Introducing The Incrementum Recession Phase Model.

What assets perform well during a recession?

We look at 5 different phases of a recession and the performance of various assets during each phase.

1/

What assets perform well during a recession?

We look at 5 different phases of a recession and the performance of various assets during each phase.

1/

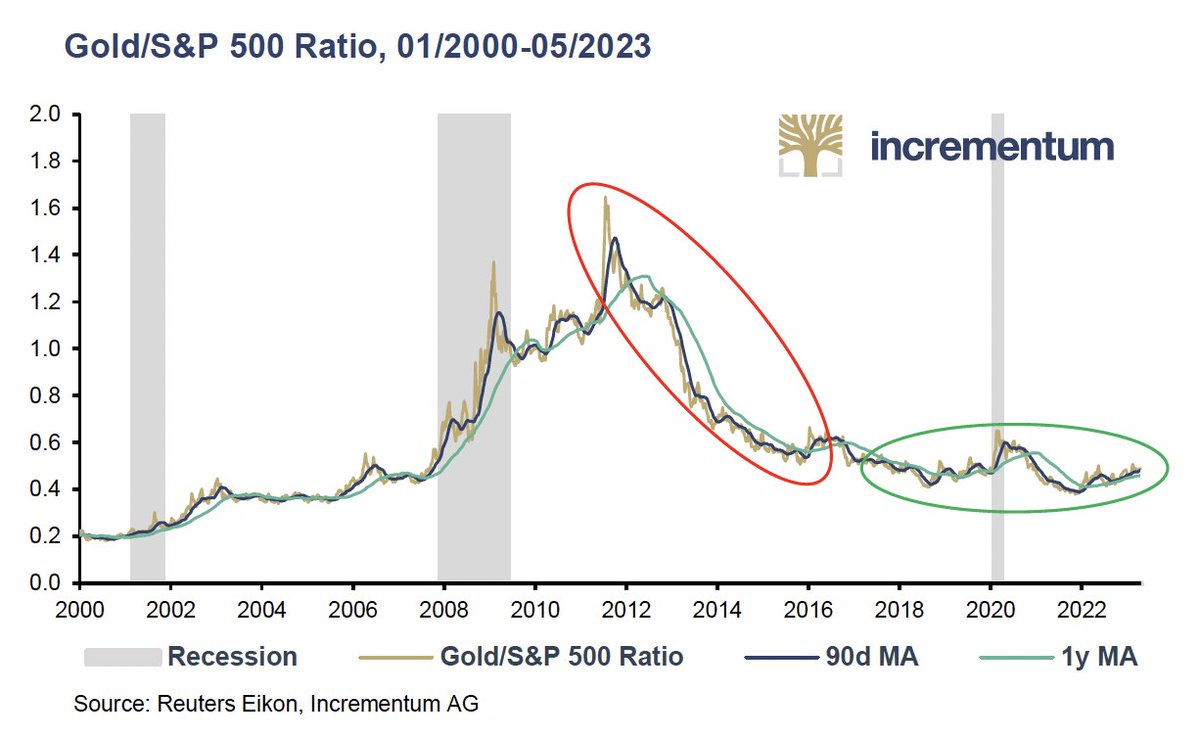

We analyzed eight recessions since 1970. Turns out that gold and mining stocks tend to perform quite well during a recession.

2/

2/

We also look at different leading economic indicators to establish if a recession is imminent. Currently, all of

them are signalling an imminent recession.

3/

them are signalling an imminent recession.

3/

For a more detailed look at the Incrementum Recession Model, check out our chapter, The Showdown in Monetary Policy, on page 118 of this year's #IGWT report.

Available to download here:

ingoldwetrust.report/?lang=en

Available to download here:

ingoldwetrust.report/?lang=en

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter