/1 This beautiful Friday researchers from @blockworksres dropped a very solid and very detailed thread on how $crvUSD keeps peg.

So I decided to do a short thread of my own with a few additional comments and thoughts.

Let's dive in....

$CRV $CVX #DeFi

So I decided to do a short thread of my own with a few additional comments and thoughts.

Let's dive in....

$CRV $CVX #DeFi

https://twitter.com/blockworksres/status/1662105313598898177

/2 PegKeepers will be very busy generating profits for the Curve DAO during times of increased soft liquidations when the market experiences downside volatility (especially if the pegs of various LSD collaterals come under pressure), as there would be increased demand for crvUSD.

/3 LPs in the 4 $crvUSD stability pools will also profit from the actions of the PegKeeper from all the additional volume and fees it generates during times of peg volatility (up and down).

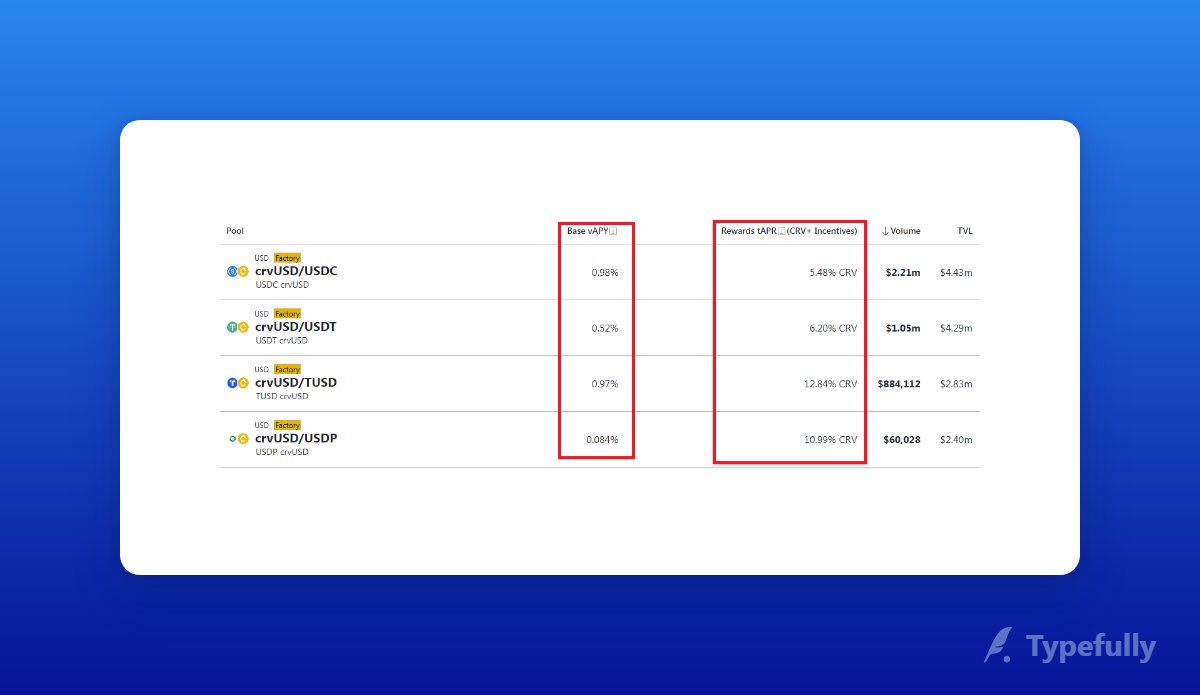

/4 Since there is a dedicated PegKeeper for each of the 4 $crvUSD stability pools, choosing which pool(s) to LP can be a strategy in itself, as each pools will have different $CRV APY(affected by CRV/CVX bribes) and base APY(affected by PegKeeper actions)

https://twitter.com/blockworksres/status/1662105322604077057

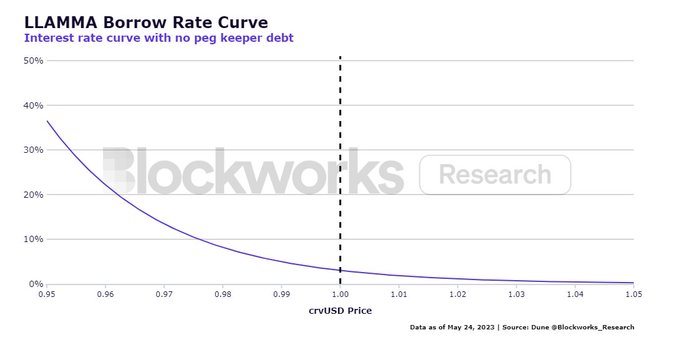

/5 In strong bull markets where many investors are swapping stables for risk assets, stables come under pressure quite frequently. If $crvUSD peg comes under sustained pressure in a strong bull market from borrowers & traders despite action of PegKeeper...

https://twitter.com/blockworksres/status/1662105340530548741

/6 .. the slope of the $crvUSD borrow interest rate curve will steepen quite a bit to force existing borrowers to decrease some of their crvUSD debt, which pushes the price of crvUSD back up.

https://twitter.com/blockworksres/status/1662105370138136576

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter