Buy-side Portfolio Manager | Long term, fundamental, bottom up investing | Weekly deep dive articles & The Barbell Portfolio in Outperforming the Market (link)

2 subscribers

How to get URL link on X (Twitter) App

2. AWS stated that 96% of AI/ML unicorns and 90% of the 2024 Forbes AI 50 are running on AWS.

2. AWS stated that 96% of AI/ML unicorns and 90% of the 2024 Forbes AI 50 are running on AWS.

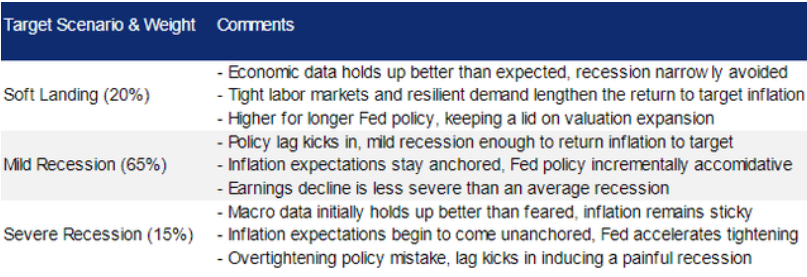

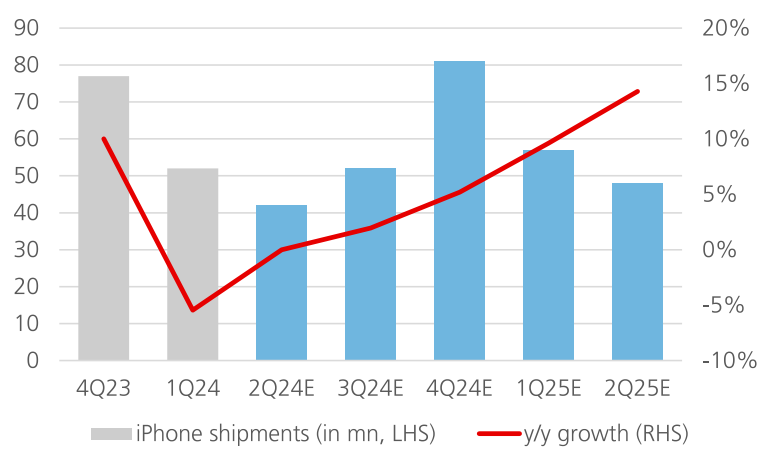

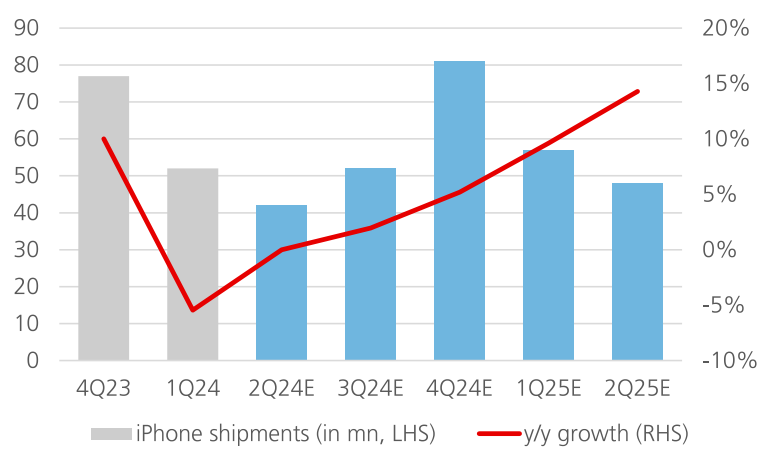

(2/4) Apple's services revenue contribution continues to grow.

(2/4) Apple's services revenue contribution continues to grow.

1. The $PANW question

1. The $PANW question

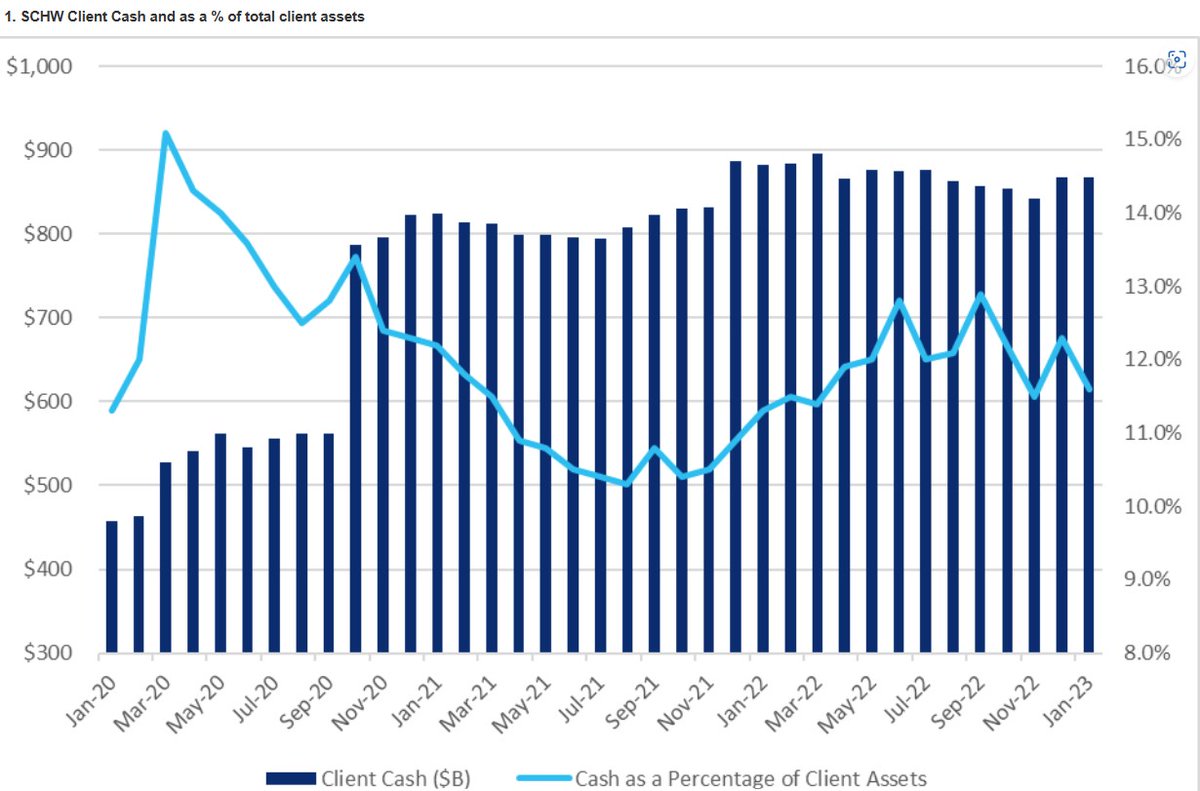

1. 2Q23 results

1. 2Q23 results

1. Upstart is a leading AI lender

1. Upstart is a leading AI lender

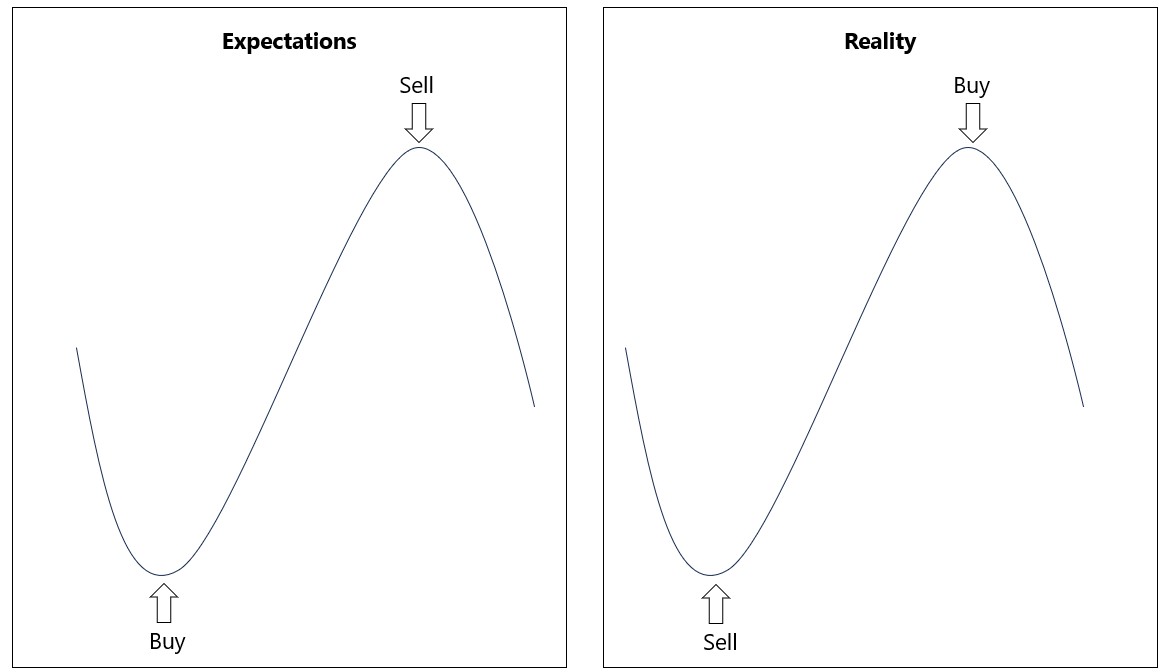

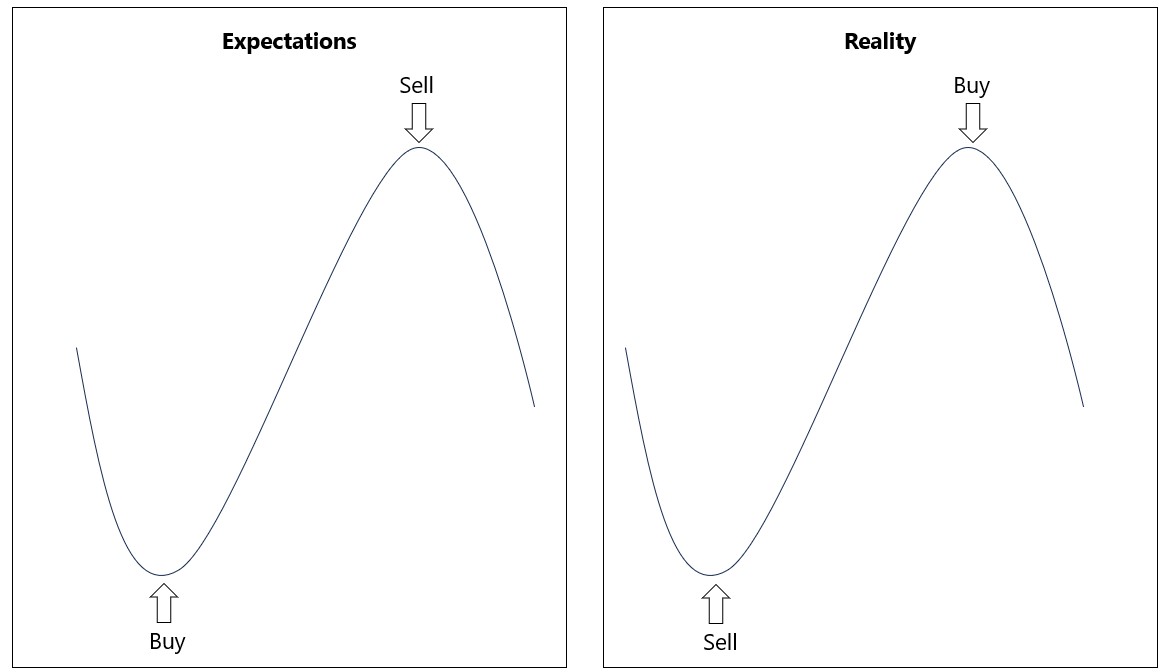

1. Know your game

1. Know your game

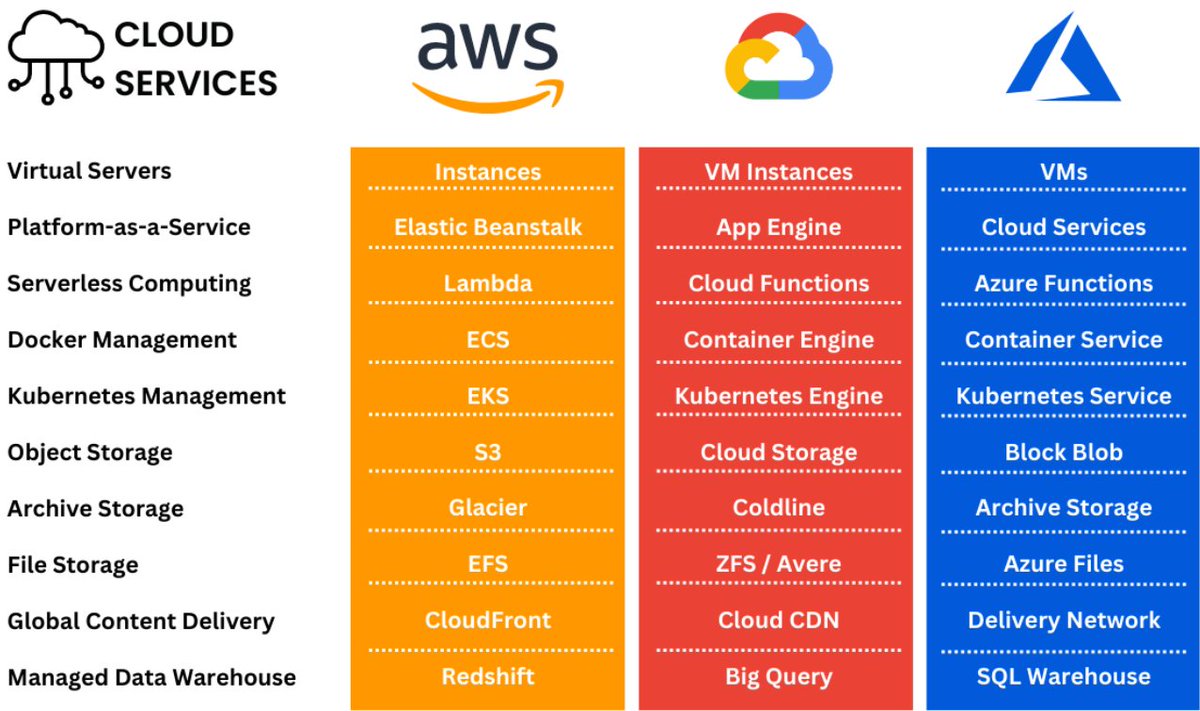

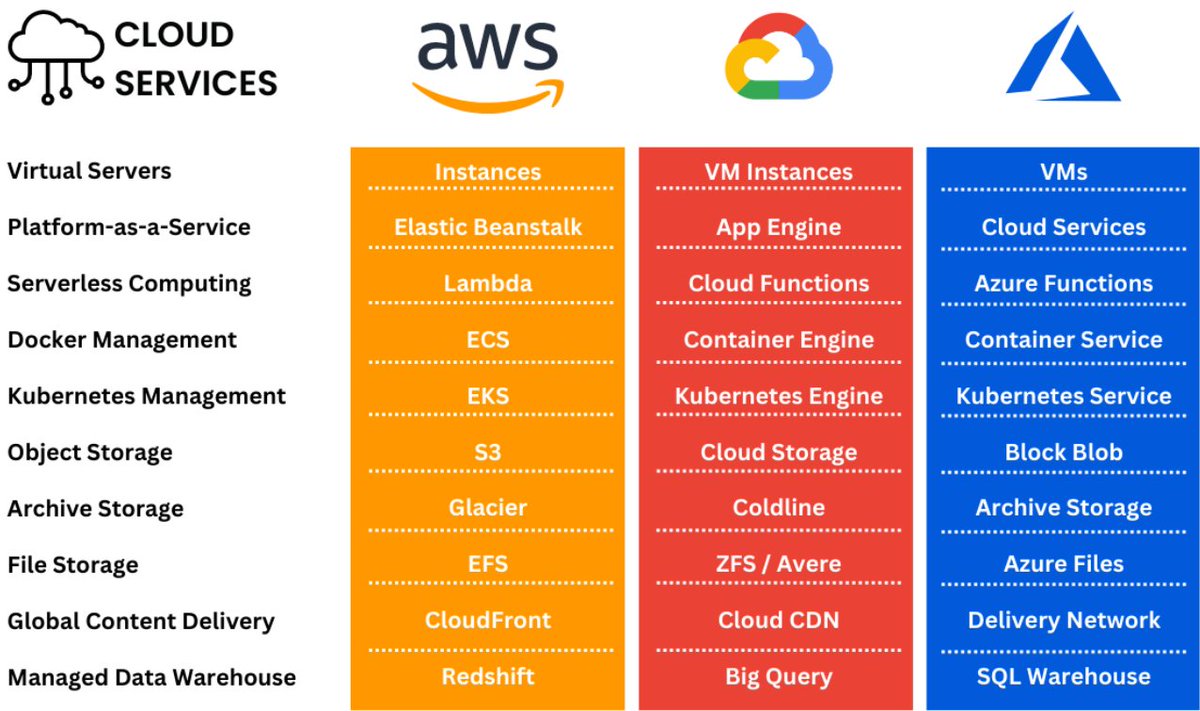

$AMZN AWS

$AMZN AWS

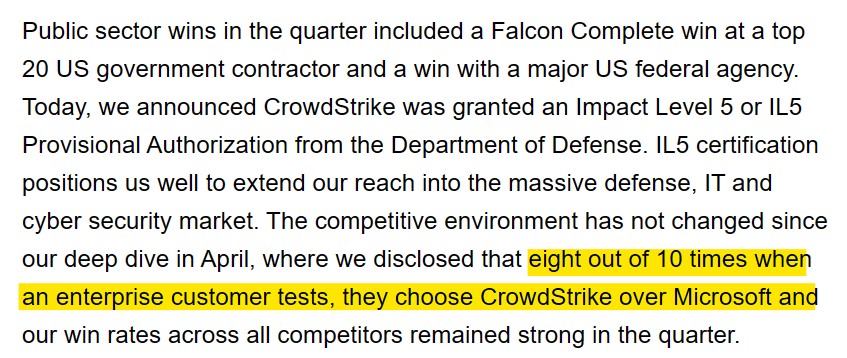

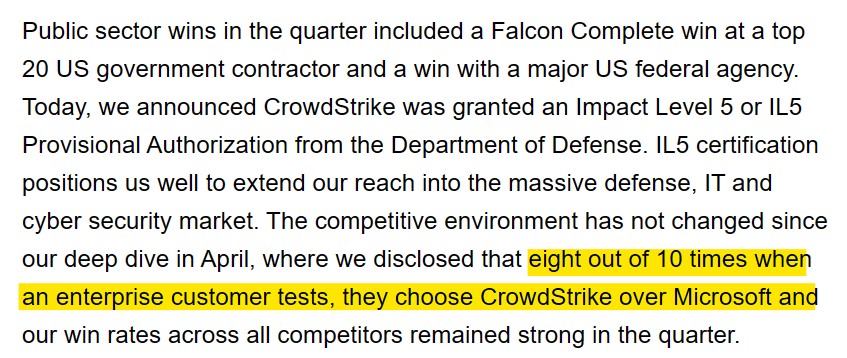

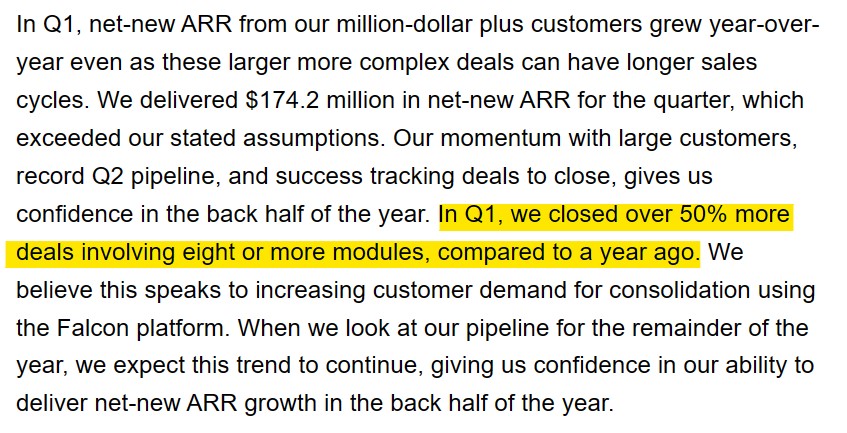

Similar to $PANW, $CRWD seeing consolidation in their Falcon platform:

Similar to $PANW, $CRWD seeing consolidation in their Falcon platform:

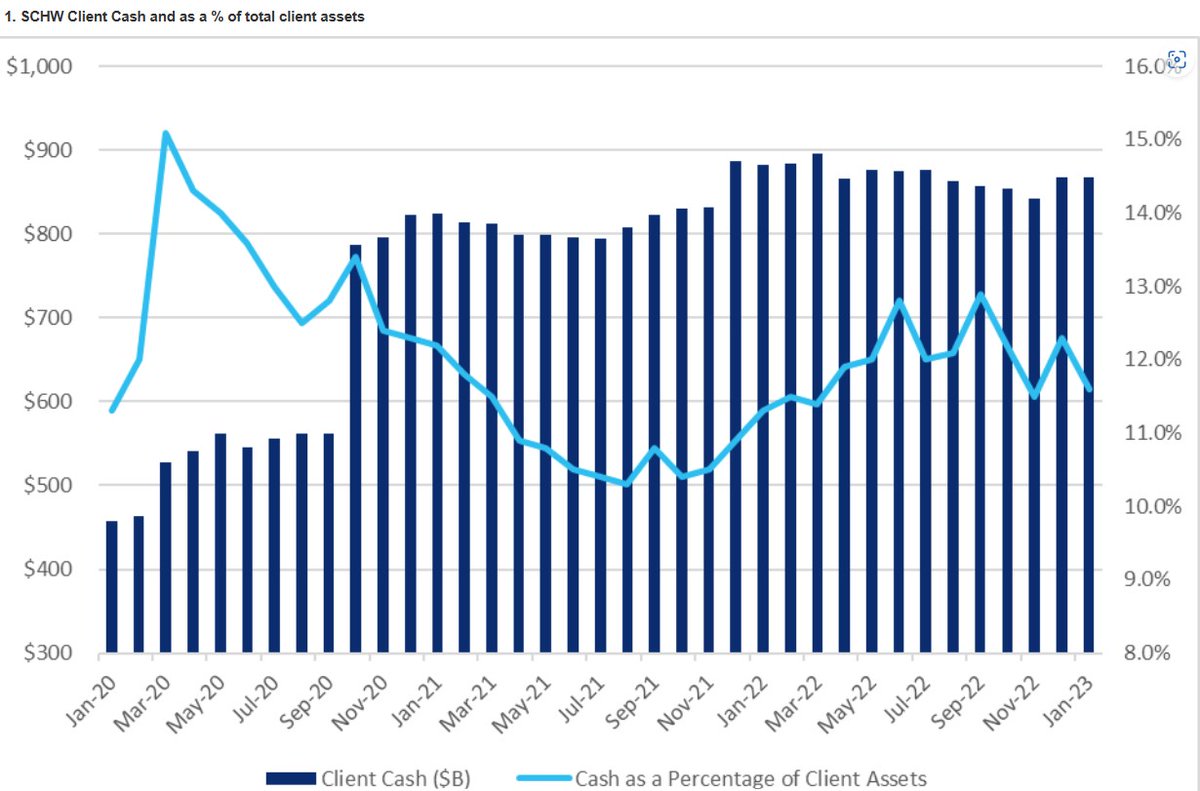

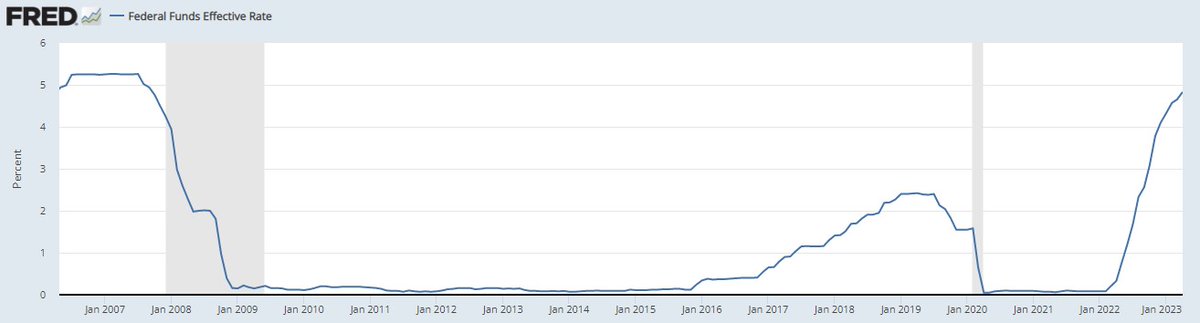

2. Bonds more attractive than equities today.

2. Bonds more attractive than equities today.

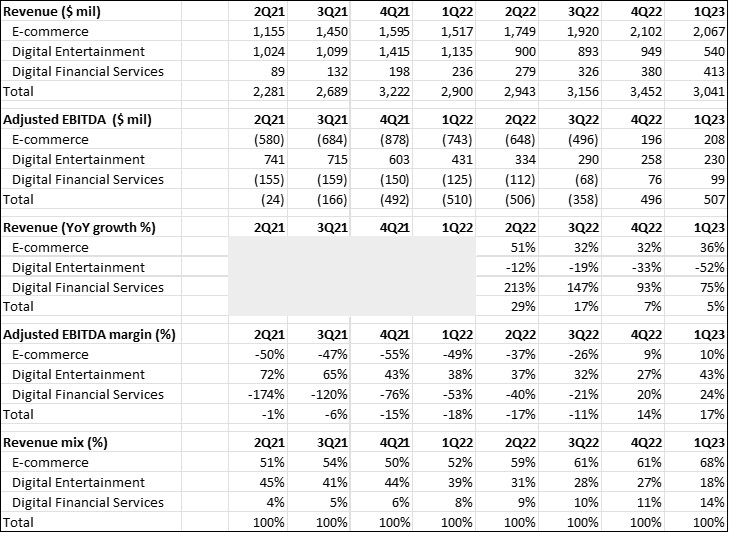

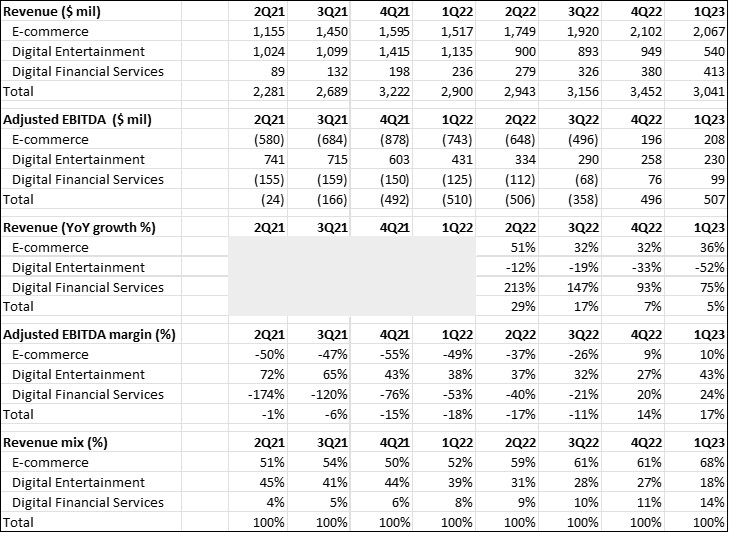

1. Firstly, as of 1Q23, revenue growth in e-commerce accelerated to 36% while adjusted EBITDA margin improved from -49% in the prior year to 10% in 1Q23.

1. Firstly, as of 1Q23, revenue growth in e-commerce accelerated to 36% while adjusted EBITDA margin improved from -49% in the prior year to 10% in 1Q23.