$BNB chain has the third highest TVL of $4.5Billion.

But some are not sure which projects to Invest in #BSC.

List of my Top 7 project picks on @BNBCHAIN 🧵

But some are not sure which projects to Invest in #BSC.

List of my Top 7 project picks on @BNBCHAIN 🧵

1/ Radiant Capital

@RDNTCapital is an omnichain protocol where users can deposit any major asset on any major chain and borrow various supported assets across multiple chains.

Total Market Size on BSC - $240M

Below are the assets on the BNB chain.

@RDNTCapital is an omnichain protocol where users can deposit any major asset on any major chain and borrow various supported assets across multiple chains.

Total Market Size on BSC - $240M

Below are the assets on the BNB chain.

2/ Thena

@ThenaFi_ is a Ve(3,3) protocol on BSC that has improved the Solidly model with new features such as NFTs, Referrals and Gauges.

TVL of Thena - $73.13M

Market Cap - $3.8M

@ThenaFi_ is a Ve(3,3) protocol on BSC that has improved the Solidly model with new features such as NFTs, Referrals and Gauges.

TVL of Thena - $73.13M

Market Cap - $3.8M

3/ Velvet Capital

@Velvet_Capital

is a DeFi operating system that helps institutions launch and manage financial products on-chain.

It allows users to create tokenized funds and yield farming strategies.

Below is a list of portfolios in which users can invest:

@Velvet_Capital

is a DeFi operating system that helps institutions launch and manage financial products on-chain.

It allows users to create tokenized funds and yield farming strategies.

Below is a list of portfolios in which users can invest:

4/ Alpaca Finance

@AlpacaFinance is the largest lending protocol allowing leveraged yield farming on BNB Chain.

It helps lenders earn safe and stable yields, and offers borrowers undercollateralized loans for leveraged yield farming positions.

TVL of Alpaca - $381M

@AlpacaFinance is the largest lending protocol allowing leveraged yield farming on BNB Chain.

It helps lenders earn safe and stable yields, and offers borrowers undercollateralized loans for leveraged yield farming positions.

TVL of Alpaca - $381M

5/ Level Finance

@Level__Finance is a perpetual DEX on Binance Smart chain that provides Real Yield to its users.

Its focus is on providing clear risk management solutions for liquidity providers.

TVL of Level Finance - $29.04M

@Level__Finance is a perpetual DEX on Binance Smart chain that provides Real Yield to its users.

Its focus is on providing clear risk management solutions for liquidity providers.

TVL of Level Finance - $29.04M

6/ Wombat Exchange

@WombatExchange is Scalable, low slippage, and single-sided staking stableswap backed by Binance Labs.

TVL of Wombat -$95.73M

Below are some of the pools available on Wombat:

@WombatExchange is Scalable, low slippage, and single-sided staking stableswap backed by Binance Labs.

TVL of Wombat -$95.73M

Below are some of the pools available on Wombat:

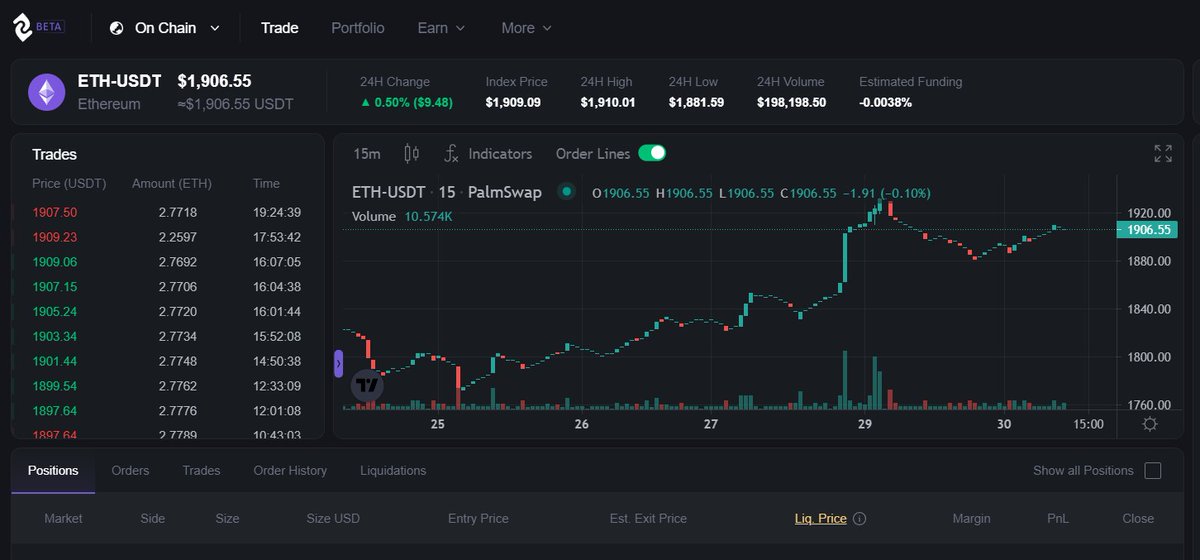

7/ Palm Swap

@Palmswaporg is a perpetual DEX on BSC that provides leverage up to 50X.

Their synthetic architecture makes Palmswap more capital-efficient than any existing platform.

They will be releasing V2 soon, which is the first single asset liquidity perpetual DEX on BSC.

@Palmswaporg is a perpetual DEX on BSC that provides leverage up to 50X.

Their synthetic architecture makes Palmswap more capital-efficient than any existing platform.

They will be releasing V2 soon, which is the first single asset liquidity perpetual DEX on BSC.

I will be adding 2 more projects and posting a list of 9 projects on my newsletter soon, so subscribe if you dont't want to miss out :

Tagging some Giga Brains :

@CryptoShiro_

@rektdiomedes

@0xSalazar

@crypto_linn

@Slappjakke

@Louround_

@Deebs_DeFi

@0xsurferboy

@poopmandefi

@DeFiMinty

@Flowslikeosmo

@FarmerTuHao

@wacy_time1

@CryptoStreamHub

@francescoweb3

@arndxt_xo

@0xFinish

@the_smart_ape

@CryptoShiro_

@rektdiomedes

@0xSalazar

@crypto_linn

@Slappjakke

@Louround_

@Deebs_DeFi

@0xsurferboy

@poopmandefi

@DeFiMinty

@Flowslikeosmo

@FarmerTuHao

@wacy_time1

@CryptoStreamHub

@francescoweb3

@arndxt_xo

@0xFinish

@the_smart_ape

If you enjoyed this thread,

• do follow me @Hercules_Defi

• please retweet the below tweet to spread knowledge:

• do follow me @Hercules_Defi

• please retweet the below tweet to spread knowledge:

https://twitter.com/Hercules_Defi/status/1663590260788576256

• • •

Missing some Tweet in this thread? You can try to

force a refresh