$CRWD is just amazing:

"8 out of 10 times when an enterprise customer tests, they choose CrowdStrike over Microsoft and our win rates across all competitors remained strong in the quarter."

"8 out of 10 times when an enterprise customer tests, they choose CrowdStrike over Microsoft and our win rates across all competitors remained strong in the quarter."

Similar to $PANW, $CRWD seeing consolidation in their Falcon platform:

"In Q1, we closed over 50% more deals involving eight or more modules, compared to a year ago.

We believe this speaks to increasing customer demand for consolidation using the Falcon platform."

"In Q1, we closed over 50% more deals involving eight or more modules, compared to a year ago.

We believe this speaks to increasing customer demand for consolidation using the Falcon platform."

$CRWD generative AI advantage

- LLMs to become commoditized over time but the data they are trained on will not.

- $CRWD has a sustainable data advantage as a result of its petrabytes of existing data and trillions more daily.

- LLMs to become commoditized over time but the data they are trained on will not.

- $CRWD has a sustainable data advantage as a result of its petrabytes of existing data and trillions more daily.

$CRWD > $MSFT

"Enterprise customer with 50k employees told $CRWD the upgrade cost of moving from $MSFT E3 to E5 would be at least $2.3 million more than their subscription and that's just for the upgrade."

"When customers map it all out, they quickly realize that using… twitter.com/i/web/status/1…

"Enterprise customer with 50k employees told $CRWD the upgrade cost of moving from $MSFT E3 to E5 would be at least $2.3 million more than their subscription and that's just for the upgrade."

"When customers map it all out, they quickly realize that using… twitter.com/i/web/status/1…

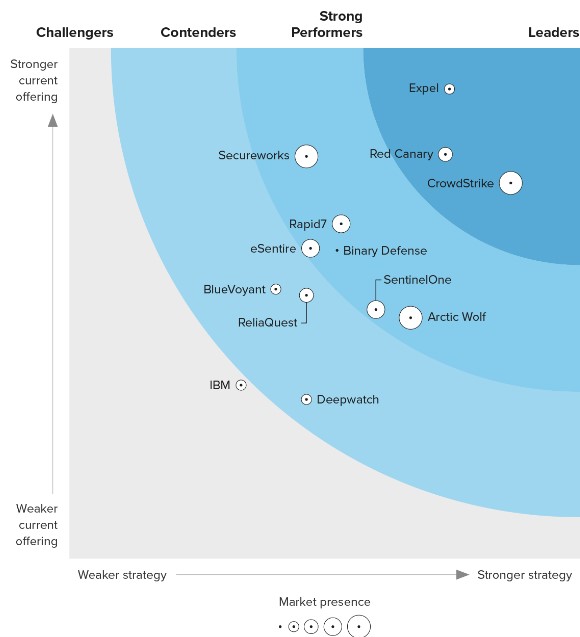

$CRWD catapulted to a leader position in the Forrester Wave for managed detection and response.

$CRWD maintained number-one market share position for the second consecutive year based on Gartner's managed security service report.

$CRWD maintained number-one market share position for the second consecutive year based on Gartner's managed security service report.

As the cybersecurity industry continues to consolidate, $CRWD is the key beneficiary:

"On average, enterprise customers can realize over 200% ROI with Falcon with ROI results like this, it's no surprise companies turn to CrowdStrike."

"On average, enterprise customers can realize over 200% ROI with Falcon with ROI results like this, it's no surprise companies turn to CrowdStrike."

$CRWD

Charlotte AI: A new generative AI security analyst

Charlotte AI is meant to help customers improve security outcomes, lower costs and yield faster results.

Works with OverWatch, Falcon Complete & Intel teams.

Charlotte AI: A new generative AI security analyst

Charlotte AI is meant to help customers improve security outcomes, lower costs and yield faster results.

Works with OverWatch, Falcon Complete & Intel teams.

$CRWD working with $AMZN AWS “to develop powerful new generative AI applications that help customers accelerate their cloud, security, and AI journey.”

Generative AI customers see the benefit of Falcon Cloud Security Complete and I think we will see more generative AI player expand to or take up $CRWD Falcon Cloud Security Complete in the future.

Closing off with $CRWD CEO George Kurtz 4 key points:

1. Clear data advantage built over the past 12 years

2. Introduction of Charlotte AI

3. Consolidation of the security stack

4. Robust business model capable of generating rapid growth at scale, earnings and durable FCF.

1. Clear data advantage built over the past 12 years

2. Introduction of Charlotte AI

3. Consolidation of the security stack

4. Robust business model capable of generating rapid growth at scale, earnings and durable FCF.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter