Detailed Analysis of #Pricol - An auto ancillary that can benefit tremendously from the EV megatrend. ⚡🚗

CMP - ₹232

Like and retweet for maximum reach!!

CMP - ₹232

Like and retweet for maximum reach!!

1. Company Overview

• Pricol Ltd manufactures Driver Information & Connected Vehicle Systems, Controls and actuations and Battery Management Systems. Their legacy products are Display Clusters and Telematics.

• Pricol Ltd manufactures Driver Information & Connected Vehicle Systems, Controls and actuations and Battery Management Systems. Their legacy products are Display Clusters and Telematics.

• It caters to 2 wheeler, Commercial, Off-road and Passenger Vehicles. It is the world’s 2nd Largest Driver Information System manufacturer for the 2 wheeler segment.

• Most of the company’s products are fuel hybrid, that means they can be used for Petrol, Hydrogen &

• Most of the company’s products are fuel hybrid, that means they can be used for Petrol, Hydrogen &

Battery Vehicles.

• In the last four decades, Pricol has become a reputed global brand in the automotive instruments and products business.

• In the last four decades, Pricol has become a reputed global brand in the automotive instruments and products business.

3. Legacy Products

a. Driver Information System (DIS)

It is used to indicate the changing parameters in the vehicle such as Speed, Engine RPM, Engine Temperature, Fuel Level, Fuel Economy, Service Reminder, Phone Connect, Navigation Assist & Various Warning Indicators.

a. Driver Information System (DIS)

It is used to indicate the changing parameters in the vehicle such as Speed, Engine RPM, Engine Temperature, Fuel Level, Fuel Economy, Service Reminder, Phone Connect, Navigation Assist & Various Warning Indicators.

b. Telematics

The telematics combines GPS systems, onboard vehicle diagnostics, wireless telematics devices, and black box technologies to record and transmit vehicle data, such as speed, location, maintenance requirements and servicing, and cross-reference this data with the

The telematics combines GPS systems, onboard vehicle diagnostics, wireless telematics devices, and black box technologies to record and transmit vehicle data, such as speed, location, maintenance requirements and servicing, and cross-reference this data with the

vehicle's internal behaviour.

4. Partnerships

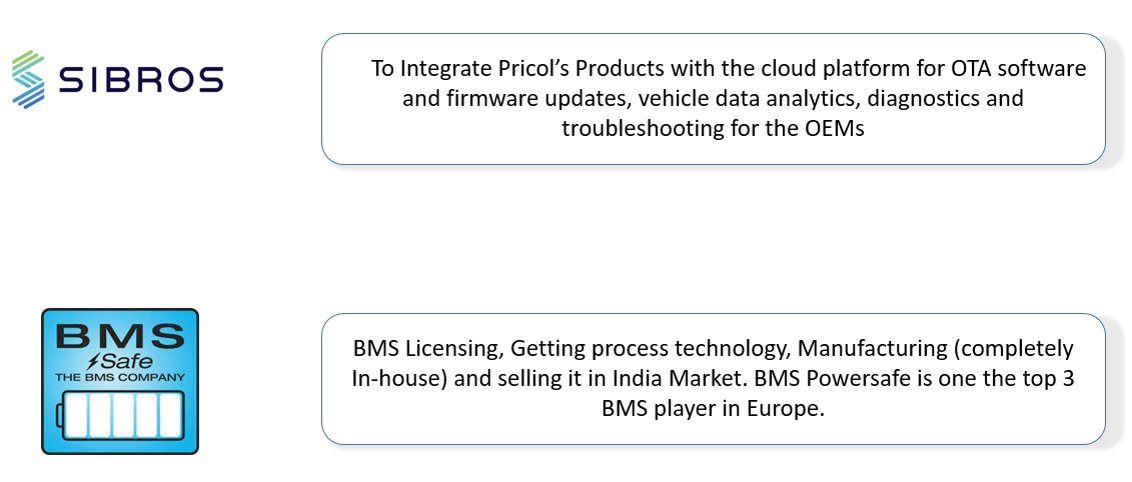

• Partnerships have helped Pricol to advance its technology to keep up with the market. In the last few years, the product has shifted more towards software from the electrical and mechanical style.

4. Partnerships

• Partnerships have helped Pricol to advance its technology to keep up with the market. In the last few years, the product has shifted more towards software from the electrical and mechanical style.

• With its partnership with BMS Safe, Pricol is able to fully manufacture Battery Management Systems in India. It has already started manufacturing BMS for 2 wheelers.

5. Management

5. Management

6. Clients

• For specific clients like Tata Motors, Mahindra, and Force Motors, the company has a 48% market share in DIS.

• Commercial Vehicle is a very large segment that Pricol operates in. They enjoys a 58% market share in DIS & 96% market share in off-road segment of DIS.

• For specific clients like Tata Motors, Mahindra, and Force Motors, the company has a 48% market share in DIS.

• Commercial Vehicle is a very large segment that Pricol operates in. They enjoys a 58% market share in DIS & 96% market share in off-road segment of DIS.

• The company supplies to 40 vehicle platforms in India and is actively working with BMW and supplies products to Harley Davidson, Triumph, Ducati, and KTM.

• It mostly supplies fluid control systems such as Oil pump & Fuel pumps to their export clients.

• It mostly supplies fluid control systems such as Oil pump & Fuel pumps to their export clients.

7. Capex

• The Company has the capacity to generate ₹180-200 crores of topline per month.

• It has planned the Capex of ₹600 crores over the next 24 months, out of which ₹400 Crores will be funded internally and ₹200 crores via debt.

• The Company has the capacity to generate ₹180-200 crores of topline per month.

• It has planned the Capex of ₹600 crores over the next 24 months, out of which ₹400 Crores will be funded internally and ₹200 crores via debt.

• Post Capex, they will have the capacity in place to generate ₹4000 crore in topline.

8. Financials

8. Financials

9. Future Outlook

• The domestic as well as Global Automotive Industry is expecting growth. As the Pricol’s major products are Fuel hybrids they are not affected by the shift from ICE to EV.

• The Company has projected a revenue of ₹4000 Crores by FY2026. Out of this revenue,

• The domestic as well as Global Automotive Industry is expecting growth. As the Pricol’s major products are Fuel hybrids they are not affected by the shift from ICE to EV.

• The Company has projected a revenue of ₹4000 Crores by FY2026. Out of this revenue,

₹3600 Crores will be Organic & rest Inorganic

• The EBITDA margin for coming years will be around 13%

• The business may be split into 3 three different verticals in the future for better supply chain & managing efficiency.

• The EBITDA margin for coming years will be around 13%

• The business may be split into 3 three different verticals in the future for better supply chain & managing efficiency.

10. Threats

• Pricol is heavily dependent upon imports. 80% of raw materials are imported.

• They have a China dependency, their key supplier is based in China.

• They are directly Impacted by shortage of IC & indirectly by Semiconductors and they have to bear

• Pricol is heavily dependent upon imports. 80% of raw materials are imported.

• They have a China dependency, their key supplier is based in China.

• They are directly Impacted by shortage of IC & indirectly by Semiconductors and they have to bear

Premium Pricing by suppliers.

• The industry as a whole gets heavily affected by change in government norms. It also generally leads to the additional capex.

• The industry as a whole gets heavily affected by change in government norms. It also generally leads to the additional capex.

Join the Micro Cap Club:

bit.ly/3zYY8OS

bit.ly/3zYY8OS

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter