1/ @chaos_labs is proud to launch the @Uniswap V3 TWAP Oracle Risk Portal, in collaboration with @UniswapFND.

The Portal highlights real-time cost of of TWAP manipulation across V3 pools.

The Portal highlights real-time cost of of TWAP manipulation across V3 pools.

2/ But first, why is Oracle Manipulation an attractive exploit vector for attackers?

TWAP oracle manipulation leads to severe consequences for protocols that consume those price feeds, enabling attackers to distort prices, leading to economic exploits. Examples below 👇

TWAP oracle manipulation leads to severe consequences for protocols that consume those price feeds, enabling attackers to distort prices, leading to economic exploits. Examples below 👇

3/ @Moola_Market and @mangomarkets, both suffered significant losses due to TWAP oracle manipulation. In each case, attackers exploited thin liquidity to pump collateral value, leading to under-collateralized loans and substantial financial damage.

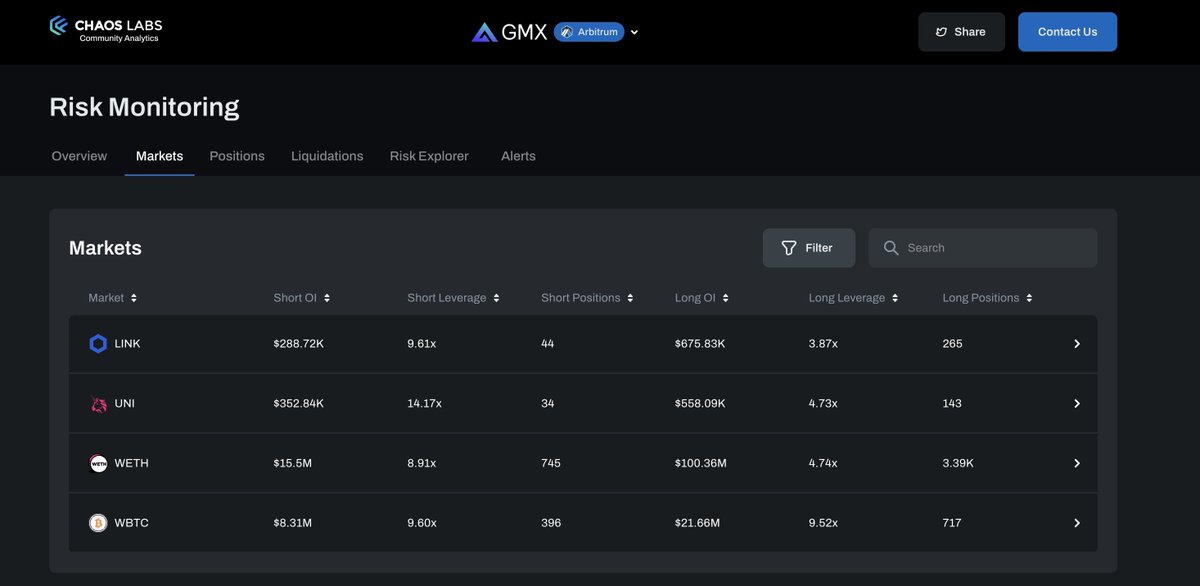

4/ The @chaos_labs TWAP Market Risk application, leverages pool data, including liquidity depth and exhaustion prices, to quantify real-time manipulation risk across all V3 pools and deployments. Users can view manipulation costs across all pools

5/ The portal factors real-time concentrated liquidity distribution into quantifying manipulation costs:

7/ As well as quantifying the capital requirements for moving the time-weighted average price over a 30-minute window

8/ Real-time data is important, but we'd like to make this information actionable for protocols using TWAPs. Therefore, we allow users to simulate how additional liquidity across specific ticks increases capital requirements for manipulations. Thanks @fedeebasta for this idea!

9/ The research and methodologies for quantifying the price of manipulation can be found in our full-length risk assessment here:

chaoslabs.xyz/posts/chaos-la…

chaoslabs.xyz/posts/chaos-la…

10/ As always, we encourage you to check out our application and we'd love to hear your feedback. Your ideas and feature requests can help us make it even more powerful. Explore the portal here:

community.chaoslabs.xyz/uniswap/twap

community.chaoslabs.xyz/uniswap/twap

11/ @chaos_labs is dedicated to ensuring the economic and oracle security in the #DeFi space. If you're an application grappling with these challenges, don't hesitate to reach out 🙏

12/ We're incredibly proud to partner on this critical research with our partners at @UniswapFND @Uniswap. Their collaboration is invaluable, and we look forward to what comes next. Stay tuned, as we're releasing additional research with @UniswapFND soon!

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter