ROAD MAP THREAD:

There are at least 5 things Congress calls “spending.”

1. Budgets from budget committee.

2. Authorizations to spend money from various committees.

3. Appropriations from approps committee.

4. Entitlements/nondiscretionary spending by law.

5. Debt limit.

There are at least 5 things Congress calls “spending.”

1. Budgets from budget committee.

2. Authorizations to spend money from various committees.

3. Appropriations from approps committee.

4. Entitlements/nondiscretionary spending by law.

5. Debt limit.

BUDGET

It’s an aspirational guideline that typically covers 10 years. It’s reported from the House Budget committee. Years 2 thru 10 are routinely ignored. It considers discretionary and non-discretionary spending. Ironically it’s not very relevant to Congressional spending.

It’s an aspirational guideline that typically covers 10 years. It’s reported from the House Budget committee. Years 2 thru 10 are routinely ignored. It considers discretionary and non-discretionary spending. Ironically it’s not very relevant to Congressional spending.

AUTHORIZATIONS

An example would be the Science committee authorizes $5 billion per year for 6 years to be spent at NASA. This makes it legal for Congress to spend UP TO that amount of money.

Surprisingly many government departments are not authorized, and operate on waivers.

An example would be the Science committee authorizes $5 billion per year for 6 years to be spent at NASA. This makes it legal for Congress to spend UP TO that amount of money.

Surprisingly many government departments are not authorized, and operate on waivers.

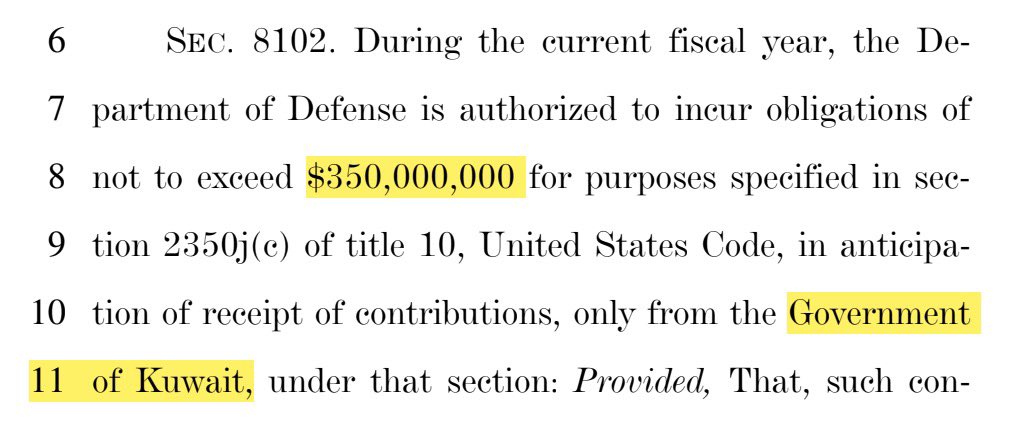

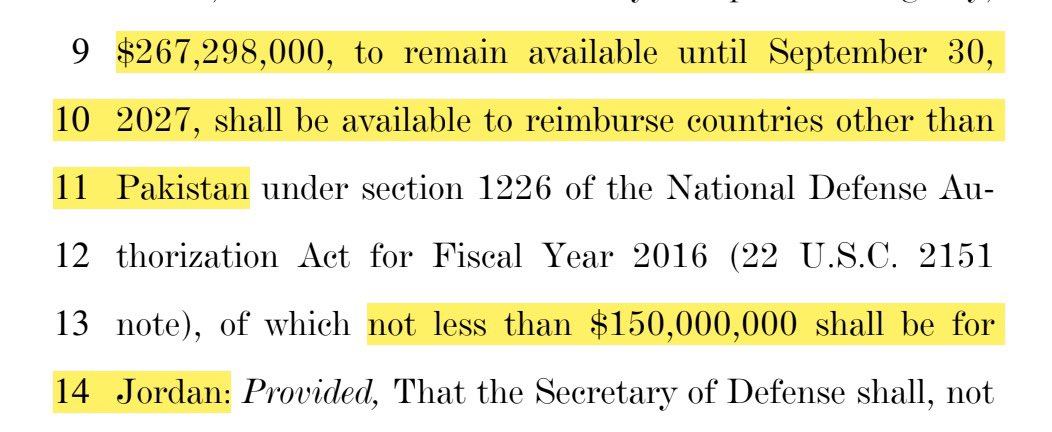

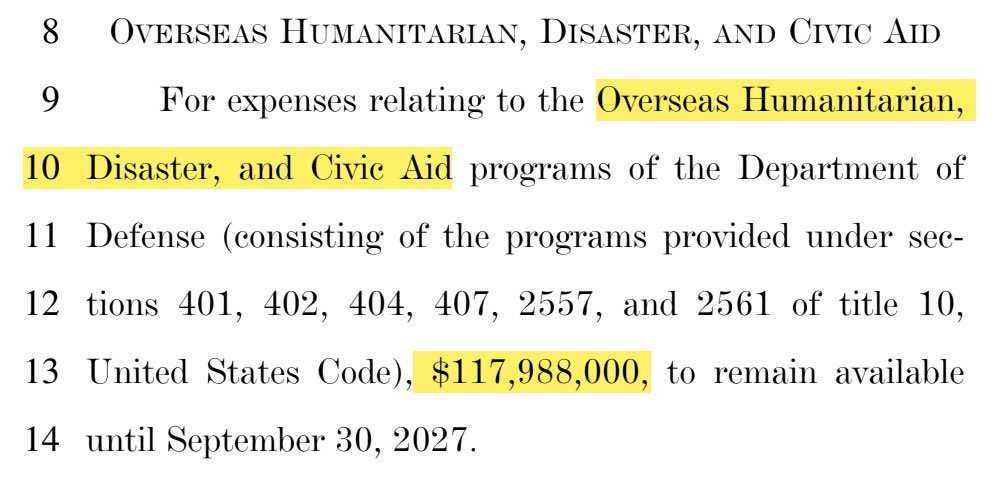

APPROPRIATIONS

This is where most of the action is.

Don’t like something? Don’t fund it! Congress is supposed to pass 12 separate approps bills, but most often devolves into passing an omnibus or CR. These bills are due Oct 1, and if not passed, the government shuts down.

This is where most of the action is.

Don’t like something? Don’t fund it! Congress is supposed to pass 12 separate approps bills, but most often devolves into passing an omnibus or CR. These bills are due Oct 1, and if not passed, the government shuts down.

NON-DISCRETIONARY

These are government programs like Social Security and Medicare that are not affected by annual appropriations bills. They do not stop during a government shut down. Historically, they constitute about 3/4 of government spending, and they are rarely modified.

These are government programs like Social Security and Medicare that are not affected by annual appropriations bills. They do not stop during a government shut down. Historically, they constitute about 3/4 of government spending, and they are rarely modified.

DEBT LIMIT

When the prior statutory debt limit is reached, Congress, in order to keep spending money it doesn’t have, typically authorizes debt to be incurred for which Americans will be liable. The debt limit can be raised a certain amount or suspended for a certain time.

When the prior statutory debt limit is reached, Congress, in order to keep spending money it doesn’t have, typically authorizes debt to be incurred for which Americans will be liable. The debt limit can be raised a certain amount or suspended for a certain time.

If you have followed my thread to this point, you now understand more about the ways in which Congress spends money than I did when I first got elected.

Unfortunately the mainstream media and my colleagues frequently conflate these different methods Congress uses to spend money.

Unfortunately the mainstream media and my colleagues frequently conflate these different methods Congress uses to spend money.

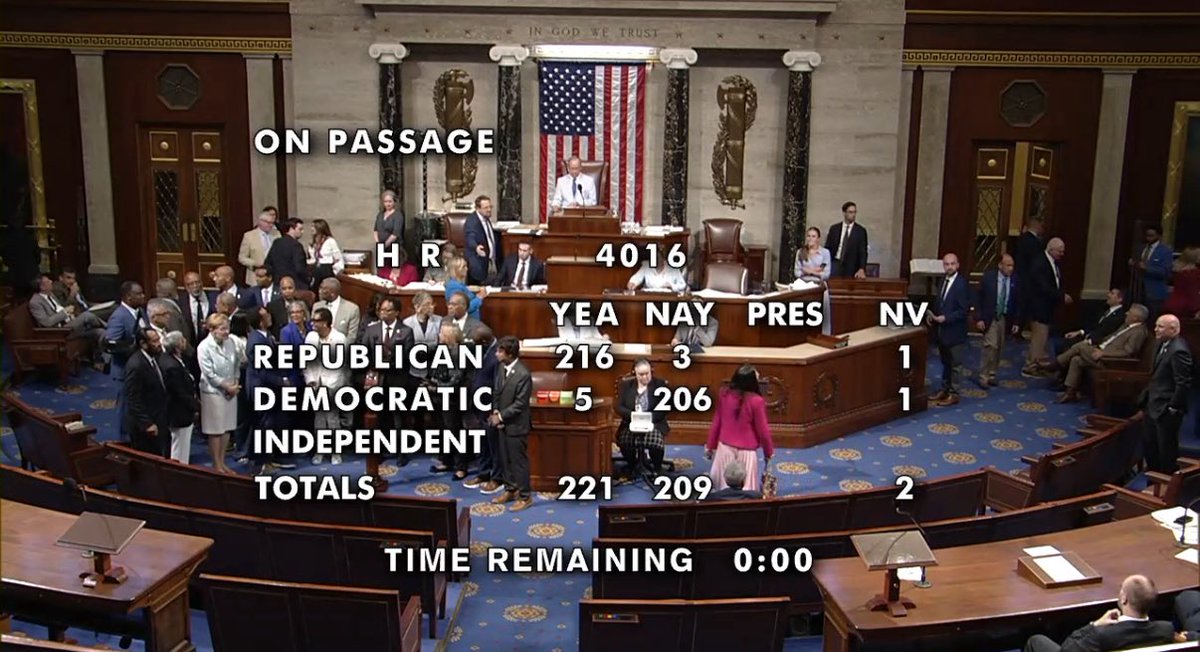

In order to simplify, I’ve left out some details of Congressional process, and in doing so have opened myself up to valid critiques of my technical correctness, but I hope at this point to have established a framework for now conveying my message:

Conditioning an increase in the debt limit upon opaquely negotiated concessions from the President is one way to get things done.

But we can and should control spending more transparently and precisely using powerful Congressional tools such as the upcoming appropriations bills.

But we can and should control spending more transparently and precisely using powerful Congressional tools such as the upcoming appropriations bills.

• • •

Missing some Tweet in this thread? You can try to

force a refresh