Here's 16 reasons why the Stage 3 tax cuts should be scrapped 🧵

1/ FACT: the Stage 3 tax cuts are massively expensive and massively unfair

They will cost at least $254 billion over a decade, of which $117.6 billion will go to those earning more than $180,000 a year. #auspol

1/ FACT: the Stage 3 tax cuts are massively expensive and massively unfair

They will cost at least $254 billion over a decade, of which $117.6 billion will go to those earning more than $180,000 a year. #auspol

2/

Every dollar of the Stage 3 tax cuts to the wealthy ($254billion), is a dollar not spent on government services that are crying out for funds like Aged Care and Medicare, or increasing the rate of Jobseeker above the poverty line. #auspol

Every dollar of the Stage 3 tax cuts to the wealthy ($254billion), is a dollar not spent on government services that are crying out for funds like Aged Care and Medicare, or increasing the rate of Jobseeker above the poverty line. #auspol

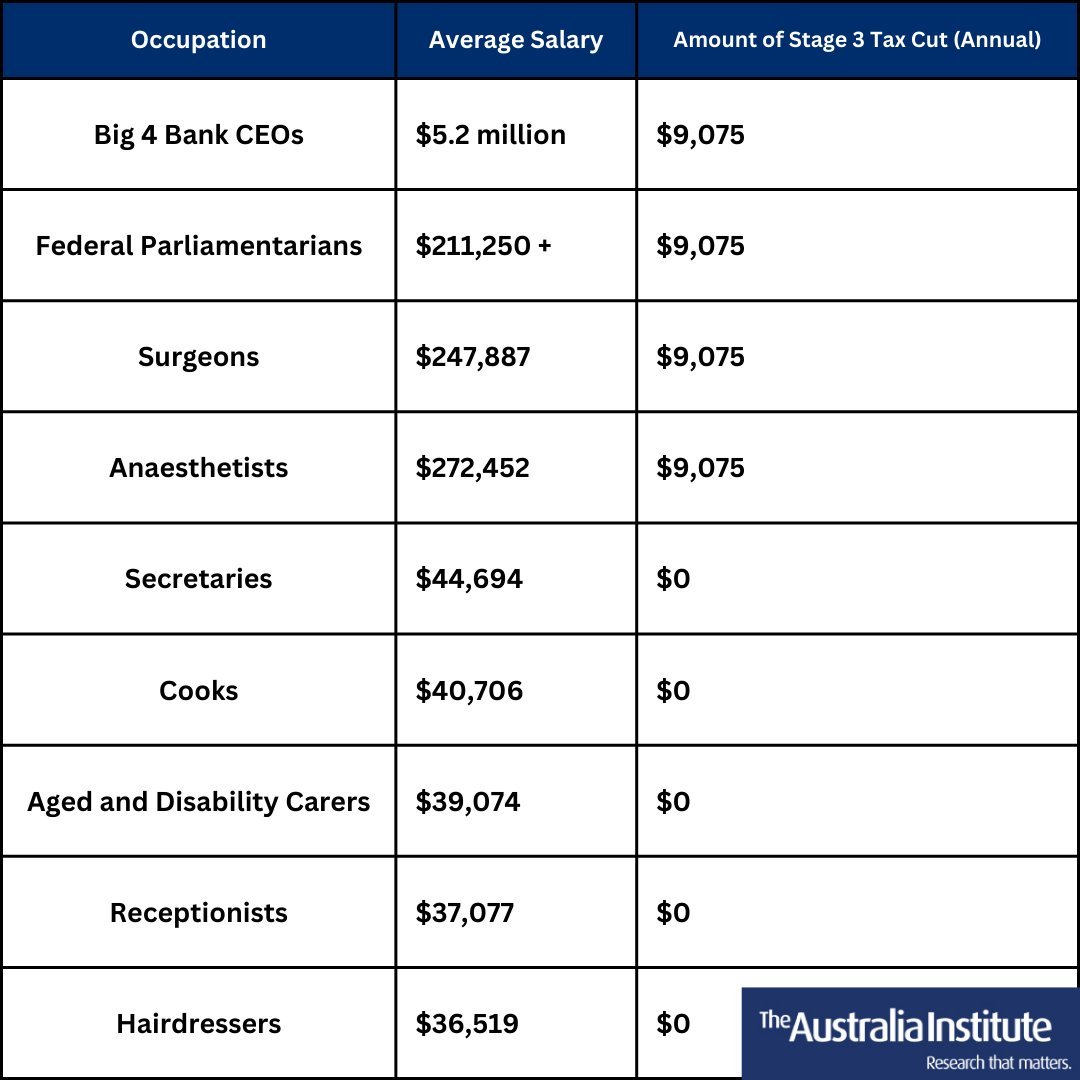

3/ They will give bankers, surgeons, and MPs an extra $9075 a year, while hospo workers get nothing.

Australia is in the middle of a cost-of-living crisis, and the Stage 3 tax cuts will deliver 0 for those struggling to make ends meet on the minimum wage or low incomes. #auspol

Australia is in the middle of a cost-of-living crisis, and the Stage 3 tax cuts will deliver 0 for those struggling to make ends meet on the minimum wage or low incomes. #auspol

4/ Men get twice as much benefit as women.

