0/n Since the onset of 2023, LSD has emerged as one of the most significant trends in the DeFi space. This report offers an overview of LSD, highlighting the 5 drivers of growth, indicating a potential 7-fold increase over the next 5 years.

medium.com/@gryphsisacade…

medium.com/@gryphsisacade…

1/n There are four primary ways to stake ETH, solo staking, stSaaS, pool staking, and CEX staking. Among these four, pool staking, capturing 36.6% of total ETH staked market share, has emerged as the most popular way due to LSD’s accessibility, versatility, and unique advantages

2/n Within pool staking, Lido Finance leads the sector by holding a significant 73% share, contributing to a near-monopoly in the liquid staking market where nearly 97% is controlled by the top five protocols.

3/n The Merge, an ETH upgrade moving from PoW to PoS, replaces miners with validators staking ETH. Enter Liquid Staking Derivatives (LSDs), tokens reflecting staked ETH. Two types: 1) Rebasing expanding token count with rewards, 2) Reward-Bearing adding value via appreciation.

4/n Post-Shanghai Upgrade, withdrawal uncertainty is tackled, stabilizing the peg. Major LSDs like stETH have reduced depeg risks. Smaller, less liquid LSDs with less established brands might still face higher depeg risks.

5/n Shepalla's completion and key protocols' price behavior suggest an enhanced LSD Beta potential. Echoing $BTC till mid-2022, $LDO and $RPL demonstrated significant momentum from the approaching of the Merge to Shepalla, indicating a fundamental shift in LSD Beta.

6/n LSD sector branches into five: infrastructure, pool staking, LSDFi, re-staking, and MEV yield sharing. LSDFi provides most opportunities for now, while re-staking could drive future LSD market expansion with its innovative concept.

7/n LSDFi refer to DeFi products or protocols based on LSD and can be divided into the following categories: lending platforms, yield protocols, aggregators, and service product.

8/n Re-staking, introduced by EigenLayer, involves re-staking already committed capital, adding more slashing conditions. This pools fragmented security, offering apps a novel approach to network bootstrapping and boosting capital efficiency.

9/n Despite recent substantial growth, the LSD market is set to grow further. Five key drivers: low current staking ratio, infrastructure development, staking rehypothecation, institutional inflow, and yield wars.

10/n ETH's current staking ratio is much lower than other chains, with others having ratios 2-5x greater. With ETH staking rewards higher than other networks, there's ample room for more stakers before equilibrium.

11/n ETH staking ratio offers substantial upside with virtually no downside. High underwater ratio, elimination of withdrawal uncertainty post-Shanghai Upgrade, and growing staking activity since Shapella upgrade make a future decrease in staking ratio unlikely.

12/n EigenLayer's re-staking concept can further boosts the LSD ecosystem in the future. With the reduced security costs and increased developers, the flywheel effect between adoptions and rewards will spur more re-staking activity.

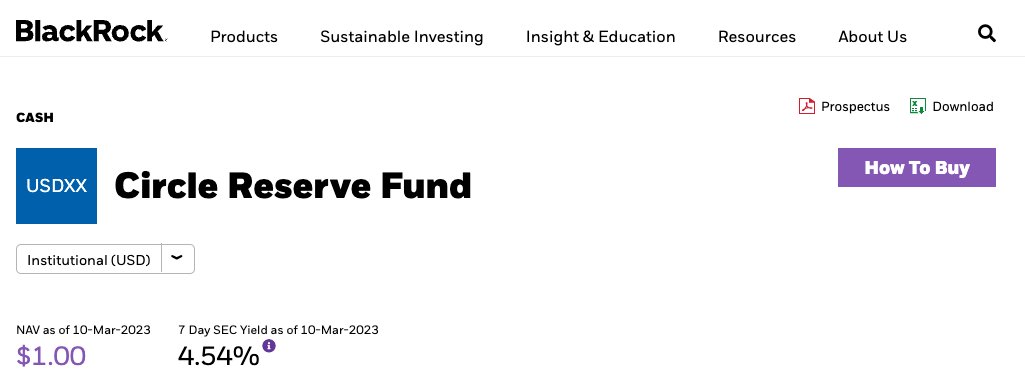

13/n Institutional inflow, a consistent crypto growth driver, could boost the LSD sector. Current high US Govt. Bond Yield makes ETH staking yield less attractive, but as yields likely drop, the crypto market could re-enter a bullish phase.

14/n ETH staking may become more appealing. Institutional investors, often prioritizing BTC and ETH, find stable yields from ETH staking beneficial. A bull rally for the LSD sector, fuelled by significant capital inflows, could be on the horizon.

15/n Using DeFi's compounding composability, LSDFi protocols sparked a yield war, enhancing yields to attract users. Yield sources in LSDFi include vanilla staking, looping, governance incentives, aggregators, yield trading, and structured products.

16/n Within LSDFi, notable protocols include Pendle Finance and Lybra Finance. By introducing novel yield opportunities, both protocols experienced tremendous growth in TVL and token price in recent months.

17/n Each of the sectors in the LSD ecosystem has its core protocols. For infrastructure, SSV Network and Obel Network are two prominent protocols leading the road of decentralizing ETH staking.

18/n Lido and Rocket control over 80% of liquid staking. Backed by top-tier institutions (a16z, Paradigm), Lido uses first-mover advantage, resources, and economies of scale for high stETH liquidity. While likely to retain dominance, emerging competitors may challenge its share.

19/n Though less dominant than Lido, Rocket Pool's decentralized operator onboarding gains traction. Post-Atlas Update, anyone with 8 ETH and minimum 2.4 ETH worth of $RPL can become a node operator, reducing entry barriers and fostering decentralization.

20/n To further explor the potential of the LSD market, we built a forecasting model that involves comparable and scenario analysis that includes bear, base, and bull cases, providing a broader perspective of possible outcomes.docs.google.com/spreadsheets/d…

21/n Based on these factors, the base case result projects a possibility of substantial three-digit percentage growth in the mid-term, with a potential for reaching six-digit growth over the next five years.

22/n Modeling results project significant growth in staked ETH. Even in a conservative scenario, staked ETH could grow 250% in 5 years. In an optimistic scenario, growth could be 560%, underlining the vast potential of this emerging sector.

23/n Service revenue is a fundamental factor for every protocol, especially after the advent of the “Real Yield” narrative. The stunning growth potential of the LSD service revenue also implies the possible emergence of dominating real yield protocols within the sector.

24/n In conclusion, our forecast model predicts a potential 286% growth in staked ETH in LSD, and a 710% increase in service revenue, underscoring the massive potential of this growing sector. These outcomes illuminate the LSD market's substantial growth possibilities.

25/n Given market potential and improved Beta returns from LSD sector, evident in key protocols' tokens price behavior, the LSD ecosystem offers ample Beta play and Alpha-seeking opportunities. Ideal for investors with medium to high risk tolerance.

26/n In summary, the LSD market offers growth potential and is expected to continue evolving. Many factors could affect this expansion, and tracking market trends is key. With current trends, we can hold an optimistic outlook for this emerging sector. #LSD #Growth #CryptoTrends

This report was written by @BC082559, a trainee of @gryphsisacademy, and guided by @CryptoScott_ETH and @Zou_Block, mentors of Gryphsis Academy.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter