I often wonder whether Bitcoiners like @saylor or @jackmallers actually use the Lightning Network. It's not the panacea they promise, and due to certain technical and financial limitations, it never will be. Understanding why is important to the future of Bitcoin, so a 🧵

P2P Channels are at the heart of LN. You can send a payment to anyone you open a channel with on the main chain, up to the amount of you lock up. But this introduces a major cost of capital constraint. Everything is pre-funded, so more channels = more locked up BTC.

The genius of LN is the ability to securely route payments through other channels. You have a channel with Bob and he has one with Alice, so you don't need a channel with Alice. So far so good. But what if Bob doesn't have a channel with all the other people you'd like to pay?

You can look for many other Bobs to open channels with, but that too is costly. The optimal setup is to find someone with a gazillion other channels and open a single one with them.

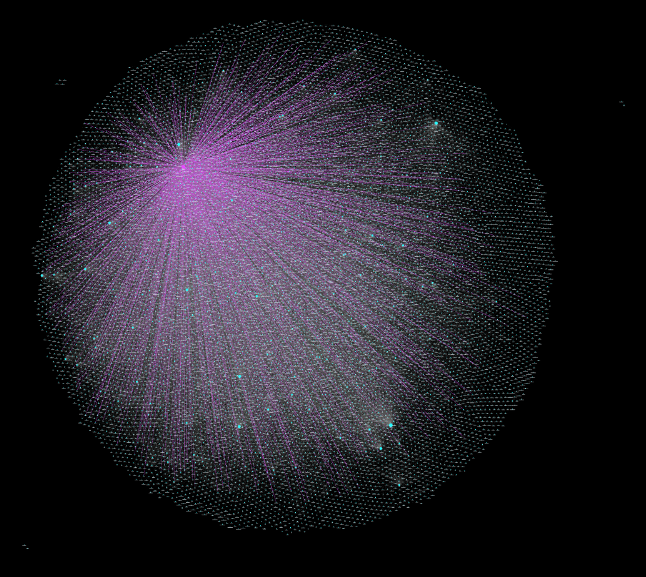

Cost of capital forces the network graph into severe concentration. We're already seeing this:

Cost of capital forces the network graph into severe concentration. We're already seeing this:

Imagine travelling to a new city and wanting to pay with LN. You can try opening a channel with every restaurant or hotel, but that would be complicated and costly. You're better off finding the most connected node in that city and opening 1 channel. So is everyone else.

Cost of capital constraints in payments creating network concentration is well established in TradFi. That's why correspondent banking exists. Banks who want to route payments to other banks can directly open nostro accounts with every other bank, but that's crazy expensive.

So most banks open one account at a correspondent bank. This is a lot more capital efficient, but also means a few big banks become hubs for virtually all payments. If LN ever takes off, it will have the same severe channel concentration. But is that bad?

Not necessarily, because LN does protect user funds and you can always default to L1 to get your BTC back. But it does mean LN is not the panacea maxis make it out to be. Major hubs can censor particular users, or be forced to shut down by the government, causing disruption.

Also, the concentration issue is 10x worse for other assets (like stablecoins) which some people fantasize will live on LN. Technically it's doable, but even less liquidity for that asset will result in even greater concentration of the network graph.

LN also has technical limitations (e.g., the current need to run your own node). Those might be solved eventually, but cost of capital can't be. Add them together and you end up with the present state: custodial solutions, ironically offered by the prophets of self-custody.

@Strike is a custodial solution, as is @jack's @CashApp. $MSTR LN bitcoin rewards appear to be too. I'm sympathetic why - it's impossible to expand adoption otherwise. And ultimately why bother? Non-custodial users would still just open 1 channel with a custodial hub like Strike.

It would be one thing if the vocal proponents talked openly about these limitations. Instead they wax poetic about how Lightning will magically fix all of Bitcoin's problems, offering stablecoins and DeFi too! Such a waste of time and energy.

That's not to say LN isn't useful. It's awesome tech for building on-chain clearinghouse for exchanges and connecting custodial wallet providers. There are probably other uses, but "decentralized Visa on Bitcoin" aint one of them.

That means the search for a more useful and less concentrated L2 on #Bitcoin continues. One reason I support the "fucking around" thesis of @udiWertheimer and @ercwl is Bitcoin needs a lot more experimentation. Maybe rollups or some Ordinal based L2 is the answer. Let's find out!

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter