The markets are doing well since the last few days.

Here are some stock market memes to add to the cheer.

A thread🧵⬇️

1/ The chances of recession in India are low. That’s why FIIs are pouring money into Indian stock markets.

Welcome back FIIs, have a long stay. twitter.com/i/web/status/1…

Here are some stock market memes to add to the cheer.

A thread🧵⬇️

1/ The chances of recession in India are low. That’s why FIIs are pouring money into Indian stock markets.

Welcome back FIIs, have a long stay. twitter.com/i/web/status/1…

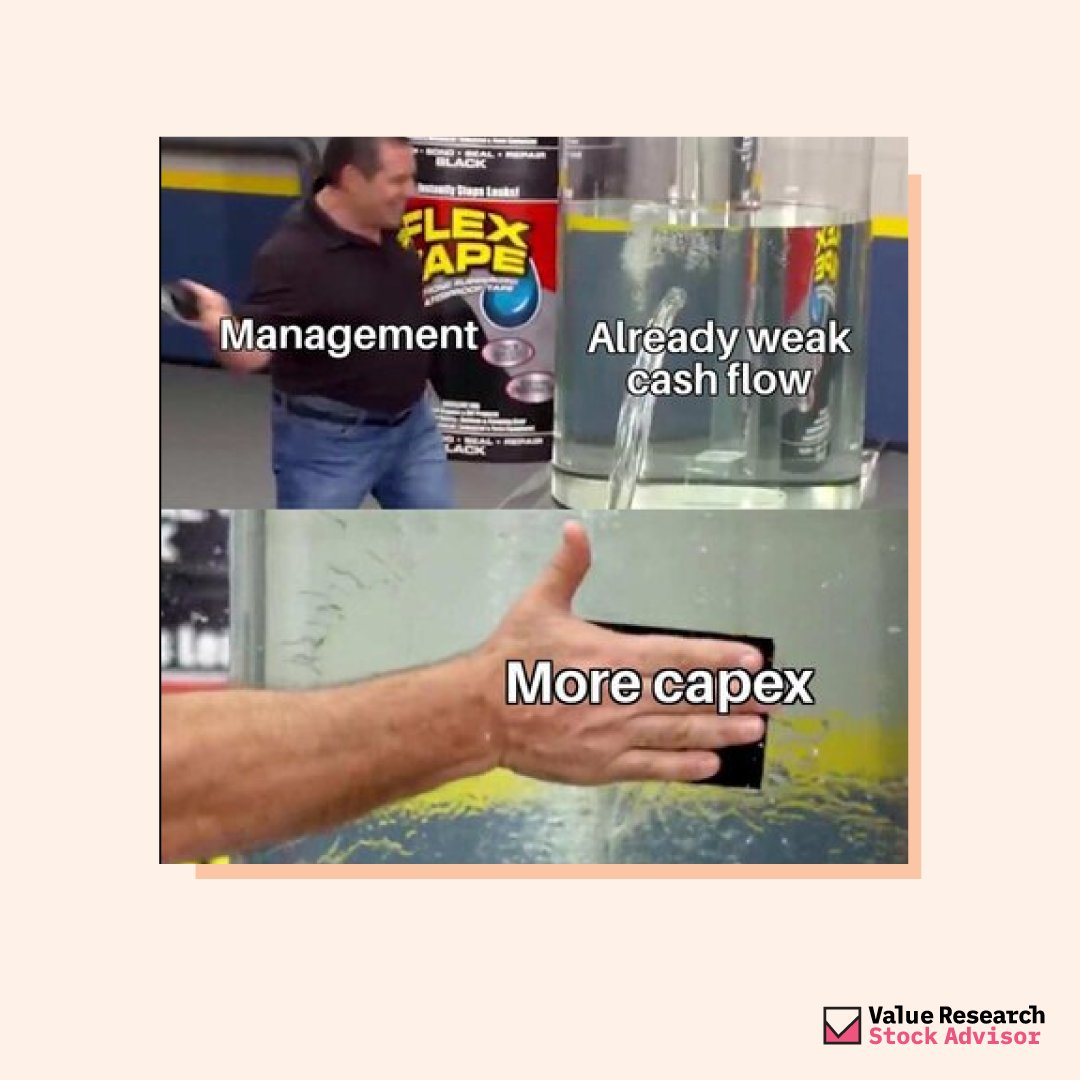

4/ Some companies struggle to meet working capital requirements yet they splurge on capex. It’s like plugging holes in a sinking ship.

5/ Just when Axis Bank investors thought they were out of the woods, this happened.

The company posted a loss of Rs. 5,700 crores after acquiring Citi India’s consumer business. I guess it will take some time for Axis bank to get back up from that blow.

The company posted a loss of Rs. 5,700 crores after acquiring Citi India’s consumer business. I guess it will take some time for Axis bank to get back up from that blow.

6/ You may think fast food chains are profitable.

But due to slim profit margins, it is hard to run one without intense belt-tightening.

But due to slim profit margins, it is hard to run one without intense belt-tightening.

7/

Check out Laughing Stock every Saturday for your weekly dose of humour.

Full article:➡️ bit.ly/3oyVQo4

#investing #stockmarketmeme #investingmeme #StockMarketindia

Check out Laughing Stock every Saturday for your weekly dose of humour.

Full article:➡️ bit.ly/3oyVQo4

#investing #stockmarketmeme #investingmeme #StockMarketindia

• • •

Missing some Tweet in this thread? You can try to

force a refresh