For every dollar of Stage 3 tax cuts women get, men will get two dollars. This will only serve to increase the wealth divide, and worsen gender inequality. #auspol

For every dollar of Stage 3 tax cuts women get, men will get two dollars. This will only serve to increase the wealth divide, and worsen gender inequality. #auspol

5/ Gen Z will receive only 2.8% of the Stage 3 tax cuts in the first year.

Despite making up 12.7% of taxpayers, Gen Z (those under 25) will only receive 2.8% of the benefit in the first year of operation of the Stage 3 tax cuts. #auspol

Despite making up 12.7% of taxpayers, Gen Z (those under 25) will only receive 2.8% of the benefit in the first year of operation of the Stage 3 tax cuts. #auspol

6/ Rural & regional areas miss out, metro areas get most of the benefit.

Of the 20 electorates that get the least benefit from Stage 3, 12 are rural seats (60%). Of the 20 that get the most benefit, 17 are inner metro seats, with half in Sydney, a quarter in Melbourne. #auspol

Of the 20 electorates that get the least benefit from Stage 3, 12 are rural seats (60%). Of the 20 that get the most benefit, 17 are inner metro seats, with half in Sydney, a quarter in Melbourne. #auspol

7/ The Stage 3 tax cuts will be responsible for up to 42% of the Budget deficit in 2025-26.

Treasury estimates the Budget deficit in 2025-26 will fall to $49.6b, but the cost of Stage 3 cuts in that year will rise to $20.8b. #auspol

Treasury estimates the Budget deficit in 2025-26 will fall to $49.6b, but the cost of Stage 3 cuts in that year will rise to $20.8b. #auspol

8/ The Stage 3 tax cuts were promised in wildly different economic circumstances.

We’re now facing a cost of living crisis, skyrocketing inflation, and a potential recession. Doesn’t really seem like a good time to blow more money on tax funds for the rich, does it? #auspol

We’re now facing a cost of living crisis, skyrocketing inflation, and a potential recession. Doesn’t really seem like a good time to blow more money on tax funds for the rich, does it? #auspol

9/ More than 50% of the Stage 3 tax cuts goes to the top 10% of taxpayers.

If these tax cuts are really supposed to provide cost-of-living relief, giving most of them to those who need it least is incredibly badly thought-out. #auspol

If these tax cuts are really supposed to provide cost-of-living relief, giving most of them to those who need it least is incredibly badly thought-out. #auspol

10/ Stage 3 will do little more than add to aggregate demand and inflation.

Inflation is estimated to still be above the RBA target range when the tax cuts come into effect. Because the RBA is focused on reducing inflation it will keep interest rates higher for longer. #auspol

Inflation is estimated to still be above the RBA target range when the tax cuts come into effect. Because the RBA is focused on reducing inflation it will keep interest rates higher for longer. #auspol

11/ Over 100 economists and tax experts agree the Stage 3 tax cuts are unfair & unaffordable.

Over 100 economists and tax experts have published an open letter in the SMH and the Age newspapers, calling on the PM to reconsider the Stage 3 tax cuts for high income earners.#auspol

Over 100 economists and tax experts have published an open letter in the SMH and the Age newspapers, calling on the PM to reconsider the Stage 3 tax cuts for high income earners.#auspol

12/ Almost twice as many Australians support the Labor Government repealing the Stage 3 tax cuts (41%) than oppose (22%).

Just 15% say proceeding with Stage 3 is better for Australia’s long term national interests than increased spending on health, education, or defence. #auspol

Just 15% say proceeding with Stage 3 is better for Australia’s long term national interests than increased spending on health, education, or defence. #auspol

13/ The Stage 3 tax cuts remove the 37% tax bracket entirely, flattening Australia’s income tax system and reducing its progressive nature.

It’s a progressive system designed to promote equality, that has served Australia well. #auspol

It’s a progressive system designed to promote equality, that has served Australia well. #auspol

14/ Stage 3 is a permanent hit to Australia’s revenue base. The LMITO (low and middle income tax offset) was a temporary measure, and ended last year.

Delivering temporary fixes for the poor, permanent boosts to the wealthy, and flattening our progressive tax system. #auspol

Delivering temporary fixes for the poor, permanent boosts to the wealthy, and flattening our progressive tax system. #auspol

15/ Even the IMF thinks the Stage 3 tax cuts are risky.

An IMF report on the Australian economy underscored the economic and budgetary risks of proceeding with the Stage 3 Tax Cuts for high income earners. #auspol

australiainstitute.org.au/post/imf-repor…

An IMF report on the Australian economy underscored the economic and budgetary risks of proceeding with the Stage 3 Tax Cuts for high income earners. #auspol

australiainstitute.org.au/post/imf-repor…

16/ FACT: those on lower incomes are more affected by bracket creep than higher incomes

Although those on lower incomes are more affected by bracket creep, Stage 3 disproportionally compensates people on higher incomes for bracket creep. #auspol

Although those on lower incomes are more affected by bracket creep, Stage 3 disproportionally compensates people on higher incomes for bracket creep. #auspol

It’s time to scrap the Stage 3 tax cuts.

Add your name to our petition. #auspol

nb.australiainstitute.org.au/scrap_stage_3_…

Add your name to our petition. #auspol

nb.australiainstitute.org.au/scrap_stage_3_…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter