Being early to the right crypto narratives can be very lucrative.

And since this world is in continuous evolution, it's not easy to spot them.

Here are 8 narratives that I'm paying attention to, some related protocols + personal considerations.

1/19 🧵👇

And since this world is in continuous evolution, it's not easy to spot them.

Here are 8 narratives that I'm paying attention to, some related protocols + personal considerations.

1/19 🧵👇

1.

~ LSD ~

The Ethereum Shanghai update has given the possibility to investors to stake/unstake their ETH at any time.

This can hugely benefit Liquid Staking Derivatives platforms.

Some protocols I'm eyeing:

• RocketPool

• Lido Finance

• Frax

• Lybra

~ LSD ~

The Ethereum Shanghai update has given the possibility to investors to stake/unstake their ETH at any time.

This can hugely benefit Liquid Staking Derivatives platforms.

Some protocols I'm eyeing:

• RocketPool

• Lido Finance

• Frax

• Lybra

2.

~ Scalability solutions ~

ETH continues to remain the most used platform, with plenty of Dapps built on it.

The latest updates have been interesting but didn't solve transactional costs and scalability.

Considering this, the next wave of retailers will search for solutions.

~ Scalability solutions ~

ETH continues to remain the most used platform, with plenty of Dapps built on it.

The latest updates have been interesting but didn't solve transactional costs and scalability.

Considering this, the next wave of retailers will search for solutions.

3.

Layers 2 are the way, with 2 types of rollups:

• Optimistic rollups

• ZK rollups

Optimistic have onboarded the first wave of interest, but ZK are technologically more advanced.

This also means that they're more complexed, thus potential longer time of solid implementation.

Layers 2 are the way, with 2 types of rollups:

• Optimistic rollups

• ZK rollups

Optimistic have onboarded the first wave of interest, but ZK are technologically more advanced.

This also means that they're more complexed, thus potential longer time of solid implementation.

4.

There are several ZK rollups:

• Scroll

• Starknet

• ZK sync

• Polygon Miden

• Fox

• dydx

It's likely that many new Dapps will come out with this new technology implementation (if ZK times will be ready)

New Dapps ➩ new technology ➩ fresh money attraction

There are several ZK rollups:

• Scroll

• Starknet

• ZK sync

• Polygon Miden

• Fox

• dydx

It's likely that many new Dapps will come out with this new technology implementation (if ZK times will be ready)

New Dapps ➩ new technology ➩ fresh money attraction

5.

~ GameFi ~

The first GameFi rise happened during the middle/late period of the last bull run.

Pure speculation and bad tokenomics have been the keywords, but the gaming industry is far from over.

You can have a better outlook by checking my analysis

~ GameFi ~

The first GameFi rise happened during the middle/late period of the last bull run.

Pure speculation and bad tokenomics have been the keywords, but the gaming industry is far from over.

You can have a better outlook by checking my analysis

https://twitter.com/iamzeroika/status/1661392548219473920?s=46&t=zQsEQ04Vv_i__FW0dMS9qQ

6.

Few potential catalysts:

• Products/games improvements

• Tokenomics revamp

• In-game NFTs addition

• AI NPC integration

• GTA 6 P2E rumors

Few things I'm looking at:

• Ultra

• Sandbox

• Fusionist

• Nakamoto games

• Illuvium

I personally love this sector.

Few potential catalysts:

• Products/games improvements

• Tokenomics revamp

• In-game NFTs addition

• AI NPC integration

• GTA 6 P2E rumors

Few things I'm looking at:

• Ultra

• Sandbox

• Fusionist

• Nakamoto games

• Illuvium

I personally love this sector.

7.

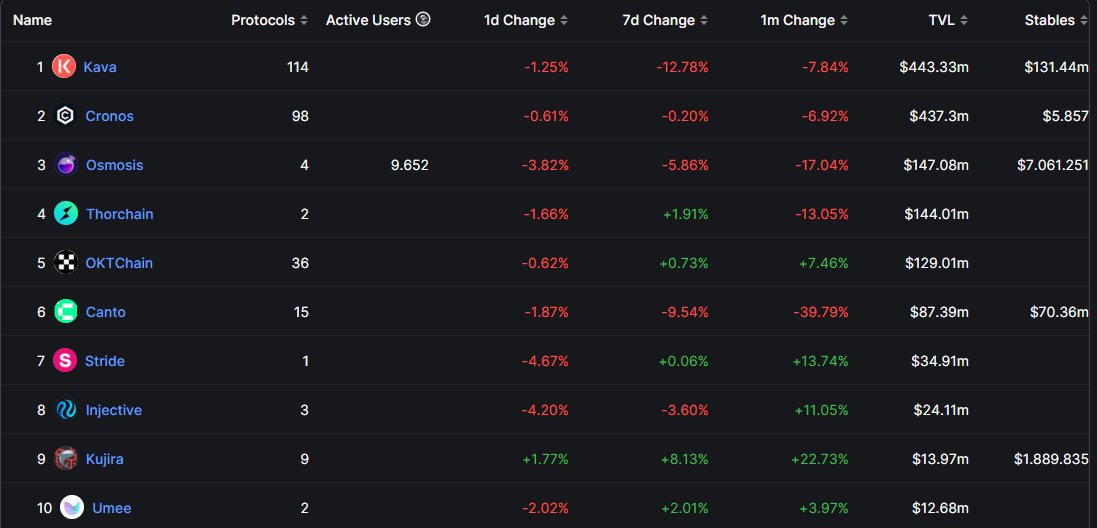

~ Cosmos ecosystem ~

A lot of new projects are being built on Cosmos, probably due to its interoperability + tendermint.

It’s also interesting to notice the TVL of these chains, which has substantially increased over the last period.

Chains are hot.

~ Cosmos ecosystem ~

A lot of new projects are being built on Cosmos, probably due to its interoperability + tendermint.

It’s also interesting to notice the TVL of these chains, which has substantially increased over the last period.

Chains are hot.

8.

What I’m specifically eyeing:

• Kujira ➩ real yield narrative + frequent updates and products.

• Secret ➩ privacy smart contracts

• Injective ➩ DEX

• Berachain ➩ proof of liquidity consensus (to come out)

Expecting Cosmos chain to be attractive.

What I’m specifically eyeing:

• Kujira ➩ real yield narrative + frequent updates and products.

• Secret ➩ privacy smart contracts

• Injective ➩ DEX

• Berachain ➩ proof of liquidity consensus (to come out)

Expecting Cosmos chain to be attractive.

9.

~ Tokenized RWA ~

Real-world asset tokenization unlocks many benefits:

• Non crypto tied cashflow

• Democratization of access

• More liquidity

• Full ownership

To note: regulation process is very long and complicated, but speculation can rule.

~ Tokenized RWA ~

Real-world asset tokenization unlocks many benefits:

• Non crypto tied cashflow

• Democratization of access

• More liquidity

• Full ownership

To note: regulation process is very long and complicated, but speculation can rule.

https://twitter.com/IamZeroIka/status/1645079737898004481?s=20

10.

~ Artificial Intelligence ~

Easy to pick after the latest crypto AI explosion, the whole world is talking about AI in general.

But the integration and developments that we can in see in the future go above our imagination.

~ Artificial Intelligence ~

Easy to pick after the latest crypto AI explosion, the whole world is talking about AI in general.

But the integration and developments that we can in see in the future go above our imagination.

https://twitter.com/iamzeroika/status/1658861973050912768?s=46&t=zQsEQ04Vv_i__FW0dMS9qQ

11.

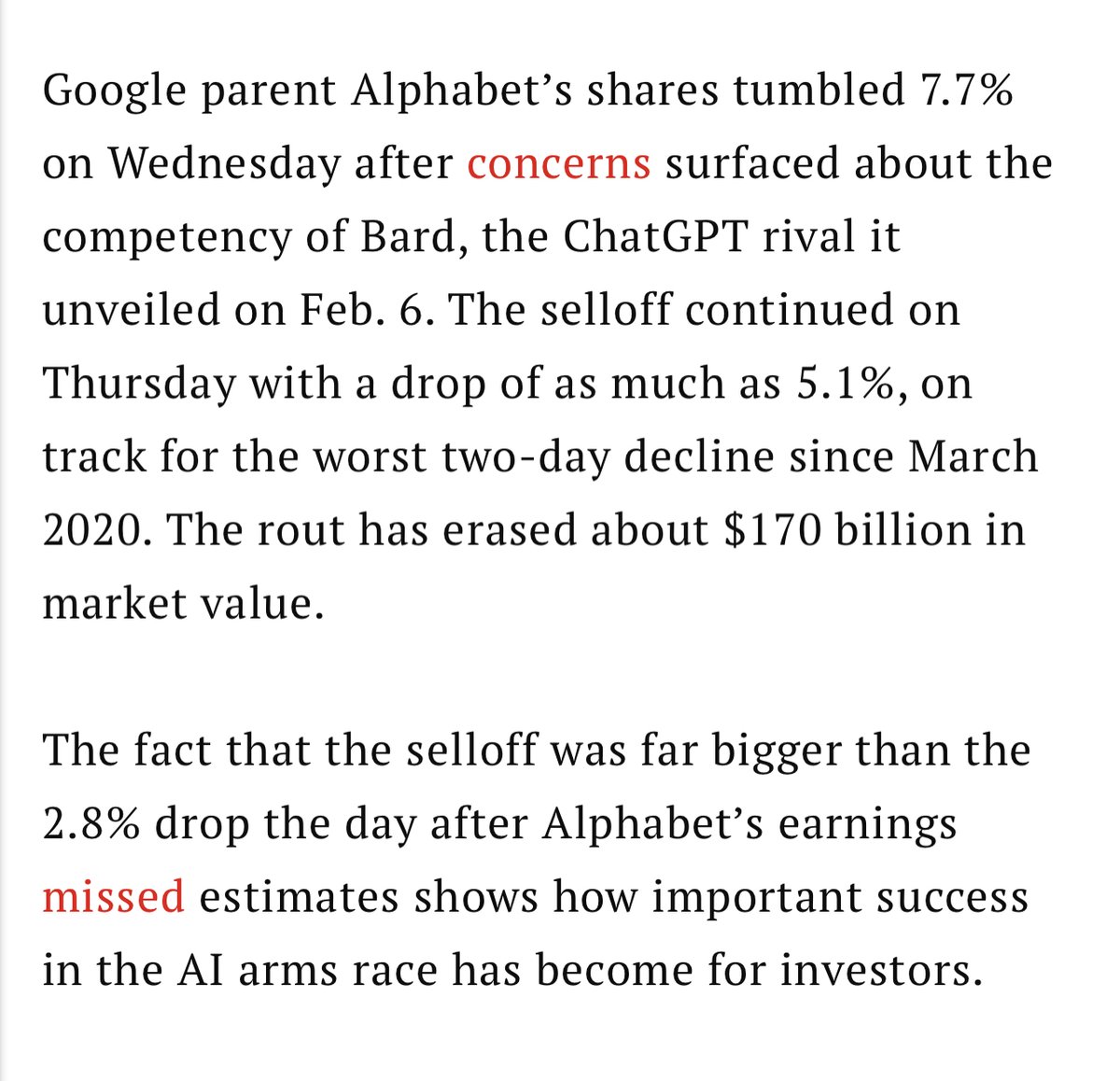

Chat GPT’s competitor Bard by Google has been revealed in February and a factual error made on the stage, made Alphabet’s shares drop more than 7%.

This means that investors are hot on the narrative and this trend it's likely to continue in the crypto sphere, in the future.

Chat GPT’s competitor Bard by Google has been revealed in February and a factual error made on the stage, made Alphabet’s shares drop more than 7%.

This means that investors are hot on the narrative and this trend it's likely to continue in the crypto sphere, in the future.

12.

~ The Hong Kong connection ~

Starting today, individual investors can trade larger coins on exchanges licensed by the SC under Hong Kong's new approach.

@tedtalksmacro highlighted the situation also covering the tradable assets.

~ The Hong Kong connection ~

Starting today, individual investors can trade larger coins on exchanges licensed by the SC under Hong Kong's new approach.

@tedtalksmacro highlighted the situation also covering the tradable assets.

https://twitter.com/tedtalksmacro/status/1661049591985324046?s=46&t=zQsEQ04Vv_i__FW0dMS9qQ

13.

~ GambleFi ~

Ah, the good old desire of people to bet and get rich overnight, a booming industry that is expected to grow at a CAGR of 11.7% by 2030.

Crypto is no different, it can also amplify the concept of gambling, with a lot of tokens that already performed well.

~ GambleFi ~

Ah, the good old desire of people to bet and get rich overnight, a booming industry that is expected to grow at a CAGR of 11.7% by 2030.

Crypto is no different, it can also amplify the concept of gambling, with a lot of tokens that already performed well.

14.

This is a concept tied to memecoins.

Retailers and newcomers look at the nominal value of a cryptocurrency, ignoring tokenomics and the project behind it.

This teleports us to a simple formula:

Funny logo ➩ low value ➩ get rich overnight ➩gamble.

Pepe’s way.

This is a concept tied to memecoins.

Retailers and newcomers look at the nominal value of a cryptocurrency, ignoring tokenomics and the project behind it.

This teleports us to a simple formula:

Funny logo ➩ low value ➩ get rich overnight ➩gamble.

Pepe’s way.

15.

~ Sharing opinions ~

• These are my personal opinions taking a look at what is happening. Always NFA.

• “But mate, you didn't talk about “x” coin”

There are plenty of good projects out there, I can't write the “Divine Comedy”.

Don’t take it personally.

~ Sharing opinions ~

• These are my personal opinions taking a look at what is happening. Always NFA.

• “But mate, you didn't talk about “x” coin”

There are plenty of good projects out there, I can't write the “Divine Comedy”.

Don’t take it personally.

16.

~ Adapt or die ~

These are my opinions right now but since this world moves INSANELY fast, things can change.

New narratives and projects could come out quickly, especially during a full blown bullrun.

Being open mind is a crucial attitude to survive.

~ Adapt or die ~

These are my opinions right now but since this world moves INSANELY fast, things can change.

New narratives and projects could come out quickly, especially during a full blown bullrun.

Being open mind is a crucial attitude to survive.

17.

~ My strategy ~

At the current moment the majority of my main portfolio is in BTC.

I'm not risking too much.

On the other side, I'm slowly accumulating a few coins, without rushing.

There is plenty of time to accumulate until the next bullrun.

~ My strategy ~

At the current moment the majority of my main portfolio is in BTC.

I'm not risking too much.

On the other side, I'm slowly accumulating a few coins, without rushing.

There is plenty of time to accumulate until the next bullrun.

18.

~ General opinion ~

I think that we already absorbed the worst part of this bear market.

• FTX/LUNA contagion

• War

• Inflation

• Pandemic

Until a new black swan comes into the market, I don't see another huge liquidation cascade.

You know how I work: level by level.

~ General opinion ~

I think that we already absorbed the worst part of this bear market.

• FTX/LUNA contagion

• War

• Inflation

• Pandemic

Until a new black swan comes into the market, I don't see another huge liquidation cascade.

You know how I work: level by level.

19.

That's it!🎯

• If you liked this thread, follow me @IamZeroIka for more crypto insights.

• Like and RT the first tweet to support my work!✌️

• If you want to have access to deeper guides and info, subscribe to my FREE newsletter! (link in bio)

That's it!🎯

• If you liked this thread, follow me @IamZeroIka for more crypto insights.

• Like and RT the first tweet to support my work!✌️

• If you want to have access to deeper guides and info, subscribe to my FREE newsletter! (link in bio)

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter