies, payment instruments, and platforms. They are to report back to the BRICS leaders by the next Presidency.(next year)

2. The document tasks the Finance Ministers and Central Bank Governors of the BRICS countries to continue considering local currencies, payment instruments, and platforms. They are to report back to the BRICS leaders by the next Presidency.(next year)

2. Central banks are a decisive factor in the demand for gold: Demand from these institutions is not very price-sensitive. Central banks are likely to have put a floor under the gold price.

2. Central banks are a decisive factor in the demand for gold: Demand from these institutions is not very price-sensitive. Central banks are likely to have put a floor under the gold price.

We also feature the iPhone/gold ratio. Every year, the latest Iphone is more expensive than the previous year.

We also feature the iPhone/gold ratio. Every year, the latest Iphone is more expensive than the previous year.

We analyzed eight recessions since 1970. Turns out that gold and mining stocks tend to perform quite well during a recession.

We analyzed eight recessions since 1970. Turns out that gold and mining stocks tend to perform quite well during a recession.

2. Gold, you are the apple of my eye… in terms of purchasing power! In 2007, the first iPhone cost $599 or the equivalent of 0.92 ounces of gold. Fifteen years later, only 0.75 ounces of gold are due for the iPhone 14 Pro, which cost $1,499 at its launch in September 2022.

2. Gold, you are the apple of my eye… in terms of purchasing power! In 2007, the first iPhone cost $599 or the equivalent of 0.92 ounces of gold. Fifteen years later, only 0.75 ounces of gold are due for the iPhone 14 Pro, which cost $1,499 at its launch in September 2022.

In the past, the IMF considered gold to be a "barbarous relic" and advocated for its replacement with a more modern and flexible reserve asset, such as its own Special Drawing Rights (SDRs). However, in recent years, the IMF has changed its stance on gold.

In the past, the IMF considered gold to be a "barbarous relic" and advocated for its replacement with a more modern and flexible reserve asset, such as its own Special Drawing Rights (SDRs). However, in recent years, the IMF has changed its stance on gold.

#5 The Greek Hyperinflation of 1941-1944: Greece experienced a severe episode of hyperinflation during the German occupation in World War II. The inflation rate reached an estimated 50% per month, causing widespread poverty and social unrest.

#5 The Greek Hyperinflation of 1941-1944: Greece experienced a severe episode of hyperinflation during the German occupation in World War II. The inflation rate reached an estimated 50% per month, causing widespread poverty and social unrest.

If accepted, the new proposed BRICS members would create an entity with a GDP 30% larger than the United States, over 50% of the global population and in control of 60% of global gas reserves.

If accepted, the new proposed BRICS members would create an entity with a GDP 30% larger than the United States, over 50% of the global population and in control of 60% of global gas reserves.

We regard Chinese President Xi Jinping's visit to Saudi Arabia for the China-Gulf Cooperation Council (GCC) Summit a pivotal moment in this storyline.

We regard Chinese President Xi Jinping's visit to Saudi Arabia for the China-Gulf Cooperation Council (GCC) Summit a pivotal moment in this storyline.

In the late 1800s, most bank notes were redeemable for gold at par value. This means that you could take a bank note to the issuing bank and they would give you gold in return for the note. Responsible banks would take in gold and issue notes for the amount of gold deposited.

In the late 1800s, most bank notes were redeemable for gold at par value. This means that you could take a bank note to the issuing bank and they would give you gold in return for the note. Responsible banks would take in gold and issue notes for the amount of gold deposited.

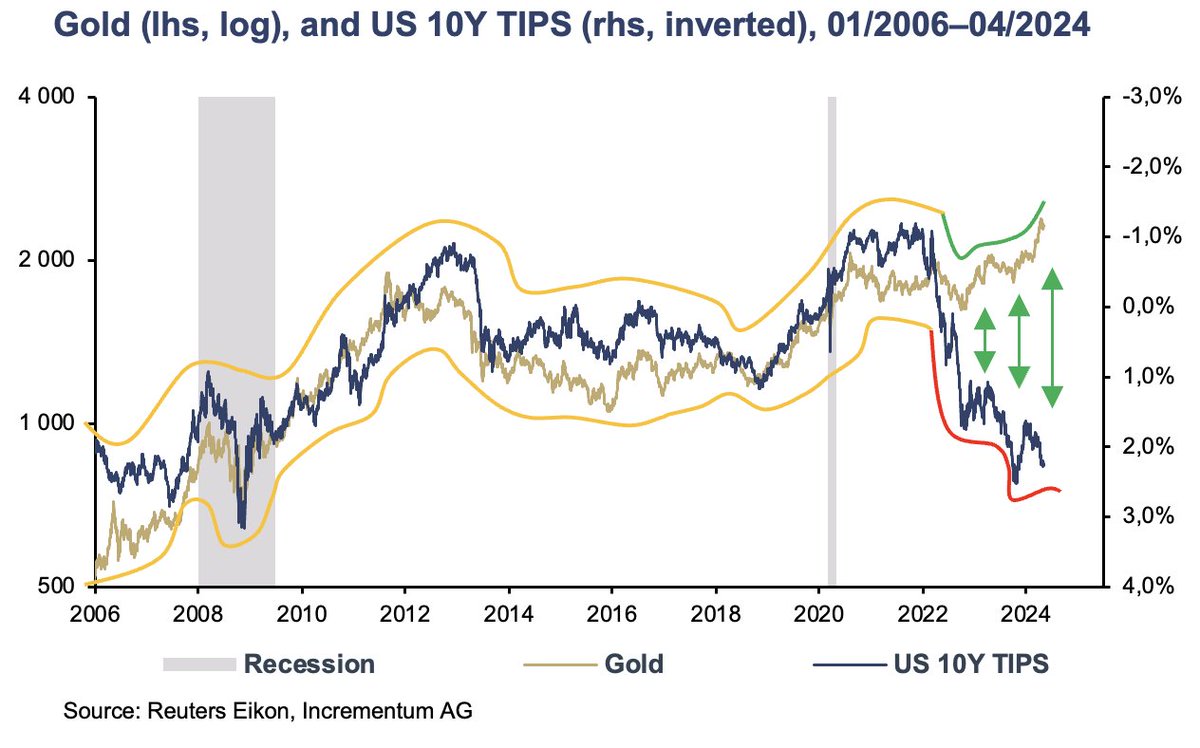

From the report: "Recent developments - politicians’ growing control over credit creation, average inflation targeting policy, and the historic expansion of the broad monetary aggregate – suggest the 2020s could become a stagflationary era."

From the report: "Recent developments - politicians’ growing control over credit creation, average inflation targeting policy, and the historic expansion of the broad monetary aggregate – suggest the 2020s could become a stagflationary era."

In his 1931 essay: The Causes of the Economic Crises: An Address, Ludwig von Mises succinctly explains what happens when credit expansion takes place:

In his 1931 essay: The Causes of the Economic Crises: An Address, Ludwig von Mises succinctly explains what happens when credit expansion takes place:

First introduced by Ludwig von Mises in his 'Theory of Money and Credit' (1912), ABCT has been expanded upon by Murray Rothbard, Friedrich Hayek and Roger Garrison. Here is a succinct explanation of the ABCT from Mises himself:

First introduced by Ludwig von Mises in his 'Theory of Money and Credit' (1912), ABCT has been expanded upon by Murray Rothbard, Friedrich Hayek and Roger Garrison. Here is a succinct explanation of the ABCT from Mises himself:

In their seminal book "40 Centuries of Wage and Price Controls", 1979, Schuettinger and Butler takes you on a historic tour of price and wage controls, from the ancient world, to Roman times, through medieval and early modern times and into the 20th century.

In their seminal book "40 Centuries of Wage and Price Controls", 1979, Schuettinger and Butler takes you on a historic tour of price and wage controls, from the ancient world, to Roman times, through medieval and early modern times and into the 20th century.

Royalty & streaming companies (R&S) do not build mines, they do not produce gold, or silver, or anything else. They do not have to deal with cost overruns, growing labor costs, or endless permitting processes. They simply invest in royalties and streams.

Royalty & streaming companies (R&S) do not build mines, they do not produce gold, or silver, or anything else. They do not have to deal with cost overruns, growing labor costs, or endless permitting processes. They simply invest in royalties and streams.